Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me, I am super confused. Thank you! Problem E : PROFIT Jayla is quite tech savvy and decides to open her own computer

Please help me, I am super confused. Thank you!

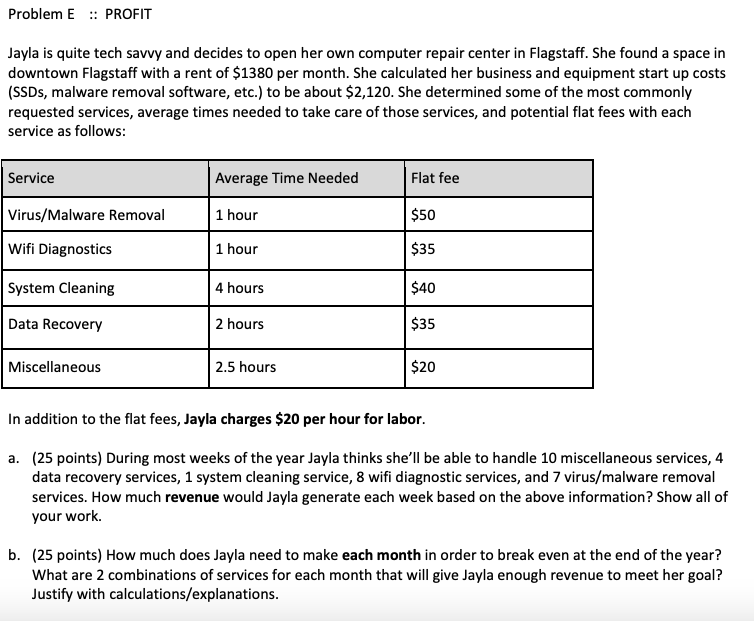

Problem E : PROFIT Jayla is quite tech savvy and decides to open her own computer repair center in Flagstaff. She found a space in downtown Flagstaff with a rent of $1380 per month. She calculated her business and equipment start up costs (SSDs, malware removal software, etc.) to be about $2,120. She determined some of the most commonly requested services, average times needed to take care of those services, and potential flat fees with each service as follows: Service Average Time Needed Flat fee Virus/Malware Removal 1 hour $50 Wifi Diagnostics 1 hour $35 System Cleaning 4 hours $40 Data Recovery 2 hours $35 Miscellaneous 2.5 hours $20 In addition to the flat fees, Jayla charges $20 per hour for labor. a. (25 points) During most weeks of the year Jayla thinks she'll be able to handle 10 miscellaneous services, 4 data recovery services, 1 system cleaning service, 8 wifi diagnostic services, and 7 virus/malware removal services. How much revenue would Jayla generate each week based on the above information? Show all of your work b. (25 points) How much does Jayla need to make each month in order to break even at the end of the year? What are 2 combinations of services for each month that will give Jayla enough revenue to meet her goal? Justify with calculations/explanationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started