Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me!!!! need in 20 mins!! please!!! Sandoval Company has three potential investment projects, but can choose only one to invest in. Below is

please help me!!!! need in 20 mins!! please!!!

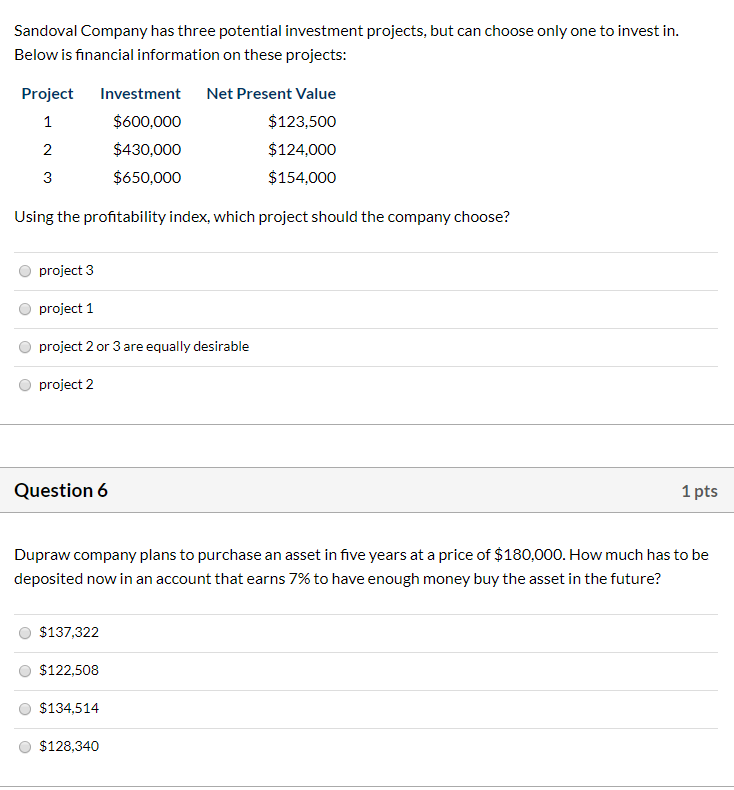

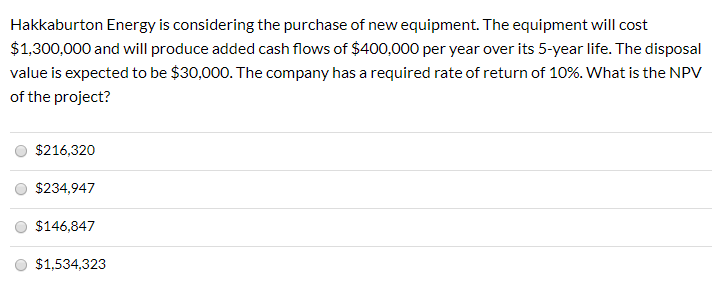

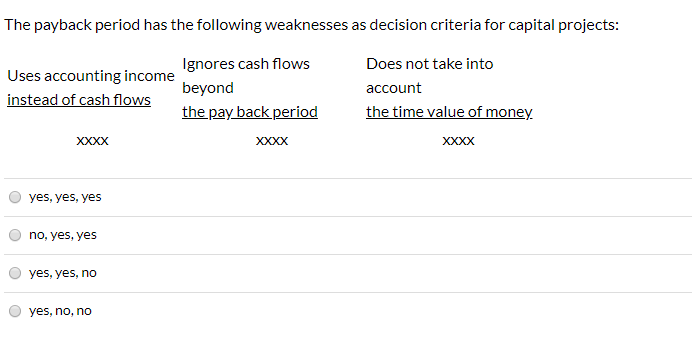

Sandoval Company has three potential investment projects, but can choose only one to invest in. Below is financial information on these projects: Project Investment $600,000 $430,000 $650,000 Net Present Value $123,500 $124.000 $154,000 2 Using the profitability index, which project should the company choose? project 3 project 1 project 2 or 3 are equally desirable project 2 Question 6 1 pts Dupraw company plans to purchase an asset in five years at a price of $180,000. How much has to be deposited now in an account that earns 7% to have enough money buy the asset in the future? $137,322 $122,508 $134,514 $128,340 Hakkaburton Energy is considering the purchase of new equipment. The equipment will cost $1,300,000 and will produce added cash flows of $400.000 per year over its 5-year life. The disposal value is expected to be $30,000. The company has a required rate of return of 10%. What is the NPV of the project? $216,320 $234,947 $146,847 $1,534,323 The payback period has the following weaknesses as decision criteria for capital projects: Ignores cash flows Uses accounting income beyond instead of cash flows the pay back period Does not take into account the time value of money. XXXX XXXX O yes, yes, yes O no, yes, yes O yes, yes, no O yes, no, noStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started