Please help me out in this question, the answers 200 and 2100 are both wrong. Please explain how to get the answers

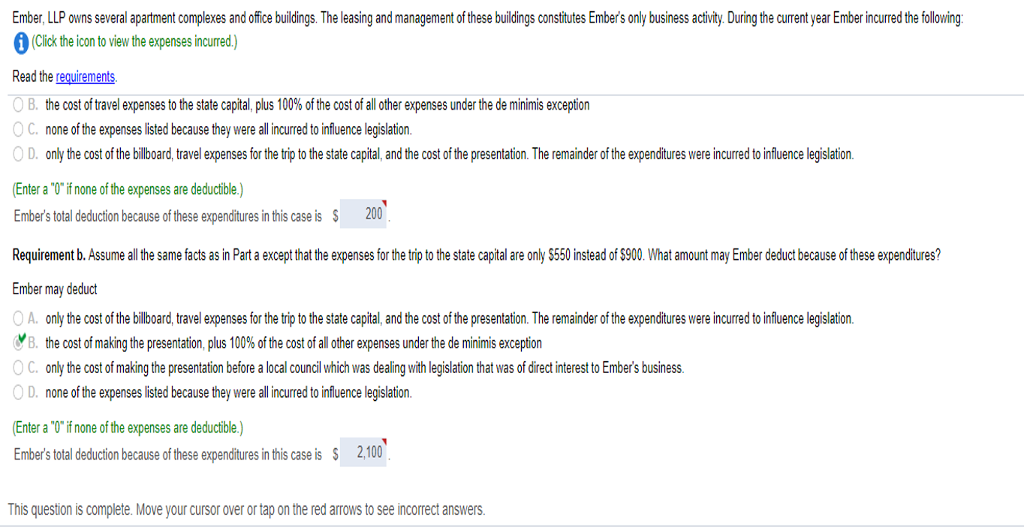

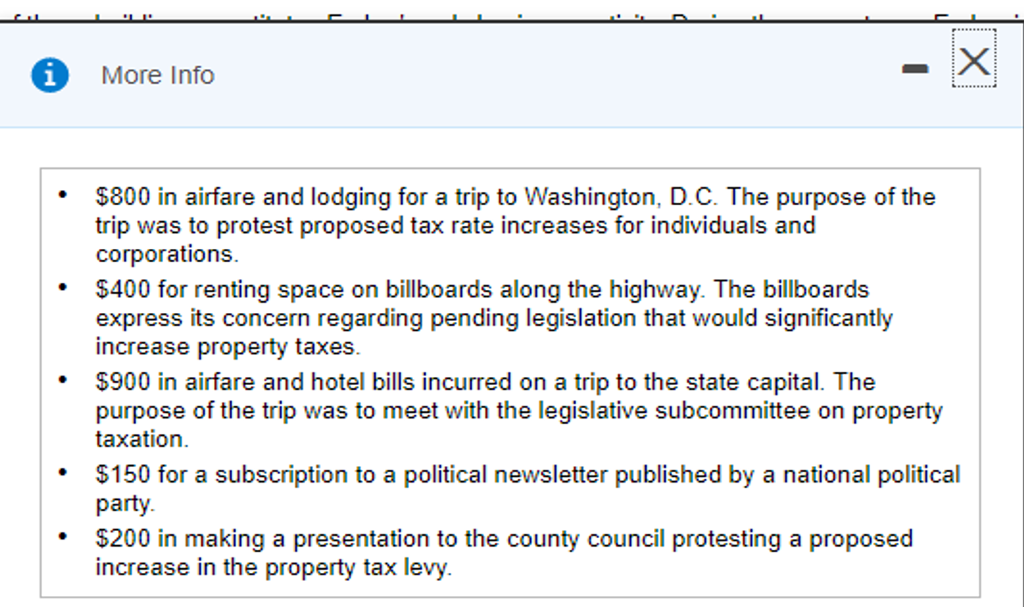

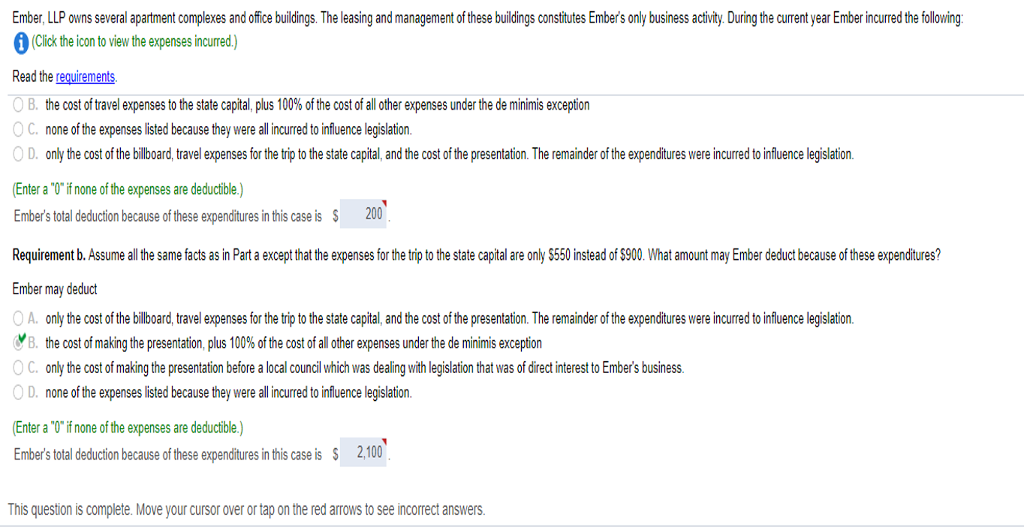

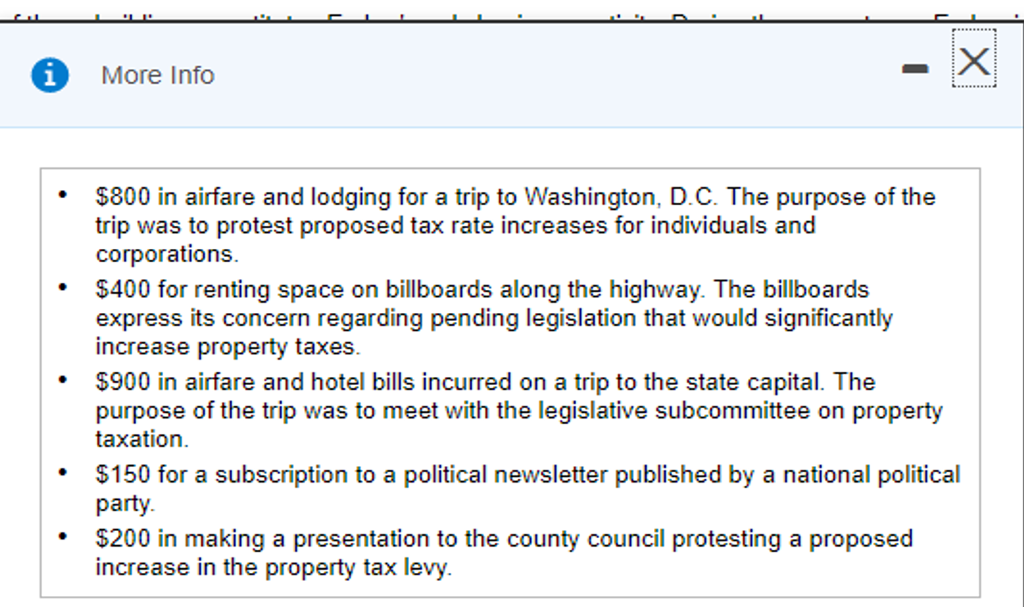

Ember, LLP owns several apartment complexes and office buildings. The leasing and management of these buildings constitutes Ember's only business activity, During the current year Ember incurred the following Clckthe icon to view the expenses incurred.) Read the requirements O B, the cost of travel expenses to the state capital, plus 100% of the cost of all other expenses under the de minimis exception C. none of the expenses listed because they were all incurred to influence legislation OD. only the cost of the billboard, travel expenses for the trip to the state capital, and the cost of the presentation. The remainder of the expenditures were incurred to influence legislation Enter a "0" if none of the expenses are deductible) Ember's total deduction because of these expenditures in this case is 200 Requirement b. Assume all he same facts as in Part a except that the expenses for the trip to the state capital are only $550 instead of $900. What amount may Ember deduct because of these expenditures? Ember may deduct OA. only the cost of the billboard, travel expenses for the trip to the state capital, and the cost of the presentation. The remainder of the expenditures were incurred to influence legislation. B, the cost of making the presentation, plus 100% of the cost of all other expenses under the de minimis exception C. only the cost of making the presentation before a local council which was dealing with legislation that was of direct interest to Ember's business O D. none of the expenses listed because they were all incurred to influence legislation. Enter a "0"if none of the expenses are deductible) Ember's total deduction because of these expenditures in this case is 2,100 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers Ember, LLP owns several apartment complexes and office buildings. The leasing and management of these buildings constitutes Ember's only business activity, During the current year Ember incurred the following Clckthe icon to view the expenses incurred.) Read the requirements O B, the cost of travel expenses to the state capital, plus 100% of the cost of all other expenses under the de minimis exception C. none of the expenses listed because they were all incurred to influence legislation OD. only the cost of the billboard, travel expenses for the trip to the state capital, and the cost of the presentation. The remainder of the expenditures were incurred to influence legislation Enter a "0" if none of the expenses are deductible) Ember's total deduction because of these expenditures in this case is 200 Requirement b. Assume all he same facts as in Part a except that the expenses for the trip to the state capital are only $550 instead of $900. What amount may Ember deduct because of these expenditures? Ember may deduct OA. only the cost of the billboard, travel expenses for the trip to the state capital, and the cost of the presentation. The remainder of the expenditures were incurred to influence legislation. B, the cost of making the presentation, plus 100% of the cost of all other expenses under the de minimis exception C. only the cost of making the presentation before a local council which was dealing with legislation that was of direct interest to Ember's business O D. none of the expenses listed because they were all incurred to influence legislation. Enter a "0"if none of the expenses are deductible) Ember's total deduction because of these expenditures in this case is 2,100 This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers