Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me out with a short written explanation 1. Which of the following statements regarding installment sales is correct? a. All payments received by

please help me out with a short written explanation

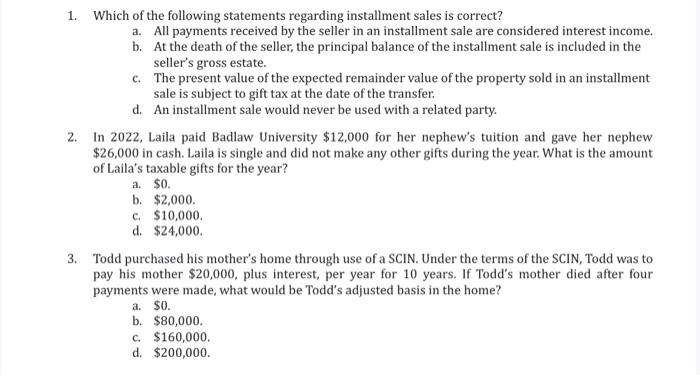

1. Which of the following statements regarding installment sales is correct? a. All payments received by the seller in an installment sale are considered interest income, b. At the death of the seller, the principal balance of the installment sale is included in the seller's gross estate. c. The present value of the expected remainder value of the property sold in an installment sale is subject to gift tax at the date of the transfer. d. An installment sale would never be used with a related party. 2. In 2022, Laila paid Badlaw University $12,000 for her nephew's tuition and gave her nephew $26,000 in cash. Laila is single and did not make any other gifts during the year. What is the amount of Laila's taxable gifts for the year? a. $0. b. $2,000. c. $10,000. d. $24,000. 3. Todd purchased his mother's home through use of a SCIN. Under the terms of the SCIN, Todd was to pay his mother $20,000, plus interest, per year for 10 years. If Todd's mother died after four payments were made, what would be Todd's adjusted basis in the home? a. $0. b. $80,000. c. $160,000. d. $200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started