Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me! i will give you a thumbs up!! Required information Exercise 6-10A (Algo) Adjusting the cash account LO 6-3 [The following information applies

please help me! i will give you a thumbs up!!

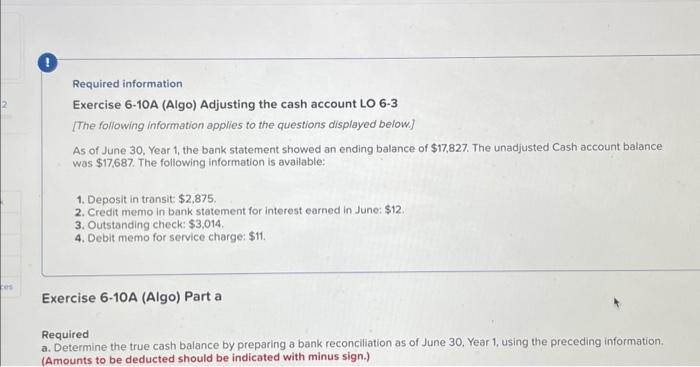

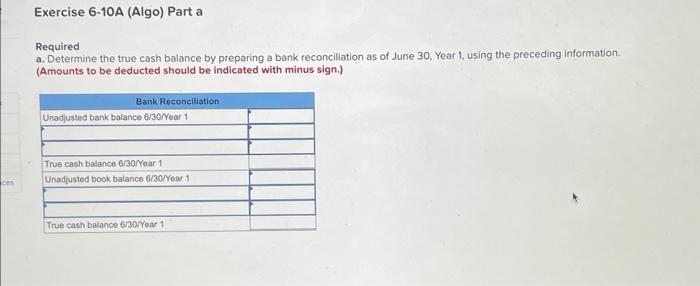

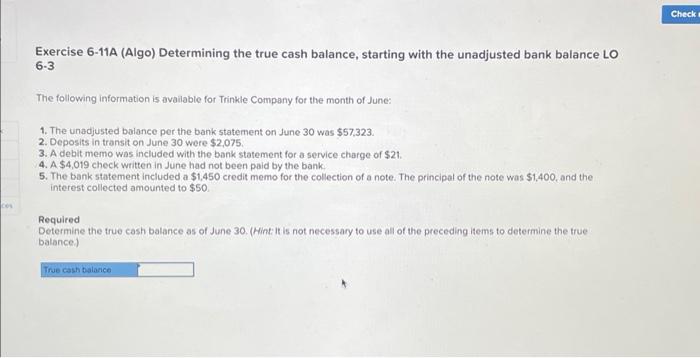

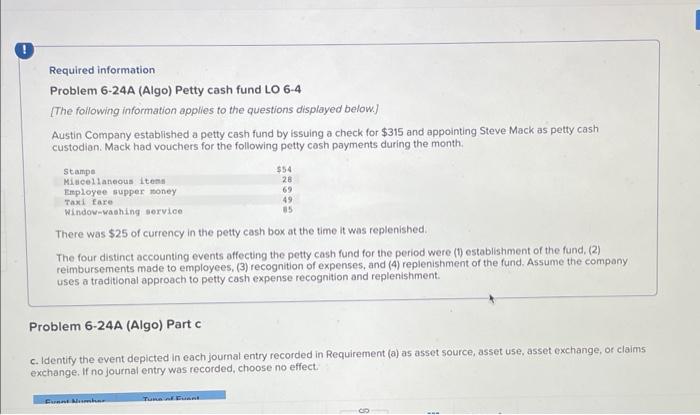

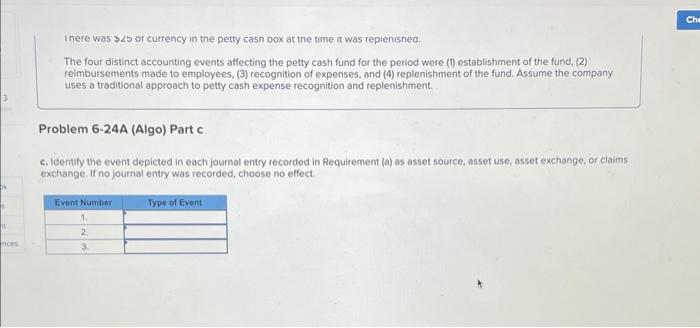

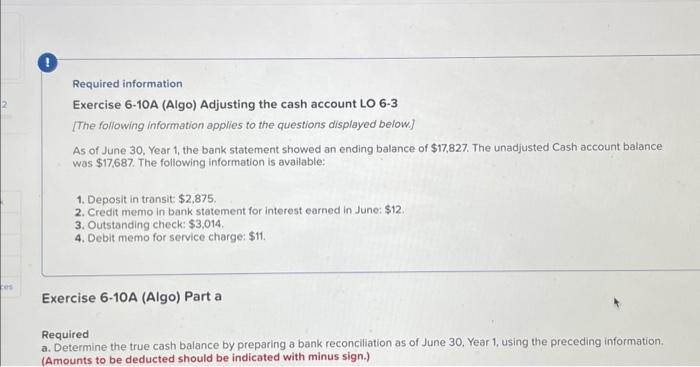

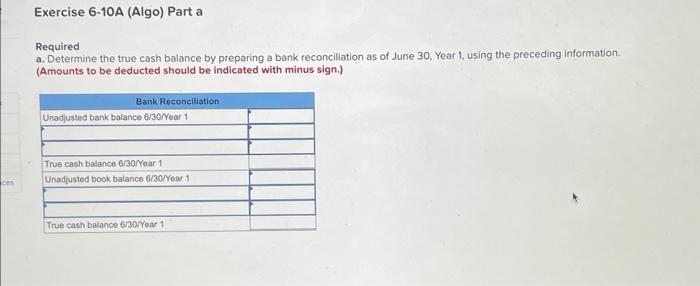

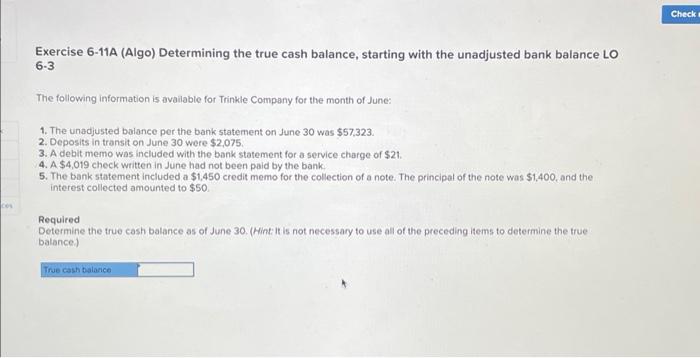

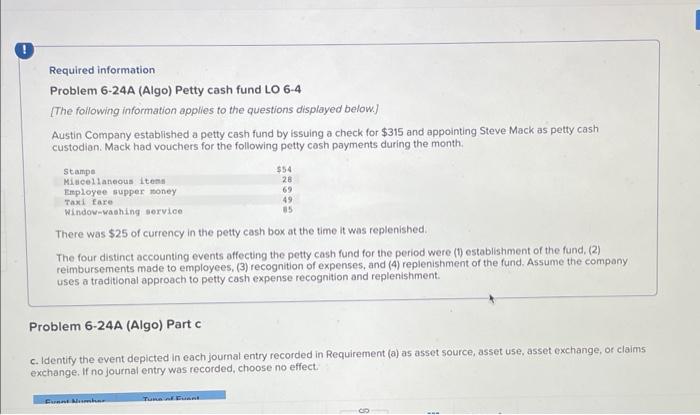

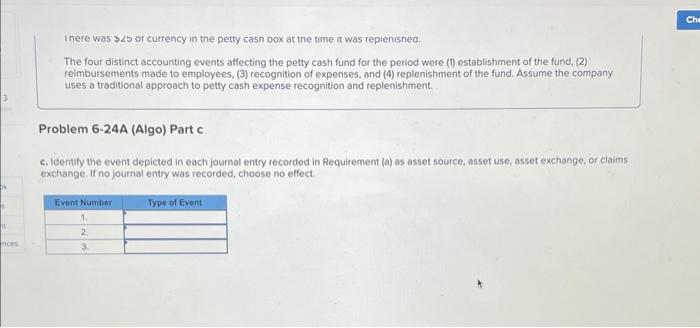

Required information Exercise 6-10A (Algo) Adjusting the cash account LO 6-3 [The following information applies to the questions displayed below.] As of June 30, Year 1 , the bank statement showed an ending balance of $17,827. The unadjusted Cash account balance was $17.687. The following information is available: 1. Deposit in transit: $2,875. 2. Credit memo in bank statement for interest earned in June: $12. 3. Outstanding check: $3,014. 4. Debit memo for service charge: $11. Exercise 6-10A (Algo) Part a Required a. Determine the true cash balance by preparing a bank reconciliation as of June 30, Year 1 , using the preceding information. Amounts to be deducted should be indicated with minus sign.) Required a. Determine the true cash balance by preparing a bank reconcillation as of June 30 , Year 1 , using the preceding information. (Amounts to be deducted should be indicated with minus sign.) Exercise 6-11A (Algo) Determining the true cash balance, starting with the unadjusted bank balance LO 63 The following information is available for Trinkle Company for the month of June: 1. The unadjusted balance per the bank statement on June 30 was $57,323. 2. Deposits in transit on June 30 were $2,075. 3. A debit memo was included with the bank statement for a service charge of $21. 4. A $4,019 check written in June had not been paid by the bank. 5. The bank statement included a $1,450 credit memo for the collection of a note. The principal of the note was $1,400, and the interest collected amounted to $50. Required Determine the true cash balance as of June 30. (Hint:it is not necessary to use all of the preceding items to determine the true balonce) Required information Problem 6-24A (Algo) Petty cash fund LO 6-4 [The following information applies to the questions displayed below.] Austin Company established a petty cash fund by issuing a check for $315 and appointing Steve Mack as petty cash custodian. Mack had vouchers for the following petty cash payments during the month. There was $25 of currency in the petty cash box at the time it was replenished; The four distinct accounting events affecting the petty cash fund for the period were (1) establishment of the fund, (2) reimbursements made to employees, (3) recognition of expenses, and (4) replenishment of the fund. Assume the company uses a traditional approach to petty cash expense recognition and replenishment. Problem 6-24A (Algo) Part c c. Identify the event depicted in each journal entry recorded in Requirement (a) as asset source, asset use, asset exchange, or claims exchange. If no journal entry was recorded, choose no effect. Inere was $5 of curtency in the petty casn box at the tume it was reptenisned. The four distinct accounting events affecting the petty cash fund for the period were (1) establishment of the fund, (2) reimbursements made to employees, (3) recognition of expenses, and (4) replenishment of the fund. Assume the company uses a traditional approach to petty cash expense recognition and replenishment. Problem 6-24A (Algo) Part c c. Identify the event depicted in each journal entry recorded in Requirement (a) as asset source, asset use, asset exchange, or claims exchange. If no journal entry was recorded, choose no effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started