PLEASE HELP ME OUT

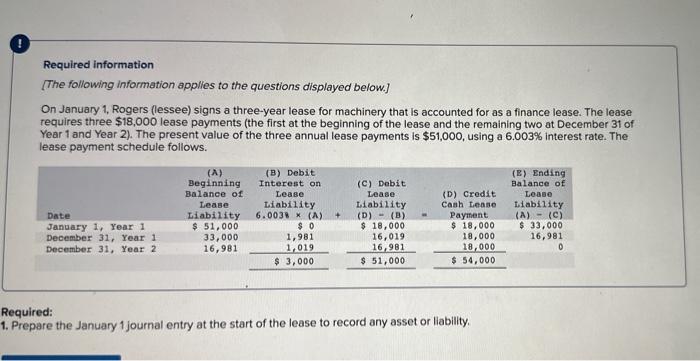

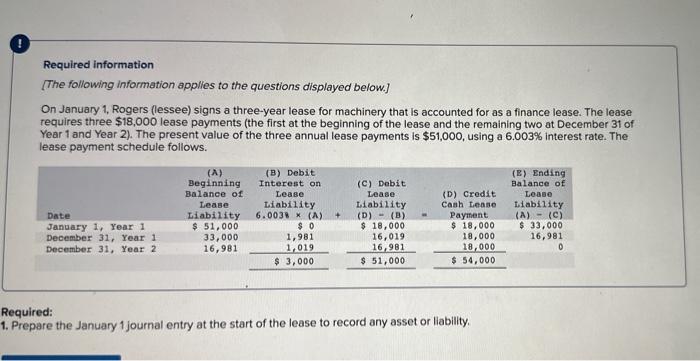

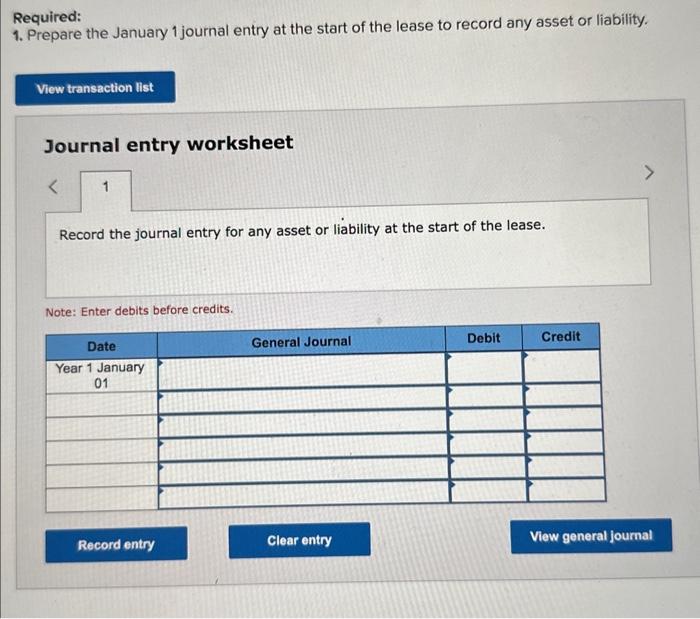

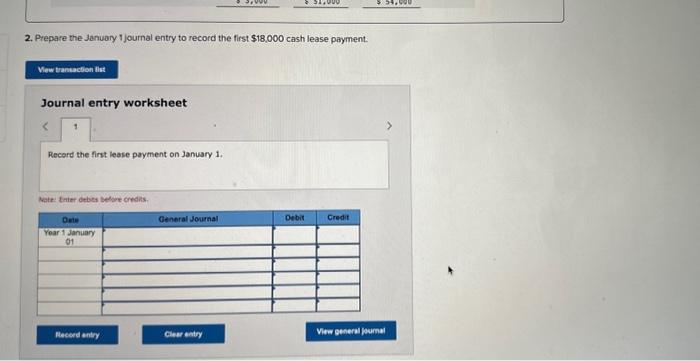

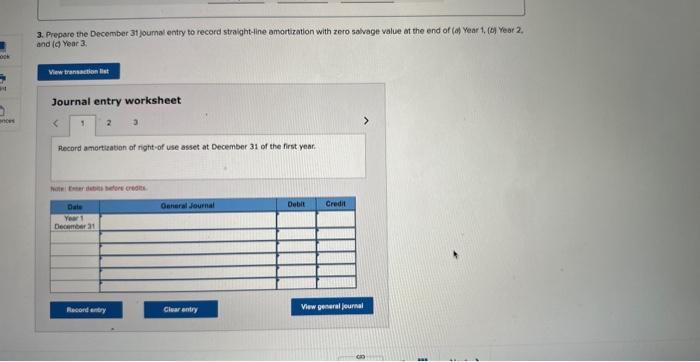

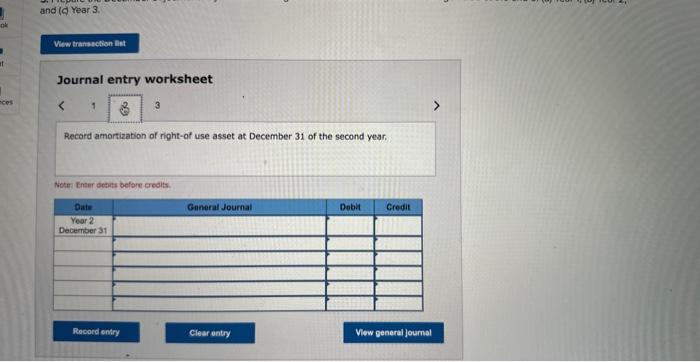

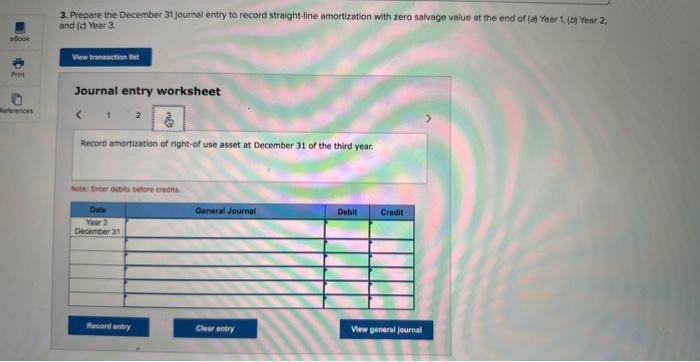

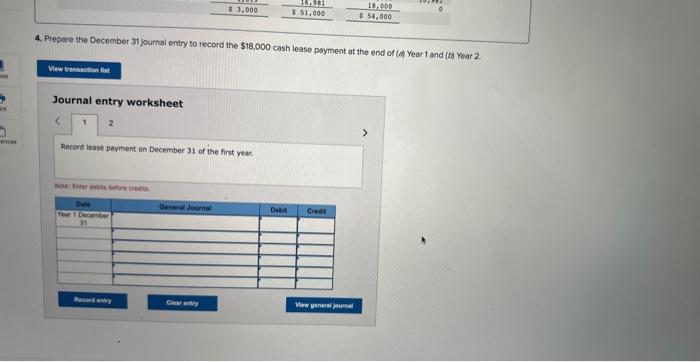

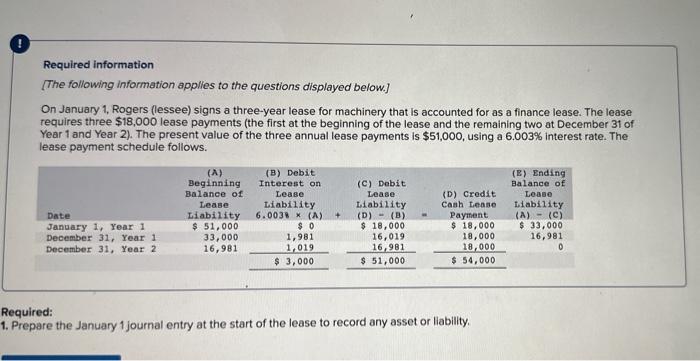

Required information [The following information applles to the questions displayed below.] On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a finance lease. The lease requires three $18,000 lease payments (the first at the beginning of the lease and the remaining two at December 31 of Year 1 and Year 2). The present value of the three annual lease payments is $51,000, using a 6.003% interest rate. The lease payment schedule follows. Required: 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability. Required: 1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability. Journal entry worksheet Record the journal entry for any asset or liability at the start of the lease. Note: Enter debits before credits. 2. Prepare the January 1 journal entry to record the first $18,000 cash lease payment. Journal entry worksheet Record the first lease payment on January 1 . Nate: tuiner drbes belye oredas. 3. Prepore the December 3t)oumal entry to record stralght-ine amortization with zero salvage value at the end of (ad) Year 1, (b) Year 2, and (c) Year 3 . Journal entry worksheet Record amortuation of night-of use asset at December 31 of the first year. hule foegr itshes butere cregite. Journal entry worksheet 3 Record amortization of right-of use asset at December 31 of the second year. Noter Enter detits befare eredits. 3. Prepare the December 31 joumal entry to record straight-4ine amortization with zero salvage value at the end of (a) Year 1, fof Yoar 2 . and (c) Your 3 . Journal entry worksheet Record amortization of right-of use asset at December 31 of the third year. feyker frexr decots tafore cradas. 4. Prepare the December 31 journal entry to record the $18,000 cash lease payment at the end of \{od Year 1 and (b) Year 2 . Journal entry worksheet Record lease payment on December 31 of the first year, 4. Prepare the December 31 journal entry to record the $18,000 cash lease peyment at the end of (a) Year 1 and (b) Year 2 . Journal entry worksheet Resard lease payment an December 31 of the second year. Notes Finter debilta before credits