Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me in solving this questions ! asap please , little urgent Your team at Simba Designs Limited has just been asked by the

please help me in solving this questions ! asap please , little urgent

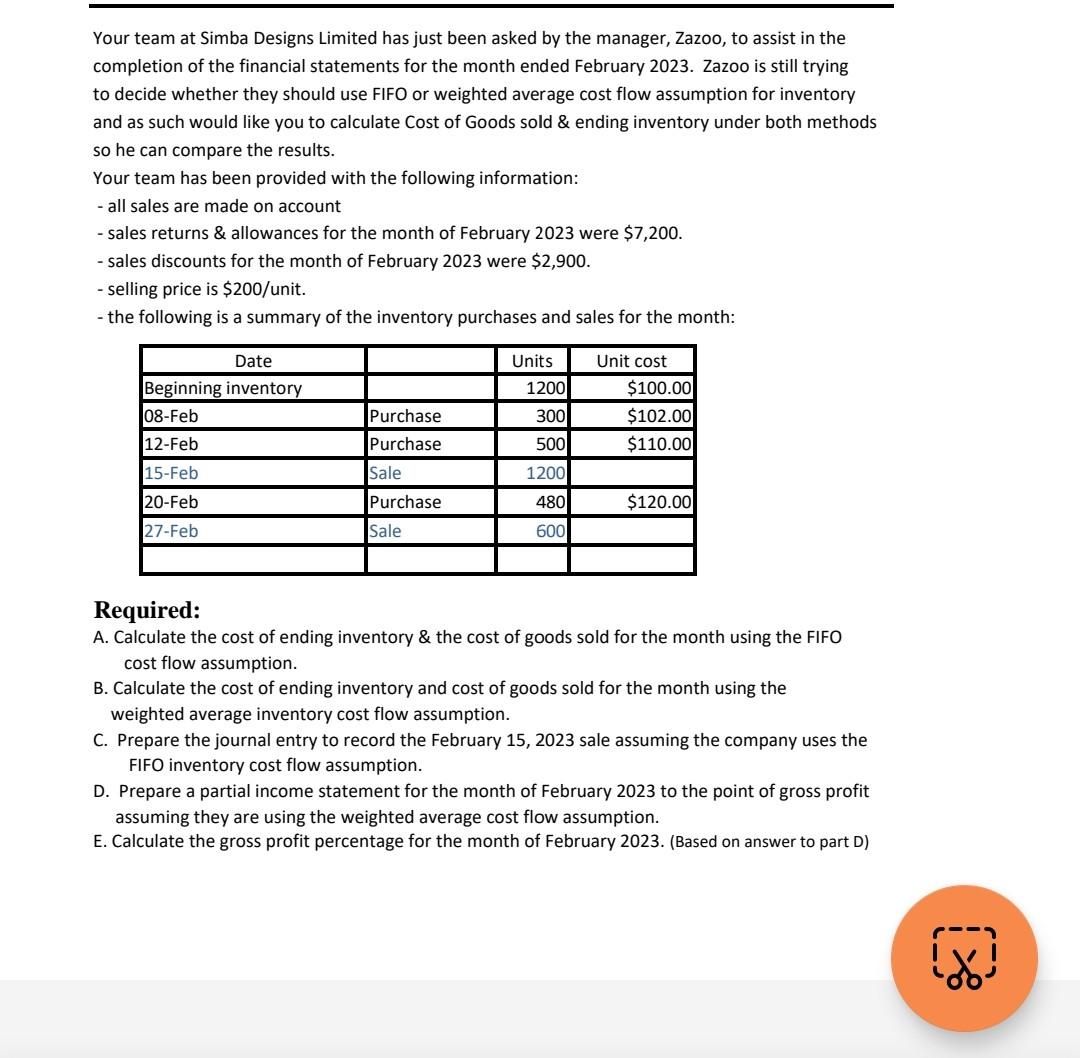

Your team at Simba Designs Limited has just been asked by the manager, Zazoo, to assist in the completion of the financial statements for the month ended February 2023. Zazoo is still trying to decide whether they should use FIFO or weighted average cost flow assumption for inventory and as such would like you to calculate Cost of Goods sold \& ending inventory under both methods so he can compare the results. Your team has been provided with the following information: - all sales are made on account - sales returns \& allowances for the month of February 2023 were $7,200. - sales discounts for the month of February 2023 were $2,900. - selling price is $200 /unit. - the following is a summary of the inventory purchases and sales for the month: Required: A. Calculate the cost of ending inventory \& the cost of goods sold for the month using the FIFO cost flow assumption. B. Calculate the cost of ending inventory and cost of goods sold for the month using the weighted average inventory cost flow assumption. C. Prepare the journal entry to record the February 15, 2023 sale assuming the company uses the FIFO inventory cost flow assumption. D. Prepare a partial income statement for the month of February 2023 to the point of gross profit assuming they are using the weighted average cost flow assumption. E. Calculate the gross profit percentage for the month of February 2023. (Based on answer to part D)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started