Answered step by step

Verified Expert Solution

Question

1 Approved Answer

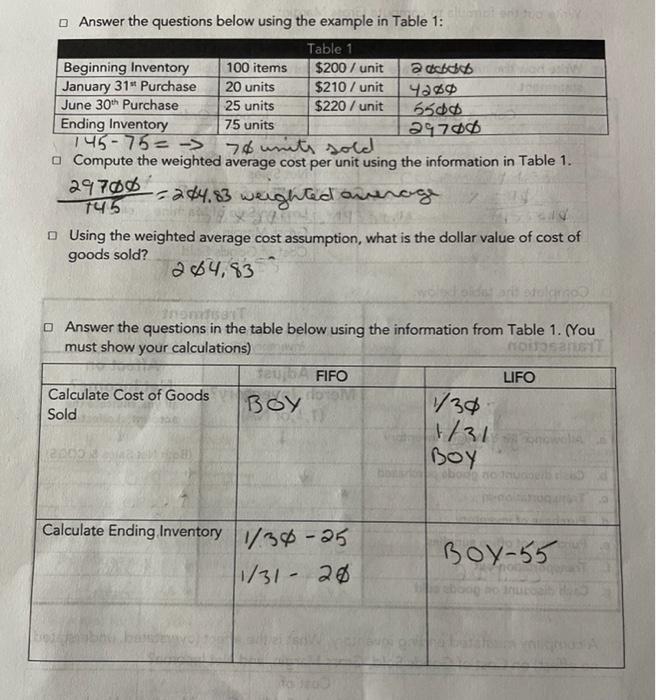

PLEASE HELP ME! I am so confused! Answer the questions below using the example in Table 1: Table 1 Beginning Inventory 100 items $200 /

PLEASE HELP ME! I am so confused!

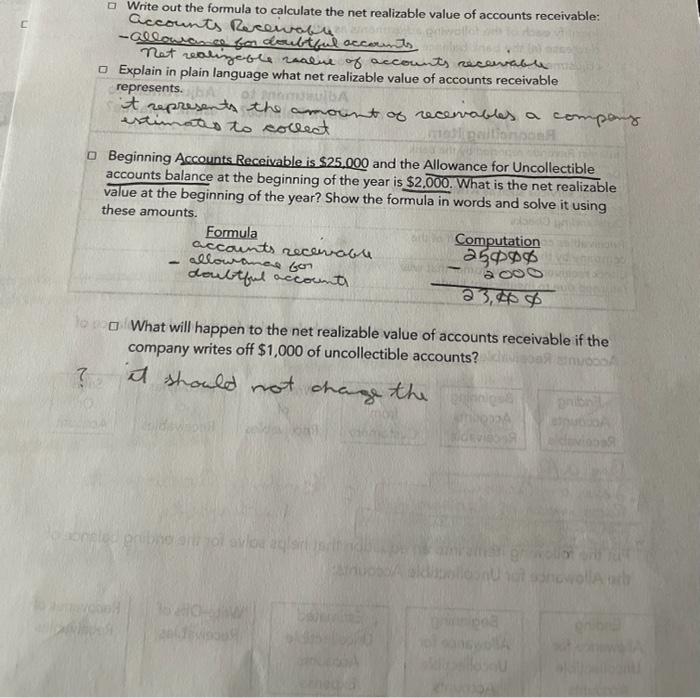

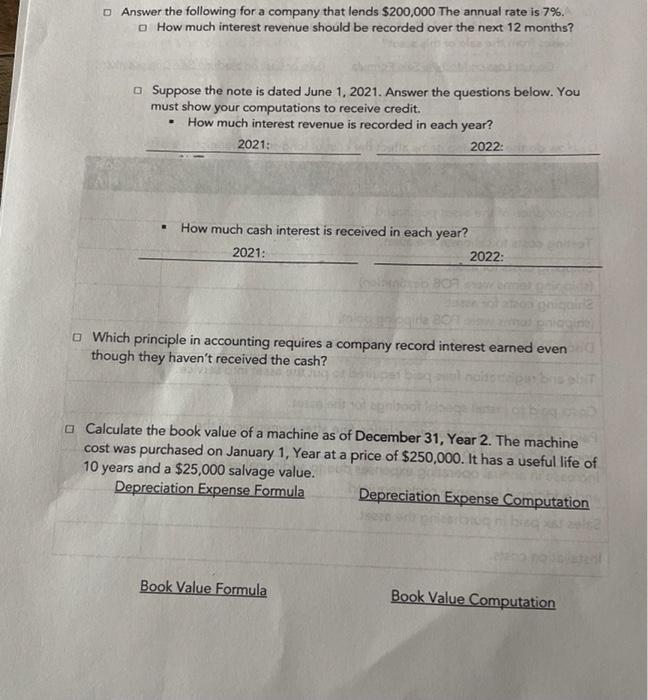

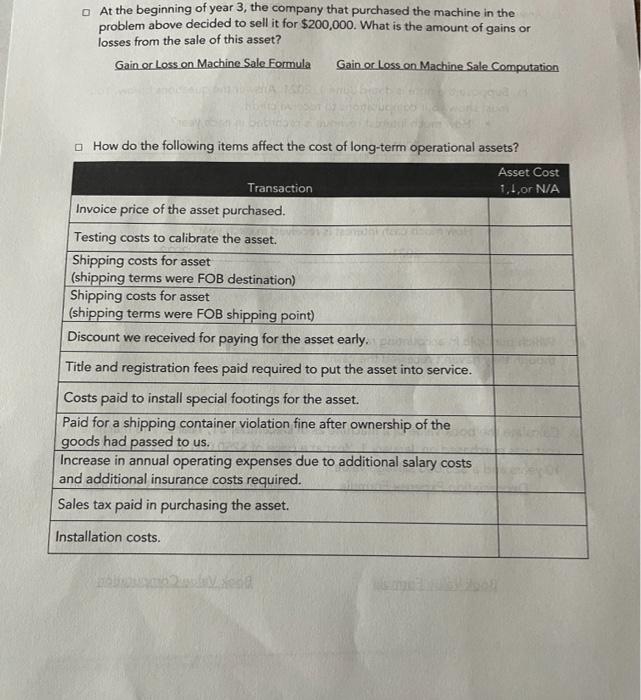

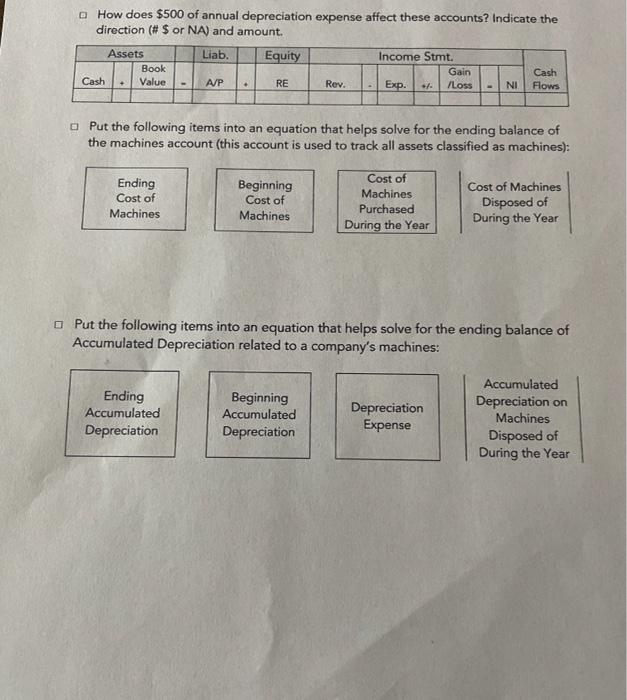

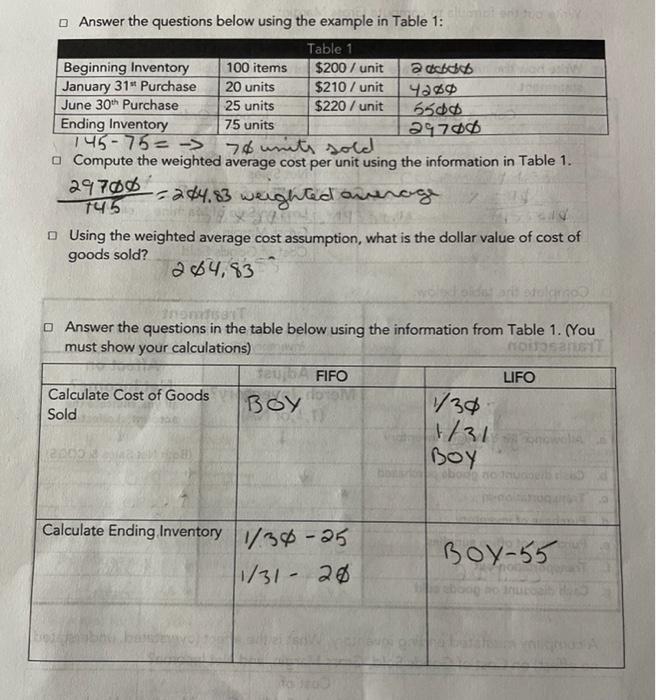

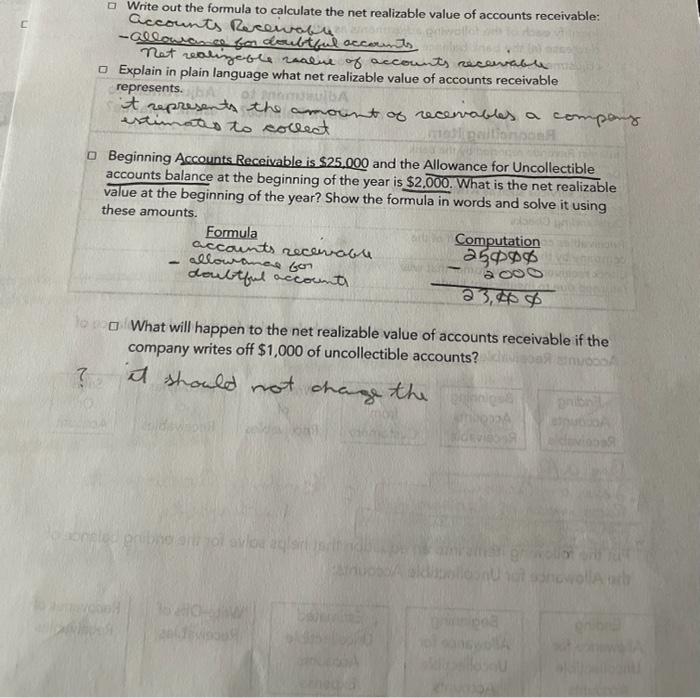

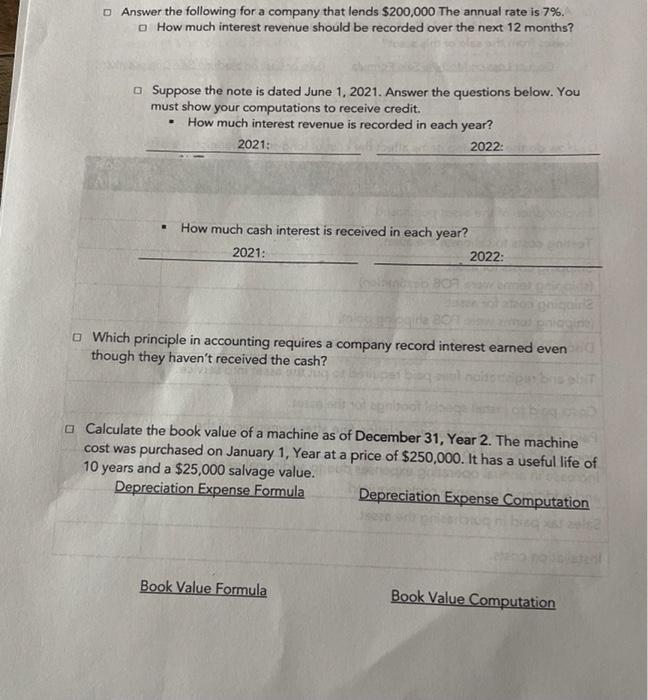

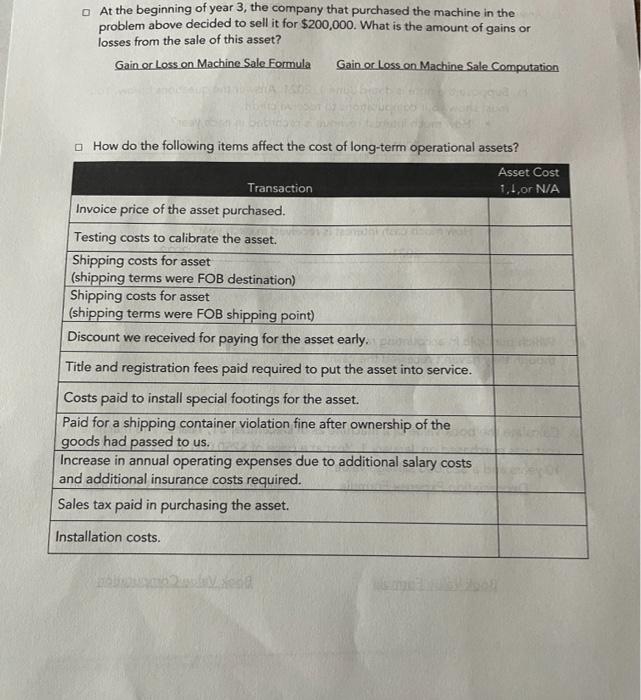

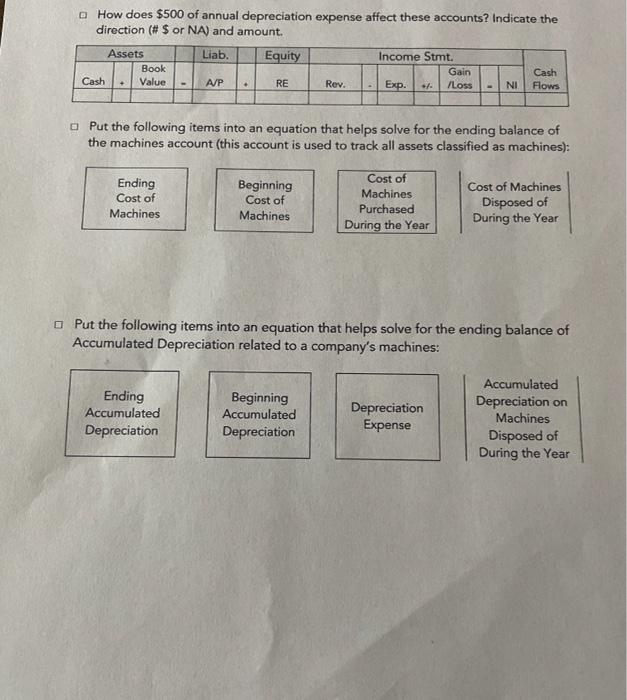

Answer the questions below using the example in Table 1: Table 1 Beginning Inventory 100 items $200 / unit a debat January 31* Purchase 20 units $210 / unit Ya80 June 30th Purchase 25 units $220 / unit 5506 Ending Inventory 75 units 29700 745-75 --> 76 units sold Compute the weighted average cost per unit using the information in Table 1. 29700 - 284.83 weighted average 145 Using the weighted average cost assumption, what is the dollar value of cost of goods sold? 204,83 ari edoc Answer the questions in the table below using the information from Table 1. (You must show your calculations) nosan seu FIFO LIFO Calculate Cost of Goods TOYONE BOY 1/30 Sold 1/31 Boy dolu Calculate Ending Inventory /38-25 1/31 20 Boy-55 Write out the formula to calculate the net realizable value of accounts receivable: accounts Recewable -Allowance for doubtful accounts Net realizeole realue of accounts recevable Explain in plain language what net realizable value of accounts receivable represents. BA it represents the amount of recevables a company estimates to collect obligations Beginning Accounts Receivable is $25.000 and the Allowance for Uncollectible accounts balance at the beginning of the year is $2,000. What is the net realizable value at the beginning of the year? Show the formula in words and solve it using these amounts. Formula Computation accounts receivable allowance for 25$$$$ S doubtful account 23,400 To What will happen to the net realizable value of accounts receivable if the company writes off $1,000 of uncollectible accounts? samo ? it should not change the nib BEVID Vio oob ovog Solo Onun shorollando Answer the following for a company that lends $200,000 The annual rate is 7%. How much interest revenue should be recorded over the next 12 months? Suppose the note is dated June 1, 2021. Answer the questions below. You must show your computations to receive credit. How much interest revenue is recorded in each year? 2021: 2022: . . How much cash interest is received in each year? 2021: 2022: Which principle in accounting requires a company record interest earned even though they haven't received the cash? a Calculate the book value of a machine as of December 31, Year 2. The machine cost was purchased on January 1, Year at a price of $250,000. It has a useful life of 10 years and a $25,000 salvage value. Depreciation Expense Formula Depreciation Expense Computation bi Book Value Formula Book Value Computation At the beginning of year 3, the company that purchased the machine in the problem above decided to sell it for $200,000. What is the amount of gains or losses from the sale of this asset? Gain.or Loss on Machine Sale Formula Gain or Loss on Machine Sale Computation How do the following items affect the cost of long-term operational assets? Asset Cost Transaction 1,1,or N/A Invoice price of the asset purchased. Testing costs to calibrate the asset. Shipping costs for asset (shipping terms were FOB destination) Shipping costs for asset (shipping terms were FOB shipping point) Discount we received for paying for the asset early. Title and registration fees paid required to put the asset into service. Costs paid to install special footings for the asset. Paid for a shipping container violation fine after ownership of the goods had passed to us. Increase in annual operating expenses due to additional salary costs and additional insurance costs required. Sales tax paid in purchasing the asset. Installation costs. How does $500 of annual depreciation expense affect these accounts? Indicate the direction (# $ or NA) and amount. Assets Liab. Equity Income Stmt. Book Gain Cash Cash Value RE Rev. Exp. /Loss NI Flows . Put the following items into an equation that helps solve for the ending balance of the machines account (this account is used to track all assets classified as machines): Ending Cost of Machines Beginning Cost of Machines Cost of Machines Purchased During the Year Cost of Machines Disposed of During the Year Put the following items into an equation that helps solve for the ending balance of Accumulated Depreciation related to a company's machines: Ending Accumulated Depreciation Beginning Accumulated Depreciation Depreciation Expense Accumulated Depreciation on Machines Disposed of During the Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started