please help me find the ratios for a. through k.

more information ...

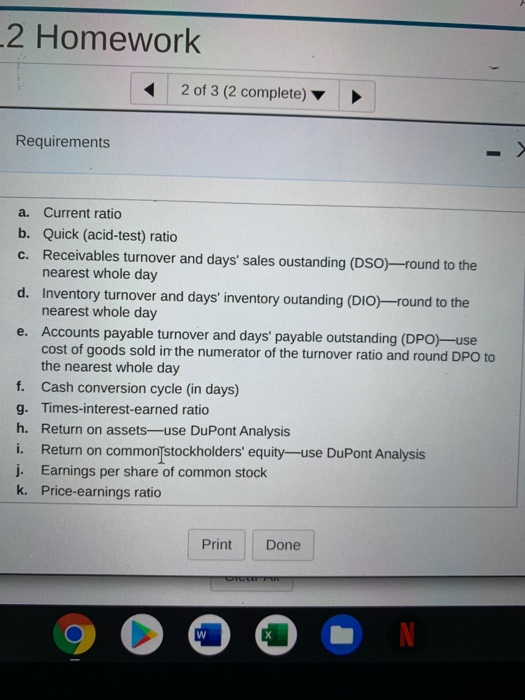

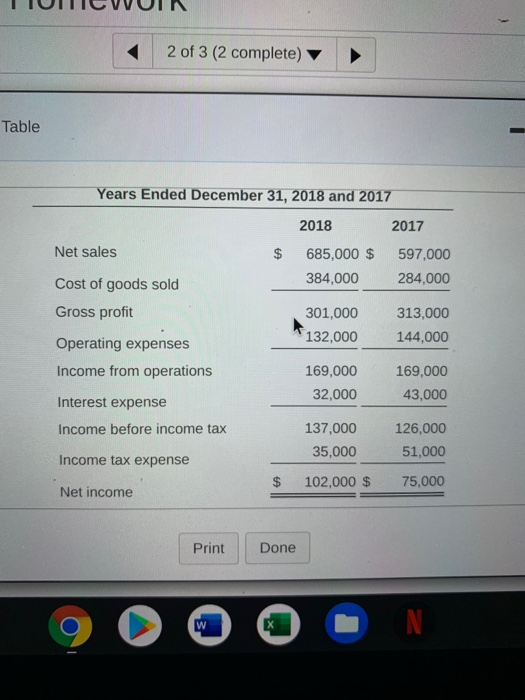

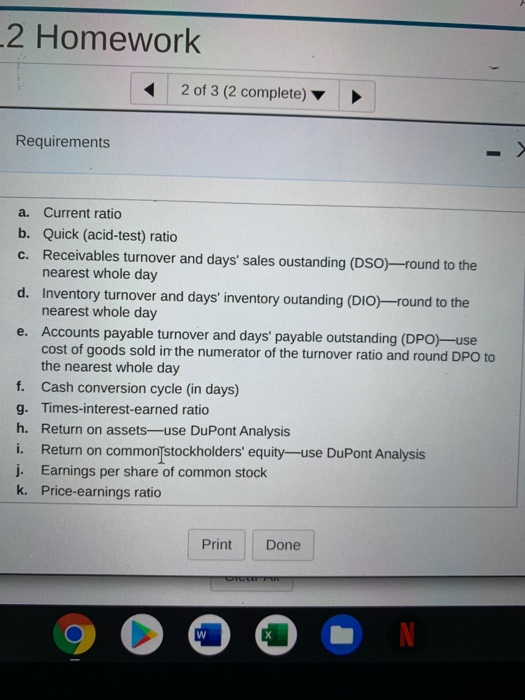

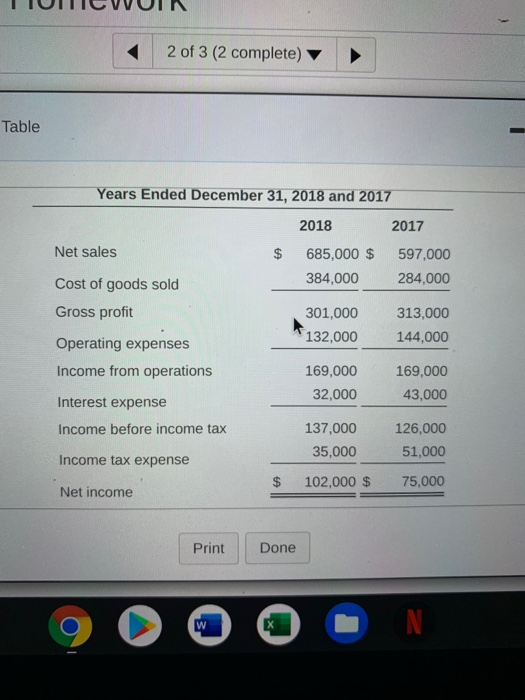

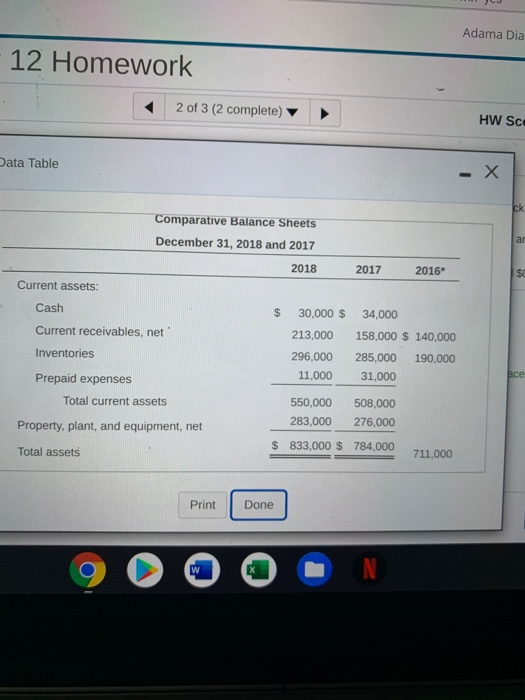

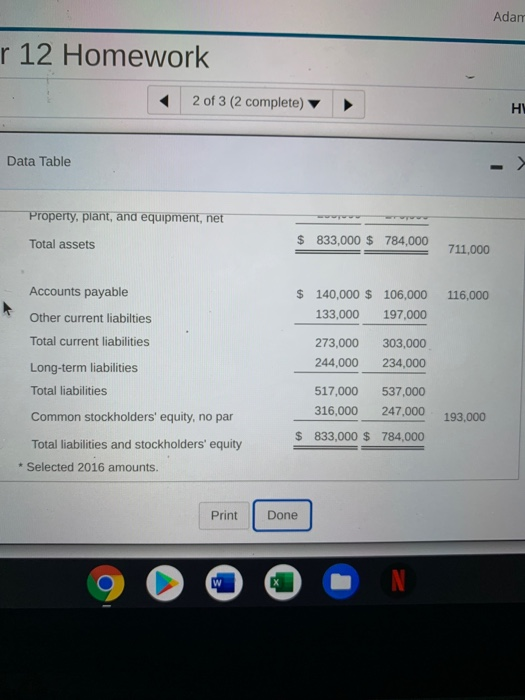

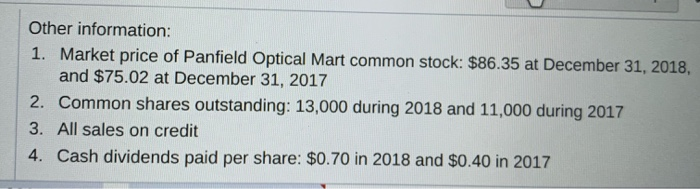

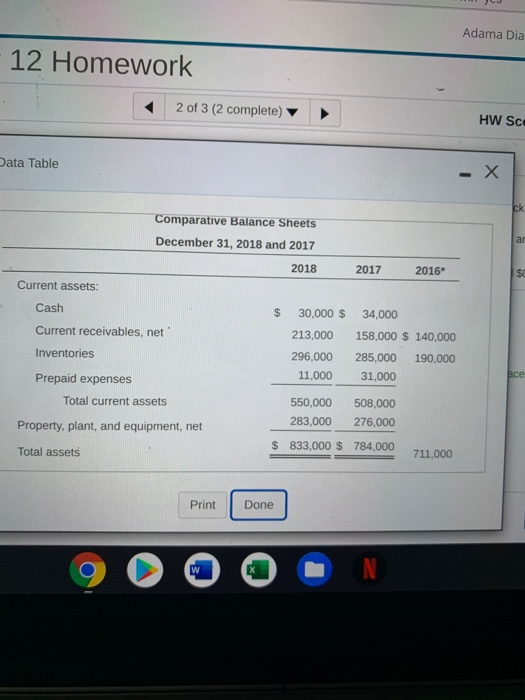

2 Homework 2 of 3 (2 complete) Requirements a. Current ratio b. Quick (acid-test) ratio C. Receivables turnover and days' sales oustanding (DSO)-round to the nearest whole day d. Inventory turnover and days' inventory outanding (DIO)-round to the nearest whole day e. Accounts payable turnover and days' payable outstanding (DPO)-use cost of goods sold in the numerator of the turnover ratio and round DPO to the nearest whole day f. Cash conversion cycle (in days) g. Times-interest-earned ratio h. Return on assetsuse DuPont Analysis i. Return on common stockholders' equity-use DuPont Analysis j. Earnings per share of common stock k. Price-earnings ratio Print Done 90 OOON TIUUTIC VOIN 2 of 3 (2 complete) Table Years Ended December 31, 2018 and 2017 2018 2017 Net sales $ 685,000 $ 597,000 Cost of goods sold 384,000 284,000 Gross profit 301,000 313,000 Operating expenses 132,000 144,000 Income from operations 169,000 169,000 32,000 43,000 Interest expense Income before income tax 137,000 126,000 35,000 51,000 Income tax expense $ 102,000 $ 75,000 Net income Print Done 90 ON Adama Dia -12 Homework 2 of 3 (2 complete) HW Sce Data Table Comparative Balance Sheets December 31, 2018 and 2017 2018 2017 2016 Current assets: Cash $ Current receivables, net Inventories 30,000 $ 213,000 296,000 11,000 34,000 158,000 $ 140,000 285,000 190,000 31,000 Prepaid expenses Total current assets Property, plant, and equipment, net 550,000 508,000 283,000 276,000 $ 833,000 $ 784,000 Total assets 711,000 Print Done 90 OOON Adam r 12 Homework 2 of 3 (2 complete) Data Table Property, plant, and equipment, net Total assets $ 833,000 $ 784,000 711,000 Accounts payable 116,000 $ 140,000 $ 133,000 106,000 197,000 Other current liabilties Total current liabilities 273,000 244,000 303,000 234,000 Long-term liabilities Total liabilities Common stockholders' equity, no par 517,000 537,000 316,000 247.000 $ 833,000 $ 784.000 193,000 Total liabilities and stockholders' equity * Selected 2016 amounts. Print Done 9 O O ON Other information: 1. Market price of Panfield Optical Mart common stock: $86.35 at December 31, 2018, and $75.02 at December 31, 2017 2. Common shares outstanding: 13,000 during 2018 and 11,000 during 2017 3. All sales on credit 4. Cash dividends paid per share: $0.70 in 2018 and $0.40 in 2017