please help me. i need help for all

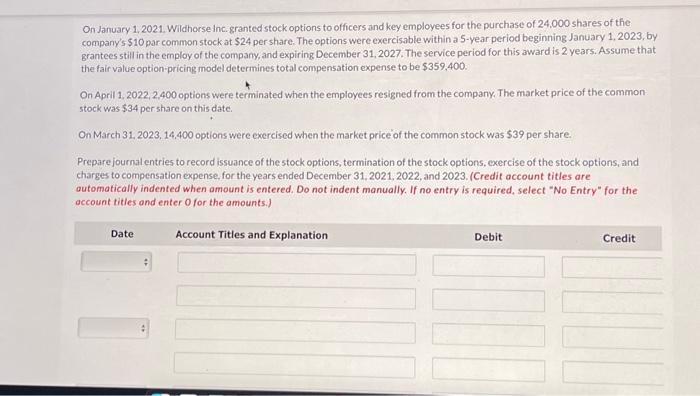

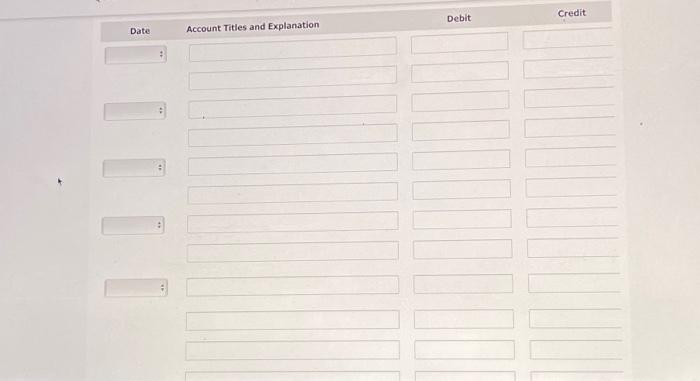

of those qustion

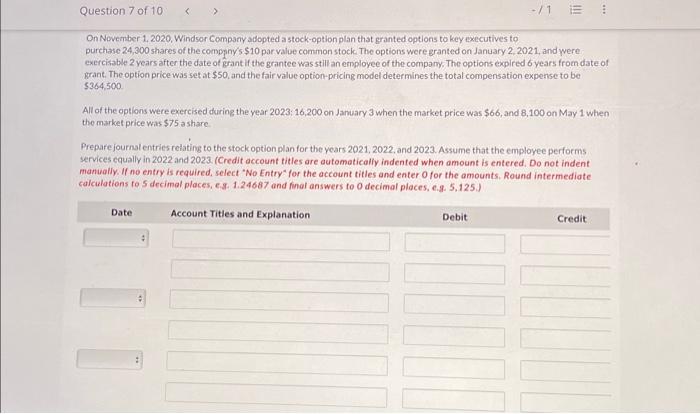

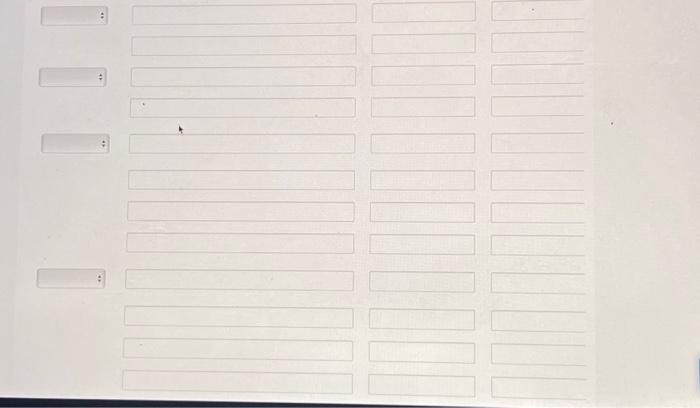

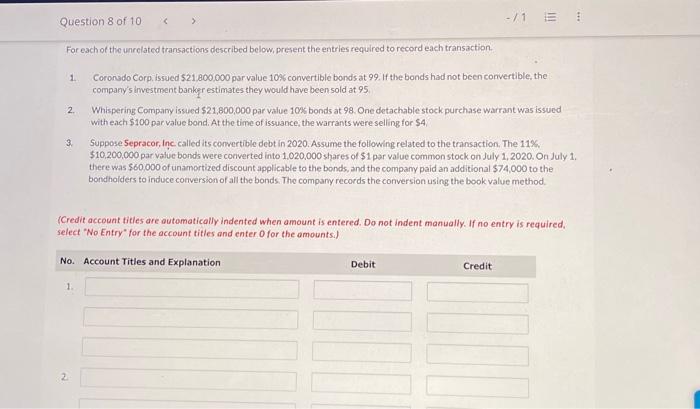

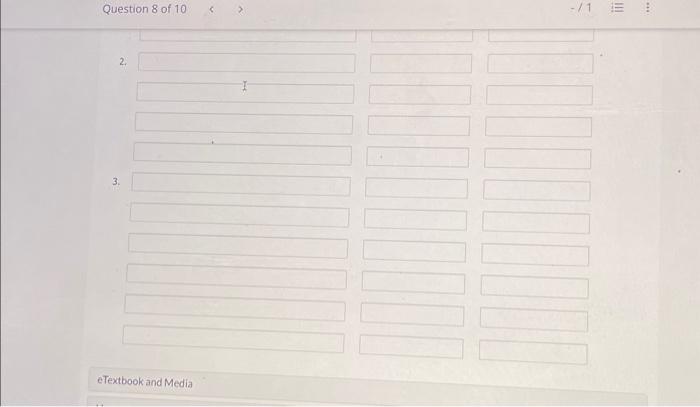

On November 1.2020, Windsor Company adopted a stock-option plan that granted options to key executives to purchase 24,300 shares of the compiny 5$10 par valive common stock. The options were granted on fanuary 2,2021 , and were exercisable 2 years after the date of grant if the grantee was still an ernployee of the company. The options expired 6 years from date of grant. The option price was set at $50, and the fair value option-pricing model determines the total compensation expense to be $344,500 All of the options were exercised during the year 2023;16,200 on January 3 when the market price was $66, and 8,100 on May 1 when the market price wis $75 a share Prepare journal entries relating to the stock option plan for the years 2021, 2022, and 2023. Assume that the employee performs services equally in 2022 and 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter ofor the amounts. Round intermediate calculations to 5 decimal places, e.g. 1.24687 and final answers to 0 decimal places, e.g. 5.125.) On January 1.2021. Wildhorse inc. granted stock options to officers and key employees for the purchase of 24,000 shares of the company's $10 par common stock at $24 per share. The options were exereisable within a 5 -year period beginning January 1, 2023, by grantees still in the employ of the company, and expiring December 31,2027. The service period for this award is 2 years. Assume that the fair value option-pricing model determines total compensation expense to be $359,400. On April 1,2022,2,400 options were terminated when the employees resigned from the company, The market price of the common stock was $34 per share on this date. On March 31, 2023, 14,400 options were excrcised when the market price of the common stock was $39 per share. Prepare journal entries to record issuance of the stock options, termination of the stock options, exercise of the stock options, and charges to compensation expense, for the years ended December 31,2021, 2022, and 2023. (Credit account titles are automaticaffy indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) For each of the unrelated transactions described below, present the entries required to record each transaction. 1. Coronado Corp. issued $21,800,000 par value 10% convertible bonds at 99 . If the bonds had not been convertible, the company's investment banker estimates they would have been sold at 95 . 2. Whispering Company issued $21,800,000 par value 100 bonds at 98 . One detachable stock purchase warrant was issued witheach $100 par value bond. At the time of issuance, the warrants were selling for $4, 3. Suppose 5epracor, Inc called its convertible debt in 2020. Assume the following related to the transaction. The 11\%. $10,200,000 par vatue bonds were converted into 1,020,000 shares of $1 par value common stock on July 1,2020. On July 1 . there was $60,000 of unamortized discount applicable to the bonds, and the company paid an additional $74,000 to the bondholders to induce conversion of all the bonds. The company records the conversion using the book value method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required. select "No Entry" for the account titles and enter o for the amounts.) Question 8 of 10 2. 3. eTextbook and Media