Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me I need it in an hour please and show all workingd please Hope it is better this way? It is your system

Please help me I need it in an hour please and show all workingd please

Hope it is better this way? It is your system that is making that blurry. Show all workings please

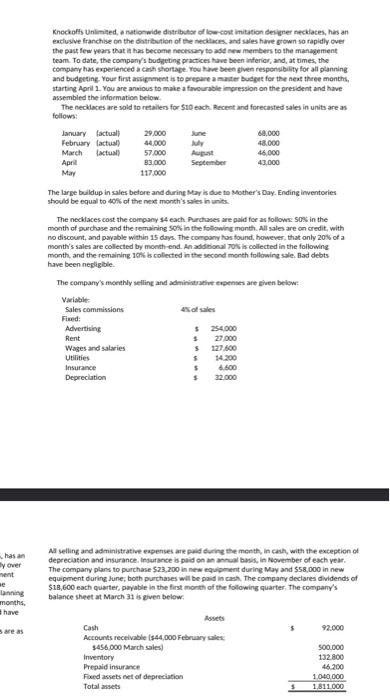

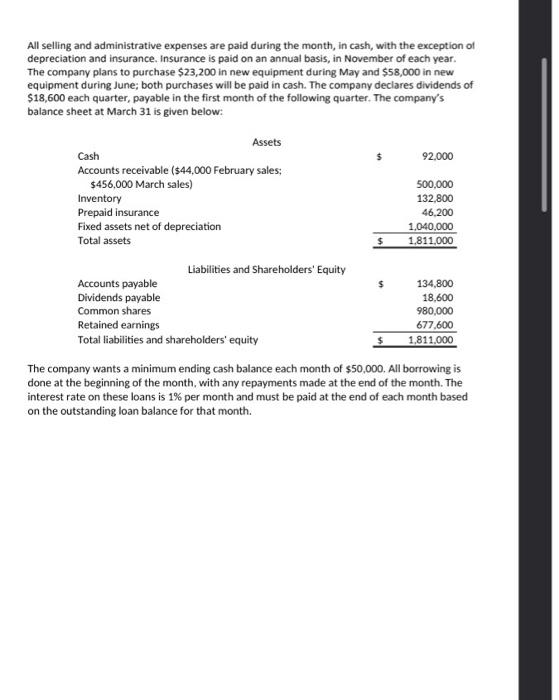

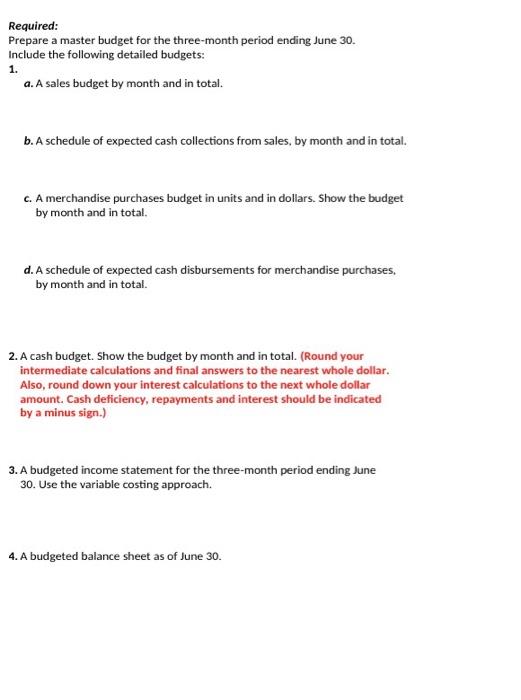

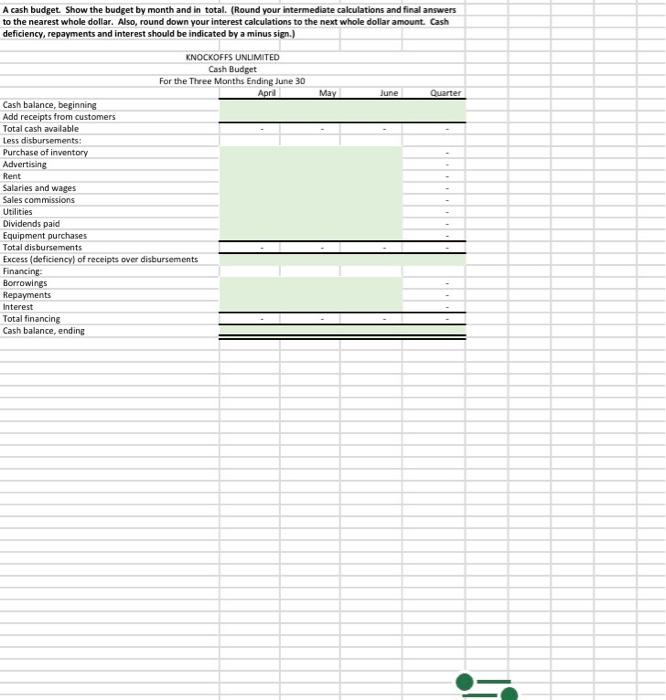

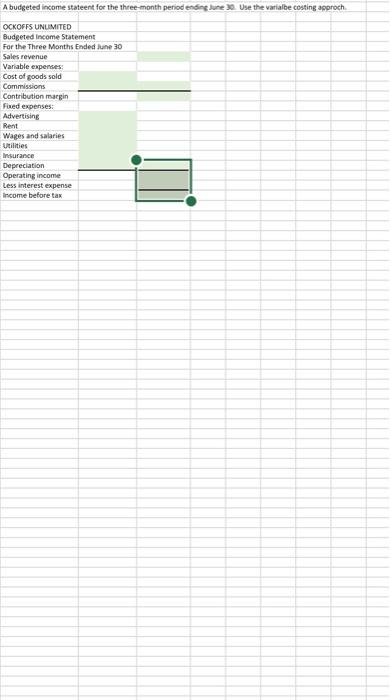

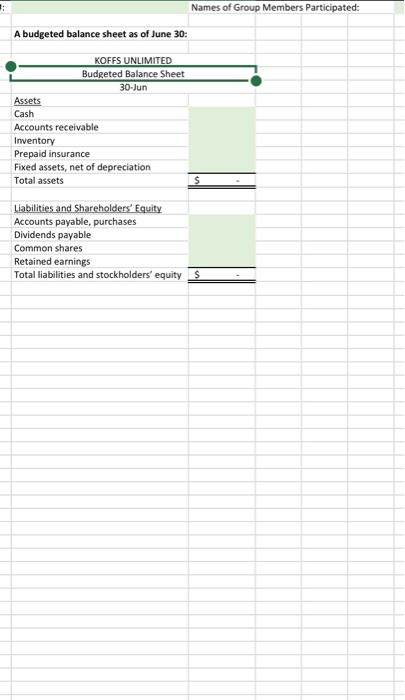

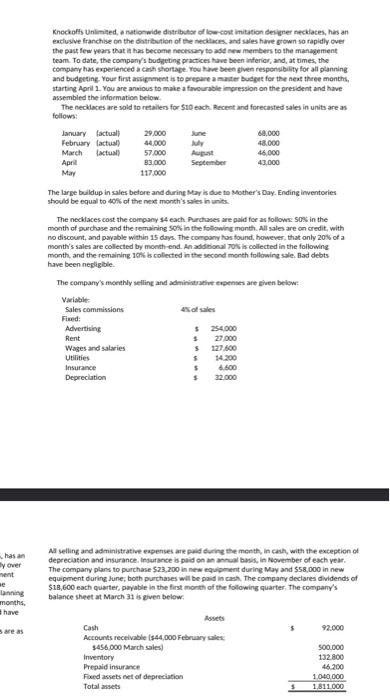

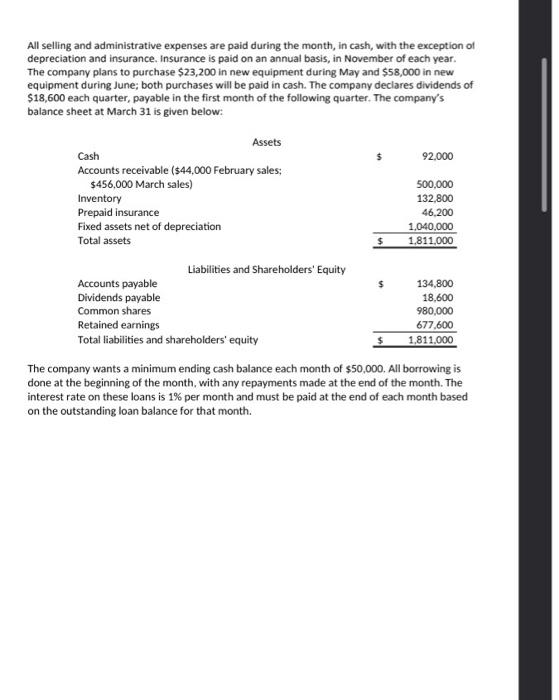

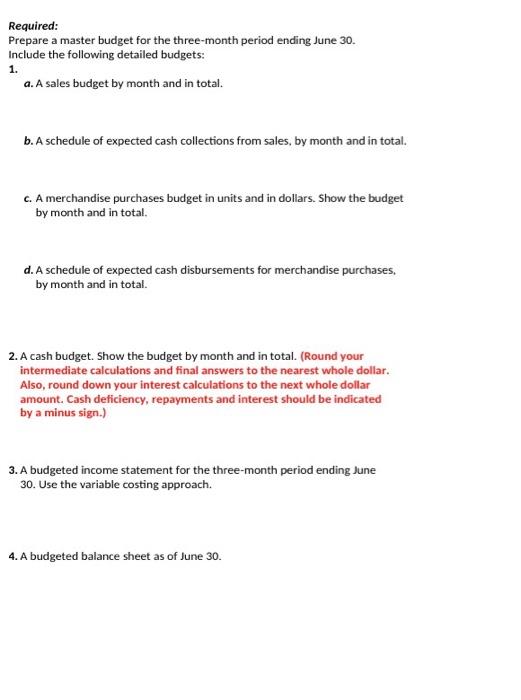

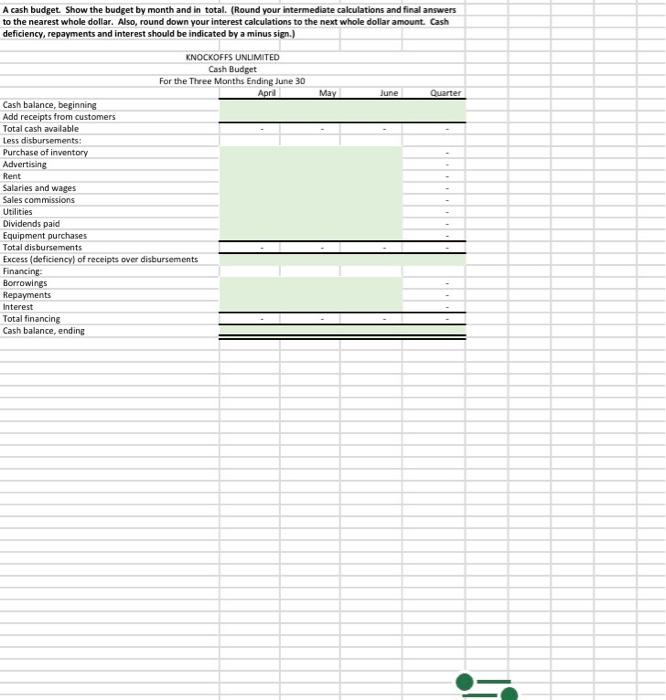

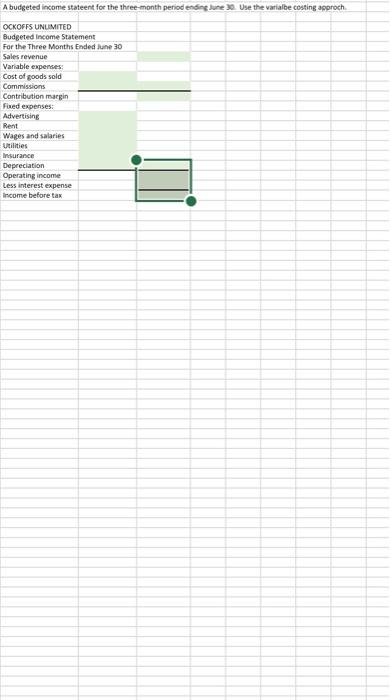

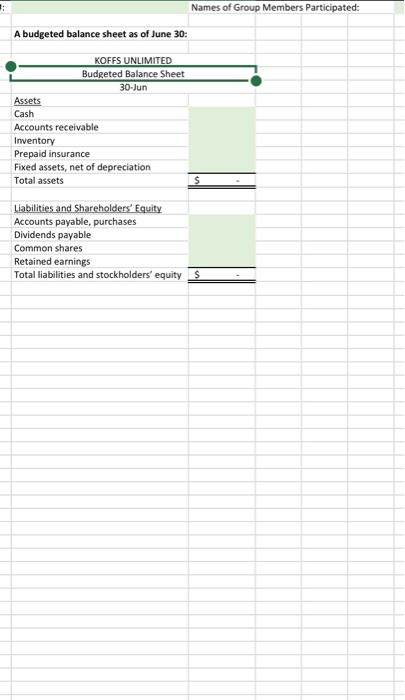

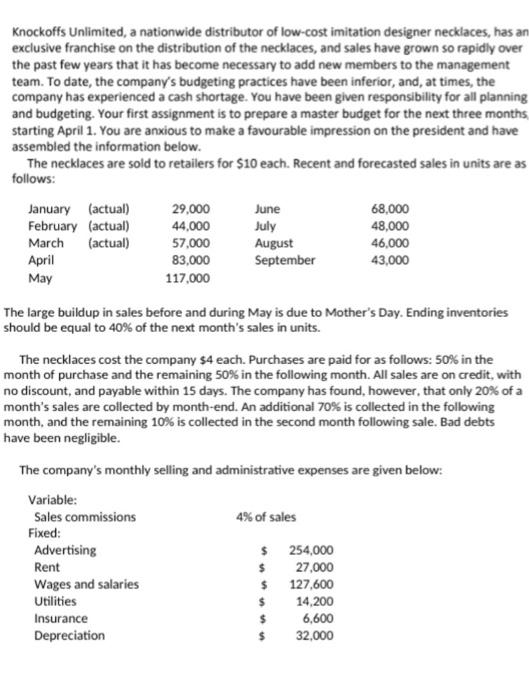

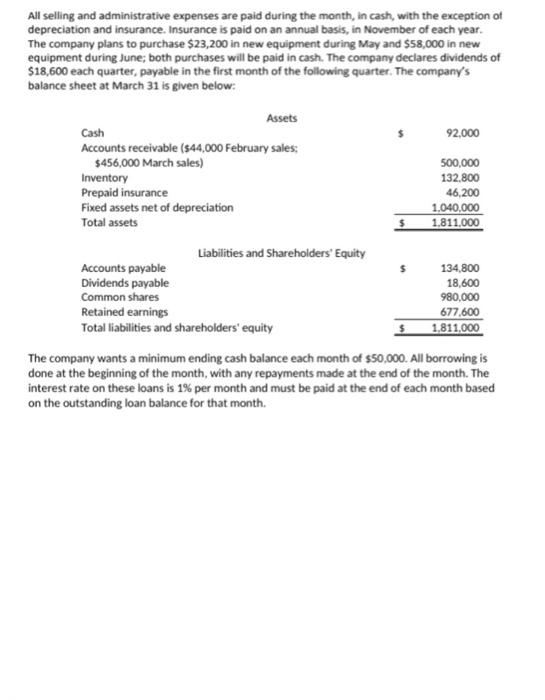

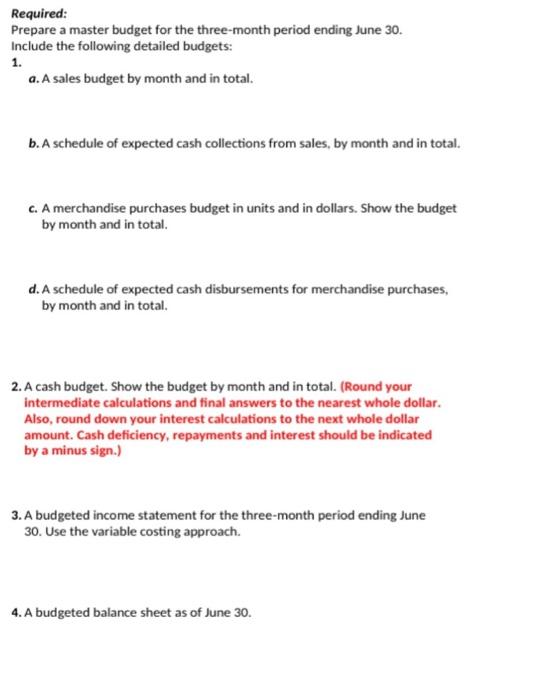

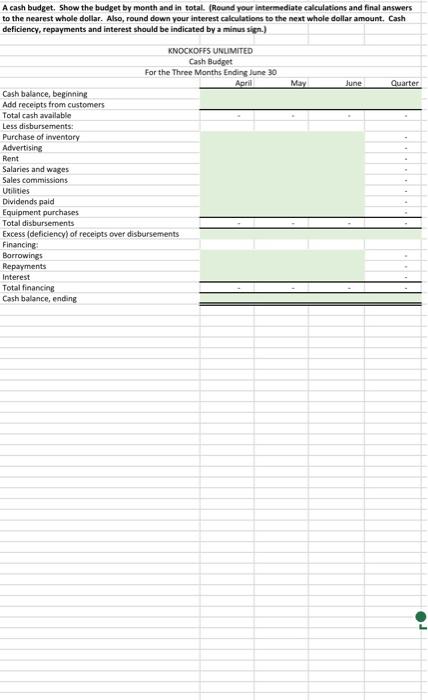

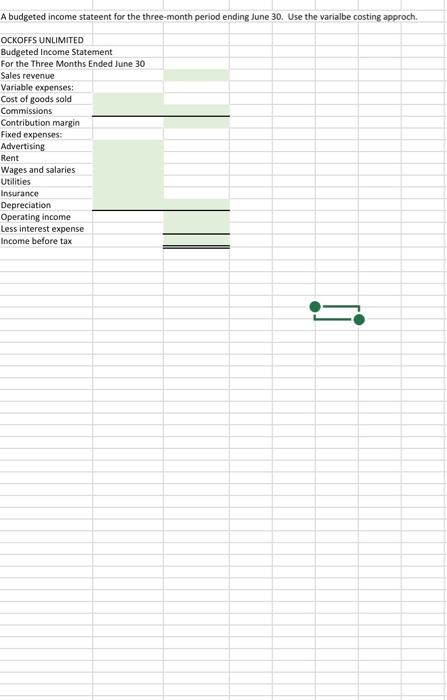

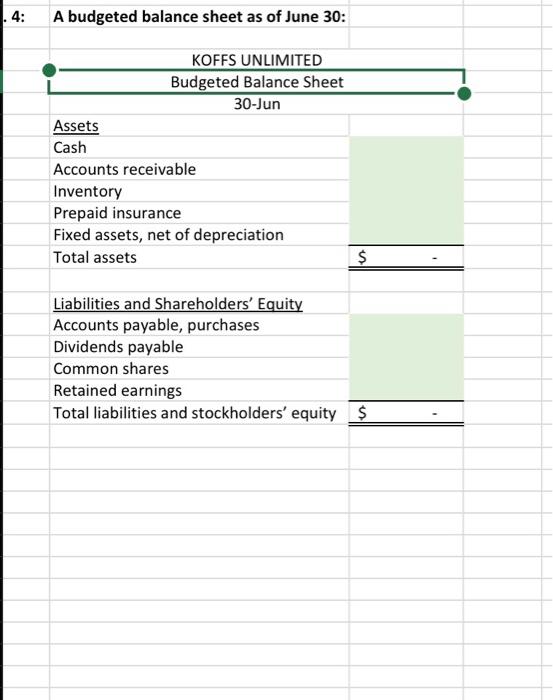

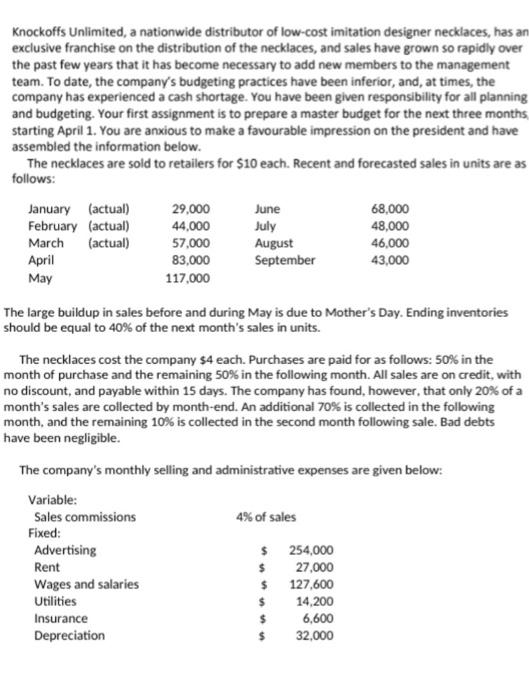

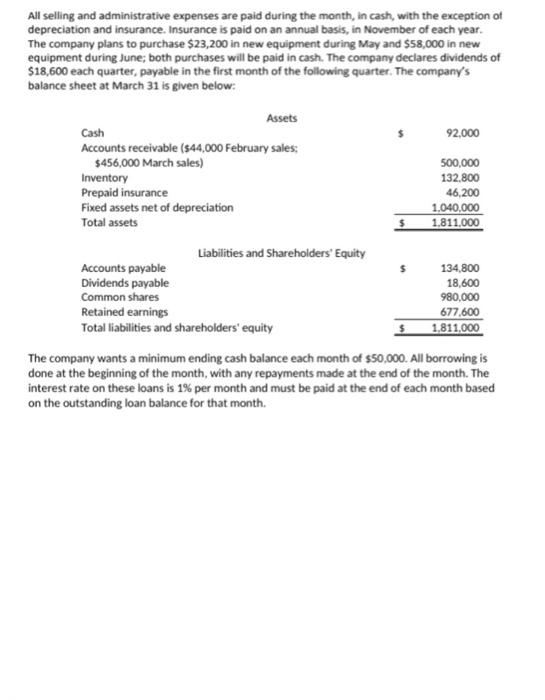

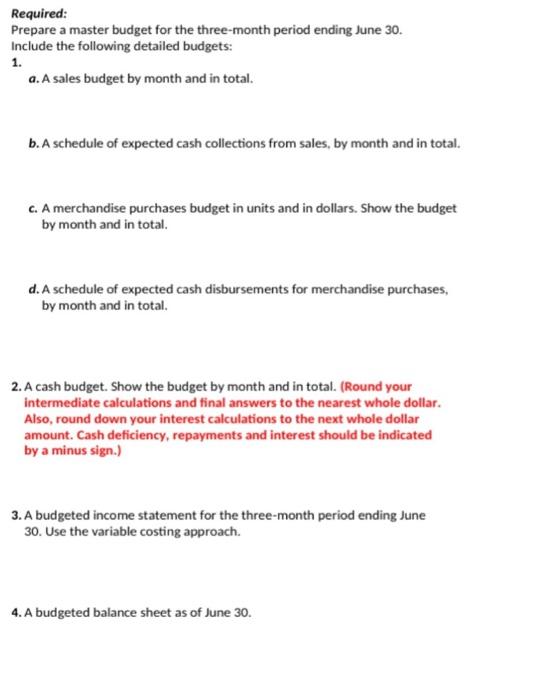

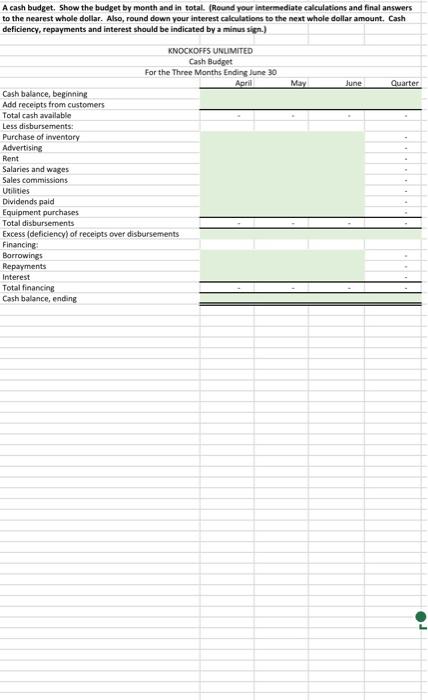

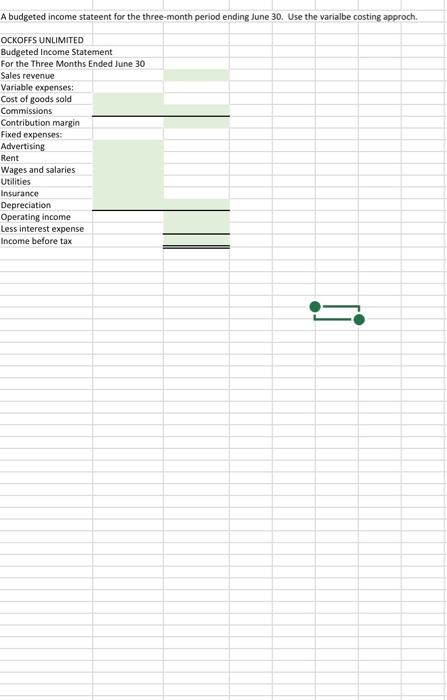

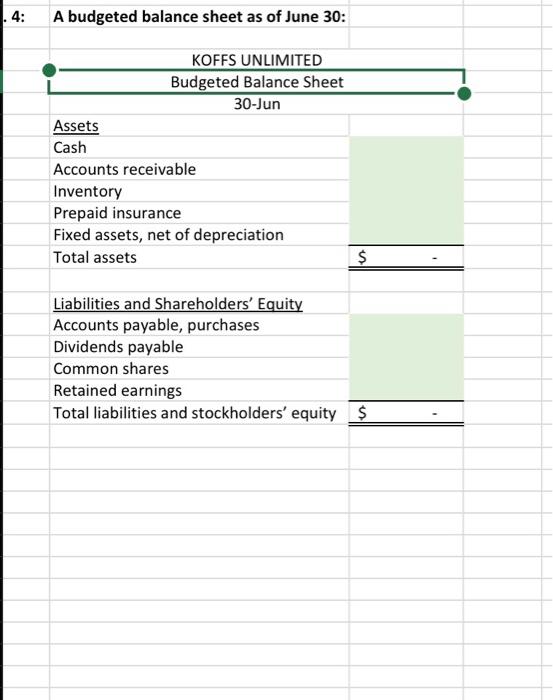

Knockofts Unlimited, a nationwide dotributar of low-cost initation designer necklaces, has an excluslye franchise on the dotribution of the necklaces, and sales have grown so rapidly over the past lew years that ia has become necesary ts asd new memters to the management team. To date, the company's budgeting practices have been inferior, and, at times, the tompany has experienced a cash shortage. Tow hive beee given respenubility for all planning and budgeting. Your first ansignment is to prepure a mater budget for the neat three months. starting April 1. You are anwious to make a favcurable impression on the president and have assembied the information below. The necklaces are sold to retalless for Sto each. Receet and forecasted sales in units are an follows: The large buldup in sales betore and during May is doe to Mother's Day. Ending inventories should be equal to dofs of the next month's sales in units The necklaces cost the company 14 each Murchases are paid for as followr: 50s in the month of porchase and the remairing soks in the following month. All sales are on credit, with no discount, and payable within 15 days. The company hos found, however, that only 2016 of a month's sales are collected by month-end. An addicional 7ots is collected in the following month and the remaining 10 is is colected in the second month following sale. Bad debts have been nepligible. The company's moethly selline and administrytive expenses are siven belowe At seling and administrative expenses are puid during the menth, in cash, with the exteption of depreciation and insurance, Induracce is paid on an annuar basis, in November of each year. The company plans to purchase $23,200 in new equlpment during May and $58,000 in new equipment during June, both purchases will be paid in cash. The company deciares dividends of $18,600 each quarter, payable in the first month of the following quarter. The company's balance sheet at March 31 is ziven below: All selling and administrative expenses are paid during the month, in cash, with the exception of depreciation and insurance. Insurance is paid on an annual basis, in November of each year. The company plans to purchase $23,200 in new equipment during May and $58,000 in new equipment during June; both purchases will be paid in cash. The company declares dividends of $18,600 each quarter, payable in the first month of the following quarter. The company's balance sheet at March 31 is given below: The company wants a minimum ending cash balance each month of $50,000. All borrowing is done at the beginning of the month, with any repayments made at the end of the month. The interest rate on these loans is 1% per month and must be paid at the end of each month based on the outstanding loan balance for that month. Required: Prepare a master budget for the three-month period ending June 30. Include the following detailed budgets: 1. a. A sales budget by month and in total. b. A schedule of expected cash collections from sales, by month and in total. c. A merchandise purchases budget in units and in dollars. Show the budget by month and in total. d. A schedule of expected cash disbursements for merchandise purchases, by month and in total. 2. A cash budget. Show the budget by month and in total. (Round your intermediate calculations and final answers to the nearest whole dollar. Also, round down your interest calculations to the next whole dollar amount. Cash deficiency, repayments and interest should be indicated by a minus sign.) 3. A budgeted income statement for the three-month period ending June 30. Use the variable costing approach. 4. A budgeted balance sheet as of June 30 . A cash budget. Show the budget by month and in total. (Round your intermediate calculations and final answers to the nearest whole dollar. Also, round down your interest calculations to the next whole dollar amount. Cash deficiency, repayments and interest should be indicated by a minus sign.) KNOCKOFFS UNLMITED Cash Budget For the Three Months Ending June 30 Cash balance, beginning Add receipts from customers Total cash available Less disbursements: Purchase of inventory Advertising Rent Salaries and wages Sales commissions Utilities Dividends paid Equipment purchases Total disbursements Excess (deficiency) of receipts over disbursements Financing:- Borrowings Repayments Interest Total financing Cash balance, ending Names of Group Members Participated: A budgeted balance sheet as of June 30: KOFFS UNLIMITED \begin{tabular}{l} Budgeted Balance Sheet \\ \multicolumn{1}{c|}{ 30-Jun } \\ CashAssets \\ Accounts receivable \\ Inventory \\ Prepaid insurance \\ Fixed assets, net of depreciation \\ Total assets \end{tabular} Liabilities and Shareholders' Equity Accounts payable, purchases Dividends payable Common shares Retained earnings Total liabilities and stockholders' equity \begin{tabular}{l} $ \\ \hline \hline \end{tabular} Knockoffs Unlimited, a nationwide distributor of low-cost imitation designer necklaces, has an exclusive franchise on the distribution of the necklaces, and sales have grown so rapidly over the past few years that it has become necessary to add new members to the management team. To date, the company's budgeting practices have been inferior, and, at times, the company has experienced a cash shortage. You have been given responsibility for all planning and budgeting. Your first assignment is to prepare a master budget for the next three months starting April 1. You are anxious to make a favourable impression on the president and have assembled the information below. The necklaces are sold to retailers for $10 each. Recent and forecasted sales in units are as follows: The large buildup in sales before and during May is due to Mother's Day. Ending inventories should be equal to 40% of the next month's sales in units. The necklaces cost the company $4 each. Purchases are paid for as follows: 50% in the month of purchase and the remaining 50% in the following month. All sales are on credit, with no discount, and payable within 15 days. The company has found, however, that only 20% of a month's sales are collected by month-end. An additional 70% is collected in the following month, and the remaining 10% is collected in the second month following sale. Bad debts have been negligible. The company's monthly selling and administrative expenses are given below: All selling and administrative expenses are paid during the month, in cash, with the exception of depreciation and insurance. Insurance is paid on an annual basis, in November of each year. The company plans to purchase $23,200 in new equipment during May and $58,000 in new equipment during June; both purchases will be paid in cash. The company declares dividends of $18,600 each quarter, payable in the first month of the following quarter. The company's balance sheet at March 31 is given below: The company wants a minimum ending cash balance each month of $50,000. All borrowing is done at the beginning of the month, with any repayments made at the end of the month. The interest rate on these loans is 1% per month and must be paid at the end of each month based on the outstanding loan balance for that month. Required: Prepare a master budget for the three-month period ending June 30 . Include the following detailed budgets: 1. a. A sales budget by month and in total. b. A schedule of expected cash collections from sales, by month and in total. c. A merchandise purchases budget in units and in dollars. Show the budget by month and in total. d. A schedule of expected cash disbursements for merchandise purchases, by month and in total. 2. A cash budget. Show the budget by month and in total. (Round your intermediate calculations and final answers to the nearest whole dollar. Also, round down your interest calculations to the next whole dollar amount. Cash deficiency, repayments and interest should be indicated by a minus sign.) 3. A budgeted income statement for the three-month period ending June 30. Use the variable costing approach. 4. A budgeted balance sheet as of June 30 . A cash budget. Show the budget by month and in total. (Round your inteemediate calculations and final answers A cash budget, Show the budget by month and in total- (hound your intecmediate calculations and final answer A budgeted income stateent for the three-month period ending June 30. Use the varialbe costing approch. OCKOFFS UNLIMITED Budgeted Income Statement For the Three Months Ended June 30 Sales revenue Variable expenses: Cost of goods sold Commissions Contribution margin Fixed expenses: Advertising Rent Wages and salaries Utilities Insurance Depreciation Operating income Less interest expense Income before tax 4: A budgeted balance sheet as of June 30: KOFFS UNLIMITED Budgeted Balance Sheet 30-Jun Assets Cash Accounts receivable Inventory Prepaid insurance Fixed assets, net of depreciation Total assets Liabilities and Shareholders' Equity Accounts payable, purchases Dividends payable Common shares Retained earnings Total liabilities and stockholders' equity $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started