Answered step by step

Verified Expert Solution

Question

1 Approved Answer

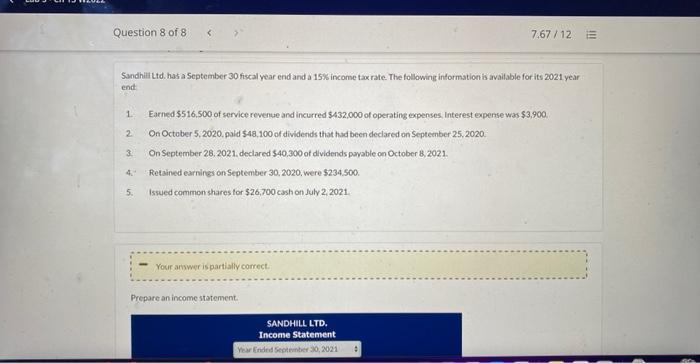

Please help me finish Question 8 of 8 7.67/12 Sandhill Ltd. has a September 30 fiscal year end and a 15% income tax rate. The

Please help

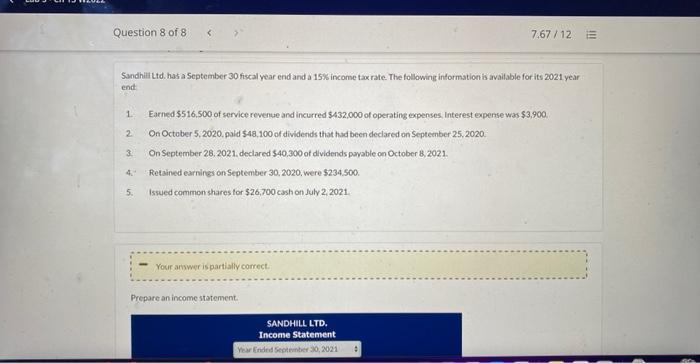

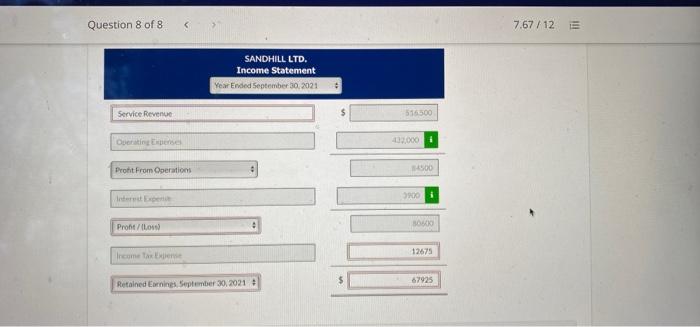

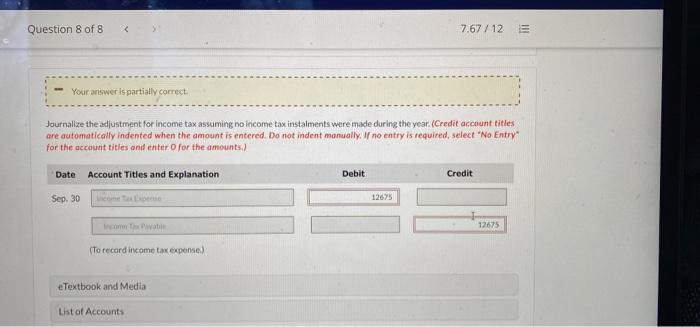

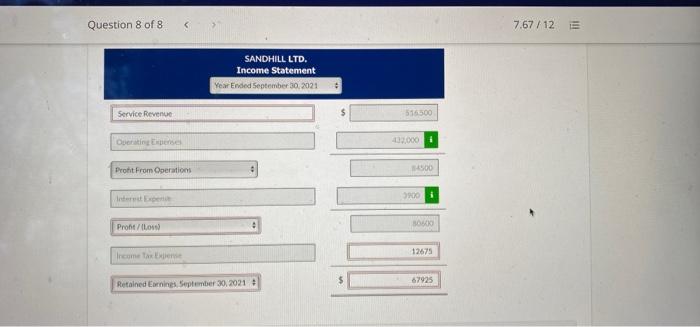

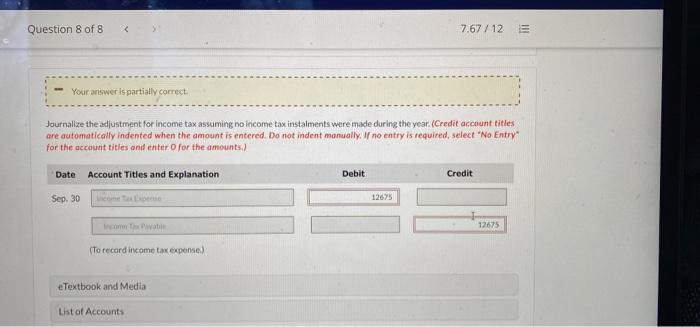

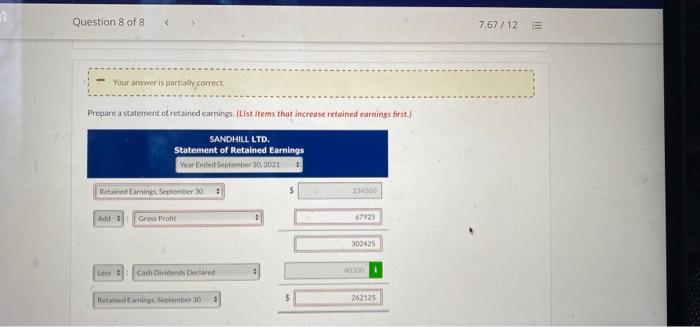

Question 8 of 8 7.67/12 Sandhill Ltd. has a September 30 fiscal year end and a 15% income tax rate. The following information is available for its 2021 year end 1 2 3. Earned $516.500 of service revenue and incurred 8432,000 of operating expenses. Interest expense was $3,900, On October 5, 2020, paid $48,100 of dividends that had been declared on September 25, 2020 On September 28,2021. declared 540.300 of dividends payable on October 8, 2021. Retained earnings on September 30, 2020, were $234.500. Issued common shares for $26,700 cash on July 2 2021 5. Your answer is partially correct. Prepare an income statement SANDHILL LTD. Income Statement Year Ended Sember 30, 2021 Question 8 of 8 me finish

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started