Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me out with the first three questions Following is a table for the present value of s1 at compound interest: Year 6% 10%

please help me out with the first three questions

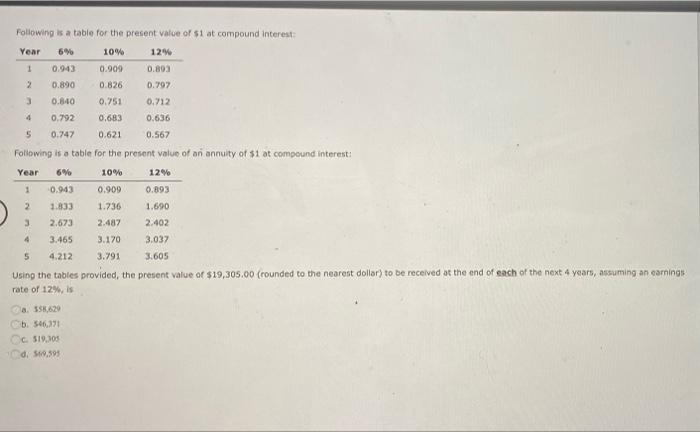

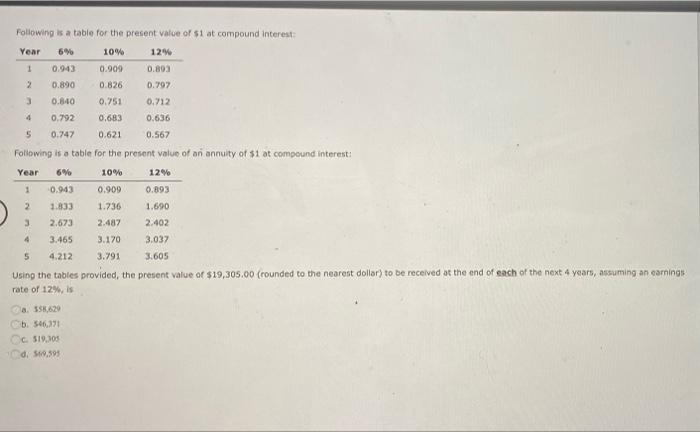

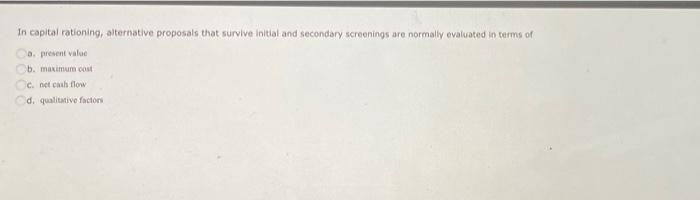

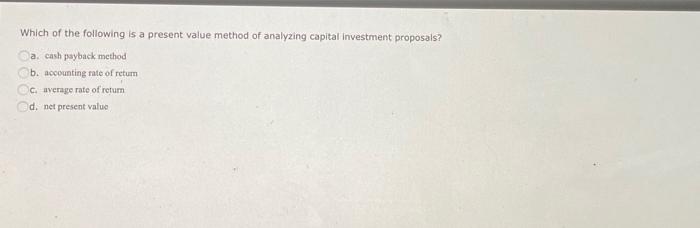

Following is a table for the present value of s1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0,683 0.636 5 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables provided, the present value of $19,305.00 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%, is 558,629 b. 546.31 CC519.30 d. 560,395 In capital rationing, alternative proposals that survive initial and secondary screenings are normally evaluated in terms of a present Value b. maximum cost Cnet cash flow de qualitative factors Which of the following is a present value method of analyzing capital investment proposals? a. cash payback method b. accounting rate of return c. average rate of return d. net present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started