Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me its due today !!! Springsteen Company manufactures guitars. The company uses a standard, job-order cost-accounting system in two production departments: In the

please help me its due today !!!

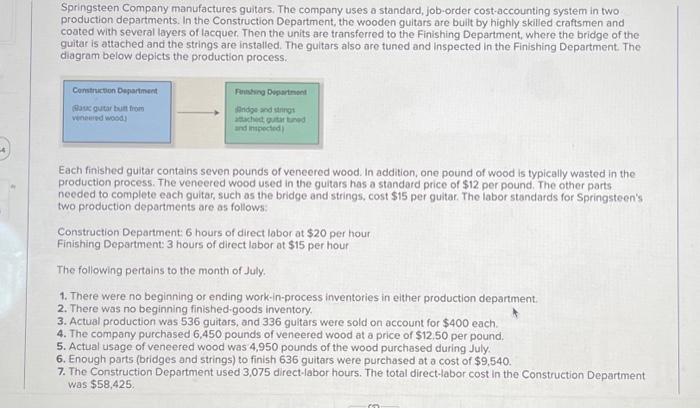

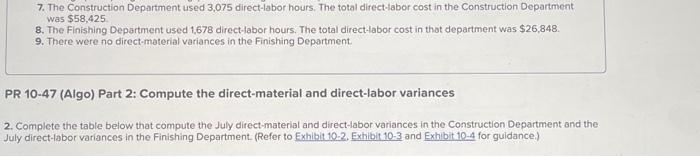

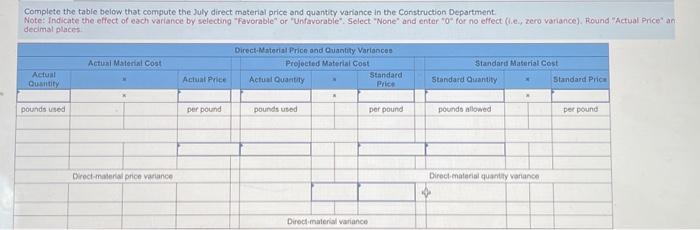

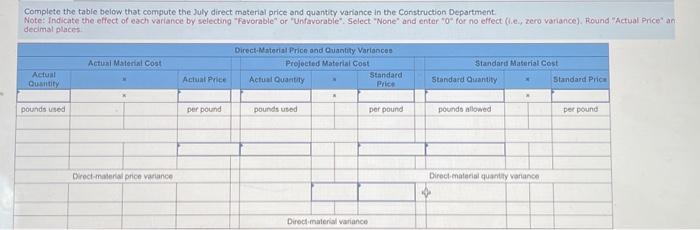

Springsteen Company manufactures guitars. The company uses a standard, job-order cost-accounting system in two production departments: In the Construction Department, the wooden gultars are buft by highly skilled craftsmen and coated with several layers of lacquer. Then the units are transforred to the Finishing Department, where the bridge of the guitar is attached and the strings are installed. The guitars also are tuned and inspected in the Finishing Department. The diagram below depicts the production process. Each finished guitar contains seven pounds of veneered wood. In addition, one pound of wood is typically wasted in the production process. The veneered wood used in the guitars has a standard price of $12 per pound. The other parts needed to complete each guitar, such as the bridge and strings, cost $15 per guitar. The labor standards for Springsteen's two production departments are as follows: Construction Department: 6 hours of direct labor at $20 per hour Finishing Department: 3 hours of direct labor at $15 per hour The following pertains to the month of July. 1. There were no beginning or ending work-in-process inventories in either production department. 2. There was no beginning finished-goods inventory. 3. Actual production was 536 guitars, and 336 guitars were sold on account for $400 each. 4. The company purchased 6,450 pounds of veneered wood at a price of $12,50 per pound. 5. Actual usage of veneered wood was 4,950 pounds of the wood purchased during July. 6. Enough parts (bridges and strings) to finish 636 guitars were purchased at a cost of $9,540. 7. The Construction Department used 3,075 direct-labor hours. The total direct-labor cost in the Construction Department was $58,425. 7. The Construction Department used 3,075 direct-labor hours. The total direct-labor cost in the Construction Department was $58,425 8. The Finishing Department used 1,678 direct-labor hours. The total direct-labor cost in thot department was $26,848. 9. There were no direct-material variances in the Finishing Department R 10-47 (Algo) Part 2: Compute the direct-material and direct-labor variances Complete the table below that compute the July direct-material and direct-labor variances in the Construction Department and the sly direct-labor variances in the Finishing Department. (Refer to Exhibit 10-2, Exhibit 10-3 and Exhibit 10-4 for guidance.) Complete the table below that compute the July direct material price and quantity variance in the Conistruction Department. Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter " 0 for no effect (lie., zero variance). Reund "Actual Price" decimal places Complete the table below that compute the July direct material purchase price variance in the Construction Departme Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for n (l.e., zero variance), Round "Actual Price" and "Standard Price" to 2 decimal places. Complete the table below that compute the July direct-labor rate and efficiency variances in the Construction Department. Note: Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter " 0 " for no effect (i.e., zero variance) "Standard Rate" to 2 decimal places. Complete the table below that compute the July direct-labor rate and efficiency variances in the Finishing Department. Notei Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter " 0 for no effect (l.e, zero variance), Riound "Act Rate" to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started