please help me find those multiple questions

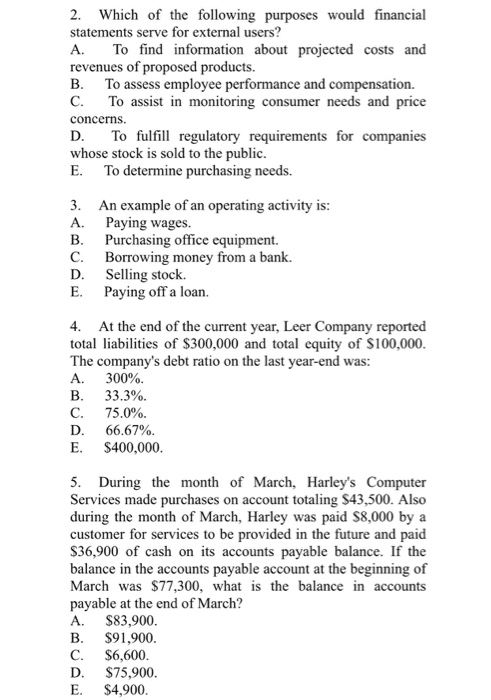

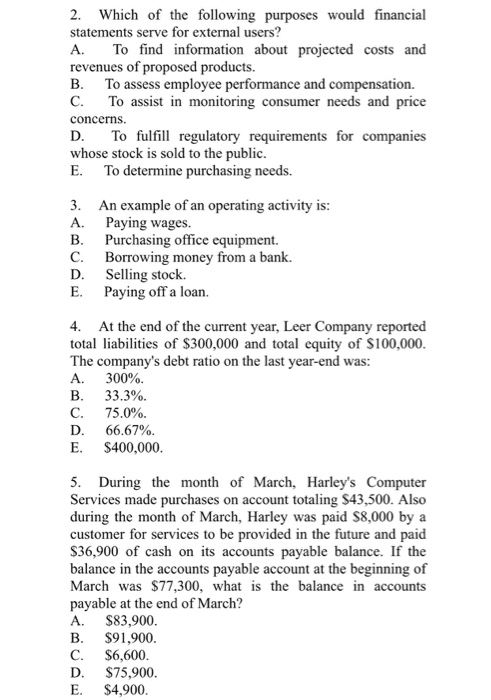

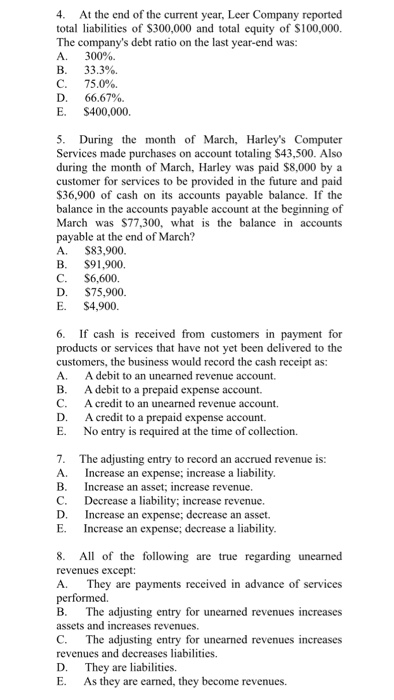

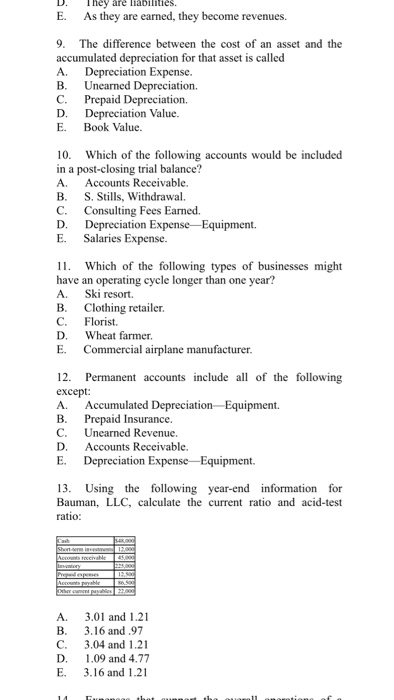

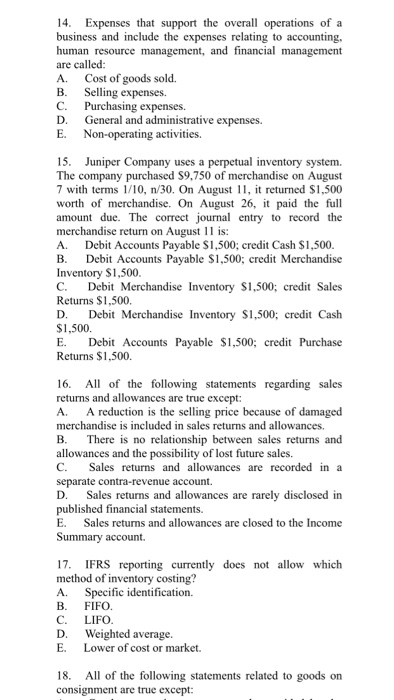

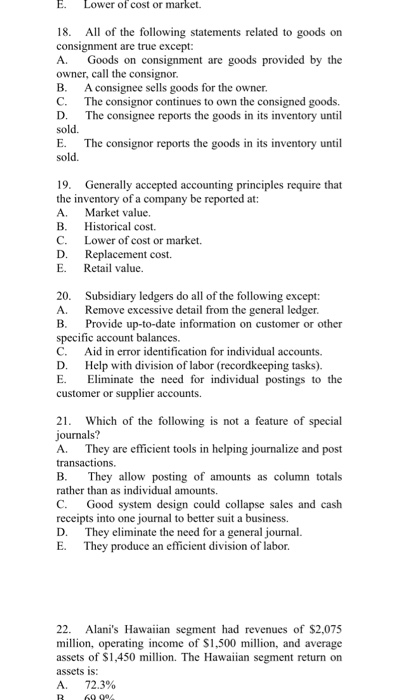

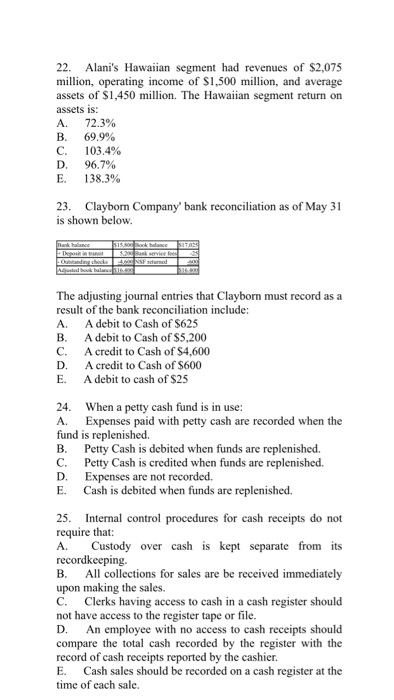

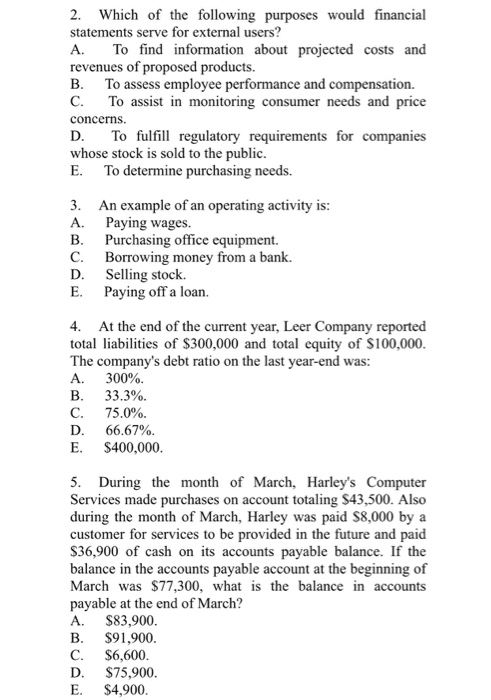

2. Which of the following purposes would financial statements serve for external users? revenues of proposed products. B. To assess employee performance and compensation. C. To assist in monitoring consumer needs and price concerns. D. To fulfill regulatory requirements for companies whose stock is sold to the public. E. To determine purchasing needs. 3. A. B. C. D. E. An example of an operating activity is: Paying wages. Purchasing office equipment. Borrowing money from a bank. Selling stock Paying off a loan. 4. At the end of the current year, Leer Company reported total liabilities of $300,000 and total equity of $100,000. The company's debt ratio on the last year-end was: A. 300%. B. 33.3% 75.0%. D. 66.67% E. $400,000 C. 5. During the month of March, Harley's Computer Services made purchases on account totaling $43,500. Also during the month of March, Harley was paid $8,000 by a customer for services to be provided in the future and paid $36,900 of cash on its accounts payable balance. If the balance in the accounts payable account at the beginning of March was $77,300, what is the balance in accounts payable at the end of March? A. $83,900. B. $91,900. C. $6,600. D. $75,900. E. $4,900. 4. At the end of the current year, Leer Company reported total liabilities of $300,000 and total equity of $100,000. The company's debt ratio on the last year-end was: A. 300%. B. 33.3% c. 75.0%. D. 66.67%. E. $400,000. 5. During the month of March, Harley's Computer Services made purchases on account totaling $43,500. Also during the month of March, Harley was paid $8,000 by a customer for services to be provided in the future and paid $36,900 of cash on its accounts payable balance. If the balance in the accounts payable account at the beginning of March was $77,300, what is the balance in accounts payable at the end of March? A. S83,900. B. $91,900. C. $6,600. D. $75,900. E. $4,900. 6. If cash is received from customers in payment for products or services that have not yet been delivered to the customers, the business would record the cash receipt as: A. A debit to an unearned revenue account. B. A debit to a prepaid expense account. c. Acredit to an unearned revenue account. D. A credit to a prepaid expense account. E. No entry is required at the time of collection. 7. A. B. C. D. E. The adjusting entry to record an accrued revenue is: Increase an expense; increase a liability. Increase an asset, increase revenue. Decrease a liability, increase revenue. Increase an expense; decrease an asset. Increase an expense; decrease a liability. 8. All of the following are true regarding unearned revenues except: A. They are payments received in advance of services performed. B. The adjusting entry for unearned revenues increases assets and increases revenues. C. The adjusting entry for unearned revenues increases revenues and decreases liabilities. D. They are liabilities. E. As they are earned, they become revenues. D. E. They are liabilities. As they are earned, they become revenues. 9. The difference between the cost of an asset and the accumulated depreciation for that asset is called A. Depreciation Expense. B. Unearned Depreciation. C. Prepaid Depreciation. D. Depreciation Value. E. Book Value. 10. Which of the following accounts would be included in a post-closing trial balance? A. Accounts Receivable. B. S. Stills, Withdrawal. C. Consulting Fees Earned. D. Depreciation Expense-Equipment. E. Salaries Expense. 11. Which of the following types of businesses might have an operating cycle longer than one year? A Ski resort B. Clothing retailer C. Florist. D. Wheat farmer. E Commercial airplane manufacturer. 12. Permanent accounts include all of the following except: A. Accumulated Depreciation Equipment. B. Prepaid Insurance. C. Unearned Revenue. D. Accounts Receivable. E. Depreciation Expense-Equipment. 13. Using the following year-end information for Bauman, LLC, calculate the current ratio and acid-test ratio: A B. C. D. E. 3.01 and 1.21 3.16 and 97 3.04 and 1.21 1.09 and 4.77 3.16 and 1.21 14. Expenses that support the overall operations of a business and include the expenses relating to accounting, human resource management, and financial management are called: A. Cost of goods sold. B. Selling expenses. C. Purchasing expenses. D. General and administrative expenses. E. Non-operating activities. The company purchased $9,750 of merchandise on August 7 with terms 1/10, n/30. On August 11, it returned $1,500 worth of merchandise. On August 26, it paid the full amount due. The correct journal entry to record the merchandise return on August 11 is: A. Debit Accounts Payable $1,500; credit Cash $1,500. B. Debit Accounts Payable $1,500; credit Merchandise Inventory $1,500. C. Debit Merchandise Inventory $1,500; credit Sales Returns $1,500. D. Debit Merchandise Inventory $1,500; credit Cash $1,500. E. Debit Accounts Payable $1,500; credit Purchase Returns $1,500. 16. All of the following statements regarding sales returns and allowances are true except: A. A reduction is the selling price because of damaged merchandise is included in sales returns and allowances. B. There is no relationship between sales returns and allowances and the possibility of lost future sales. C. Sales returns and allowances are recorded in a separate contra-revenue account. D. Sales returns and allowances are rarely disclosed in published financial statements. E. Sales returns and allowances are closed to the Income Summary account 17. IFRS reporting currently does not allow which method of inventory costing? A. Specific identification. B. FIFO. C. LIFO. D. Weighted average. E Lower of cost or market. 18. All of the following statements related to goods on consignment are true except: E. Lower of cost or market. 18. All of the following statements related to goods on consignment are true except: A. Goods on consignment are goods provided by the owner, call the consignor. B. A consignee sells goods for the owner. C. The consignor continues to own the consigned goods. D. The consignee reports the goods in its inventory until sold. E. The consignor reports the goods in its inventory until sold. 19. Generally accepted accounting principles require that the inventory of a company be reported at: A Market value. B. Historical cost. C. Lower of cost or market. D. Replacement cost. E. Retail value. 20. Subsidiary ledgers do all of the following except: A. Remove excessive detail from the general ledger. B. Provide up-to-date information on customer or other specific account balances. c. Aid in error identification for individual accounts. D. Help with division of labor (recordkeeping tasks). Eliminate the need for individual postings to the customer or supplier accounts. 21. Which of the following is not a feature of special journals? A. They are efficient tools in helping journalize and post transactions. B. They allow posting of amounts as column totals rather than as individual amounts. c. Good system design could collapse sales and cash receipts into one journal to better suit a business. D. They eliminate the need for a general journal. E. They produce an efficient division of labor. 22. Alani's Hawaiian segment had revenues of $2.075 million, operating income of $1,500 million, and average assets of $1,450 million. The Hawaiian segment return on A. 72.3% R 60 00 22. Alani's Hawaiian segment had revenues of $2,075 million, operating income of $1,500 million, and average assets of $1,450 million. The Hawaiian segment return on assets is: A. 72.3% B. 69.9% C. 103.4% D 96.7% E. 138.3% 23. Clayborn Company' bank reconciliation as of May 31 is shown below. The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include: A. A debit to Cash of $625 B. A debit to Cash of $5,200 D. E. A credit to Cash of $600 A debit to cash of $25 24. A. When a petty cash fund is in use: Expenses paid with petty cash are recorded when the B. c. D. E. Petty Cash is debited when funds are replenished. Petty Cash is credited when funds are replenished. Expenses are not recorded. Cash is debited when funds are replenished. 25. Internal control procedures for cash receipts do not require that: A Custody over cash is kept separate from its recordkeeping. B. All collections for sales are be received immediately upon making the sales. C. Clerks having access to cash in a cash register should not have access to the register tape or file. D. An employee with no access to cash receipts should compare the total cash recorded by the register with the record of cash receipts reported by the cashier. E. Cash sales should be recorded on a cash register at the time of each sale