Answered step by step

Verified Expert Solution

Question

1 Approved Answer

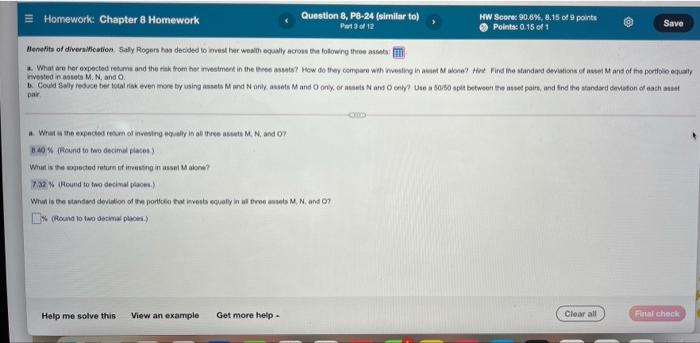

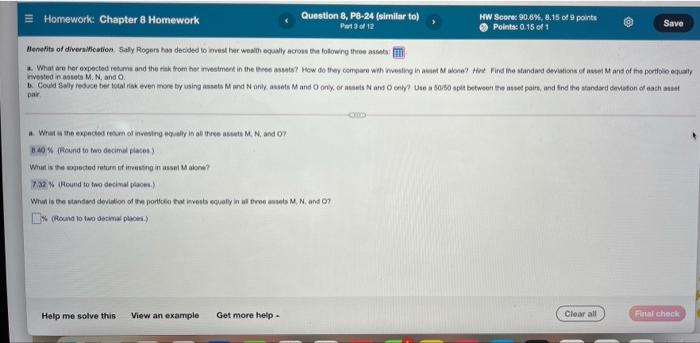

please help me find the TEN remaining parts. standard dev. of M and standard dev. of all three assets. AND MORE = Homework: Chapter 8

please help me find the TEN remaining parts.

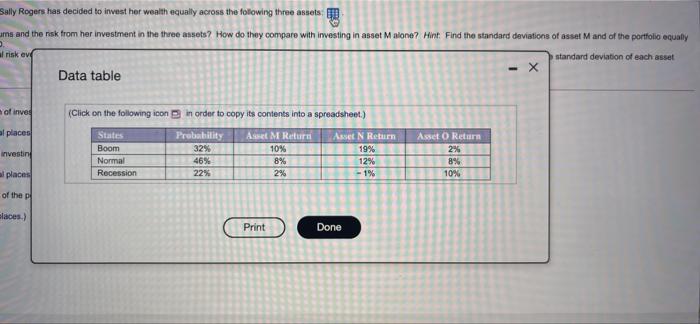

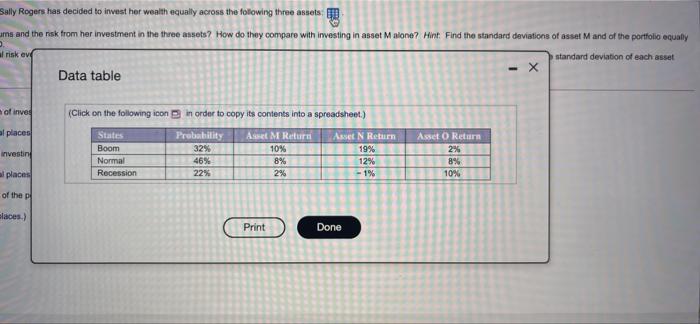

= Homework: Chapter 8 Homework Question 8, Pe-24 (similar to) Part 3 of 12 HW Score: 90.6%, 8.15 of 9 points Points: 0.15 of 1 Save Benefits of diversification Gally Rogers han decided to the weathegally across the following throat What are her expected resume and the risk from her investment in the ce? How do they compare with vesting in Moral e Find the standard deviation and of the portfolio Invested in seta M. Nando Could Salyvoxo bat total tok even more by using to Mand only acota Mand Oony or Nad Only 600 pt between the monet pairs, and find the standard devoton of each ot par cm What is the expected to investing all in all three and o B0% (Round to two decimal places What is the rected return of iting in Malow? 7.32% Round to two decimal place) What is the standard deviation of the portfolio that meet oually in altro antels M. N. and 07 D(Round to two doma pows) Help me solve this View an example Get more help Clear all Fire check Sally Rogers has decided to invest her wealth equally across the following three assets; ums and the risk from her investment in the three assets? How do they compare with investing in asset Malone? Mint. Find the standard deviations of asset M and of the portfolio equally standard deviation of each asset Data table al risk avd of inveg (Click on the following icon in order to copy its contents into a spreadsheet.) al places investing States Boom Normal Recession Probability 32% 469 22% Asset M Return 10% 8% 2% Asset N Return 19% 12% - 1% Asset Return 2% 8% 10% places of the pa Blaces) Print Done standard dev. of M and standard dev. of all three assets. AND MORE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started