please help me on this

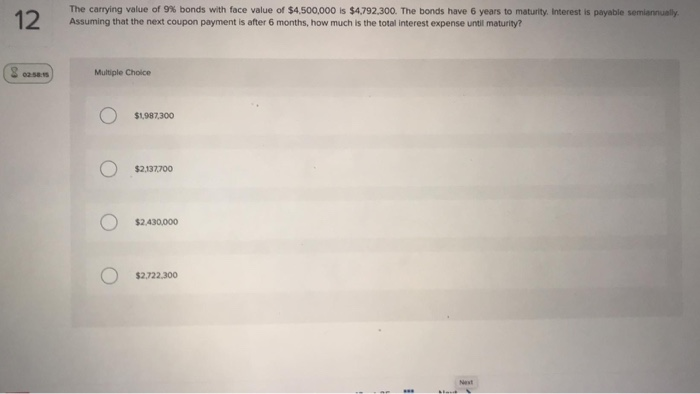

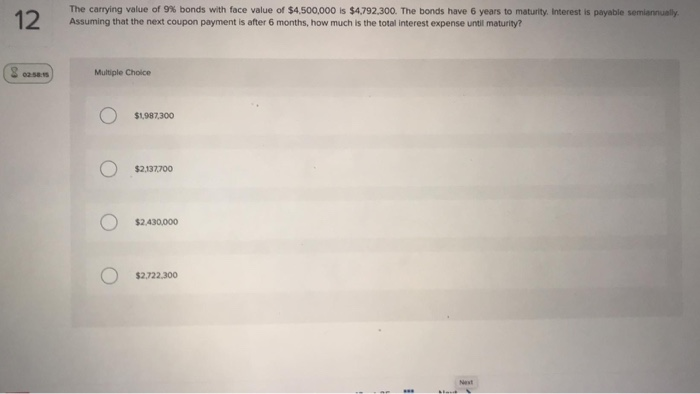

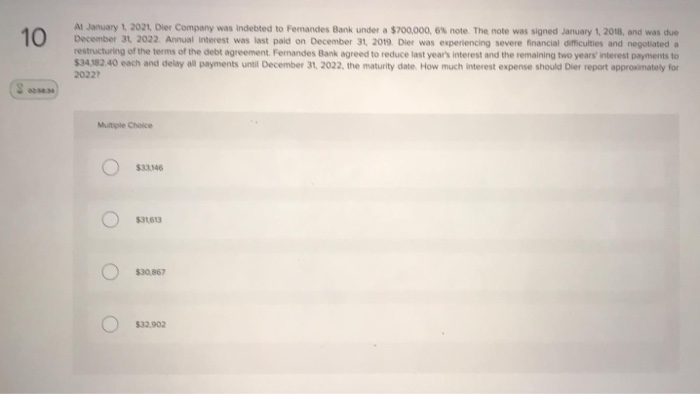

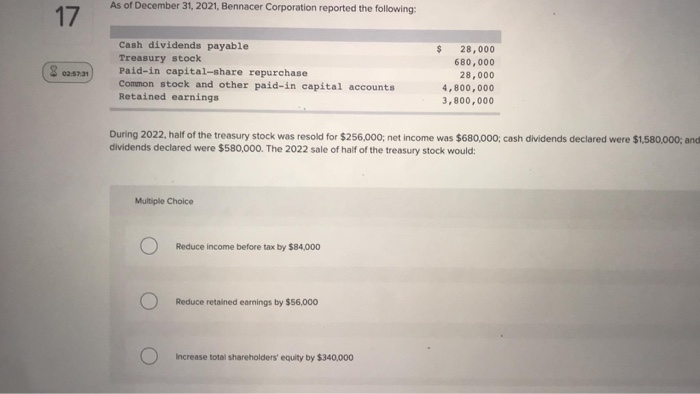

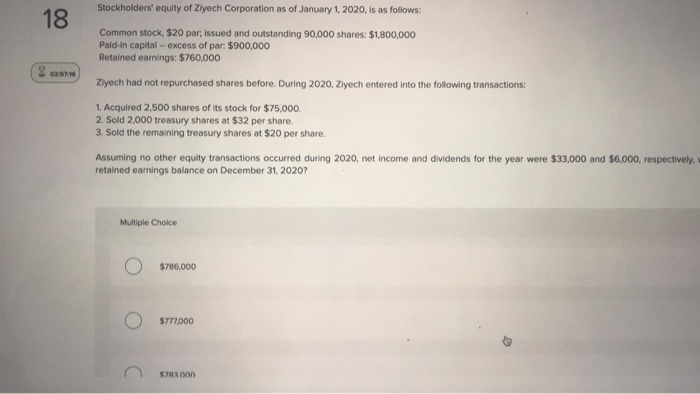

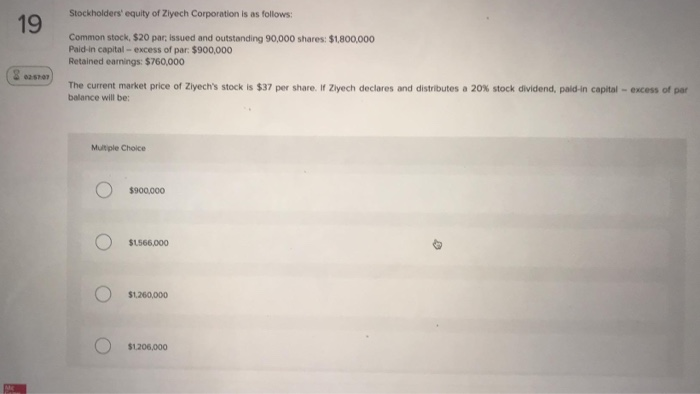

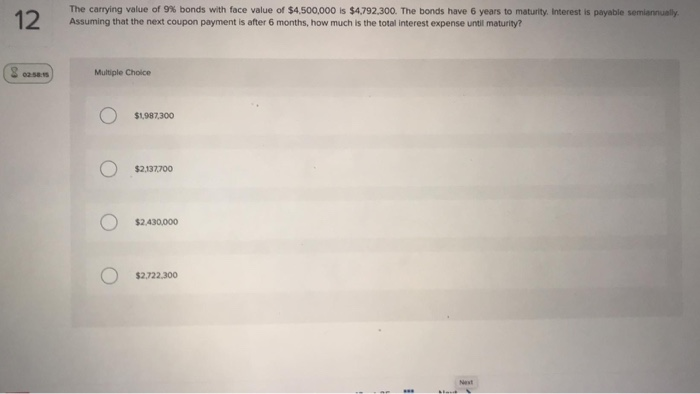

12 The carrying value of 9% bonds with face value of $4,500,000 is $4.792,300. The bonds have 6 years to maturity. Interest is payable semiannually Assuming that the next coupon payment is after 6 months, how much is the total interest expense until maturity? Multiple Choice $1987.300 $2137700 $2430,000 $2,722.300 At January 1, 2021 Dier Company was indebted to Pemandes Bank under a $700,000, 6 note. The note was signed January 1 2018, and was due December 31 2022. Annual interest was last paid on December 31, 2019. Dier was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. Fernandes Bank agreed to reduce last year's interest and the remaining two years' interest payments to $34,182.40 each and delay all payments until December 31, 2022, the maturity date. How much interest expense should Dier report approximately for 20221 Multiple Choice o O 16 Svibaneda Ss como Rick Co had 35 million shares of $3 par common stock outstanding at January 1 2021 in October 2021 Rick Co's Board of Directors declared and distributed a 3% common stock dividend when the market value of its common stock was $61 per share. In recording this transaction, Rick would Soastra Multiple Choice None of these answer choices are correct Credit paid in capital-excess of par for 56405 milion Io ooo Credit common stock for $64.5 million Debit retained earnings for $64.05 milion As of December 31, 2021, Bennacer Corporation reported the following: 17 Cash dividends payable Treasury stock Paid-in capital-share repurchase Common stock and other paid-in capital accounts Retained earnings $ 28,000 680,000 28,000 4,800,000 3,800,000 During 2022, half of the treasury stock was resold for $256,000, net income was $680,000cash dividends declared were $1,580,000, and dividends declared were $580,000. The 2022 sale of half of the treasury stock would: Multiple Choice O Reduce income before tax by $84,000 Reduce retained earnings by $56,000 Oo increase total shareholders' equity by $340,000 Stockholders' equity of Ziyech Corporation as of January 1, 2020, is as follows: Common stock, $20 par, issued and outstanding 90,000 shares: $1,800,000 Paid in capital - excess of par: $900,000 Retained earnings: $760,000 Ziyech had not repurchased shares before. During 2020. Ziyech entered into the following transactions: 1. Acquired 2,500 shares of its stock for $75,000 2. Sold 2,000 treasury shares at $32 per share. 3. Sold the remaining treasury shares at $20 per share. Assuming no other equity transactions occurred during 2020, net income and dividends for the year were $33,000 and $6,000, respectively retained earnings balance on December 31, 2020? Multiple Choice O $786,000 0 0 $777,000 0 30 C Stockholders' equity of Ziyech Corporation is as follows: Common stock, $20 par, issued and outstanding 90,000 shares: $1,800,000 Paid-in capital - excess of par: $900,000 Retained earnings: $760,000 The current market price of Ziyech's stock is $37 per share. If Ziyech declares and distributes a 20% stock dividend, pald-in capital - excess of par balance will be: Multiple Choice 3900,000 51666.000 51200000 51200000