Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me. I want to check my answer. Thank you. QUESTION 4 A'aya, Baya and Chan are partners in a partnership business in Suria

Please help me. I want to check my answer. Thank you.

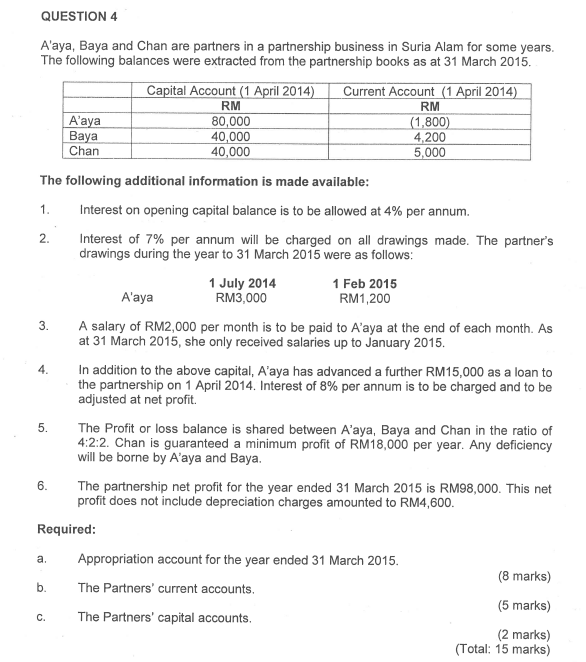

QUESTION 4 A'aya, Baya and Chan are partners in a partnership business in Suria Alam for some years The following balances were extracted from the partnership books as at 31 March 2015 A'aya Baya Chan Capital Account (1 April 2014 RM 80,000 40,000 40,000 Current Account (1 April 2014 RM (1,800) 4,200 5,000 The following additional information is made available: I. Interest on opening capital balance is to be allowed at 4% per annum. 2. Interest of 7% per annum will be charged on all drawings made. The partner's drawings during the year to 31 March 2015 were as follows 1 July 2014 RM3,000 1 Feb 2015 RM1,200 A'aya A salary of RM2,000 per month is to be paid to A'aya at the end of each month. As at 31 March 2015, she only received salaries up to January 2015. 4. In addition to the above capital, A'aya has advanced a further RM15,000 as a loan to the partnership on 1 April 2014. Interest of 8% per annum is to be charged and to be adjusted at net profit. 5. The Profit or loss balance is shared between A'aya, Baya and Chan in the ratio of 4:2:2. Chan is guaranteed a minimum profit of RM18,000 per year. Any deficiency will be borne by A'aya and Baya 6. The partnership net profit for the year ended 31 March 2015 is RM98,000. This net Required a. Appropriation account for the year ended 31 March 2015 b. The Partners' current accounts C. The Partners' capital accounts. profit does not include depreciation charges amounted to RM4,600 (8 marks) (5 marks) (2 marks) Total: 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started