Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me out with the last three questions Blaser Corporation had $1,005,000 in invested assets, sales of $1,247,000, operating income amounting to $223,000, and

please help me out with the last three questions

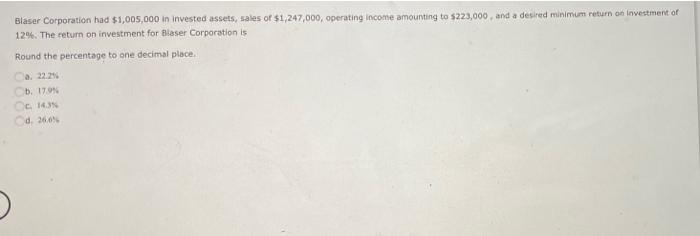

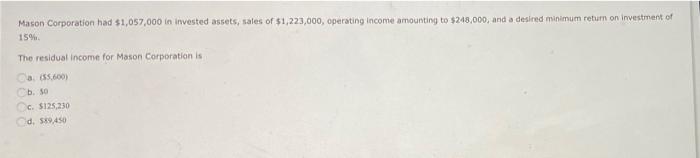

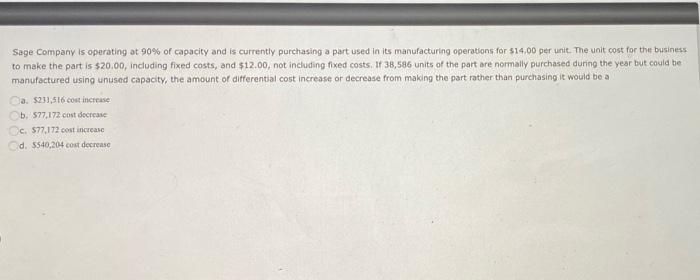

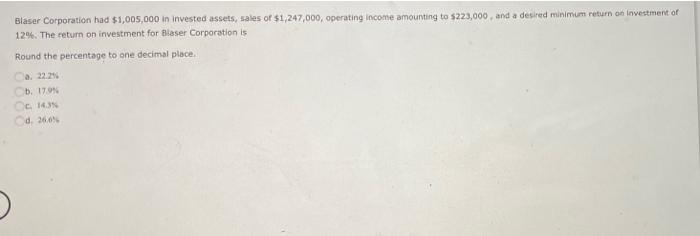

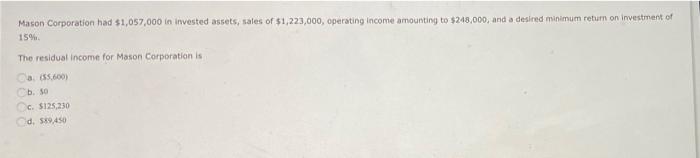

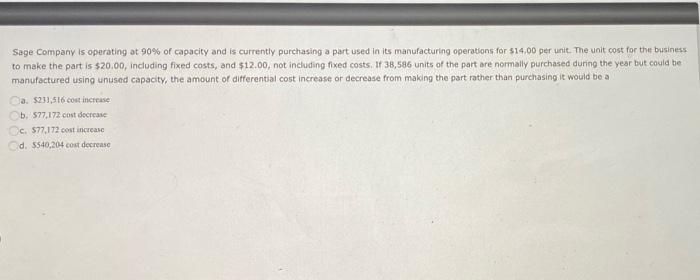

Blaser Corporation had $1,005,000 in invested assets, sales of $1,247,000, operating income amounting to $223,000, and a desired minimum return on investment of 12%. The return on investment for Blaser Corporation is Round the percentage to one decimal place. b. 17.9% Cc. 14.3% d. 26.6% D Mason Corporation had $1,057,000 in invested assets, sales of $1,223,000, operating income amounting to $248,000, and a desired minimum return on investment of 15%. The residual income for Mason Corporation is Ca(55,600) b. 50 Oc. $125,230 Cd. $89,450 Sage Company is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $14,00 per unit. The unit cost for the business to make the part is $20.00, including fixed costs, and $12.00, not including fixed costs. If 38,586 units of the part are normally purchased during the year but could be manufactured using unused capacity, the amount of differential cost increase or decrease from making the part rather than purchasing it would be a a. $231,516 cost increase b. $77,172 cost decrease Oc. $77,172 cost increase Od. $540,204 cost decrease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started