Answered step by step

Verified Expert Solution

Question

1 Approved Answer

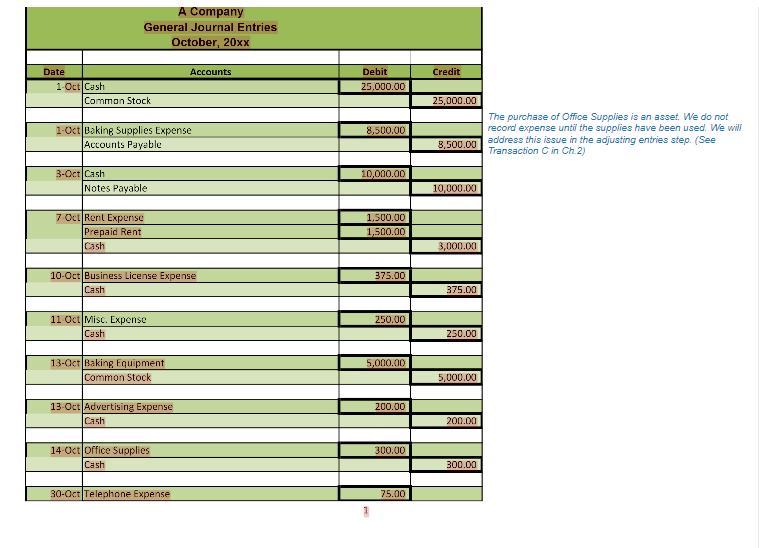

Please help me fix my mistakes thank you. A Company General Journal Entries October, 20xx Accounts Credit Date 1- Oct Cash Common Stock Debit 25.000.00

Please help me fix my mistakes thank you.

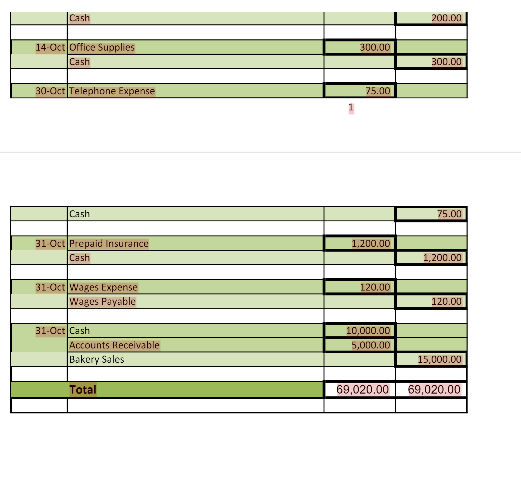

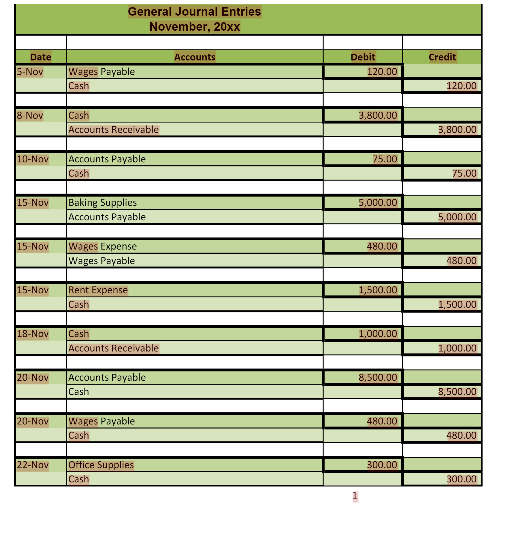

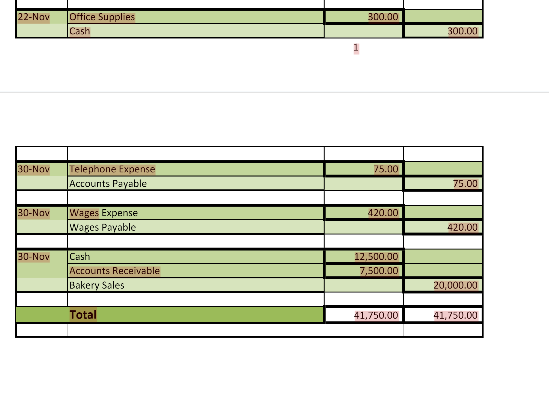

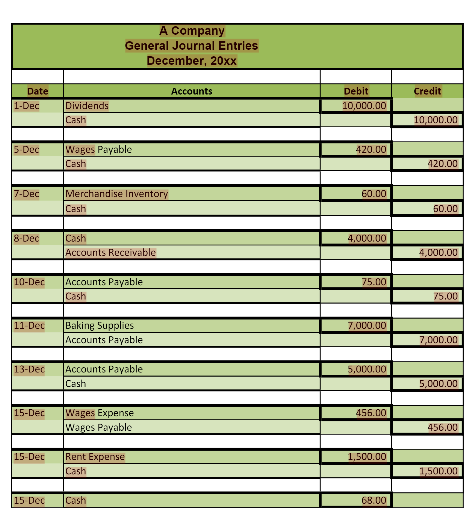

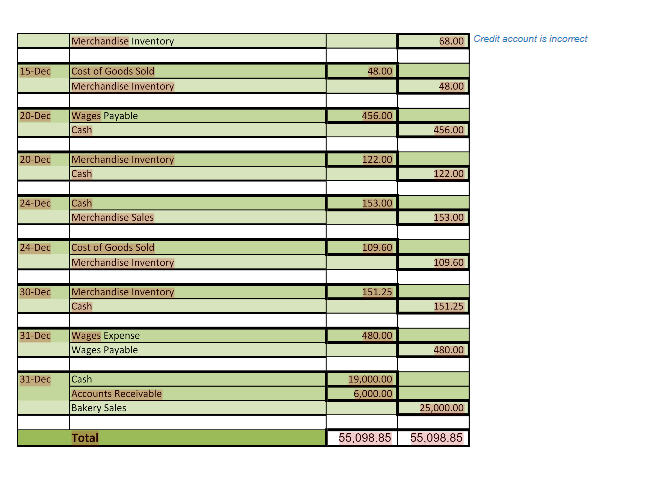

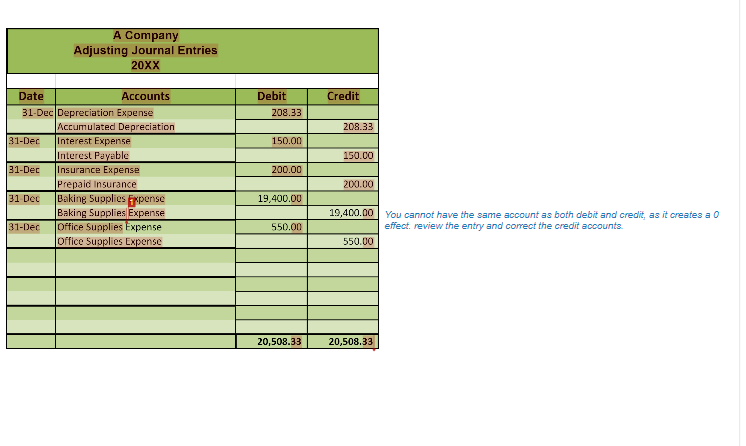

A Company General Journal Entries October, 20xx Accounts Credit Date 1- Oct Cash Common Stock Debit 25.000.00 25,000.00 8,500.00 1-Oct Waking Supplies Expense Accounts Payable The purchase of Office Supplies is an asset. We do not record expense until the supplies have been used. We will address this issue in the adjusting entries step. (See Transaction in Ch.2) 3,500.00 10,000.00 3-OctCash Notes Payable 10,000.00 7 Oct Rent Expense Prepaid Rent Cash 1.500.00 1,500.00 3,000.00 375.00 10-Oct Business License Expense Cash 375.00 250.00 11 Oct Misc. Expense Cash 250.00 5,000.00 13-OctBaking Equipment Common Stock 5,000.00 200.00 13-Oct Advertising Expense Cash 200.00 300.00 14-Oct Office Supplies Cash 300.00 30-Oct Telephone Expense 75.00 Cash 200.00 300.00 14-Oct Office Supplies Cash 300.00 30-Oct Telephone Expense 75.00 Cash 75.00 1.200.00 31 Oct Prepaid Insurance Cash 1,200.00 120.00 31-Octwages Expense Wages Payable 120.00 31-OctCash Accounts Receivable Bakery Sales 10,000.00 5,000.00 15,000.00 Total 69,020.00 69,020.00 General Journal Entries November, 20xx Date Accounts Credit Debit 120.00 15-Nov Wages Payable Cash 120.00 8 Nov 3.800.00 Cash Accounts Receivable 3,800.00 10-Nov 75.00 Accounts Payable Cash 75.00 15 Nov 5.000.00 Baking Supplies Accounts Payable 5,000.00 15-Nov 480.00 Wages Expense Wages Payable 480.00 15-Nov 1,500.00 Rent Expense Cash 1,500.00 18-Nov 1,000.00 Cash Accounts Receivable 1,000.00 20 Nov 8.500.00 Accounts Payable Cash 8,500.00 120-Nov 480.00 Wages Payable Cash 480.00 122-Nov 300.00 Office Supplies Cash 300.00 22-Nov 300.00 Office Supplies Cash 300.00 30-Nov 75.00 Telephone Expense Accounts Payable 75.00 30-Nov 420.00 Wages Expense Wages Payable 420.00 30 Nov Cash Accounts Receivable Bakery Sales 12,500.00 7,500.00 20,000.00 Total 41,750.00 41,750.00 A Company General Journal Entries December, 20xx Accounts Credit Date 1-Dec Debit 10,000.00 Dividends Cash 10,000.00 5 Dec 420.00 Wages Payable Cash 420.00 7-Dec 60.00 Merchandise Inventory Cash 50.00 8-Dec 4.000.00 Cash Accounts Receivable 4,000.00 10-Dec 75.00 Accounts Payable Cash 75.00 11 Dec 7.000.00 Baking Supplies Accounts Payable 7,000.00 13-Dec 5,000.00 Accounts Payable Cash 5,000.00 15-Dec 456.00 Wages Expense Wares Payable 456.00 15-Dec 1,500.00 Rent Expense Cash 1,500.00 15 DCC Cash 68.00 Merchandise Inventory 68.00 Credit account is incorrect 15-Dec 48.00 Cost of Goods Sold Merchandise Inventory 48.00 20-Dec 456.00 Wages Payable Cash 456.00 20 Dec 122.00 Merchandise Inventory Cash 122.00 24-Dec 153.00 Cash Merchandise Sales 153.00 24 Dec 109.60 Cust of Goods Sold Merchandise Inventory 109.60 30-Dec 151.25 Merchandise Inventory Cash 151.25 31 Dec 480.00 Wages Expense Wages Payable 480.00 31-Dec Cash Accounts Receivable Bakery Sales 19,000.00 6,000.00 25,000.00 Total 55,098.85 55.098.85 A Company Adjusting Journal Entries 20XX Credit Debit 208.33 208.33 150.00 150.00 Date Accounts 31-Dec Depreciation Expense Accumulated Depreciation 31-Dec Interest Expense Interest Payable 31-Dec Insurance Expense Prepaid Insurance 31 Dec Baking Supplies Expense Baking Supplies Expense 31-Dec Office Supplies Expense Office Supplies Expense 200.00 200.00 19,400.00 550.00 19,400.00 You cannot have the same account as both debit and credit, as it creates a 0 effect. review the entry and correct the credit accounts. 550.00 20,508.33 20,508.33Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started