Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me out for this. mdc.blackboard.com/webapps/assessment/take/launch jspcourse assessmentids 431711 18course id 101847 1&kcontent id 5086022 18 se..-Courses-Blackboa Dgtal Learning &..-YouTube NYC Cnme Map e

please help me out for this.

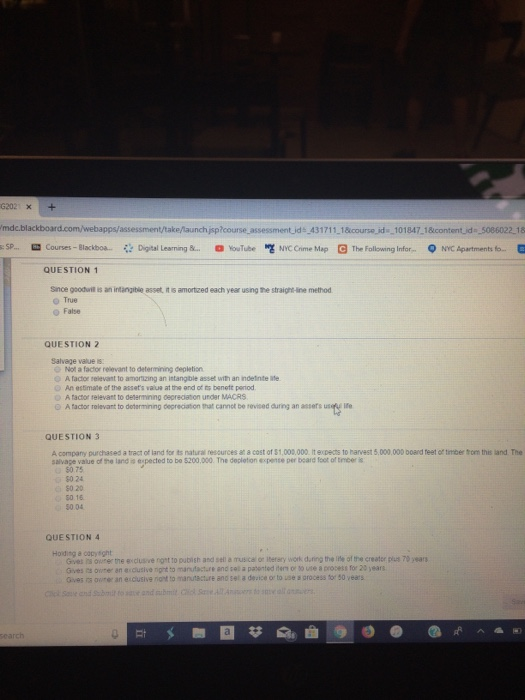

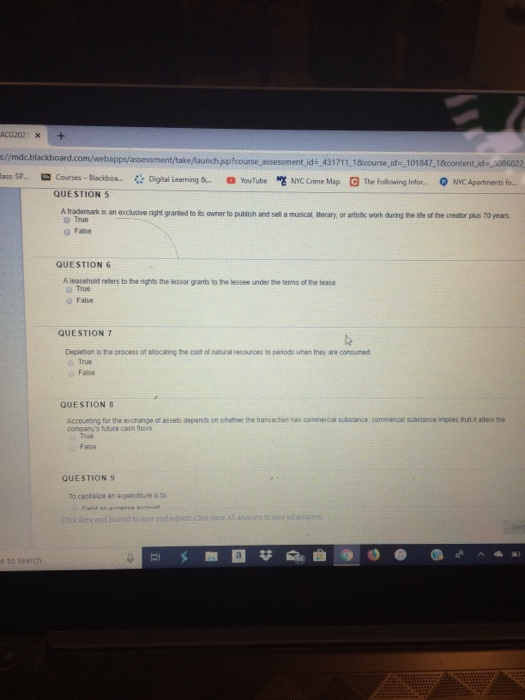

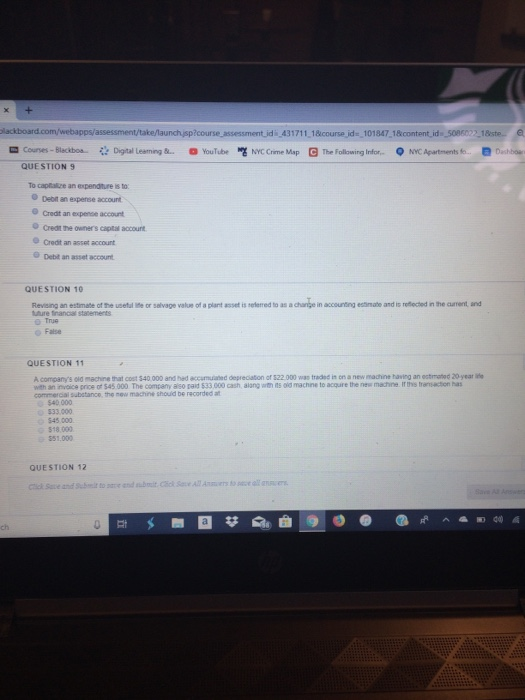

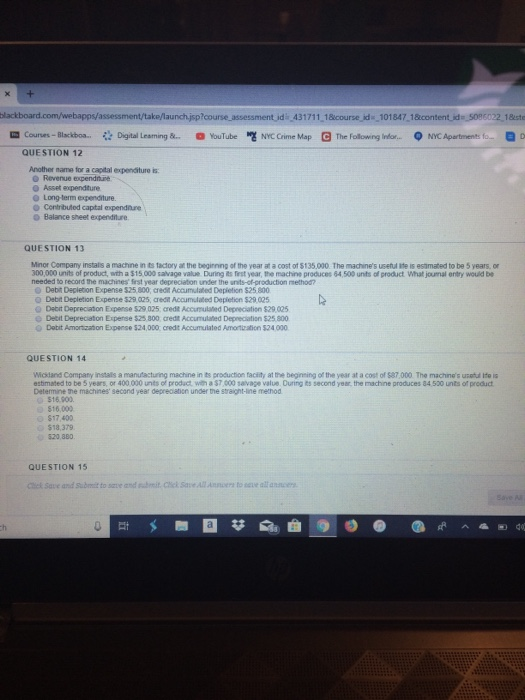

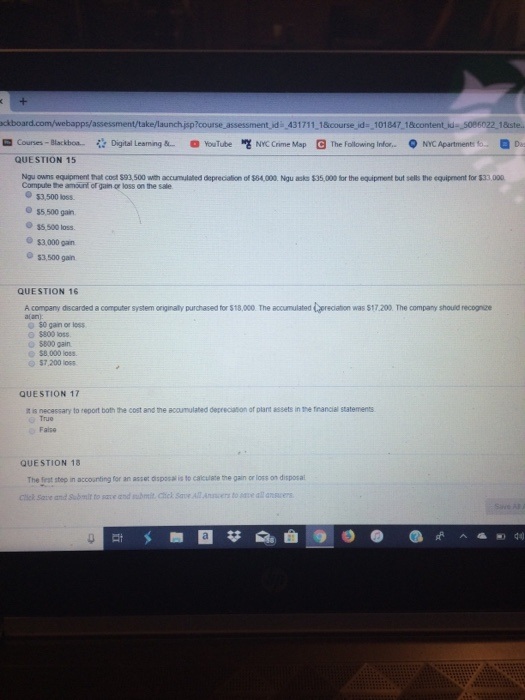

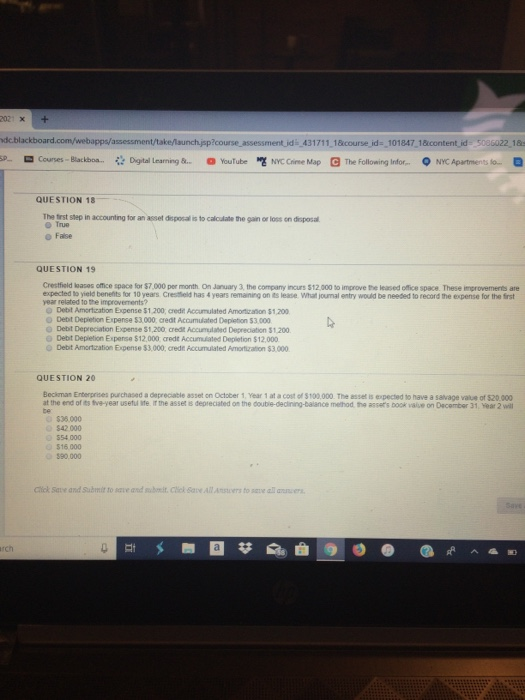

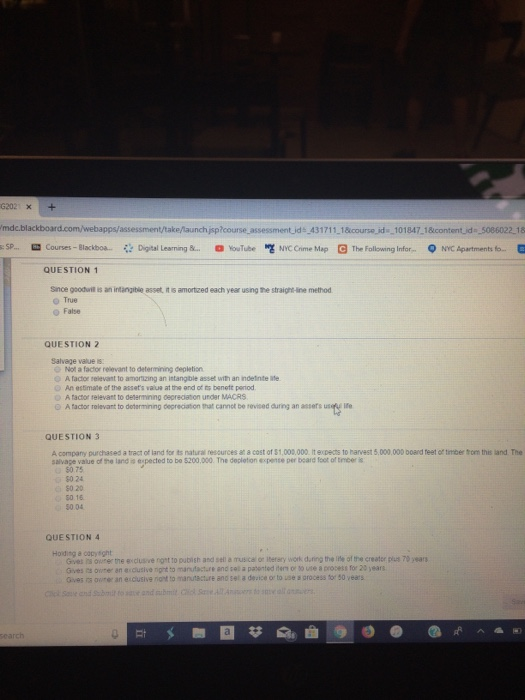

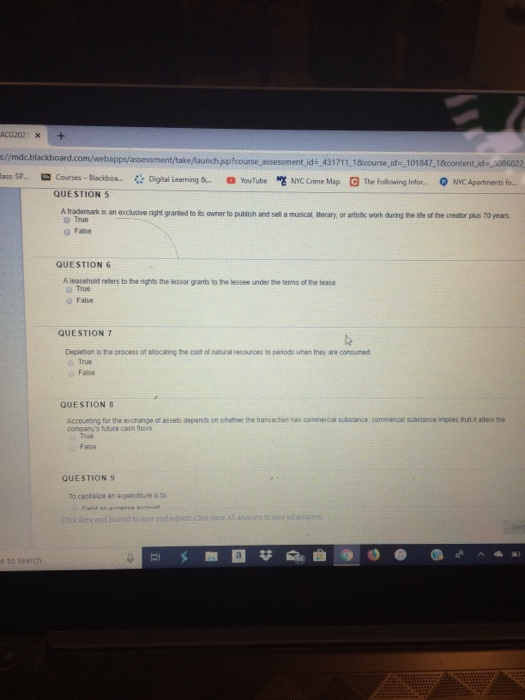

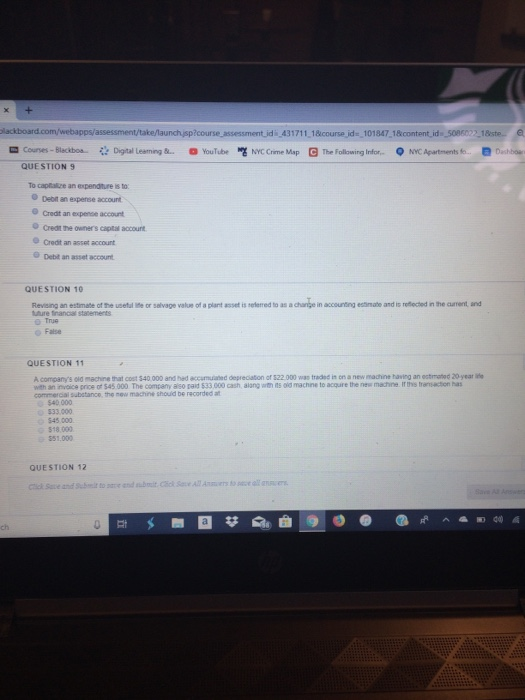

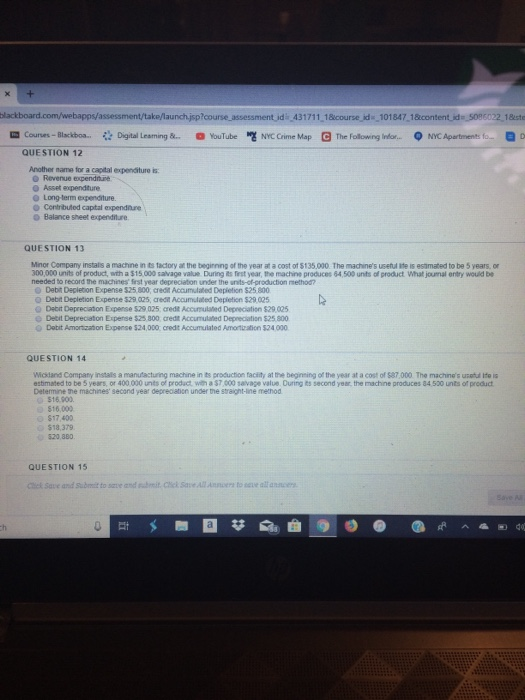

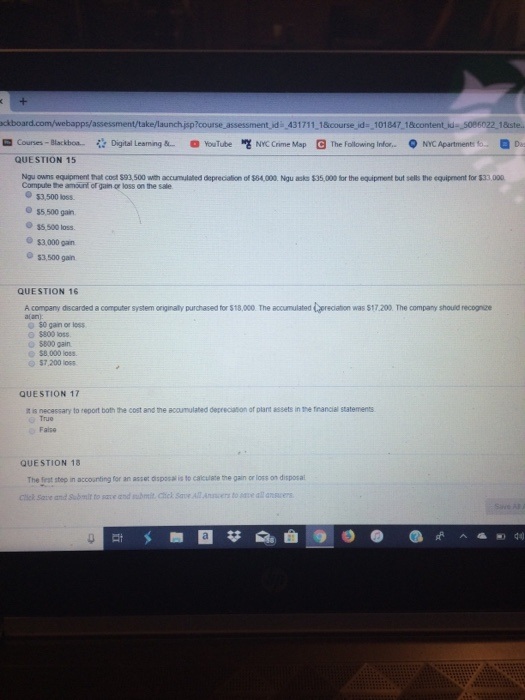

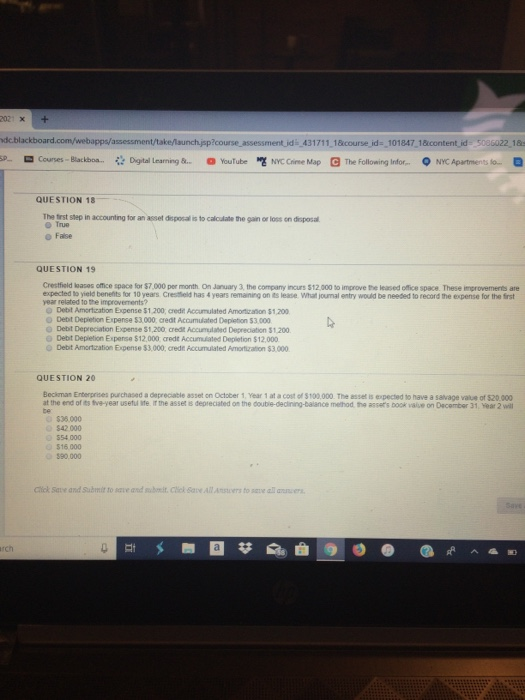

mdc.blackboard.com/webapps/assessment/take/launch jspcourse assessmentids 431711 18course id 101847 1&kcontent id 5086022 18 se..-Courses-Blackboa Dgtal Learning &..-YouTube NYC Cnme Map e The Following Infor.. NYC Apartments fo- QUESTION 1 Srce goodwil ts an intangible asset, anorteed each year usng the straig" ne method True False QUESTION 2 Salvage value is Nol a factor relevant to determining depletion O A factor selevant to amartizing an intangble asset with an indeinte lie An estimate of the asset's valus at the and of ts benett pertod O A factor relevant to determining depreciation urdar MACRS O A factor rolevant to determining degreciation that cannot be revised during an assets QUESTION 3 A company purchased a tract of land for ts natural rescurces at a cost of $1,008.000 It expects to harvest 5.000,000 board feet o salvage value of the land s expected to be 5200,000. The decletion espense per beard foot of tmcer s timber trom this land The 50 75 80 24 80 20 50 16 0 04 QUE STION4 Hoiding a copyght Gves ts ouner the eiclusive ngnt to pubish and sel a muscal or iterary work duting the lile of the creator plus 79 years Gives ts owrer an ecclusive nght to manufacture and sel a pabented iters or to use a process for 20 years Gives ra owner an e cusive nant to manutacture and sel a derice or to use a process tor 50 vears ps/a Pcourse assessment id 431711 18course id 101847,1&kcontent jds 5086022 18ste.. e The Following Infor- Courses-Blackboa. QUESTION 15 Digital Learnng& YouTube NYC Crnme Map . NYC Apartment, a De Ngu owns equipment that codt $93,500 with accumulated deprecialtion of $84,000. Ngu asks $35,000 for the equipment but sells the equipement for $33,000 Computle the amount of gain or loss on the sale $3,500 lo $5,500 gain O $5,500 loss. O$3.000 gan 53,500 gan QUESTION 16 A company discarded a computer system onginaly purchased tor $18,000. The accumulated gereciation was $17200. The company shouid recognize $0 gain or loss O $800 loss 5800 gain $8,000 loss $7.200 loss QUESTION 17 t is necassary to report both the cost and the accumulated depreciation of plant assets in the trancial statements True False QUESTION 18 The fest step in accounting for an asset osposa is to caiculate the gain or loss on disposal Cick Save and Submit to save and submit, chick Save All Ancers to de all ce 02 x+ dc.blackboard.com/webapps/assessment/take/launch,jsp?course assessment id 431711 18kcourse id-101847 18content jid s006022,18 p Courses-Blackboa..Datal Learnn9a. 0 Youtube NCCome Map e The Follo-ing Infor- O NYC Apartments l QUESTION 18 The frst step in accounting for an asset deposal is to calculate the gain or loss en disposal True False QUESTION 19 Crestfield loaces office space for $7,000 per month.On January 3, the company incurs $12.000 to improve the leased office space. These improvemerts are expected to yield benefits for 10 years Crestield has 4 years remaining on its lease. What journal entry would be needed to record the expense for the first year related to the improvements? o Debit Amortication Expense $1,200, credre Accumulated Amortization $1,200 O Debit Depietion Expense $3.000, credt Accumulated Deplotion $3000 o Debit Depreciation Expense 31,200 credt Accumulated Deprecialion $1,200 O Debit Amorization Expense $3,000, credit Accumulated Amortization $3.000 QUESTION 20 Beckman Enterprises purchased a depreciable asset on October 1, Year 1 at a cost of $100,000. The asset is expected to have a salvage vaue of $20.000 atthe end of es tv-year usetu lfeme asset B depiecated on the outo-deonrg-balance metod he assers DOok vais" on December 31, %ar 2 vil be $36.000 $42 000 554 000 516 000 90,000 Click Saive and Submit to save and sbit. Click Save All es to save all a rch E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started