please help me out

added rhe info needed

i just need exercise 4-5 done

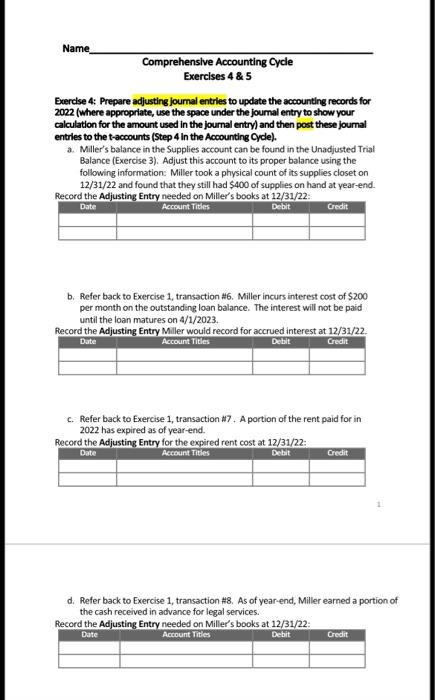

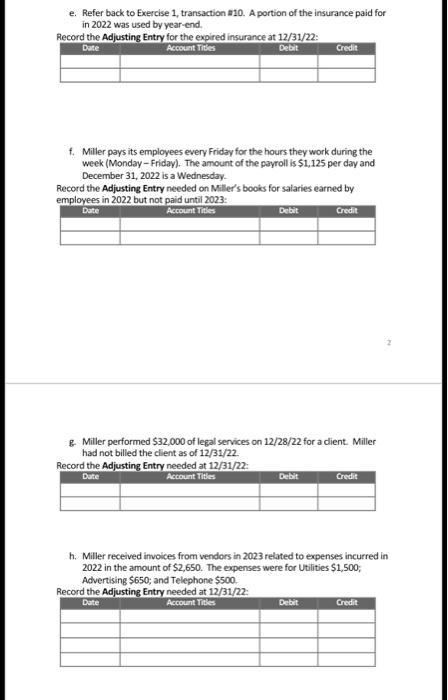

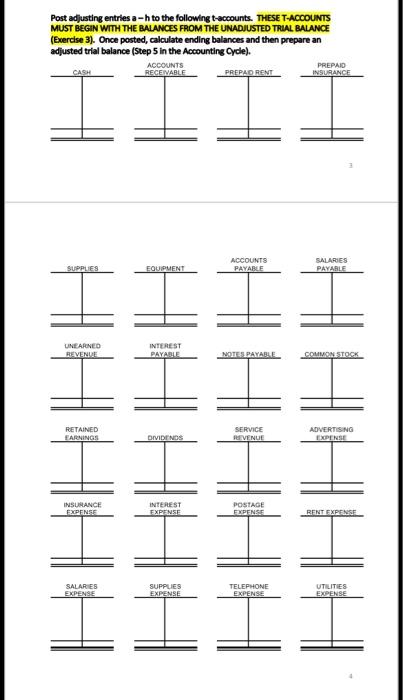

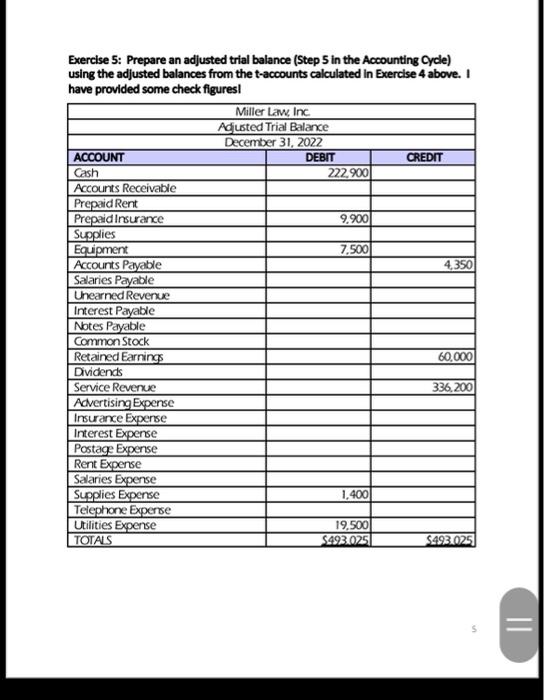

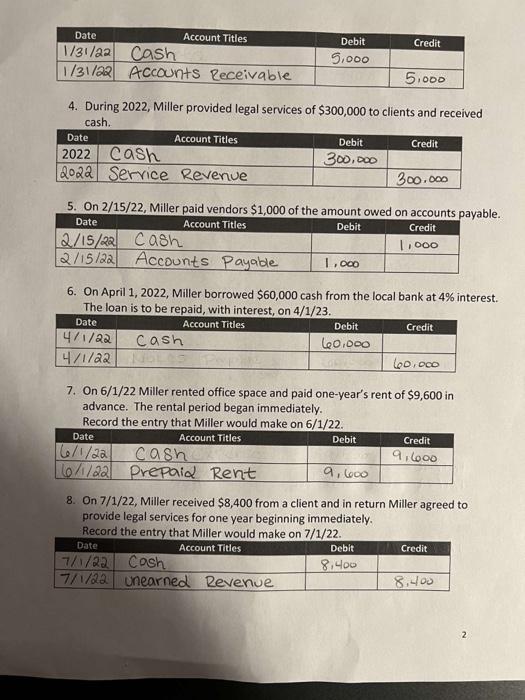

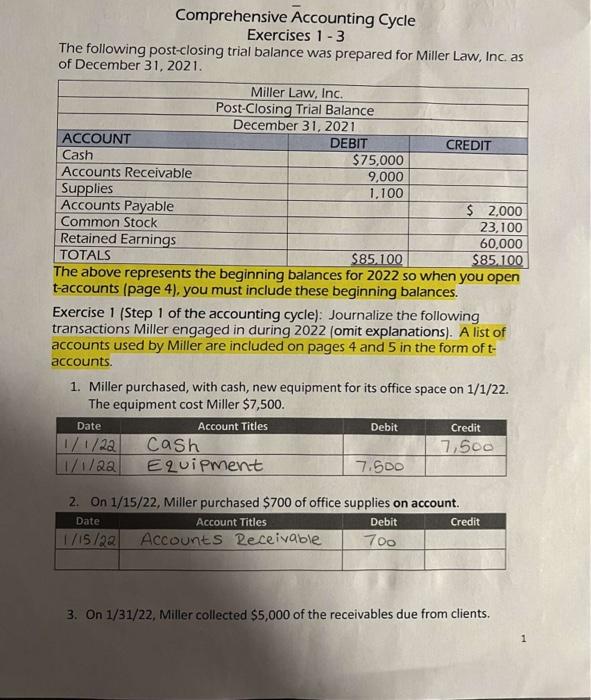

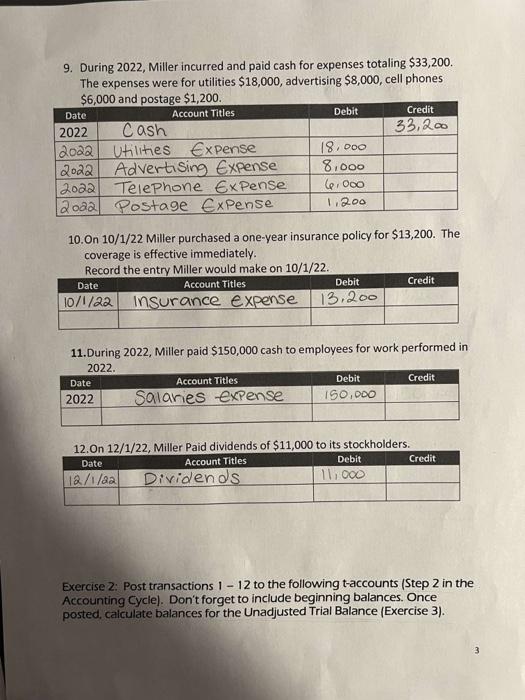

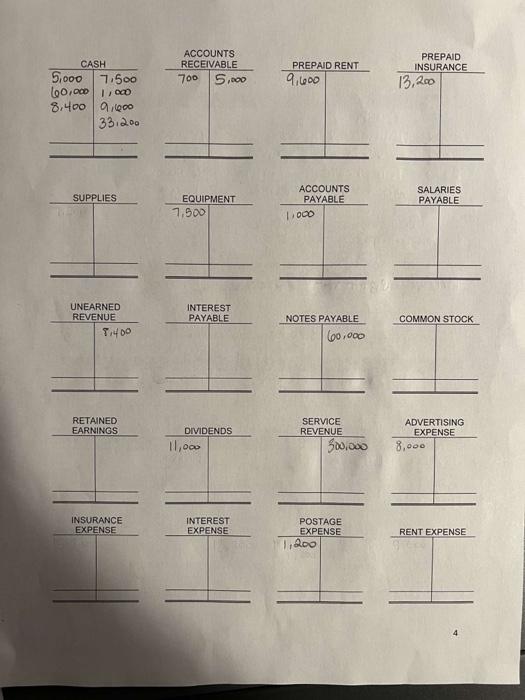

Exerclse 4: Prepare adjusting joumal entrles to update the accounting records for 2022 (where appropriate, use the space under the joumal entry to show your calculation for the amount used in the journal entry) and then post these journal entries to the t-accounts (Step 4 in the Accounting Cycle). a. Miller's balance in the Supplies account can be found in the Unadjusted Trial Balance (Exercise 3). Adjust this account to its proper balance using the following information: Miller took a physical count of its supplies closet on 12/31/22 and found that they still had $400 of supplies on hand at year-end. Record the Adjustina Entry needed on Miller's books at 12/31/22: b. Fefer back to Exercise 1, transaction #6. Miller incurs interest cost of $200 per month on the outstanding loan balance. The interest will not be paid until the loan matures on 4/1/2023. flecord the Adiustine Entrv Miller would record for accrued interest at 12/31/22. c. Refer back to Exercise 1, transaction #17. A portion of the rent paid for in 2022 has expired as of year-end. Record the Adiustina Entrv for the expired rent cost at 12/31/22: d. Refer back to Exercise 1, transaction #8. As of year-end, Miller earned a portion of the cash received in advance for legal services. Record the Adiusting Entrv needed on Miller's books at 12/31/22 : e. Refer back to Exercise 1, transaction \$10. A portion of the insurance paid for in 2022 was used by year-end. Record the Adiustine Entrv for the exoired insurance at 12/31/22: f. Miller pays its employees every Friday for the hours they work during the week (Monday - Friday). The amount of the payroll is $1,125 per day and December 31, 2022 is a Wednesday. Record the Adjusting Entry needed on Miller's books for saiaries earned by employees in 2022 but not paid untiil 2023: g. Miller performed $32,000 of legal services on 12/28/22 for a dient. Miller had not billed the client as of 12/31/22. Record the Adiustina Fntrv needed at 13/31/22. h. Miller received invoices from vendors in 2023 related to expenses incurred in 2022 in the amount of $2,650. The expenses were for Utilities $1,500; Advertising $650; and Telephone $500. Record the Adiustina Entrv needed at 12/31/22 : Post adjusting entrres a h to the following t-accounts. THESE T-ACCOUNTS MUST BCGIN WITH THE BAAACES FROM THE UNADJUSTED TRuL BALANCE (Exerclse 3). Once posted, calculate ending balances and then prepare an adjusted trial balance (5tep 5 in the Accounting Cycle). Exercise 5: Prepare an adjusted trial balance (Step 5 in the Accounting Cycle) using the adjusted balances from the t-accounts calculated in Exercise 4 above. I 4. During 2022, Miller provided legal services of $300,000 to clients and received cash. 6. On April 1, 2022, Miller borrowed $60,000 cash from the local bank at 4% interest. The loan is to be repaid, with interest. on 4/1/23. 7. On 6/1/22 Miller rented office space and paid one-year's rent of $9,600 in advance. The rental period began immediately. Record the entry that Miller would make on 6/1/22. 8. On 7/1/22, Miller received $8,400 from a client and in return Miller agreed to provide legal services for one year beginning immediately. Record the entry that Miller would make on 7/1/22. Comprehensive Accounting Cycle Exercises 1 - 3 The following post-closing trial balance was prepared for Miller Law, Inc. as of December 31,2021 . III avuve represents the beginning Dalances for 2022 so when you open t-accounts (page 4), you must include these beginning balances. Exercise 1 (Step 1 of the accounting cycle): Journalize the following transactions Miller engaged in during 2022 (omit explanations). A list of accounts used by Miller are included on pages 4 and 5 in the form of taccounts. 1. Miller purchased, with cash, new equipment for its office space on 1/1/22. The equipment cost Miller $7,500. 2. On 1/15/22, Miller purchased $700 of office supplies on account. 3. On 1/31/22, Miller collected $5,000 of the receivables due from clients. 9. During 2022, Miller incurred and paid cash for expenses totaling $33,200. The expenses were for utilities $18,000, advertising $8,000, cell phones ca nnn and nnctaoe $1,200. 10. On 10/1/22 Miller purchased a one-year insurance policy for $13,200. The coverage is effective immediately. Record the entrv Miller would make on 10/1/22. 11. During 2022, Miller paid $150,000 cash to employees for work performed in an3 12 n 12/1/22. Miller Paid dividends of $11,000 to its stockholders. Exercise 2: Post transactions 1 - 12 to the following t-accounts (Step 2 in the Accounting Cycle). Don't forget to include beginning balances. Once posted, calculate balances for the Unadjusted Trial Balance (Exercise 3). Exercise 3: Prepare an Unadjusted Trial Balance (Step 3 in the Accounting Cycle). I have given you some check figures. The accounts and the balances reported in the unadjusted trial balance should agree to the balances of your taccounts. If your total debits and total credits do not equal the check figures, try to find your error(s). It could be a mistake in the actual journal entry; a posting error or a simple math error. Only after you have attempted multiple times to locate the error(s) should you reach out to me for helpl