Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me!! Lesson 1: Extract from a New York Times article titled Nissan Got Rid of Carlos Ghosn: The Way it did so may

please help me!!

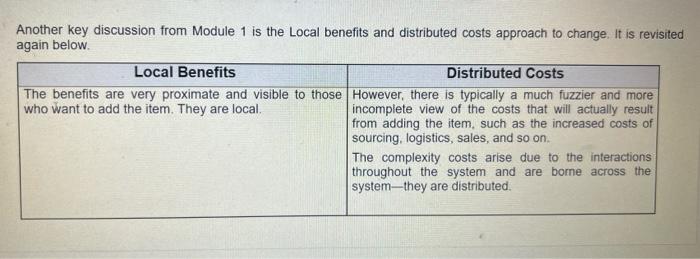

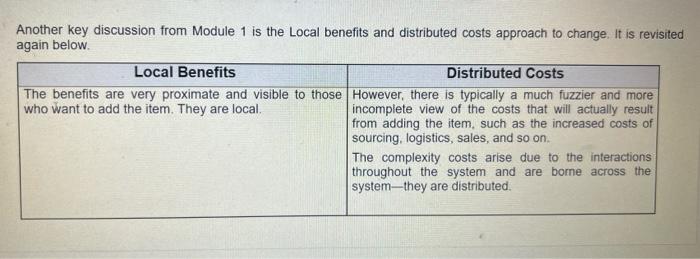

Lesson 1: Extract from a New York Times article titled Nissan Got Rid of Carlos Ghosn: The Way it did so may prove costly Page 3 of 6 Reference: Dooley, B. (2019). Nissan Got Rid of Carlos Ghosn: The Way it did so may prove costly. Retrieve from https://www.nytimes.com/2019/08/25/businessissan-ghosn-lawsuits.html?searchResultPosition=1 After the arrest last year of its chairman, Carlos Ghosn Nissan has made a very public accounting of its management failures, from a lack of strong internal checks and balances to board meetings that lasted only 20 minutes. That frankness may play well with the Japanese public and with prosecutors, who have charged the company and Mr. Ghosn with financial wrongdoing. But Nissan's disclosure of its problems at the top could cost it dearly and deliver a potential gold mine for the lawyers who squeeze multimillion-dollar settlements out of corporations accused of wrongdoing A small pension fund in Jackson, Mich that says it serves over 1.200 members, the Jackson County Employees Retirement System is helping to lead the way it holds 14,000 proxy shares of Nissan stock, and it has sued the Japanese automaker in a Tennessee federal court, asserting that its stake-today worth about half its purchase price troba enhetantial hit oftar Alicean wae ravoslar to have indarranartar Mr Chaenle romaneation and moda A small pension fund in Jackson, Mich., that says it serves over 1,200 members, the Jackson County Employees Retirement System, is helping to lead the way. It holds 14,000 proxy shares of Nissan stock, and it has sued the Japanese automaker in a Tennessee federal court, asserting that its stake - today worth about half its purchase price took a substantial hit after Nissan was revealed to have underreported Mr. Ghosn's compensation and made misleading statements about its corporate governance. As Nissan built its public case against Mr. Ghosn, the automaker has exposed itself to substantial legal liability, according to Darren Robbins, one of the lawyers leading Jackson County's suit, which seeks class-action status to include all Nissan investors in the United States, The costs are likely to mount. Nissan may already spend tens or even hundreds of millions of dollars defending itself against the suit. It could be hit with additional civil suits in Japan, though securities suits there are rarer and less punitive, and face regulatory penalties in both countries Nissan declined to comment on litigation, but said it took the charges against it "extremely seriously and expresses its deepest regret for any concern caused to its stakeholders," adding that it would continue to strengthen its governance and compliance, including making accurate disclosures of corporate information." Nissan is not alone in being sued by investors who have lost money. Settlements over such accusations are fairly common in the United States although they rarely result in large judgments or payouts, according to data collected by the Securities Class Action Clearinghouse at Stanford Law School. Between 1996 and 2017, around 1.700 suits were settled for a median payout of just $8.6 million However, that amount can increase sharply in cases where there is an egregious violation of a company's responsibilities to its shareholders. Last year, the Brazilian oil and gas company Petrobras agreed to pay almost billion to settle a class-action securities suit in the United States alleging it had overstated its assets and failed to disclose a multibillion-dollar corruption scandal An April report by an independent panel revealed that the automaker's internal controls had been a shambles for years. It said that the company's chief executive, Hiroto Saikawa - who is also named in the suit --- had signed off on documents that may have been related to the underreporting of Mr Ghosn's compensation. It also found multiple misrepresentations to shareholders, falsified documents, and rubber-stamp board meetings that averaged just 20 minutes in length 1888375 1 ES O However, that amount can increase sharply in cases where there is an egregious violation of a company's responsibilities to its shareholders. Last year, the Brazilian oil and gas company Petrobras agreed to pay almost billion to settle a class-action securities suit in the United States alleging it had overstated its assets and failed to disclose a multibillion-dollar corruption scandal An April report by an independent panel revealed that the automaker's internal controls had been a shambles for years. It said that the company's chief executive, Hiroto Saikawa - who is also named in the suit had signed off on documents that may have been related to the underreporting of Mr. Ghosn's compensation. It also found multiple misrepresentations to shareholders, falsified documents, and rubber-stamp board meetings that averaged just 20 minutes in length The challenge for Nissan is how to blame Mr. Ghosn for its problems while absolving the company's current executives of responsibility. In a court filing, Nissan argued that the independent report demonstrated that Mr. Saikawa was not aware of the well-concealed fraud perpetrated by Mr. Ghosn "It's very unusual for companies to say that they're being run by a criminal. Even if they think he's a bad guy." Mr. Pritchard said. "It's like they're asking for the judgment to be enforced in the U.S." in the American system, cooperation with the authorities normally results in a carefully crafted deal between the company and prosecutors that ends in deferred prosecution or the defendant pleading to lesser charges. Another key discussion from Module 1 is the Local benefits and distributed costs approach to change. It is revisited again below. Local Benefits Distributed Costs The benefits are very proximate and visible to those However, there is typically a much fuzzier and more who want to add the item. They are local incomplete view of the costs that will actually result from adding the item, such as the increased costs of sourcing, logistics, sales, and so on. The complexity costs arise due to the interactions throughout the system and are borne across the systemthey are distributed. Lesson 1: Extract from a New York Times article titled Nissan Got Rid of Carlos Ghosn: The Way it did so may prove costly Page 3 of 6 Reference: Dooley, B. (2019). Nissan Got Rid of Carlos Ghosn: The Way it did so may prove costly. Retrieve from https://www.nytimes.com/2019/08/25/businessissan-ghosn-lawsuits.html?searchResultPosition=1 After the arrest last year of its chairman, Carlos Ghosn Nissan has made a very public accounting of its management failures, from a lack of strong internal checks and balances to board meetings that lasted only 20 minutes. That frankness may play well with the Japanese public and with prosecutors, who have charged the company and Mr. Ghosn with financial wrongdoing. But Nissan's disclosure of its problems at the top could cost it dearly and deliver a potential gold mine for the lawyers who squeeze multimillion-dollar settlements out of corporations accused of wrongdoing A small pension fund in Jackson, Mich that says it serves over 1.200 members, the Jackson County Employees Retirement System is helping to lead the way it holds 14,000 proxy shares of Nissan stock, and it has sued the Japanese automaker in a Tennessee federal court, asserting that its stake-today worth about half its purchase price troba enhetantial hit oftar Alicean wae ravoslar to have indarranartar Mr Chaenle romaneation and moda A small pension fund in Jackson, Mich., that says it serves over 1,200 members, the Jackson County Employees Retirement System, is helping to lead the way. It holds 14,000 proxy shares of Nissan stock, and it has sued the Japanese automaker in a Tennessee federal court, asserting that its stake - today worth about half its purchase price took a substantial hit after Nissan was revealed to have underreported Mr. Ghosn's compensation and made misleading statements about its corporate governance. As Nissan built its public case against Mr. Ghosn, the automaker has exposed itself to substantial legal liability, according to Darren Robbins, one of the lawyers leading Jackson County's suit, which seeks class-action status to include all Nissan investors in the United States, The costs are likely to mount. Nissan may already spend tens or even hundreds of millions of dollars defending itself against the suit. It could be hit with additional civil suits in Japan, though securities suits there are rarer and less punitive, and face regulatory penalties in both countries Nissan declined to comment on litigation, but said it took the charges against it "extremely seriously and expresses its deepest regret for any concern caused to its stakeholders," adding that it would continue to strengthen its governance and compliance, including making accurate disclosures of corporate information." Nissan is not alone in being sued by investors who have lost money. Settlements over such accusations are fairly common in the United States although they rarely result in large judgments or payouts, according to data collected by the Securities Class Action Clearinghouse at Stanford Law School. Between 1996 and 2017, around 1.700 suits were settled for a median payout of just $8.6 million However, that amount can increase sharply in cases where there is an egregious violation of a company's responsibilities to its shareholders. Last year, the Brazilian oil and gas company Petrobras agreed to pay almost billion to settle a class-action securities suit in the United States alleging it had overstated its assets and failed to disclose a multibillion-dollar corruption scandal An April report by an independent panel revealed that the automaker's internal controls had been a shambles for years. It said that the company's chief executive, Hiroto Saikawa - who is also named in the suit --- had signed off on documents that may have been related to the underreporting of Mr Ghosn's compensation. It also found multiple misrepresentations to shareholders, falsified documents, and rubber-stamp board meetings that averaged just 20 minutes in length 1888375 1 ES O However, that amount can increase sharply in cases where there is an egregious violation of a company's responsibilities to its shareholders. Last year, the Brazilian oil and gas company Petrobras agreed to pay almost billion to settle a class-action securities suit in the United States alleging it had overstated its assets and failed to disclose a multibillion-dollar corruption scandal An April report by an independent panel revealed that the automaker's internal controls had been a shambles for years. It said that the company's chief executive, Hiroto Saikawa - who is also named in the suit had signed off on documents that may have been related to the underreporting of Mr. Ghosn's compensation. It also found multiple misrepresentations to shareholders, falsified documents, and rubber-stamp board meetings that averaged just 20 minutes in length The challenge for Nissan is how to blame Mr. Ghosn for its problems while absolving the company's current executives of responsibility. In a court filing, Nissan argued that the independent report demonstrated that Mr. Saikawa was not aware of the well-concealed fraud perpetrated by Mr. Ghosn "It's very unusual for companies to say that they're being run by a criminal. Even if they think he's a bad guy." Mr. Pritchard said. "It's like they're asking for the judgment to be enforced in the U.S." in the American system, cooperation with the authorities normally results in a carefully crafted deal between the company and prosecutors that ends in deferred prosecution or the defendant pleading to lesser charges. Another key discussion from Module 1 is the Local benefits and distributed costs approach to change. It is revisited again below. Local Benefits Distributed Costs The benefits are very proximate and visible to those However, there is typically a much fuzzier and more who want to add the item. They are local incomplete view of the costs that will actually result from adding the item, such as the increased costs of sourcing, logistics, sales, and so on. The complexity costs arise due to the interactions throughout the system and are borne across the systemthey are distributed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started