Answered step by step

Verified Expert Solution

Question

1 Approved Answer

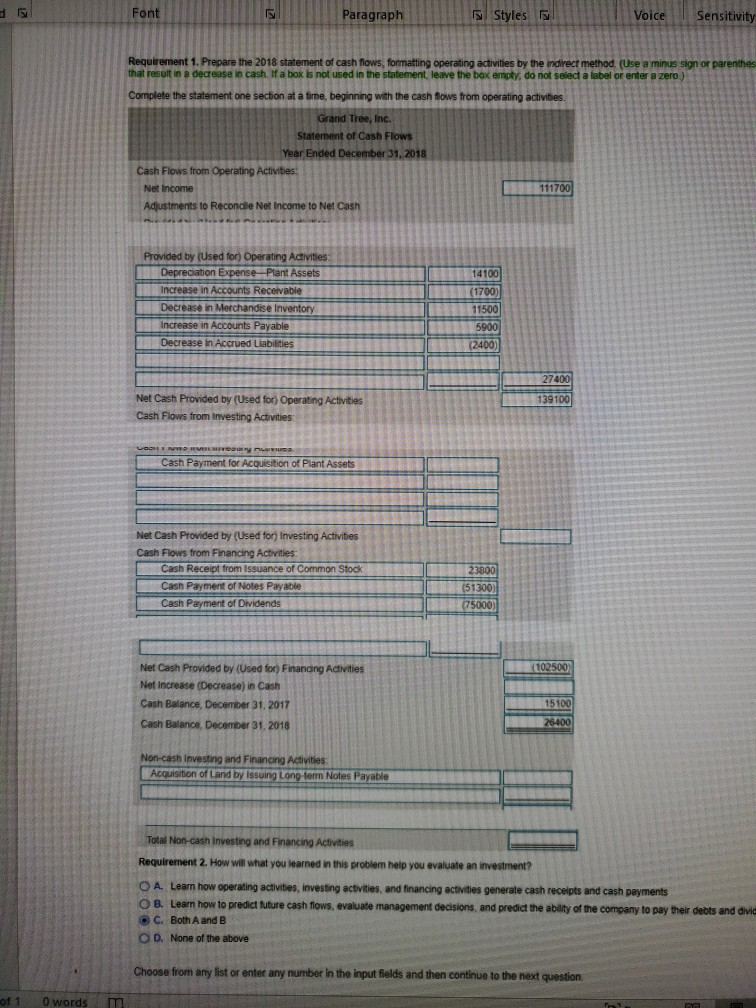

Please help me finish solving this. If I'm wrong, please correct me. Please prepare the 2018 statement of cash flows, formatting operating activities by the

Please help me finish solving this. If I'm wrong, please correct me.

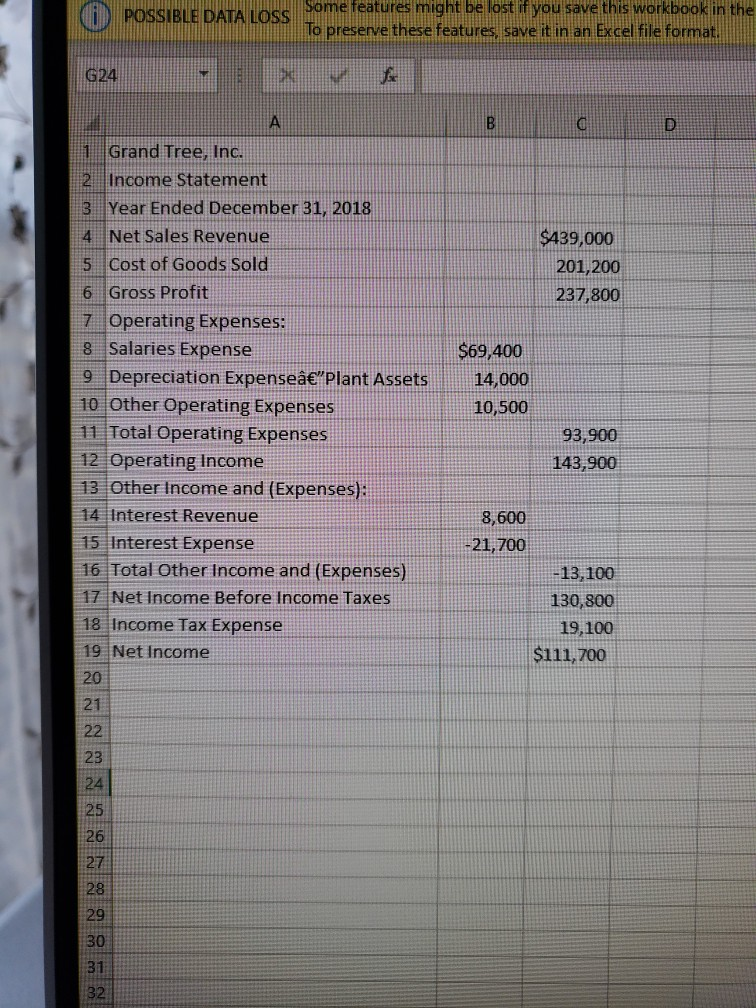

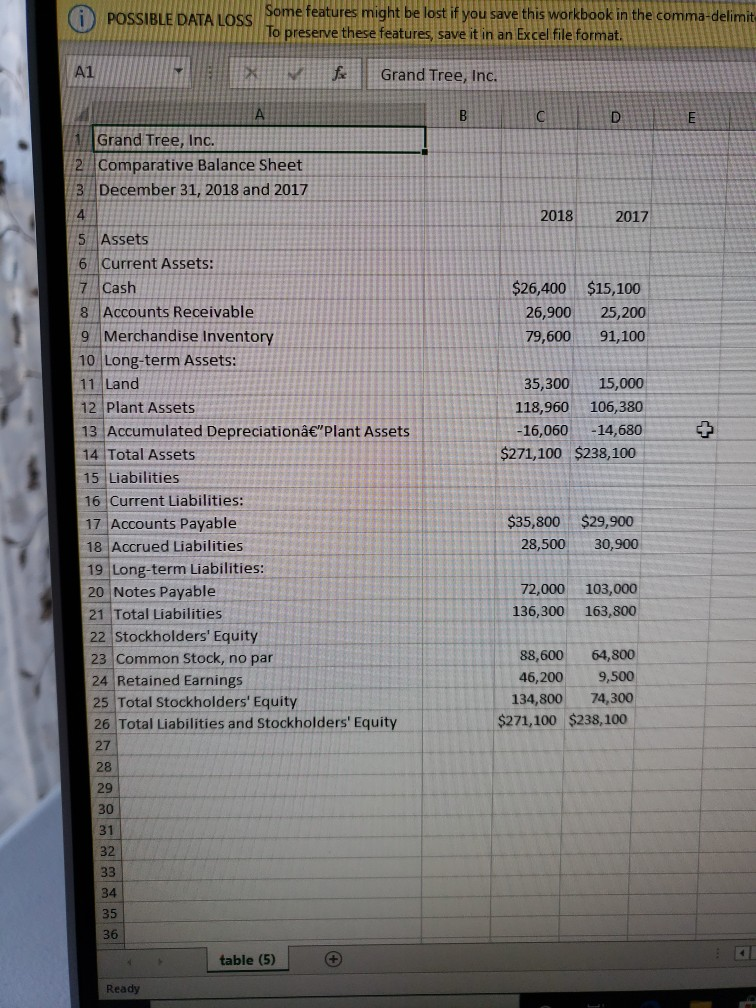

Please prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. The statement of cash flow is a work in progress. I have attached the balance sheet and income statement.

Font Paragraph Styles Voice Sensitivity Requirement 1. Prepare the 2018 statement of cash flows, formatting operating activities by the indirect method. (Use a minus sign or parenthes that result in a decrease in cash. If a box is not used in the statement, leave the box empty, do not select a label or enter a zero Complete the statement one section at a time, beginning with the cash fows from operating activities Grand Tree, Inc. Statement of Cash Flows Year Ended December 31, 2018 Cash Flows from Operating Activities Net Income Adjustments to Recondie Net Income to Net Cash 111700 141001 Provided by (Used for) Operating Activities Depreciation Expense Plant Assets Increase in Accounts Receivable Decrease in Merchandise Inventory Increase in Accounts Payable Decrease in Accrued Liabilities (1700) 11500 5900 (2400) 27400 139100 Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: VADOR COURT Cash Payment for Acquisition of Plant Assets Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock Cash Payment of Notes Payable Cash Payment of Dividends 238001 (51300) (75000) (102500 Net Cash Provided by (Used for Financing Activities Net Increase (Decrease) in Cash Cash Balance December 31, 2017 Cash Balance, December 31, 2018 15100 26400 Non-cash investing and Financing Activities Acquisition of Land by issuing Long term Notes Payable Total Non-cash Investing and Financing Activities Requirement 2. How will what you learned in this problem help you evaluate an investment? O A. Learn how operating activities, investing activities and financing activities generate cash receipts and cash payments O B. Learn how to predict future cash flows, evaluate management decisions, and predict the ability of the company to pay their debts and divic OC. Both A and B OD. None of the above Choose from any list or enter any number in the input fields and then continue to the next question of 1 O words POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the To preserve these features, save it in an Excel file format. G24 B C D $439,000 201,200 237,800 1 Grand Tree, Inc. 2 Income Statement 3 Year Ended December 31, 2018 4 Net Sales Revenue 5 Cost of Goods Sold 6 Gross Profit 7 Operating Expenses: 8 Salaries Expense 9 Depreciation Expense" Plant Assets 10 Other Operating Expenses 11 Total Operating Expenses 12 Operati Income 13 Other Income and (Expenses): 14 Interest Revenue 15 Interest Expense 16 Total Other Income and (Expenses) 17 Net Income Before Income Taxes 18 Income Tax Expense 19 Net Income 20 $69,400 14,000 10,500 93,900 143,900 8,600 -21,700 -13,100 130,800 19,100 $111,700 21 22 23 24 25 26 27 28 29 30 31 32 POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the comma-delimit To preserve these features, save it in an Excel file format. A1 > Grand Tree, Inc. B D E A Grand Tree, Inc. 2 Comparative Balance Sheet 3 December 31, 2018 and 2017 4 2018 2017 $26,400 $15,100 26,900 25,200 79,600 91,100 35,300 15,000 118,960 106,380 - 16,060 -14,680 $271,100 $238,100 5 Assets 6 Current Assets: 7 Cash 8 Accounts Receivable 9 Merchandise Inventory 10 Long-term Assets: 11 Land 12 Plant Assets 13 Accumulated Depreciation"Plant Assets 14 Total Assets 15 Liabilities 16 Current Liabilities: 17 Accounts Payable 18 Accrued Liabilities 19 Long-term Liabilities: 20 Notes Payable 21 Total Liabilities 22 Stockholders' Equity 23 Common Stock, no par 24 Retained Earnings 25 Total Stockholders' Equity 26 Total Liabilities and Stockholders' Equity 27 28 29 30 $35,800 28,500 $29,900 30,900 72,000 103,000 163,800 136,300 88,600 64,800 46,200 9,500 134,800 74,300 $271,100 $238, 100 31 32 33 34 35 36 4 table (5) + Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started