Please help me!!!!!

If you can, please also post the calculations.

Thank you so much!!!!!

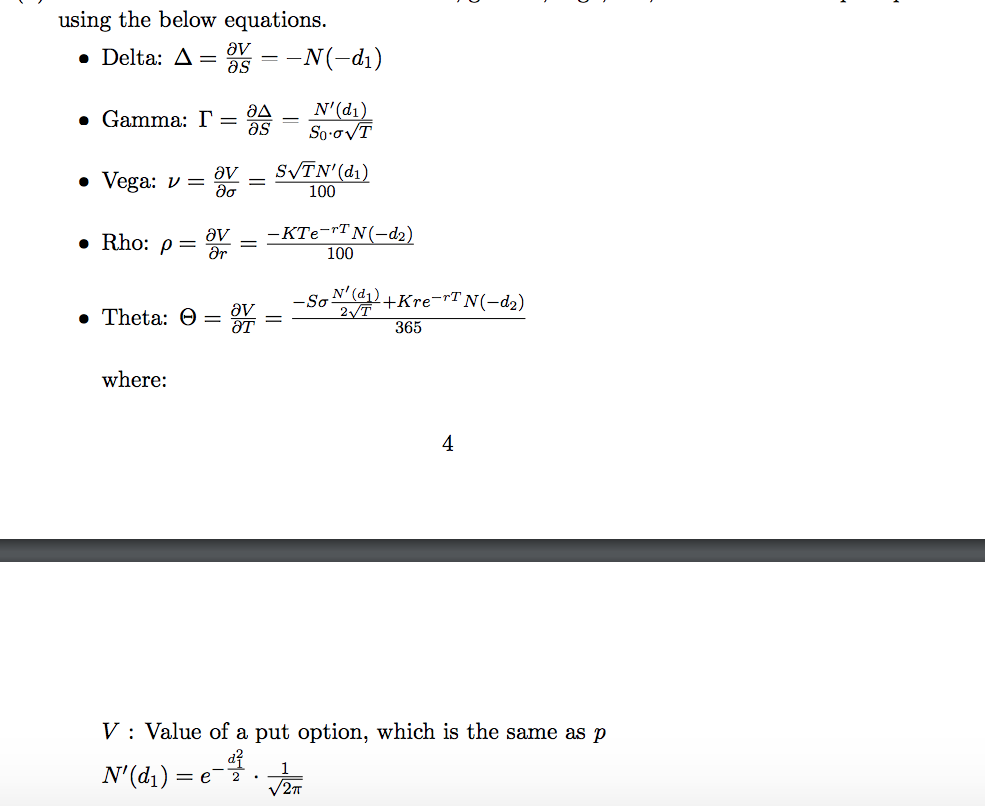

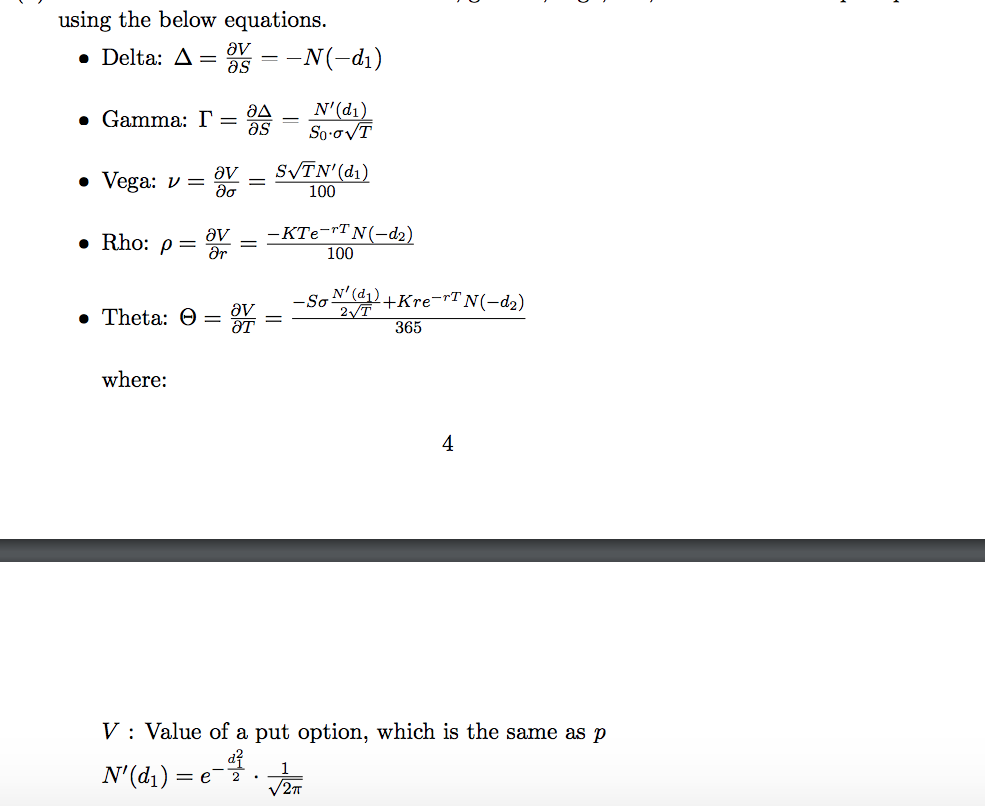

Part4: Black-Scholes and Binomial Option Pricing Let us compute an option price using Black-Scholes Model and Binomial Tree model 1. Suppose that the current price of BA is S200. The continuously compounded risk-free rate is The annual standard deviations are 20%. Also, assume BA pays no dividends % per year. 4 (a) Compute the value of a long 2 year an European put option with a strike price of S 195 and the annualized standard deviation is 20% using 1) a two-step at-1) binomial tree (BT) model , and 2) the BLACK-SCHOLES (BS) formula, which is given by call option: cSoN(di) - Xe-rTN(d2) put option: p-XeTN(-d2) SN(-di) That is, where T : Time to maturity So: Asset price X : Exercise price r: Continuously compounded risk free rate : Volatility of continuously compounded return on the stock N(*) : Cumulative Normal Probability b) Examine whether BT and BS models have the same answer or not (c) Use the put-call parity and compute two different 2 year call option prices with two different put option values (d) Calculate the Greeks that include delta, gamma, vega, rho, and theta for the put option using the below equations Delta: -as-N(-d1) using the below equations . Delta: -as-N-4 . Gamma. --"(d) 100 100 N (d1 Theta: 365 where: 4 V : Value of a put option, which is the same as p 2 Part4: Black-Scholes and Binomial Option Pricing Let us compute an option price using Black-Scholes Model and Binomial Tree model 1. Suppose that the current price of BA is S200. The continuously compounded risk-free rate is The annual standard deviations are 20%. Also, assume BA pays no dividends % per year. 4 (a) Compute the value of a long 2 year an European put option with a strike price of S 195 and the annualized standard deviation is 20% using 1) a two-step at-1) binomial tree (BT) model , and 2) the BLACK-SCHOLES (BS) formula, which is given by call option: cSoN(di) - Xe-rTN(d2) put option: p-XeTN(-d2) SN(-di) That is, where T : Time to maturity So: Asset price X : Exercise price r: Continuously compounded risk free rate : Volatility of continuously compounded return on the stock N(*) : Cumulative Normal Probability b) Examine whether BT and BS models have the same answer or not (c) Use the put-call parity and compute two different 2 year call option prices with two different put option values (d) Calculate the Greeks that include delta, gamma, vega, rho, and theta for the put option using the below equations Delta: -as-N(-d1) using the below equations . Delta: -as-N-4 . Gamma. --"(d) 100 100 N (d1 Theta: 365 where: 4 V : Value of a put option, which is the same as p 2