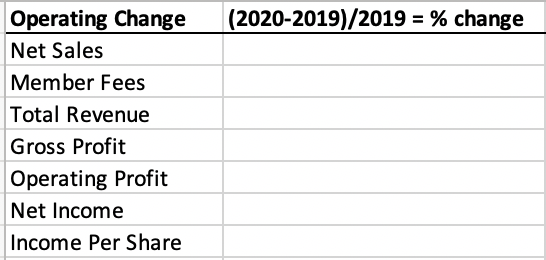

Please help me find these values using the attached financial statements

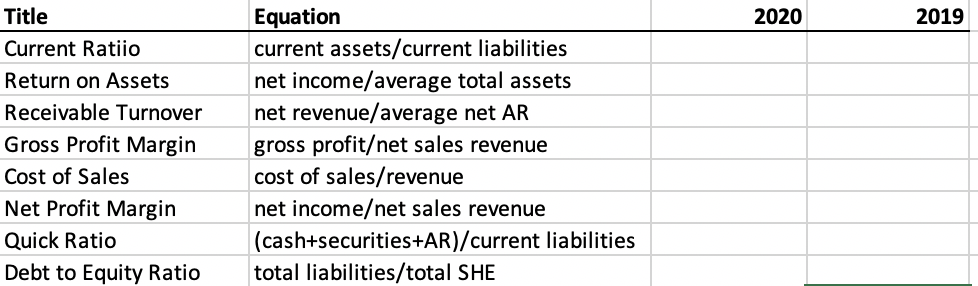

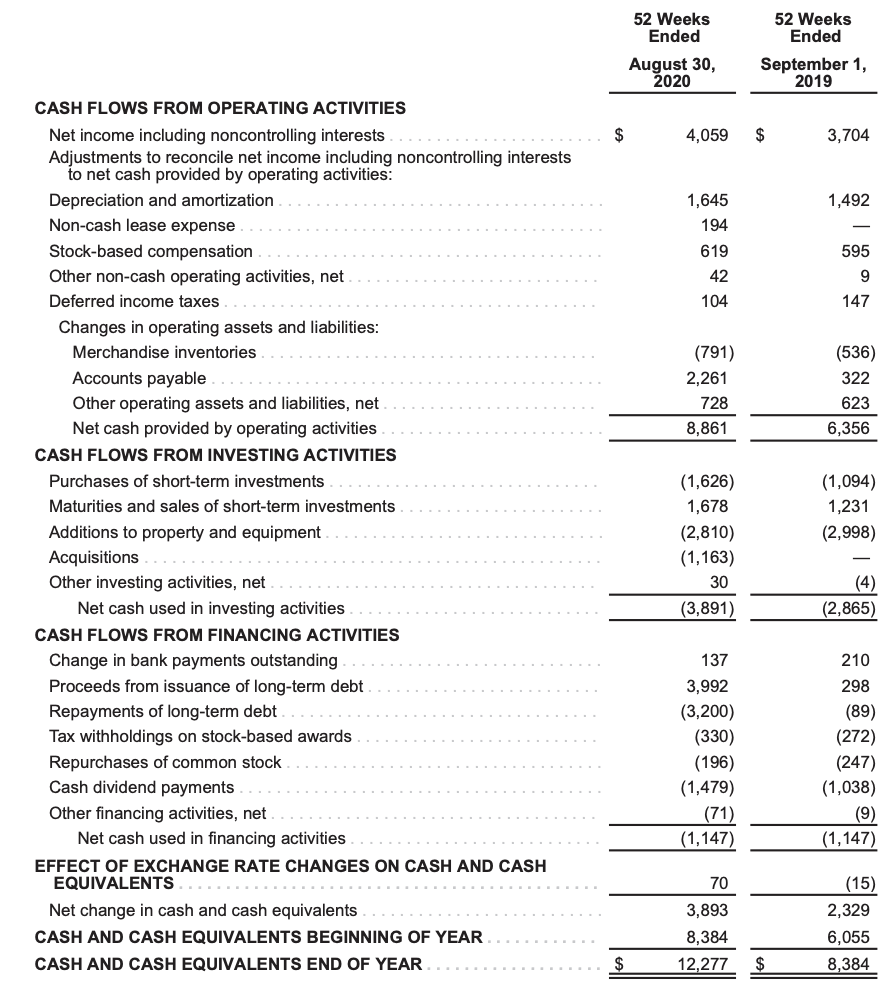

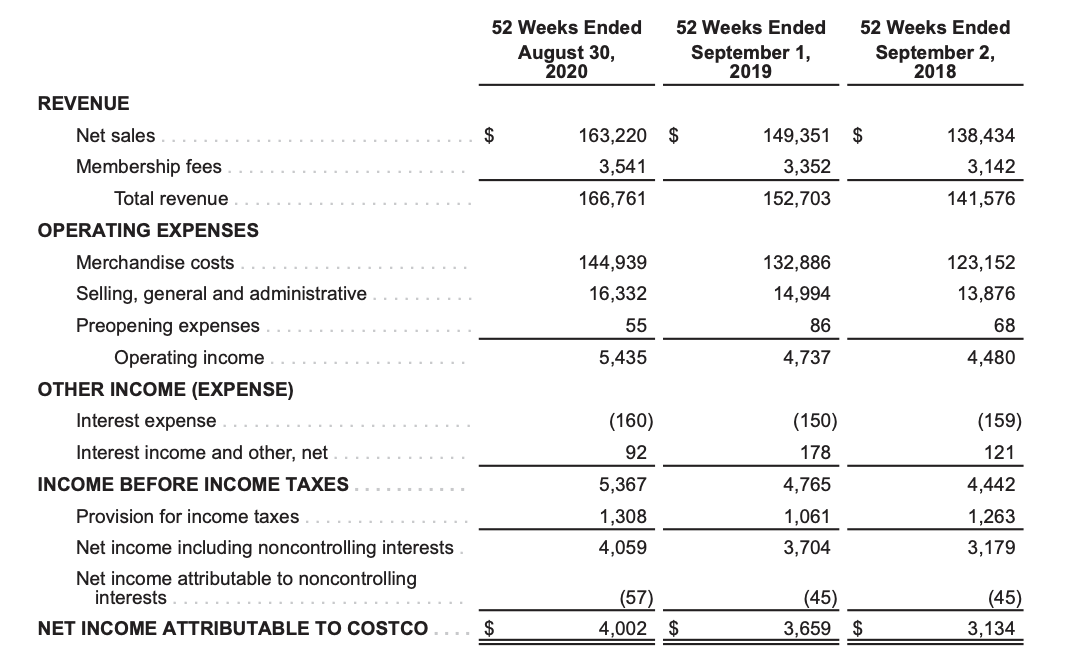

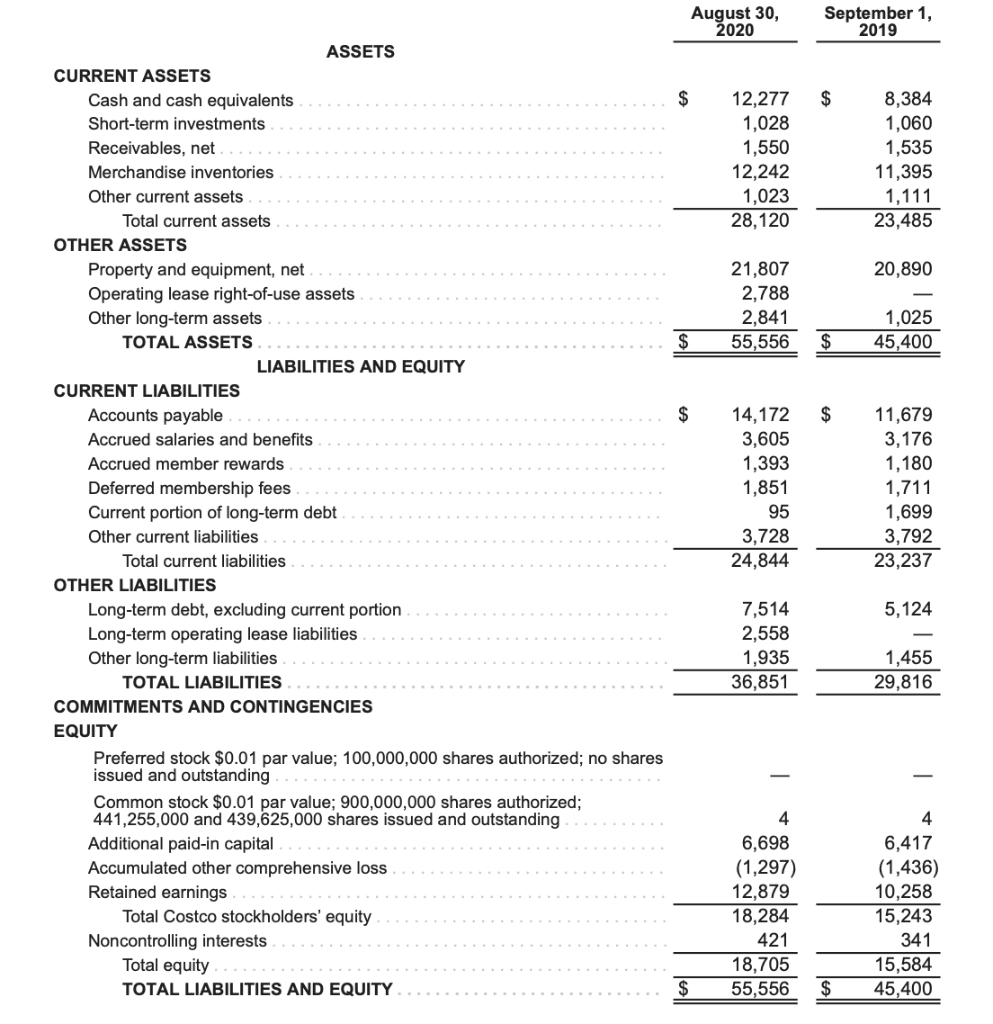

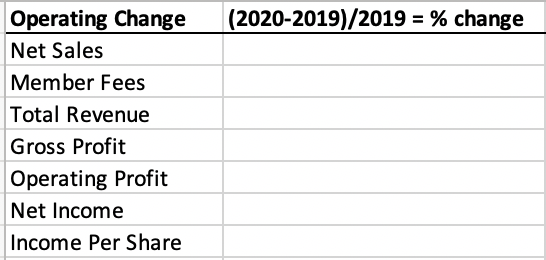

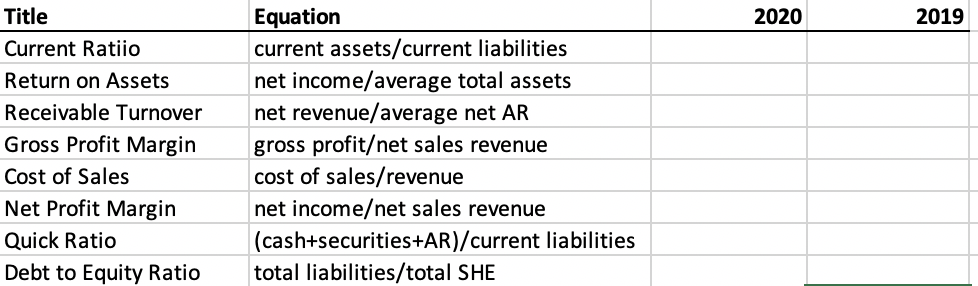

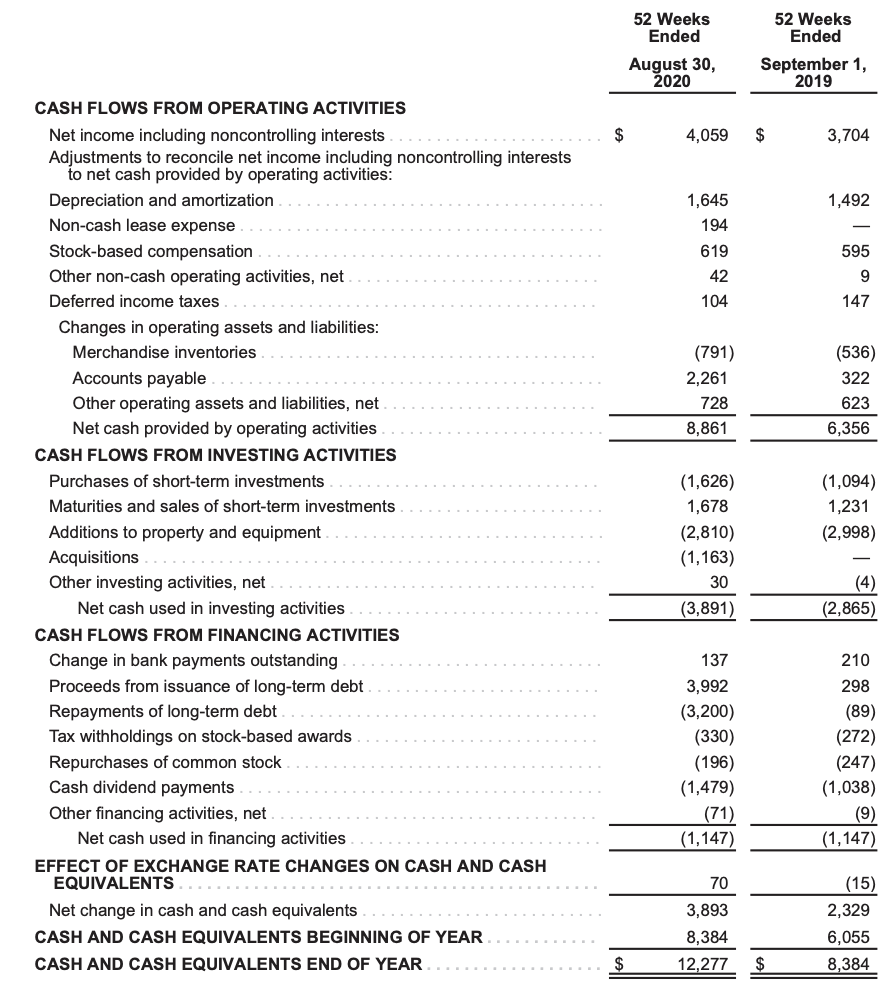

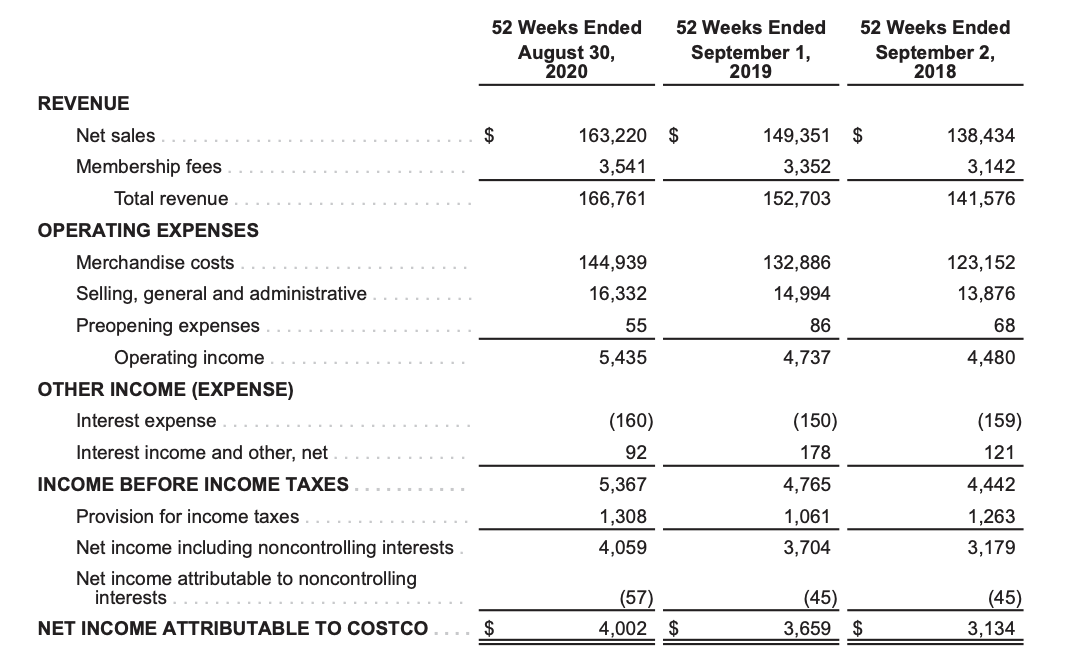

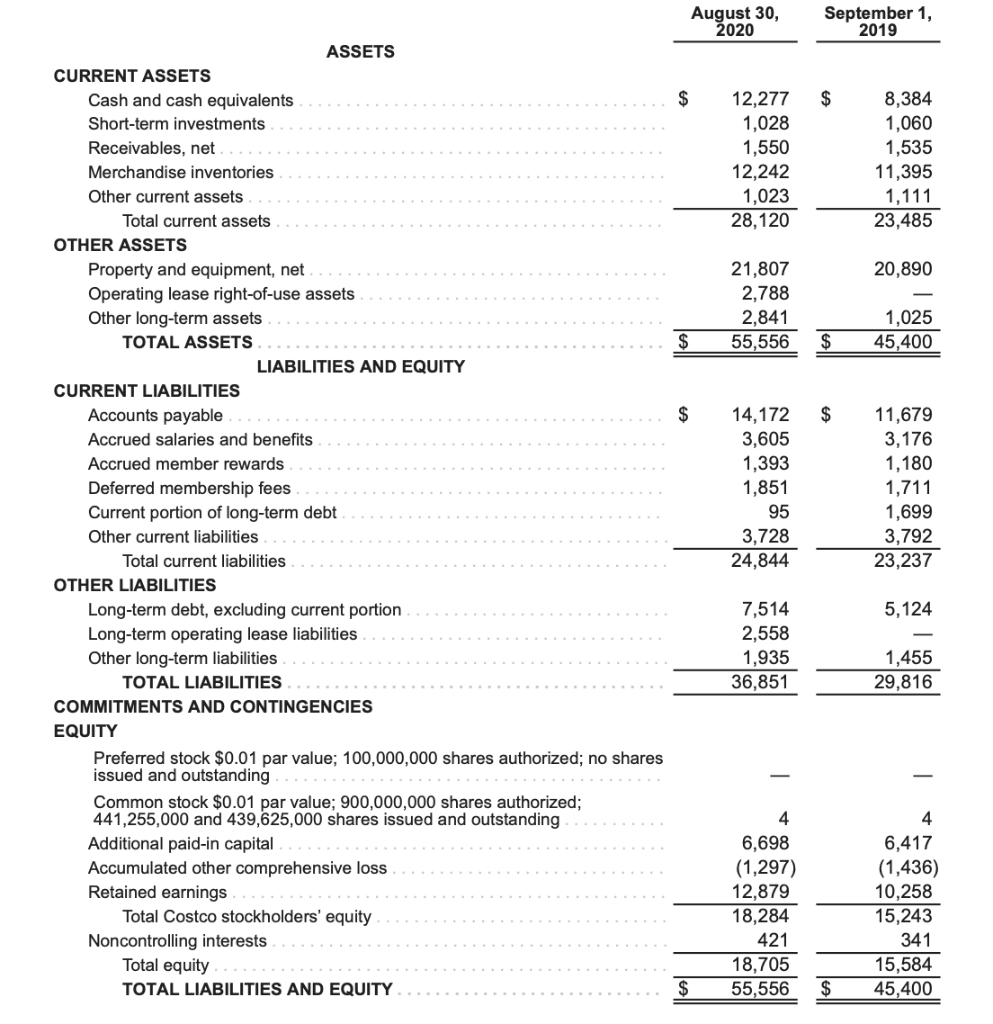

(2020-2019)/2019 = % change Operating Change Net Sales Member Fees Total Revenue Gross Profit Operating Profit Net Income Income Per Share 2020 2019 Title Current Ratio Return on Assets Receivable Turnover Gross Profit Margin Cost of Sales Net Profit Margin Quick Ratio Debt to Equity Ratio Equation current assets/current liabilities net income/average total assets net revenue/average net AR gross profitet sales revenue cost of sales/revenue net incomeet sales revenue (cash+securities+AR)/current liabilities total liabilities/total SHE 52 Weeks Ended September 1, 2019 $ 3,704 1,492 595 9 147 (536) 322 623 6,356 52 Weeks Ended August 30, 2020 CASH FLOWS FROM OPERATING ACTIVITIES Net income including noncontrolling interests ........... $ 4,059 Adjustments to reconcile net income including noncontrolling interests to net cash provided by operating activities: Depreciation and amortization 1,645 Non-cash lease expense 194 Stock-based compensation 619 Other non-cash operating activities, net 42 Deferred income taxes 104 Changes in operating assets and liabilities: Merchandise inventories (791) Accounts payable 2,261 Other operating assets and liabilities, net 728 Net cash provided by operating activities 8,861 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of short-term investments (1,626) Maturities and sales of short-term investments 1,678 Additions to property and equipment (2,810) Acquisitions (1,163) Other investing activities, net 30 Net cash used in investing activities (3,891 CASH FLOWS FROM FINANCING ACTIVITIES Change in bank payments outstanding Proceeds from issuance of long-term debt 3,992 Repayments of long-term debt. (3,200) Tax withholdings on stock-based awards (330) Repurchases of common stock (196) Cash dividend payments (1,479) Other financing activities, net (71) Net cash used in financing activities (1,147) EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS 70 Net change in cash and cash equivalents 3,893 CASH AND CASH EQUIVALENTS BEGINNING OF YEAR 8,384 CASH AND CASH EQUIVALENTS END OF YEAR $ 12,277 (1,094) 1,231 (2,998) (4) (2,865) 137 210 298 (89) (272) (247) (1,038) (9) (1,147) (15) 2,329 6,055 8,384 $ 52 Weeks Ended August 30, 2020 52 Weeks Ended September 1, 2019 52 Weeks Ended September 2, 2018 REVENUE Net sales $ 163,220 $ 3,541 166,761 Membership fees 149,351 $ 3,352 152,703 138,434 3,142 Total revenue 141,576 OPERATING EXPENSES 144,939 16,332 55 132,886 14,994 123,152 13,876 86 68 5,435 4,737 4,480 Merchandise costs Selling, general and administrative Preopening expenses Operating income OTHER INCOME (EXPENSE) Interest expense Interest income and other, net INCOME BEFORE INCOME TAXES Provision for income taxes Net income including noncontrolling interests Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO COSTCO... $ (160) 92 5,367 1,308 4,059 (150) 178 4,765 1,061 3,704 (159) 121 4,442 1,263 3,179 (57) 4,002 $ (45) 3,659 $ (45) 3,134 August 30, 2020 September 1, 2019 $ $ 12,277 1,028 1,550 12,242 1,023 28,120 8,384 1,060 1,535 11,395 1,111 23,485 20,890 21,807 2,788 2,841 55,556 1,025 45,400 $ $ $ $ ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories Other current assets Total current assets OTHER ASSETS Property and equipment, net Operating lease right-of-use assets Other long-term assets TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable Accrued salaries and benefits Accrued member rewards Deferred membership fees Current portion of long-term debt Other current liabilities Total current liabilities OTHER LIABILITIES Long-term debt, excluding current portion Long-term operating lease liabilities Other long-term liabilities TOTAL LIABILITIES COMMITMENTS AND CONTINGENCIES EQUITY Preferred stock $0.01 par value; 100,000,000 shares authorized; no shares issued and outstanding Common stock $0.01 par value; 900,000,000 shares authorized; 441,255,000 and 439,625,000 shares issued and outstanding Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total Costco stockholders' equity Noncontrolling interests Total equity TOTAL LIABILITIES AND EQUITY 14,172 3,605 1,393 1,851 95 3,728 24,844 11,679 3,176 1,180 1,711 1,699 3,792 23,237 5,124 7,514 2,558 1,935 36,851 1,455 29,816 - 4 6,698 (1,297) 12,879 18,284 421 18,705 55,556 4 6,417 (1,436) 10,258 15,243 341 15,584 45,400 $ $