Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me out with this homework i would appreciate it. And i will gave a good review. Thank you so much. the Stock that

please help me out with this homework i would appreciate it. And i will gave a good review. Thank you so much.

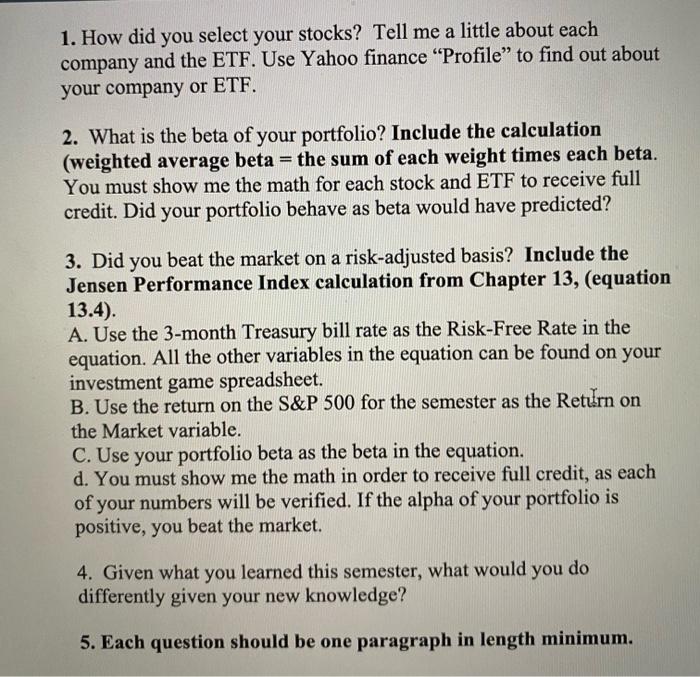

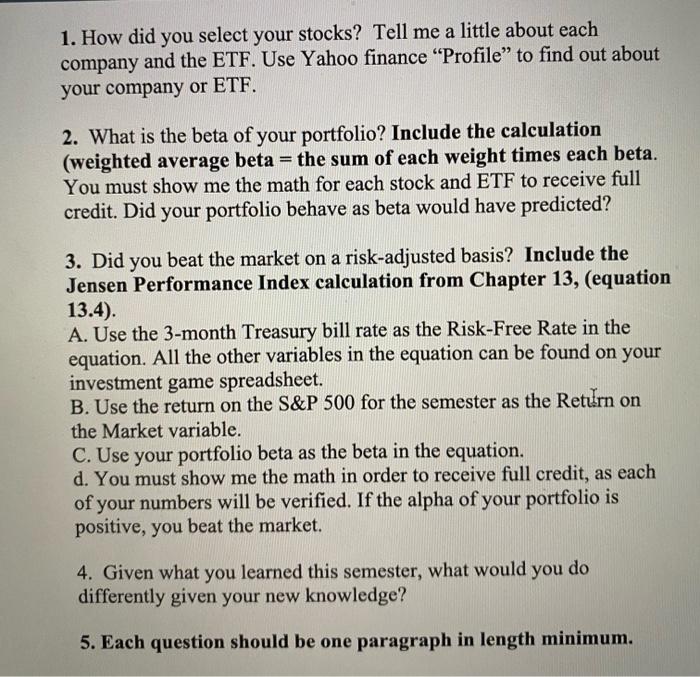

1. How did you select your stocks? Tell me a little about each company and the ETF. Use Yahoo finance "Profile" to find out about your company or ETF. 2. What is the beta of your portfolio? Include the calculation (weighted average beta = the sum of each weight times each beta. You must show me the math for each stock and ETF to receive full credit. Did your portfolio behave as beta would have predicted? 3. Did you beat the market on a risk-adjusted basis? Include the Jensen Performance Index calculation from Chapter 13, (equation 13.4). A. Use the 3-month Treasury bill rate as the Risk-Free Rate in the equation. All the other variables in the equation can be found on your investment game spreadsheet. B. Use the return on the S\&P 500 for the semester as the Retlirn on the Market variable. C. Use your portfolio beta as the beta in the equation. d. You must show me the math in order to receive full credit, as each of your numbers will be verified. If the alpha of your portfolio is positive, you beat the market. 4. Given what you learned this semester, what would you do differently given your new knowledge? 5. Each question should be one paragraph in length minimum. 1. How did you select your stocks? Tell me a little about each company and the ETF. Use Yahoo finance "Profile" to find out about your company or ETF. 2. What is the beta of your portfolio? Include the calculation (weighted average beta = the sum of each weight times each beta. You must show me the math for each stock and ETF to receive full credit. Did your portfolio behave as beta would have predicted? 3. Did you beat the market on a risk-adjusted basis? Include the Jensen Performance Index calculation from Chapter 13, (equation 13.4). A. Use the 3-month Treasury bill rate as the Risk-Free Rate in the equation. All the other variables in the equation can be found on your investment game spreadsheet. B. Use the return on the S\&P 500 for the semester as the Retlirn on the Market variable. C. Use your portfolio beta as the beta in the equation. d. You must show me the math in order to receive full credit, as each of your numbers will be verified. If the alpha of your portfolio is positive, you beat the market. 4. Given what you learned this semester, what would you do differently given your new knowledge? 5. Each question should be one paragraph in length minimum the Stock that I chose was

Amazon

Microsoft

Apple

Tesla

Visa

SPDR S&P 500 ETF

S&P 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started