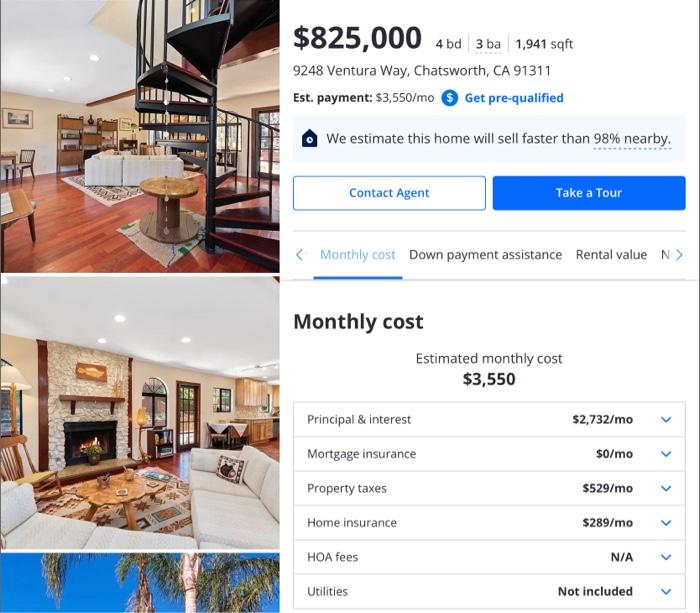

Affordability and Rate of Return of the Investment In this section you will determine the monthly after-tax cash flow required to purchase the home(s) and the gross month wages you must be making to have the after-tax cash). 1. Estimate your tax rate. Since this will require a large portion of your income, do not consider your marginal tax rate but rather your average tax rate. The average tax rate can be found by looking at your taxable income and taxes paid on your last tax return to the IRS. Now consider what your taxable income and taxes paid would be (using the last-year's tax tables) if you also itemized your mortgage payments and property taxes or if you itemized instead of using the standard deduction. If this sounds complicated, discuss it with the Instructor. 2. Draw a new cash flow diagram that includes any tax savings consideration. 3. Calculate the Rate of Return of this investment. 4. If more than one possible choice, perform an Incremental Rate of Return analysis to determine the best investment. $825,000 bd 3 ba 1,941 sqft 9248 Ventura Way, Chatsworth, CA 91311 Est. payment: $3,550/mo Get pre-qualified We estimate this home will sell faster than 98% nearby. Contact Agent Take a Tour Monthly cost Down payment assistance Rental value N Monthly cost Estimated monthly cost $3,550 o Principal & interest $2,732/mo Mortgage insurance $0/mo RO keca Property taxes $529/mo Home insurance $289/mo HOA fees N/A Utilities Not included Affordability and Rate of Return of the Investment In this section you will determine the monthly after-tax cash flow required to purchase the home(s) and the gross month wages you must be making to have the after-tax cash). 1. Estimate your tax rate. Since this will require a large portion of your income, do not consider your marginal tax rate but rather your average tax rate. The average tax rate can be found by looking at your taxable income and taxes paid on your last tax return to the IRS. Now consider what your taxable income and taxes paid would be (using the last-year's tax tables) if you also itemized your mortgage payments and property taxes or if you itemized instead of using the standard deduction. If this sounds complicated, discuss it with the Instructor. 2. Draw a new cash flow diagram that includes any tax savings consideration. 3. Calculate the Rate of Return of this investment. 4. If more than one possible choice, perform an Incremental Rate of Return analysis to determine the best investment. $825,000 bd 3 ba 1,941 sqft 9248 Ventura Way, Chatsworth, CA 91311 Est. payment: $3,550/mo Get pre-qualified We estimate this home will sell faster than 98% nearby. Contact Agent Take a Tour Monthly cost Down payment assistance Rental value N Monthly cost Estimated monthly cost $3,550 o Principal & interest $2,732/mo Mortgage insurance $0/mo RO keca Property taxes $529/mo Home insurance $289/mo HOA fees N/A Utilities Not included