Answered step by step

Verified Expert Solution

Question

1 Approved Answer

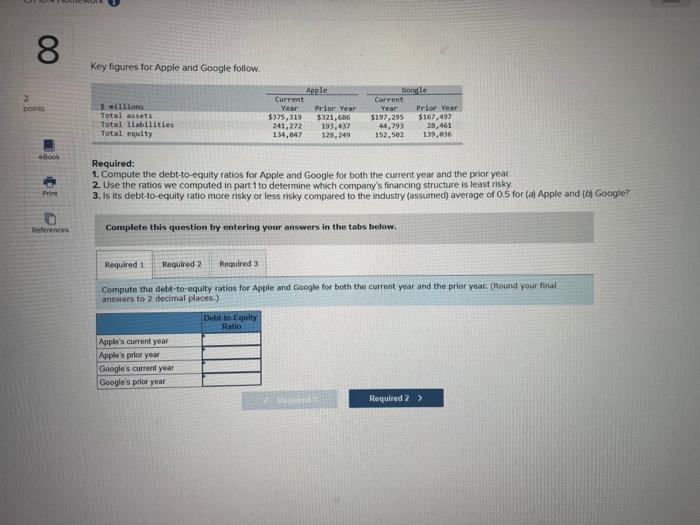

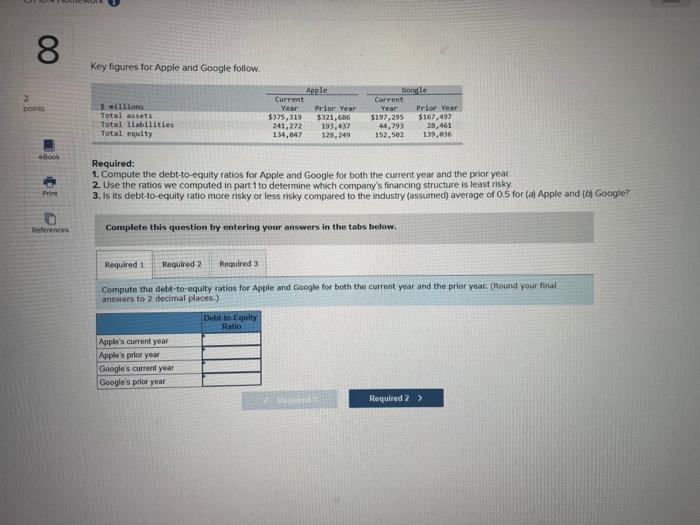

Please help me out with this one! Key figures for Apple and Google follow. Required: 1. Compute the debt-to-equity ratios for Apple and Google for

Please help me out with this one!

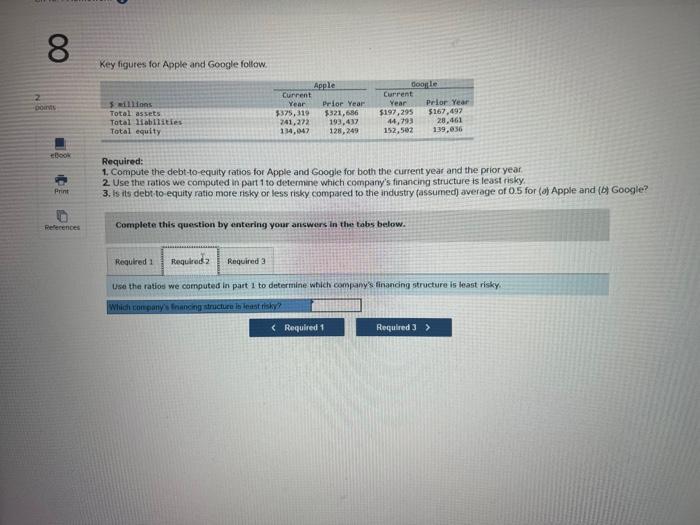

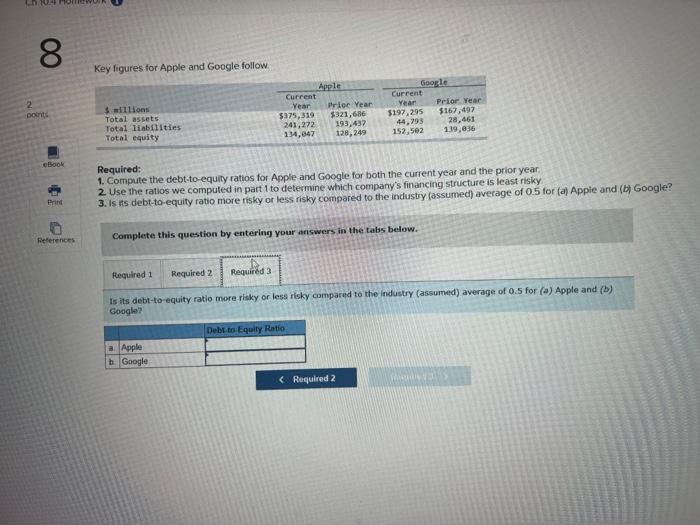

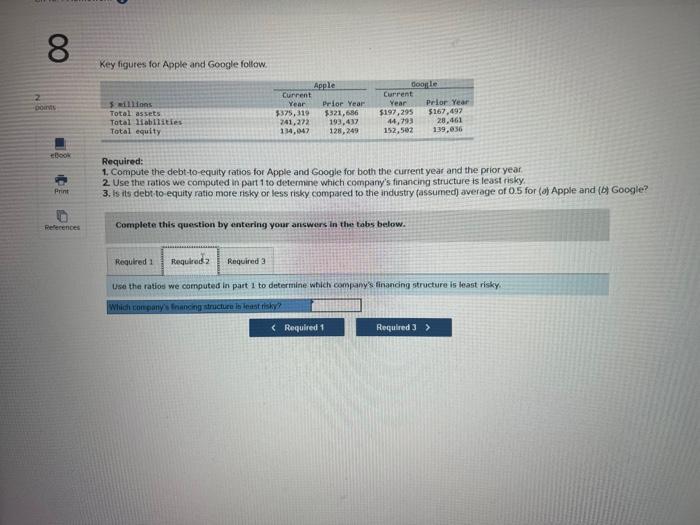

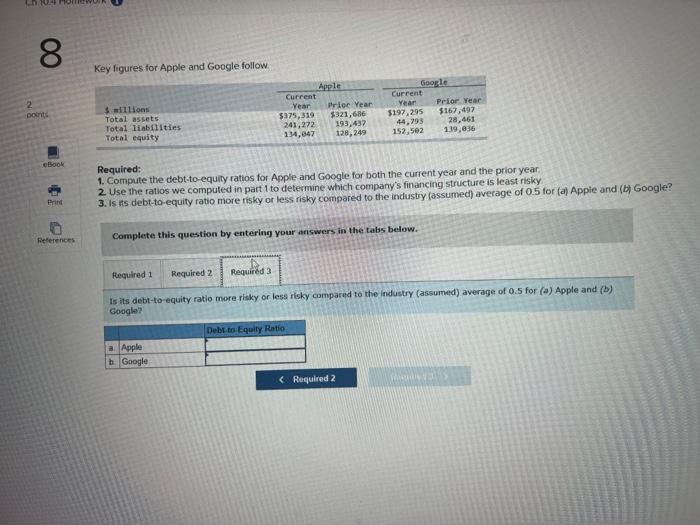

Key figures for Apple and Google follow. Required: 1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year 2. Use the ratios we computed in part 1 to determine which company's financing structure is least risky. 3. Is its debt-to-equity ratio more risky or less risky compared to the industry (assumed) average of 0.5 for (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Compute the deb-to-equity ratios for Apple and Googhe for both the current year and the prior year. (Round your final answers to 2 decimal places:) Key figures for Apple and Google follow. Required: Required: 1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year: 2 Use the ratios we computed in part 1 to determine which company's financing structure is least risky 3. Is its debt-to-equity ratio more risky or less risky compared to the industry (assumed) average of 0.5 for (a) Appie and (b) Google? Complete this question by entering your answers in the tabs below. Is its debt-to-equity ratio more risky or less risky compared to the industry (assumed) average of 0.5 for (a) Apple and (b) Gooale? Key figures for Apple and Google follow. Required: 1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year 2 Use the ratios we computed in part 1 to determine which company's financing structure is least risky. 3. Is its debt to equity ratio more risky or less risky compated to the industry (assumed) average of 0.5 for (a) Apple and (b) Google? Complete this question by entering your answers in the tabs below. Use the ratios we computed in part 1 to determine which company's finaniong structure is least risky

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started