please help me out

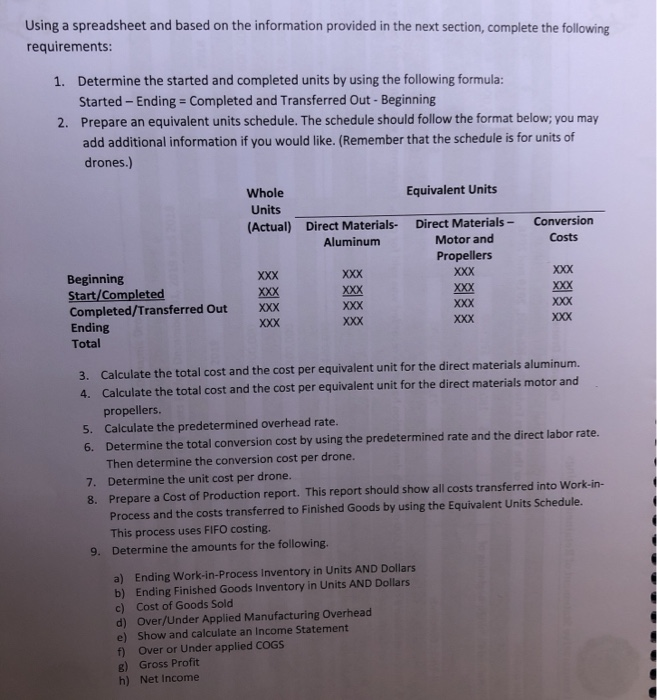

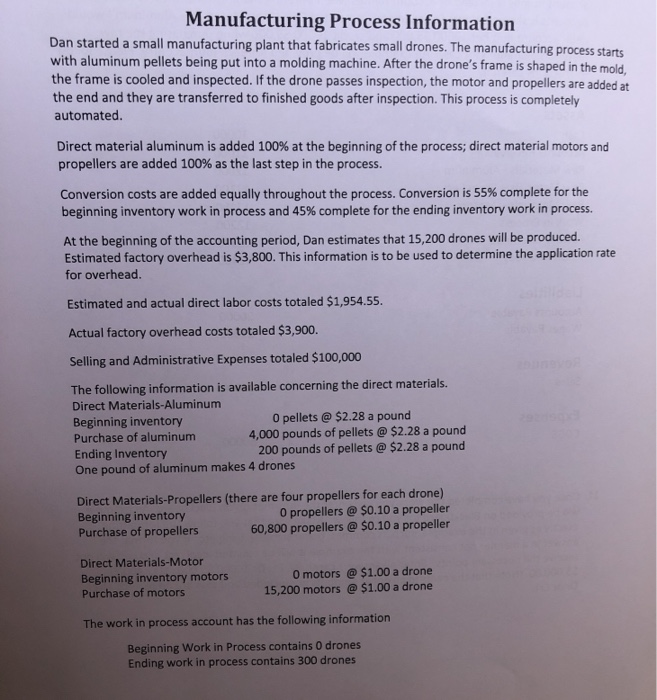

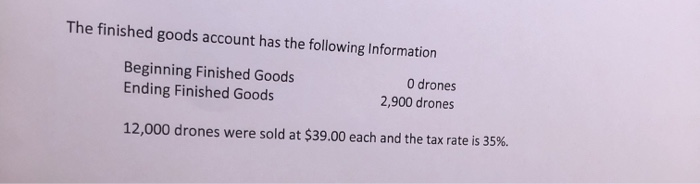

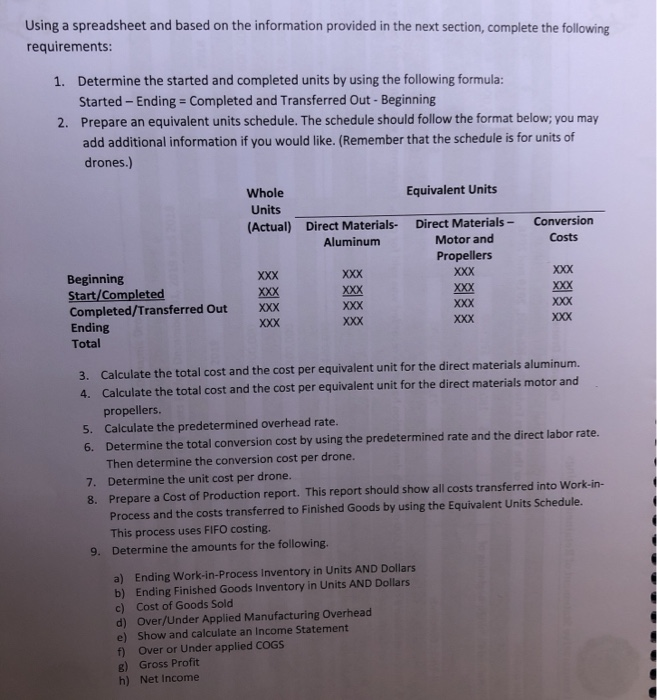

Using a spreadsheet and based on the information provided in the next section, complete the following requirements: 1. Determine the started and completed units by using the following formula: Started - Ending - Completed and Transferred Out - Beginning 2. Prepare an equivalent units schedule. The schedule should follow the format below; you may add additional information if you would like. (Remember that the schedule is for units of drones.) Equivalent Units Whole Units (Actual) Direct Materials- Aluminum Conversion Costs Direct Materials - Motor and Propellers XXX XXX XXX Beginning Start/Completed Completed/Transferred Out Ending Total XXX XXX XXX XXX XXX XXX XXX xxx xoxox XXX 3. Calculate the total cost and the cost per equivalent unit for the direct materials aluminum. 4. Calculate the total cost and the cost per equivalent unit for the direct materials motor and propellers. 5. Calculate the predetermined overhead rate. 6. Determine the total conversion cost by using the predetermined rate and the direct labor rate. Then determine the conversion cost per drone. 7. Determine the unit cost per drone. 8. Prepare a cost of Production report. This report should show all costs transferred into Work-in- Process and the costs transferred to Finished Goods by using the Equivalent Units Schedule. This process uses FIFO costing. 9. Determine the amounts for the following. a) Ending Work-in-Process Inventory in Units AND Dollars b) Ending Finished Goods Inventory in Units AND Dollars c) Cost of Goods Sold d) Over/Under Applied Manufacturing Overhead e) Show and calculate an Income Statement fOver or Under applied COGS B) Gross Profit h) Net Income Manufacturing Process Information Dan started a small manufacturing plant that fabricates small drones. The manufacturing process starts with aluminum pellets being put into a molding machine. After the drone's frame is shaped in the mold. the frame is cooled and inspected. If the drone passes inspection, the motor and propellers are added at the end and they are transferred to finished goods after inspection. This process is completely automated. Direct material aluminum is added 100% at the beginning of the process; direct material motors and propellers are added 100% as the last step in the process. Conversion costs are added equally throughout the process. Conversion is 55% complete for the beginning inventory work in process and 45% complete for the ending inventory work in process. At the beginning of the accounting period, Dan estimates that 15,200 drones will be produced. Estimated factory overhead is $3,800. This information is to be used to determine the application rate for overhead. Estimated and actual direct labor costs totaled $1,954.55. Actual factory overhead costs totaled $3,900. Selling and Administrative Expenses totaled $100,000 The following information is available concerning the direct materials. Direct Materials-Aluminum Beginning inventory O pellets @ $2.28 a pound Purchase of aluminum 4,000 pounds of pellets @ $2.28 a pound Ending Inventory 200 pounds of pellets @ $2.28 a pound One pound of aluminum makes 4 drones Direct Materials-Propellers (there are four propellers for each drone) Beginning inventory O propellers @ $0.10 a propeller Purchase of propellers 60,800 propellers @ $0.10 a propeller Direct Materials-Motor Beginning inventory motors Purchase of motors O motors @ $1.00 a drone 15,200 motors @ $1.00 a drone The work in process account has the following information Beginning Work in Process contains 0 drones Ending work in process contains 300 drones The finished goods account has the following Information Beginning Finished Goods Ending Finished Goods O drones 2,900 drones 12,000 drones were sold at $39.00 each and the tax rate is 35%