Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me out here, I don't even know where to start. Will rate immediately. Thank you! Project guidelines In this project, you will form

Please help me out here, I don't even know where to start. Will rate immediately. Thank you!

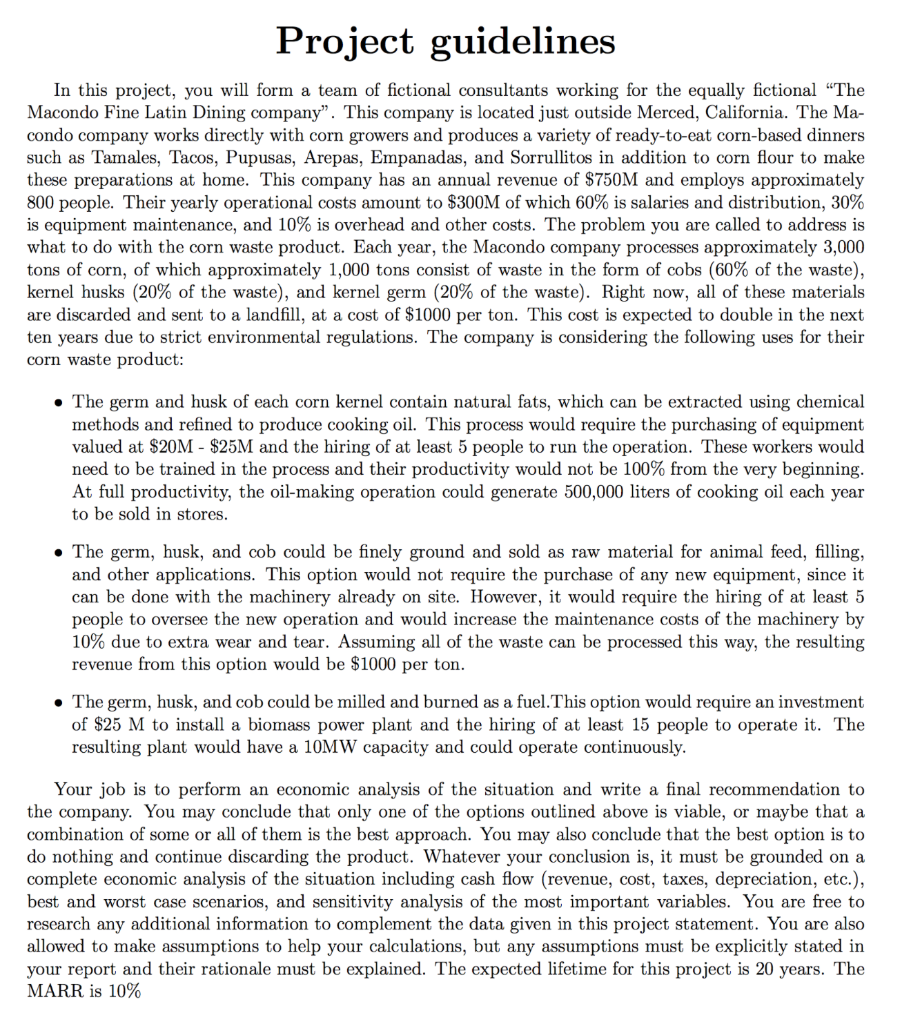

Project guidelines In this project, you will form a team of fictional consultants working for the equally fictional "The Macondo Fine Latin Dining company". This company is located just outside Merced, California. The Ma- condo company works directly with corn growers and produces a variety of ready-to-eat corn-based dinners such as Tamales, Tacos, Pupusas, Arepas, Empanadas, and Sorrullitos in addition to corn flour to make these preparations at home. This company has an annual revenue of $750M and employs approximately 800 people. Their yearly operational costs amount to $300M of which 60% is salaries and distribution, 30% is equipment maintenance, and 10% is overhead and other costs. The problem you are called to address is what to do with the corn waste product. Each year, the Macondo company processes approximately 3,000 tons of corn, of which approximately 1,000 tons consist of waste in the form of cobs (60% of the waste), kernel husks (20% of the waste), and kernel germ (20% of the waste). Right now, all of these materials are discarded and sent to a landfill, at a cost of $1000 per ton. This cost is expected to double in the next ten years due to strict environmental regulations. The company is considering the following uses for their corn waste product: The germ and husk of each corn kernel contain natural fats, which can be extracted using chemical methods and refined to produce cooking oil. This process would require the purchasing of equipment valued at $20M - $25M and the hiring of at least 5 people to run the operation. These workers would need to be trained in the process and their productivity would not be 100% from the very beginning. At full productivity, the oil-making operation could generate 500,000 liters of cooking oil each year to be sold in stores. The germ, husk, and cob could be finely ground and sold as raw material for animal feed, filling, and other applications. This option would not require the purchase of any new equipment, since it can be done with the machinery already on site. However, it would require the hiring of at least 5 people to oversee the new operation and would increase the maintenance costs of the machinery by 10% due to extra wear and tear. Assuming all of the waste can be processed this way, the resulting revenue from this option would be $1000 per ton. The germ, husk, and cob could be milled and burned as a fuel. This option would require an investment of $25 M to install a biomass power plant and the hiring of at least 15 people to operate it. The resulting plant would have a 10MW capacity and could operate continuously. Your job is to perform an economic analysis of the situation and write a final recommendation to the company. You may conclude that only one of the options outlined above is viable, or maybe that a combination of some or all of them is the best approach. You may also conclude that the best option is to do nothing and continue discarding the product. Whatever your conclusion is, it must be grounded on a complete economic analysis of the situation including cash flow (revenue, cost, taxes, depreciation, etc.), best and worst case scenarios, and sensitivity analysis of the most important variables. You are free to research any additional information to complement the data given in this project statement. You are also allowed to make assumptions to help your calculations, but any assumptions must be explicitly stated in your report and their rationale must be explained. The expected lifetime for this project is 20 years. The MARR is 10% Project guidelines In this project, you will form a team of fictional consultants working for the equally fictional "The Macondo Fine Latin Dining company". This company is located just outside Merced, California. The Ma- condo company works directly with corn growers and produces a variety of ready-to-eat corn-based dinners such as Tamales, Tacos, Pupusas, Arepas, Empanadas, and Sorrullitos in addition to corn flour to make these preparations at home. This company has an annual revenue of $750M and employs approximately 800 people. Their yearly operational costs amount to $300M of which 60% is salaries and distribution, 30% is equipment maintenance, and 10% is overhead and other costs. The problem you are called to address is what to do with the corn waste product. Each year, the Macondo company processes approximately 3,000 tons of corn, of which approximately 1,000 tons consist of waste in the form of cobs (60% of the waste), kernel husks (20% of the waste), and kernel germ (20% of the waste). Right now, all of these materials are discarded and sent to a landfill, at a cost of $1000 per ton. This cost is expected to double in the next ten years due to strict environmental regulations. The company is considering the following uses for their corn waste product: The germ and husk of each corn kernel contain natural fats, which can be extracted using chemical methods and refined to produce cooking oil. This process would require the purchasing of equipment valued at $20M - $25M and the hiring of at least 5 people to run the operation. These workers would need to be trained in the process and their productivity would not be 100% from the very beginning. At full productivity, the oil-making operation could generate 500,000 liters of cooking oil each year to be sold in stores. The germ, husk, and cob could be finely ground and sold as raw material for animal feed, filling, and other applications. This option would not require the purchase of any new equipment, since it can be done with the machinery already on site. However, it would require the hiring of at least 5 people to oversee the new operation and would increase the maintenance costs of the machinery by 10% due to extra wear and tear. Assuming all of the waste can be processed this way, the resulting revenue from this option would be $1000 per ton. The germ, husk, and cob could be milled and burned as a fuel. This option would require an investment of $25 M to install a biomass power plant and the hiring of at least 15 people to operate it. The resulting plant would have a 10MW capacity and could operate continuously. Your job is to perform an economic analysis of the situation and write a final recommendation to the company. You may conclude that only one of the options outlined above is viable, or maybe that a combination of some or all of them is the best approach. You may also conclude that the best option is to do nothing and continue discarding the product. Whatever your conclusion is, it must be grounded on a complete economic analysis of the situation including cash flow (revenue, cost, taxes, depreciation, etc.), best and worst case scenarios, and sensitivity analysis of the most important variables. You are free to research any additional information to complement the data given in this project statement. You are also allowed to make assumptions to help your calculations, but any assumptions must be explicitly stated in your report and their rationale must be explained. The expected lifetime for this project is 20 years. The MARR is 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started