Answered step by step

Verified Expert Solution

Question

1 Approved Answer

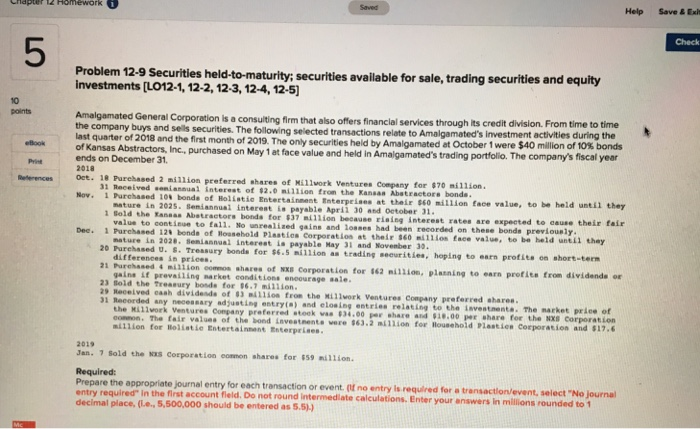

Please help me only with entries #15& #16 Help Save & Exit Check 5 Problem 12-9 Securities held-to-maturity: securities available for sale, trading securities and

Please help me only with entries #15& #16

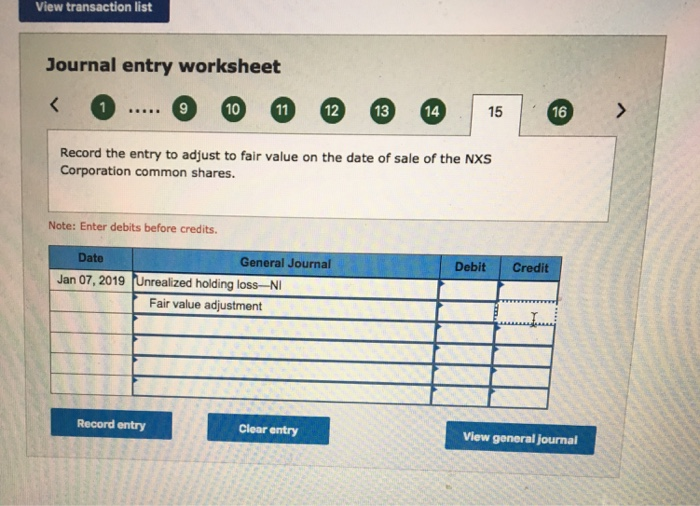

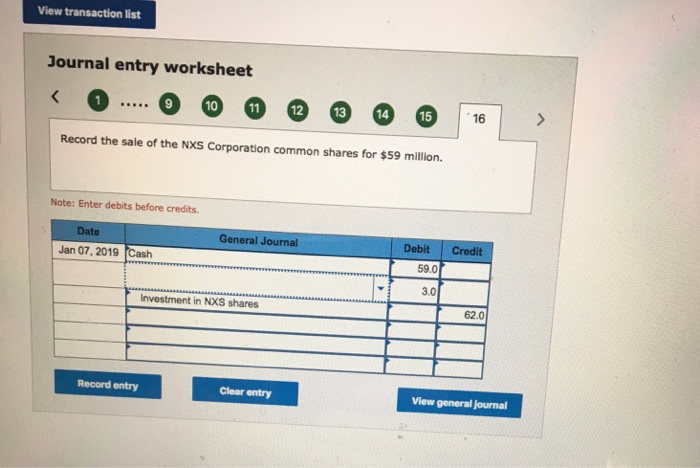

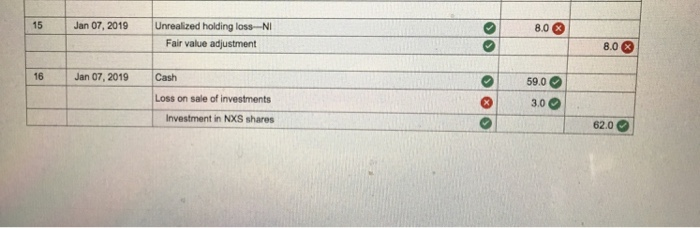

Help Save & Exit Check 5 Problem 12-9 Securities held-to-maturity: securities available for sale, trading securities and equity investments [L012-1, 12-2, 12-3, 12-4,12-5 10 points Amalgamated General Corporation is a consulting firm that the last quarter of 2018 and the first month of 2019. The only securities held of Kansas Abstractors, Inc., purchased on May 1 at face value and held in also offers financial services through its credit division. From time to time curities. The following selected transactions relate to Amalgamated's investment activities during the by Amalgamated at October 1 were $40 million of 10% bonds Amalgamated's trading portfolio. The company's fiscal year ends on December 3. Print 2018 eterencesOet. 18 Purehased 2 million preferred shares of Ki1lwork Ventures Company for $70 million. 31 Received seniannual interest of $2.0 million fron the Kansan Abstractore bonds. Nov. 1 Purchased 10s bonds of Holistic Entertai nnent Interpeines at their $60 million Eace value, to be held until they e for 937 illion because riaing interest rates are expected to cause their fair nat 1 Sold the Eansas Abatractors ure in 2025. Semiannual interest is payable April 30 and Oetober 31 No unrealized gains and losses had been recorded on these bonde previouely Dec. 1 Purchased 12 bonde of loasehold Plaatios Corporatios at their 60 i11los face value, to be held until they g securities, hoping to earn profite on shore-term al interest 31 and Novenber 30 20 Purehssed u. S. Treasury bonds for $6.5 million a tradin differences in prices 21 Purehssed 4 miiion cmnos shares of NXB Corporation for 162 to earn profitn from dividende or f prevailing narket conditions enoourage sale 23 Bold the tressury bonds for 96.7 mil1ion. 29 Received eaah dividend. of S).miliios fron the Millwork Ventures eonpany preferredhare. 31 Recorded any neee ryadjust nq entry (.) and eloaing entries relating tot the investnente. The narket price of Company preferred ..oek vas .00 per share and ..00 per share for the sa corporation tnente vere $63.2 million for lousehoid Plastien Corporation and $17,6 - common. The fair values of the bond million for Boliatie Entertainnent Enterprises $63. 2019 Jan. 7 Sold the Nas corporation comon shares for 959 million. Prepare the appropriate journal entry for each transaction or event oit no entry decimal place, (Lie, 5,500,000 should be entered as 5.5)) Is requlred for a transaction/event, select "No journal in the first account field. Do not round intermediate calculations. Enter your answers in milions rounded to 1 View transaction list Journal entry worksheet 15 16 9 Record the entry to adjust to fair value on the date of sale of the NXS Corporation common shares. Note: Enter debits before credits. Date General Journal Debit Credit Unrealized holding loss-NI Fair value adjustment Jan 07, 2019 Record entry Clear entry View general journal View transaction list Journal entry worksheet 10 16 Record the sale of the NXS Corporation common shares for $59 million. Note: Enter debits before credits. Date General Journal Debit Credit Jan 07, 2019 Cash 59.0 3.0 Investment in NXS shares 62.0 Record entry Clear entry View general journal 15 Jan 07, 2019 Unrealized holding loss-N 8.0 Fair value adjustment 8.0 16 Jan 07, 2019 Cash 59.0 Loss on sale of investments 3.0 Investment in NXS shares 62.0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started