Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME FINISH ASAP! - - - To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential.

PLEASE HELP ME FINISH ASAP!

-

-

-

-

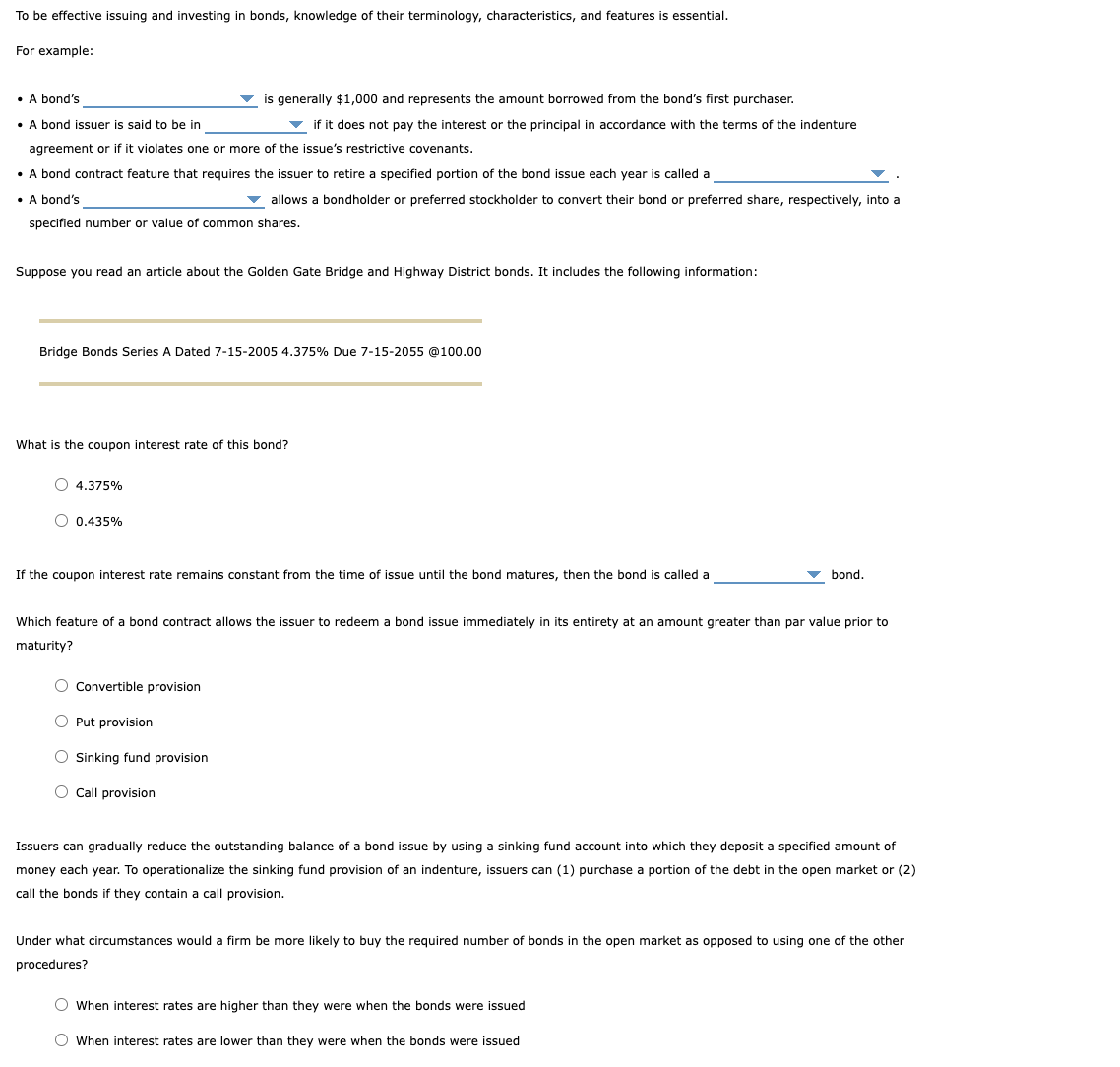

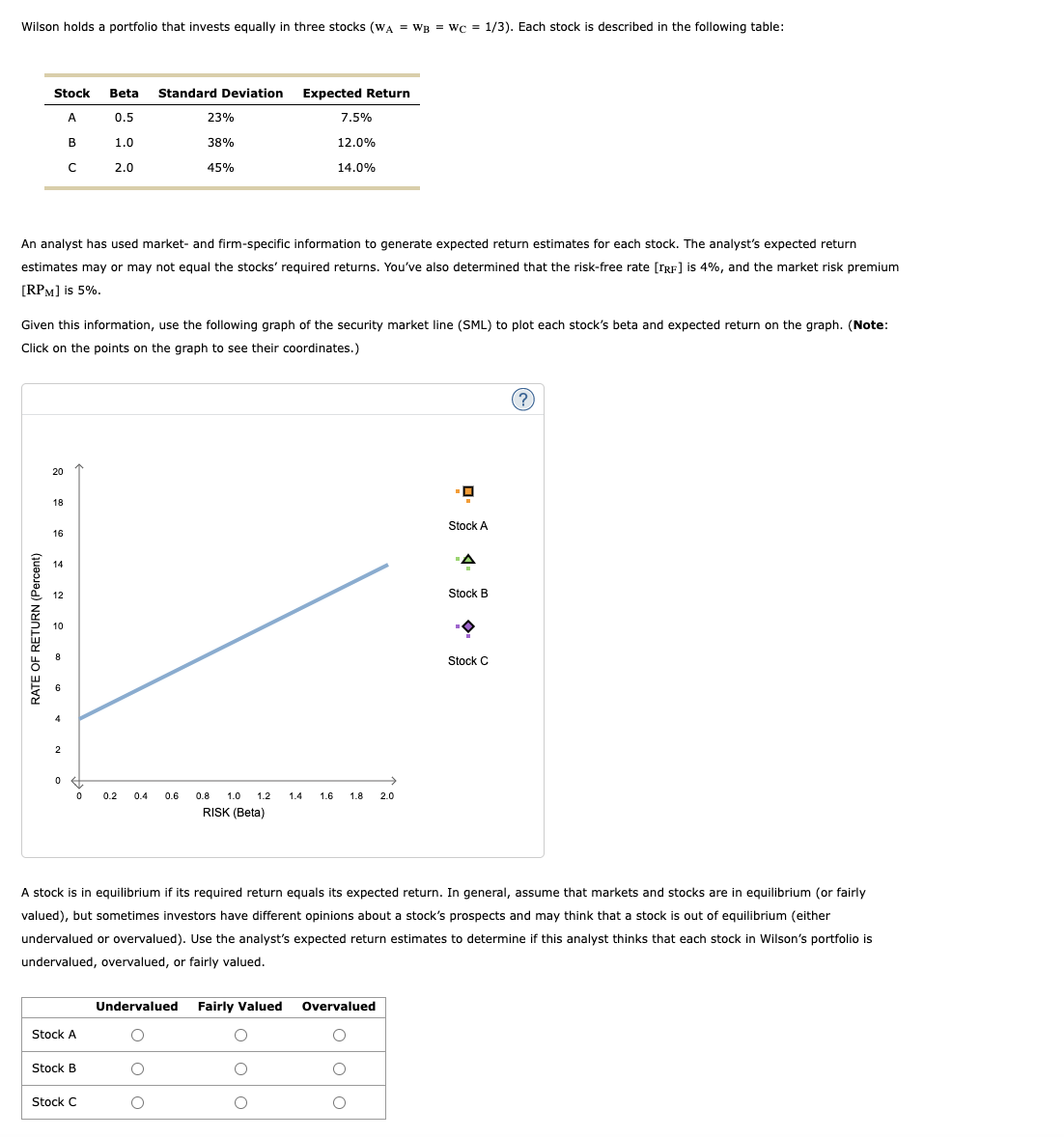

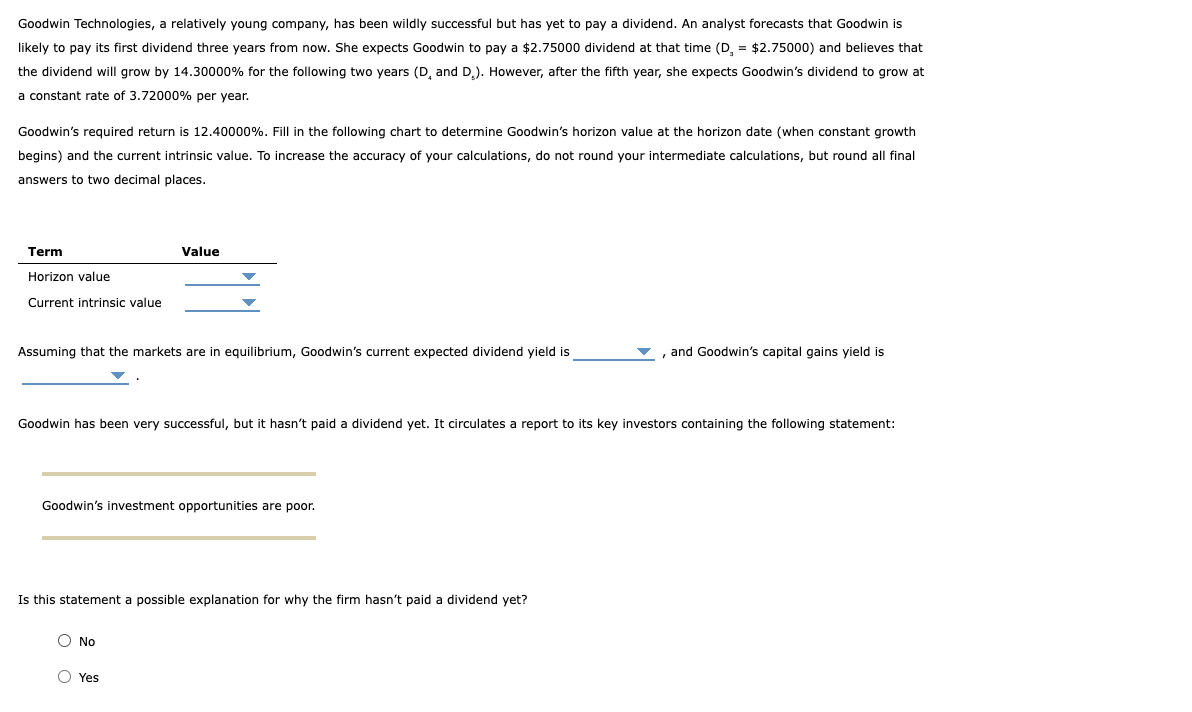

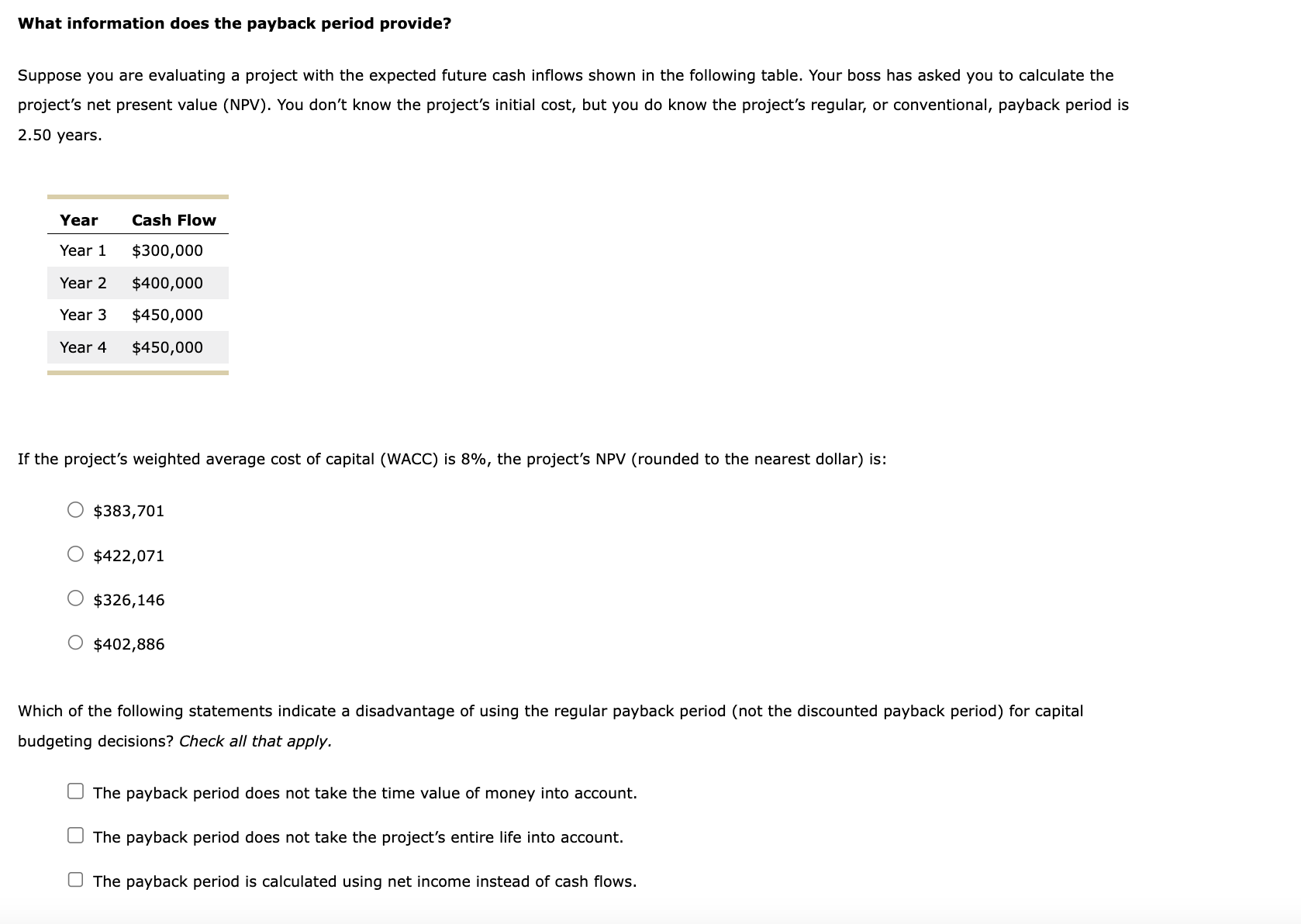

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: - A bond's - A bond issuer is said to be in is generally $1,000 and represents the amount borrowed from the bond's first purchaser. if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. - A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called a - A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375\% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? 4.375% 0.435% If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem a bond issue immediately in its entirety at an amount greater than par value prior to maturity? Convertible provision Put provision Sinking fund provision Call provision Issuers can gradually reduce the outstanding balance of a bond issue by using a sinking fund account into which they deposit a specified amount of money each year. To operationalize the sinking fund provision of an indenture, issuers can (1) purchase a portion of the debt in the open market or (2) call the bonds if they contain a call provision. Under what circumstances would a firm be more likely to buy the required number of bonds in the open market as opposed to using one of the other procedures? When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued Wilson holds a portfolio that invests equally in three stocks ( wA=wB=wC=1/3 ). Each stock is described in the following table: An analyst has used market- and firm-specific information to generate expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. You've also determined that the risk-free rate [ rRF ] is 4%, and the market risk premium [RPM] is 5%. Given this information, use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. (Note: Click on the points on the graph to see their coordinates.) A stock is in equilibrium if its required return equals its expected return. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Use the analyst's expected return estimates to determine if this analyst thinks that each stock in Wilson's portfolio is undervalued, overvalued, or fairly valued. Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.75000 dividend at that time ( D3=$2.75000 ) and believes that the dividend will grow by 14.30000% for the following two years (D4 and Ds ). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 3.72000% per year. Goodwin's required return is 12.40000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its key investors containing the following statement: Goodwin's investment opportunities are poor. Is this statement a possible explanation for why the firm hasn't paid a dividend yet? No Yes What information does the payback period provide? Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's weighted average cost of capital (WACC) is 8%, the project's NPV (rounded to the nearest dollar) is: $383,701 $422,071 $326,146 $402,886 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period does not take the time value of money into account. The payback period does not take the project's entire life into account. The payback period is calculated using net income instead of cash flows. To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: - A bond's - A bond issuer is said to be in is generally $1,000 and represents the amount borrowed from the bond's first purchaser. if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. - A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called a - A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375\% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? 4.375% 0.435% If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem a bond issue immediately in its entirety at an amount greater than par value prior to maturity? Convertible provision Put provision Sinking fund provision Call provision Issuers can gradually reduce the outstanding balance of a bond issue by using a sinking fund account into which they deposit a specified amount of money each year. To operationalize the sinking fund provision of an indenture, issuers can (1) purchase a portion of the debt in the open market or (2) call the bonds if they contain a call provision. Under what circumstances would a firm be more likely to buy the required number of bonds in the open market as opposed to using one of the other procedures? When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued Wilson holds a portfolio that invests equally in three stocks ( wA=wB=wC=1/3 ). Each stock is described in the following table: An analyst has used market- and firm-specific information to generate expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. You've also determined that the risk-free rate [ rRF ] is 4%, and the market risk premium [RPM] is 5%. Given this information, use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. (Note: Click on the points on the graph to see their coordinates.) A stock is in equilibrium if its required return equals its expected return. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Use the analyst's expected return estimates to determine if this analyst thinks that each stock in Wilson's portfolio is undervalued, overvalued, or fairly valued. Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.75000 dividend at that time ( D3=$2.75000 ) and believes that the dividend will grow by 14.30000% for the following two years (D4 and Ds ). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 3.72000% per year. Goodwin's required return is 12.40000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its key investors containing the following statement: Goodwin's investment opportunities are poor. Is this statement a possible explanation for why the firm hasn't paid a dividend yet? No Yes What information does the payback period provide? Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's weighted average cost of capital (WACC) is 8%, the project's NPV (rounded to the nearest dollar) is: $383,701 $422,071 $326,146 $402,886 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period does not take the time value of money into account. The payback period does not take the project's entire life into account. The payback period is calculated using net income instead of cash flows

To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: - A bond's - A bond issuer is said to be in is generally $1,000 and represents the amount borrowed from the bond's first purchaser. if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. - A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called a - A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375\% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? 4.375% 0.435% If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem a bond issue immediately in its entirety at an amount greater than par value prior to maturity? Convertible provision Put provision Sinking fund provision Call provision Issuers can gradually reduce the outstanding balance of a bond issue by using a sinking fund account into which they deposit a specified amount of money each year. To operationalize the sinking fund provision of an indenture, issuers can (1) purchase a portion of the debt in the open market or (2) call the bonds if they contain a call provision. Under what circumstances would a firm be more likely to buy the required number of bonds in the open market as opposed to using one of the other procedures? When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued Wilson holds a portfolio that invests equally in three stocks ( wA=wB=wC=1/3 ). Each stock is described in the following table: An analyst has used market- and firm-specific information to generate expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. You've also determined that the risk-free rate [ rRF ] is 4%, and the market risk premium [RPM] is 5%. Given this information, use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. (Note: Click on the points on the graph to see their coordinates.) A stock is in equilibrium if its required return equals its expected return. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Use the analyst's expected return estimates to determine if this analyst thinks that each stock in Wilson's portfolio is undervalued, overvalued, or fairly valued. Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.75000 dividend at that time ( D3=$2.75000 ) and believes that the dividend will grow by 14.30000% for the following two years (D4 and Ds ). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 3.72000% per year. Goodwin's required return is 12.40000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its key investors containing the following statement: Goodwin's investment opportunities are poor. Is this statement a possible explanation for why the firm hasn't paid a dividend yet? No Yes What information does the payback period provide? Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's weighted average cost of capital (WACC) is 8%, the project's NPV (rounded to the nearest dollar) is: $383,701 $422,071 $326,146 $402,886 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period does not take the time value of money into account. The payback period does not take the project's entire life into account. The payback period is calculated using net income instead of cash flows. To be effective issuing and investing in bonds, knowledge of their terminology, characteristics, and features is essential. For example: - A bond's - A bond issuer is said to be in is generally $1,000 and represents the amount borrowed from the bond's first purchaser. if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. - A bond contract feature that requires the issuer to retire a specified portion of the bond issue each year is called a - A bond's allows a bondholder or preferred stockholder to convert their bond or preferred share, respectively, into a specified number or value of common shares. Suppose you read an article about the Golden Gate Bridge and Highway District bonds. It includes the following information: Bridge Bonds Series A Dated 7-15-2005 4.375\% Due 7-15-2055 @100.00 What is the coupon interest rate of this bond? 4.375% 0.435% If the coupon interest rate remains constant from the time of issue until the bond matures, then the bond is called a bond. Which feature of a bond contract allows the issuer to redeem a bond issue immediately in its entirety at an amount greater than par value prior to maturity? Convertible provision Put provision Sinking fund provision Call provision Issuers can gradually reduce the outstanding balance of a bond issue by using a sinking fund account into which they deposit a specified amount of money each year. To operationalize the sinking fund provision of an indenture, issuers can (1) purchase a portion of the debt in the open market or (2) call the bonds if they contain a call provision. Under what circumstances would a firm be more likely to buy the required number of bonds in the open market as opposed to using one of the other procedures? When interest rates are higher than they were when the bonds were issued When interest rates are lower than they were when the bonds were issued Wilson holds a portfolio that invests equally in three stocks ( wA=wB=wC=1/3 ). Each stock is described in the following table: An analyst has used market- and firm-specific information to generate expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. You've also determined that the risk-free rate [ rRF ] is 4%, and the market risk premium [RPM] is 5%. Given this information, use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. (Note: Click on the points on the graph to see their coordinates.) A stock is in equilibrium if its required return equals its expected return. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Use the analyst's expected return estimates to determine if this analyst thinks that each stock in Wilson's portfolio is undervalued, overvalued, or fairly valued. Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.75000 dividend at that time ( D3=$2.75000 ) and believes that the dividend will grow by 14.30000% for the following two years (D4 and Ds ). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 3.72000% per year. Goodwin's required return is 12.40000%. Fill in the following chart to determine Goodwin's horizon value at the horizon date (when constant growth begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all final answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its key investors containing the following statement: Goodwin's investment opportunities are poor. Is this statement a possible explanation for why the firm hasn't paid a dividend yet? No Yes What information does the payback period provide? Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's weighted average cost of capital (WACC) is 8%, the project's NPV (rounded to the nearest dollar) is: $383,701 $422,071 $326,146 $402,886 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period does not take the time value of money into account. The payback period does not take the project's entire life into account. The payback period is calculated using net income instead of cash flows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started