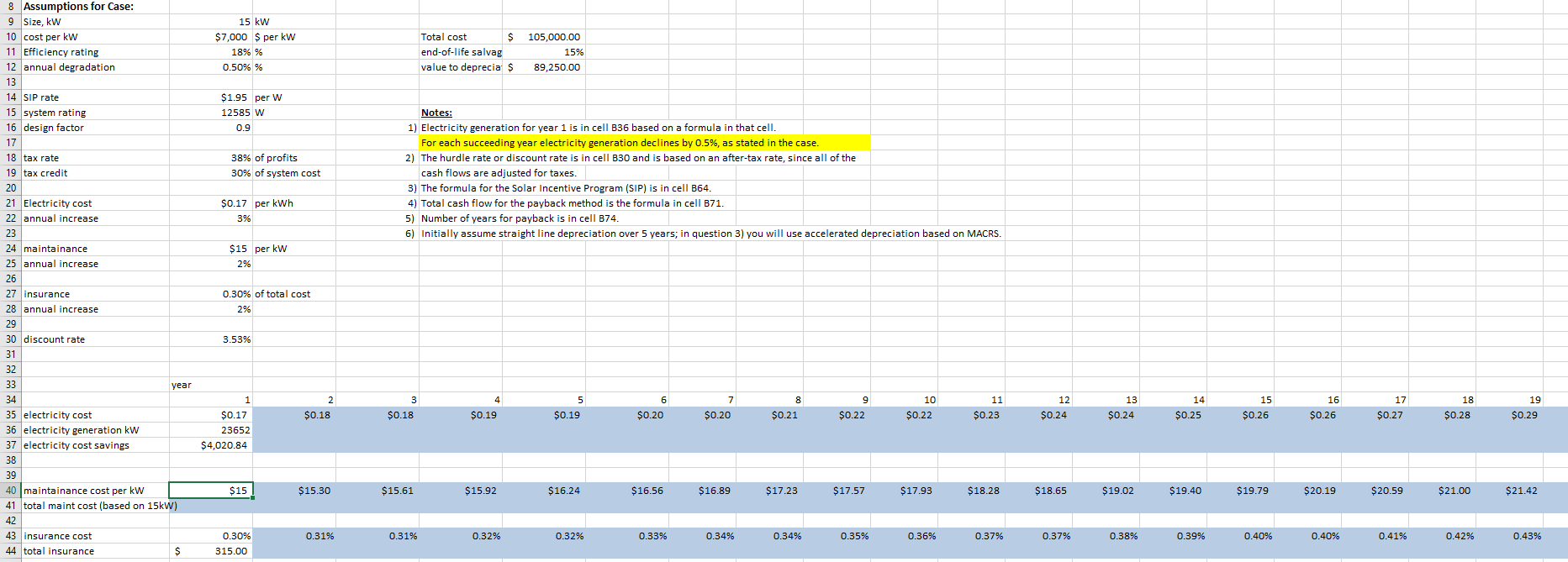

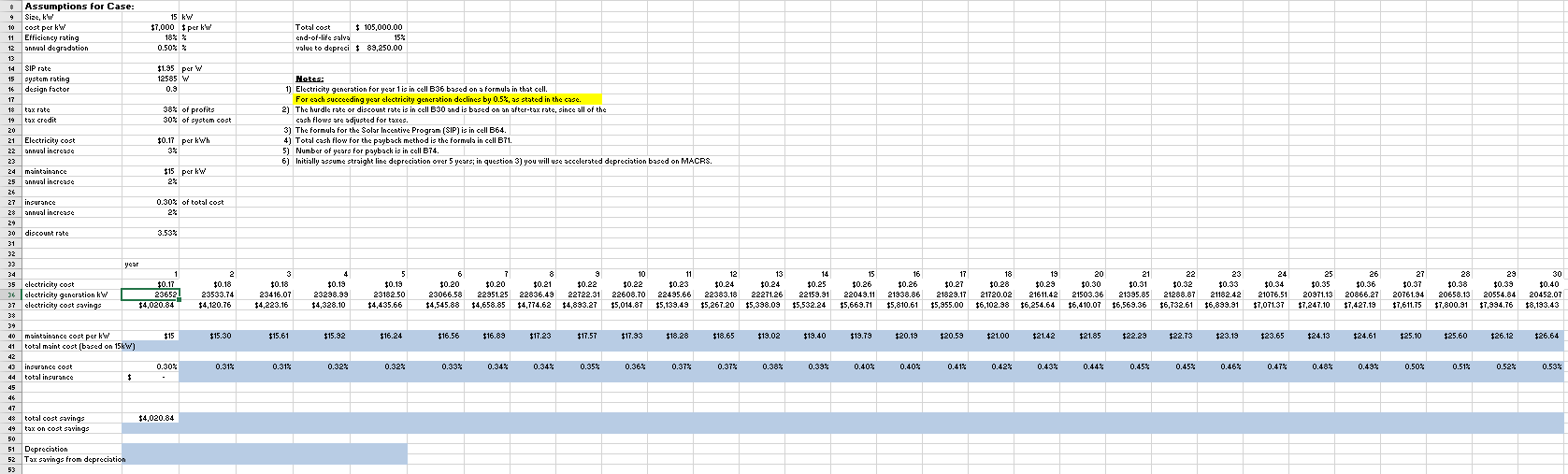

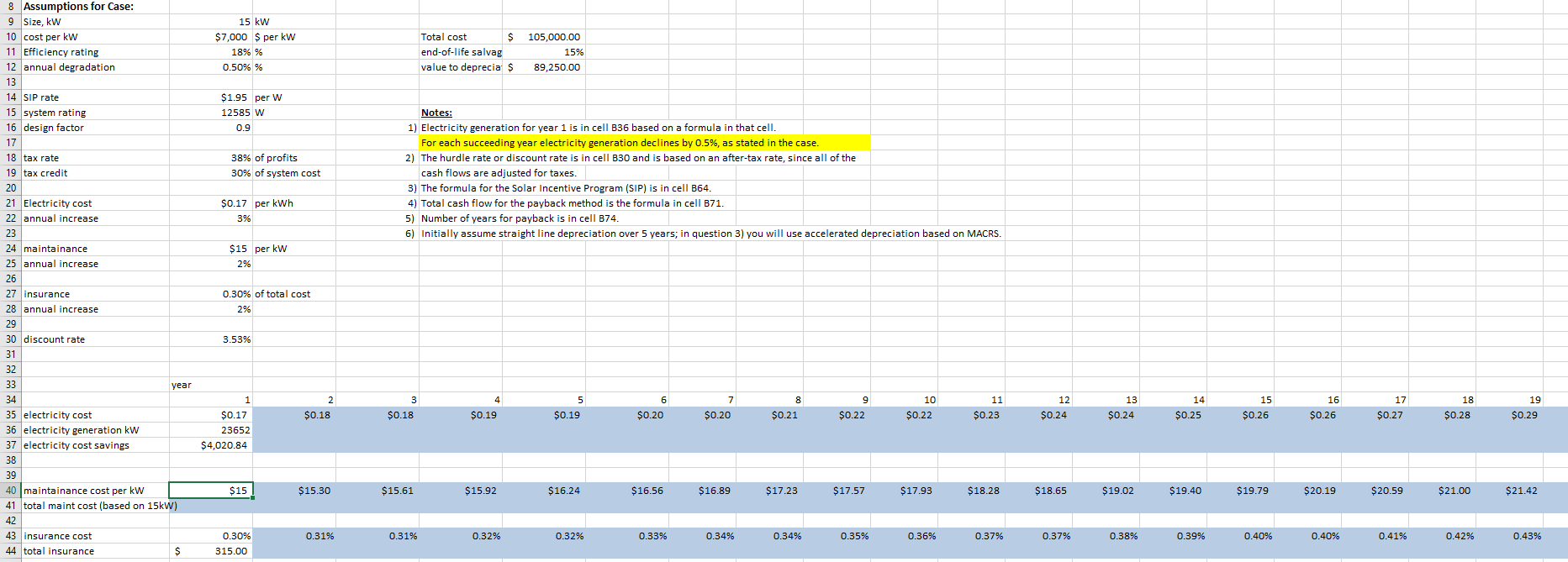

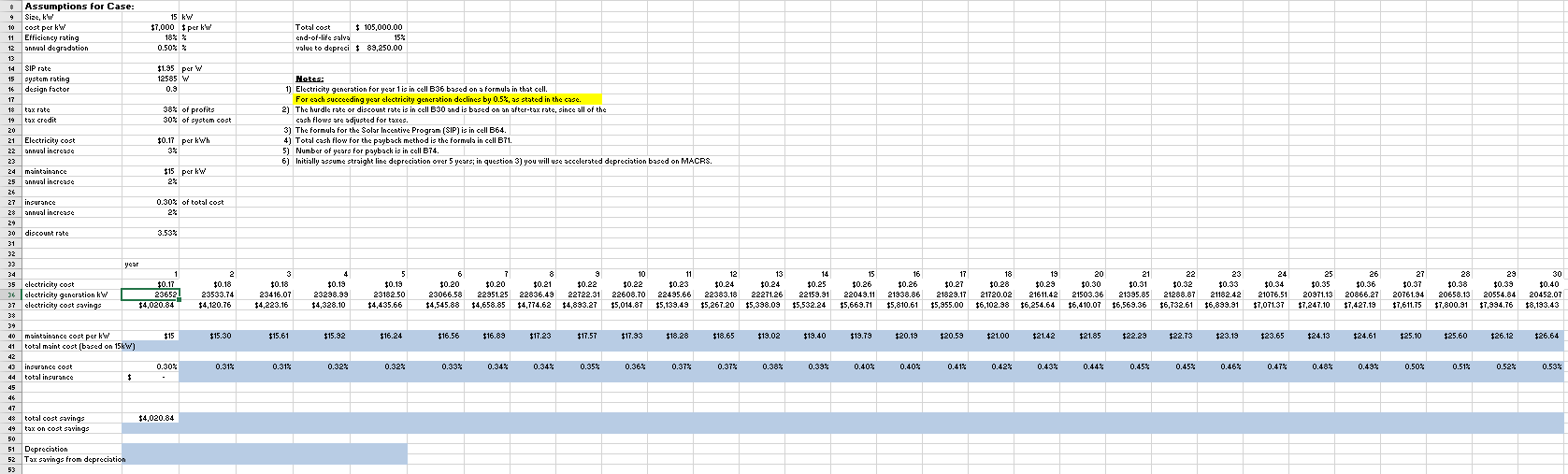

Please help me find the mainainance cost per Kw (A40) and Total Maint Cost (Based on 15kW) for years 1 through 30, as well as the Insurance cost (A43) and Total insurance (A44) for years 1 through 30. The formula in B44 is: =B43*$F$10

Thank you so much in advance! Will thumbs up!

15 kW $7,000 $ per kW 18% % 0.50% % Total cost $ end-of-life salvag value to deprecia $ 105,000.00 15% 89,250.00 $1.95 per W 12585 W 0.9 38% of profits 30% of system cost Notes: 1) Electricity generation for year 1 is in cell B36 based on a formula in that cell. For each succeeding year electricity generation declines by 0.5%, as stated in the case. 2) The hurdle rate or discount rate is in cell B30 and is based on an after-tax rate, since all of the cash flows are adjusted for taxes. 3) The formula for the Solar Incentive Program (SIP) is in cell B64. 4) Total cash flow for the payback method is the formula in cell 071. 5) Number of years for payback is in cell B74. 6) Initially assume straight line depreciation over 5 years; in question 3) you will use accelerated depreciation based on MACRS. $0.17 per kWh 3% $15 per kW 2% 8 Assumptions for Case: 9 Size, kW 10 cost per kW 11 Efficiency rating 12 annual degradation 13 14 SIP rate 15 system rating 16 design factor 17 18 tax rate 19 tax credit 20 21 Electricity cost 22 annual increase 23 24 maintainance 25 annual increase 26 27 insurance 28 annual increase 29 30 discount rate 31 32 33 year 34 35 electricity cost 36 electricity generation kW 37 electricity cost savings 38 39 40 maintainance cost per kW 41 total maint cost (based on 15kW) 42 43 insurance cost 44 total insurance $ 0.30% of total cost 2% 2 3.53% 4 6 2 $0.18 3 $0.18 5 $0.19 7 $0.20 8 $0.21 9 $0.22 10 $0.22 11 $0.23 12 $0.24 13 $0.24 14 $0.25 15 $0.26 16 $0.26 17 $0.27 18 $0.28 19 $0.29 $0.19 $0.20 1 $0.17 23652 $4,020.84 $15 $15.30 $15.61 $15.92 $16.24 $16.56 $16.89 $17.23 $17.57 $17.93 $18.28 $18.65 $19.02 $19.40 $19.79 $20.19 $20.59 $21.00 $21.42 0.31% 0.31% 0.32% 0.32% 0.33% 0.34% 0.34% 0.35% 0.36% 0.37% 0.37% 0.38% 0.39% % 0.40% 0.40% 0.41% 0.42% 0.43% 0.30% 315.00 * Assumptions for Case: 15 kW $7,000 per kW 18% % 0.50% % % % Total cost $ 105,000.00 end-of-life salva 15% value to depreci $ 89,250,00 $1.95 per W 12585 W 0.9 design factor 38% of profito 30% of system cost 9 Size, kW 10 cost per kW 11 Efficiency rating 12 annual degradation 13 14 SIP rate 15 system rating 16 17 18 tax rate 19 tax credit 20 21 Electricity cost 22 annual increase 23 24 maintainance 25 annual increase 26 27 insurance 28 annual increase 29 discount rate 31 32 Hotes: 1) Electricity generation for year is in cell B36 based on a formula in that cell. For each succeeding year electricity generation declincs by 0.5%, as stated in the case. 2) The hurdle rate or discount rate is in cell B30 and is based on an after-tax rate, since all of the cash flows are adjusted for taxes. 3) The formula for the Solar Incentive Program (SIP) is in cell B64. 4) Total cash flow for the payback method is the formula in cell B71. 5) Number of years for payback is in cell B74. 6) Initially assume straight line depreciation over 5 years; in question 3) you will use accelerated depreciation based on MACRS. $0.17 per kWh $15 per kW 2% 0.30% of total cost 2% 13* * * * * * ****************************** 13222 3.53% year 1 $0.17 23652 $4,020.84 $ 34 35 electricity cost 36 clectricity generation kW 37 electricity cost savings 2 $0.18 23533.74 $4,120.76 4 $0.19 23298.99 $4,328.10 $0.18 23416.07 $4,223.16 5 $0.19 23182.50 14.435.66 6 7 7 $0.20 $0.20 23066.58 22951.25 $4,545.88 $4,658.85 $0.21 $0.22 $ 22836.49 22722.31 $4,774.62 $4,893.27 10 11 12 13 $0.22 $0.23 $0.24 $0.24 $ 22608.70 22495.66 22383.18 22271.26 $5,014.87 $5,139.49 $5,267.20 $5,398.09 14 $0.25 22159.91 $5,532.24 15 $0.26 2204 9.11 $5,669.71 $0.39 16 17 18 19 $0.26 $0.27 $0.28 $0.29 21938.86 21829.17 21720.02 21611.42 $5,810.61 $5,355.00 $6,102.38 $6,254.64 20 21 $0.30 $0.31 21503.36 21395.85 $ $6,410.07 $6,569.36 22 23 $0.32 $0.33 21288.87 21182.42 $6,732.61 $6,839.91 24 $0.34 21076.51 $7,071.37 25 $0.35 20971.13 $7,247.10 26 $0.36 20866.27 $7,427.19 27 $0.37 20761.94 $7,611.75 28 29 $0.38 20658.13 20554.84 $7,800.91 $7,994.76 30 $0.40 20452.07 $8,193.43 $15.30 $15.61 $15.92 $16.24 $16.56 $16.89 $17.23 $17.57 $17.93 $18.28 $18.65 $19.02 $19.40 $19.79 $20.19 $20.59 $21.00 $21.42 $21.85 $22.29 $22.73 $23.19 $23.65 $24.13 $24.61 $25.10 $25.60 $26.12 $26.64 0.31% 0.31% 0.32% 0.32% 0.33% 0.34% 0.34% 0.35% 0.36% 0.37% 0.37% 0.38% 0.39% 0.40% % 0.40% 0.41% 0.42% 0.433 0.44% 0.45% 0.45% 0.46% 0.47% 0.48% 0.49% 0.50% 0.51% 0.52% 0.53% 39 40 maintainance cost per kW $15 41 total maint cost (based on 15kW) 42 43 insurance cost 0.30% 44 total insurance $ 45 46 47 48 total cost savingo $4,020.84 49 tax on cost savings 50 51 Depreciation 52 Tax savings from depreciation 53 15 kW $7,000 $ per kW 18% % 0.50% % Total cost $ end-of-life salvag value to deprecia $ 105,000.00 15% 89,250.00 $1.95 per W 12585 W 0.9 38% of profits 30% of system cost Notes: 1) Electricity generation for year 1 is in cell B36 based on a formula in that cell. For each succeeding year electricity generation declines by 0.5%, as stated in the case. 2) The hurdle rate or discount rate is in cell B30 and is based on an after-tax rate, since all of the cash flows are adjusted for taxes. 3) The formula for the Solar Incentive Program (SIP) is in cell B64. 4) Total cash flow for the payback method is the formula in cell 071. 5) Number of years for payback is in cell B74. 6) Initially assume straight line depreciation over 5 years; in question 3) you will use accelerated depreciation based on MACRS. $0.17 per kWh 3% $15 per kW 2% 8 Assumptions for Case: 9 Size, kW 10 cost per kW 11 Efficiency rating 12 annual degradation 13 14 SIP rate 15 system rating 16 design factor 17 18 tax rate 19 tax credit 20 21 Electricity cost 22 annual increase 23 24 maintainance 25 annual increase 26 27 insurance 28 annual increase 29 30 discount rate 31 32 33 year 34 35 electricity cost 36 electricity generation kW 37 electricity cost savings 38 39 40 maintainance cost per kW 41 total maint cost (based on 15kW) 42 43 insurance cost 44 total insurance $ 0.30% of total cost 2% 2 3.53% 4 6 2 $0.18 3 $0.18 5 $0.19 7 $0.20 8 $0.21 9 $0.22 10 $0.22 11 $0.23 12 $0.24 13 $0.24 14 $0.25 15 $0.26 16 $0.26 17 $0.27 18 $0.28 19 $0.29 $0.19 $0.20 1 $0.17 23652 $4,020.84 $15 $15.30 $15.61 $15.92 $16.24 $16.56 $16.89 $17.23 $17.57 $17.93 $18.28 $18.65 $19.02 $19.40 $19.79 $20.19 $20.59 $21.00 $21.42 0.31% 0.31% 0.32% 0.32% 0.33% 0.34% 0.34% 0.35% 0.36% 0.37% 0.37% 0.38% 0.39% % 0.40% 0.40% 0.41% 0.42% 0.43% 0.30% 315.00 * Assumptions for Case: 15 kW $7,000 per kW 18% % 0.50% % % % Total cost $ 105,000.00 end-of-life salva 15% value to depreci $ 89,250,00 $1.95 per W 12585 W 0.9 design factor 38% of profito 30% of system cost 9 Size, kW 10 cost per kW 11 Efficiency rating 12 annual degradation 13 14 SIP rate 15 system rating 16 17 18 tax rate 19 tax credit 20 21 Electricity cost 22 annual increase 23 24 maintainance 25 annual increase 26 27 insurance 28 annual increase 29 discount rate 31 32 Hotes: 1) Electricity generation for year is in cell B36 based on a formula in that cell. For each succeeding year electricity generation declincs by 0.5%, as stated in the case. 2) The hurdle rate or discount rate is in cell B30 and is based on an after-tax rate, since all of the cash flows are adjusted for taxes. 3) The formula for the Solar Incentive Program (SIP) is in cell B64. 4) Total cash flow for the payback method is the formula in cell B71. 5) Number of years for payback is in cell B74. 6) Initially assume straight line depreciation over 5 years; in question 3) you will use accelerated depreciation based on MACRS. $0.17 per kWh $15 per kW 2% 0.30% of total cost 2% 13* * * * * * ****************************** 13222 3.53% year 1 $0.17 23652 $4,020.84 $ 34 35 electricity cost 36 clectricity generation kW 37 electricity cost savings 2 $0.18 23533.74 $4,120.76 4 $0.19 23298.99 $4,328.10 $0.18 23416.07 $4,223.16 5 $0.19 23182.50 14.435.66 6 7 7 $0.20 $0.20 23066.58 22951.25 $4,545.88 $4,658.85 $0.21 $0.22 $ 22836.49 22722.31 $4,774.62 $4,893.27 10 11 12 13 $0.22 $0.23 $0.24 $0.24 $ 22608.70 22495.66 22383.18 22271.26 $5,014.87 $5,139.49 $5,267.20 $5,398.09 14 $0.25 22159.91 $5,532.24 15 $0.26 2204 9.11 $5,669.71 $0.39 16 17 18 19 $0.26 $0.27 $0.28 $0.29 21938.86 21829.17 21720.02 21611.42 $5,810.61 $5,355.00 $6,102.38 $6,254.64 20 21 $0.30 $0.31 21503.36 21395.85 $ $6,410.07 $6,569.36 22 23 $0.32 $0.33 21288.87 21182.42 $6,732.61 $6,839.91 24 $0.34 21076.51 $7,071.37 25 $0.35 20971.13 $7,247.10 26 $0.36 20866.27 $7,427.19 27 $0.37 20761.94 $7,611.75 28 29 $0.38 20658.13 20554.84 $7,800.91 $7,994.76 30 $0.40 20452.07 $8,193.43 $15.30 $15.61 $15.92 $16.24 $16.56 $16.89 $17.23 $17.57 $17.93 $18.28 $18.65 $19.02 $19.40 $19.79 $20.19 $20.59 $21.00 $21.42 $21.85 $22.29 $22.73 $23.19 $23.65 $24.13 $24.61 $25.10 $25.60 $26.12 $26.64 0.31% 0.31% 0.32% 0.32% 0.33% 0.34% 0.34% 0.35% 0.36% 0.37% 0.37% 0.38% 0.39% 0.40% % 0.40% 0.41% 0.42% 0.433 0.44% 0.45% 0.45% 0.46% 0.47% 0.48% 0.49% 0.50% 0.51% 0.52% 0.53% 39 40 maintainance cost per kW $15 41 total maint cost (based on 15kW) 42 43 insurance cost 0.30% 44 total insurance $ 45 46 47 48 total cost savingo $4,020.84 49 tax on cost savings 50 51 Depreciation 52 Tax savings from depreciation 53