Answered step by step

Verified Expert Solution

Question

1 Approved Answer

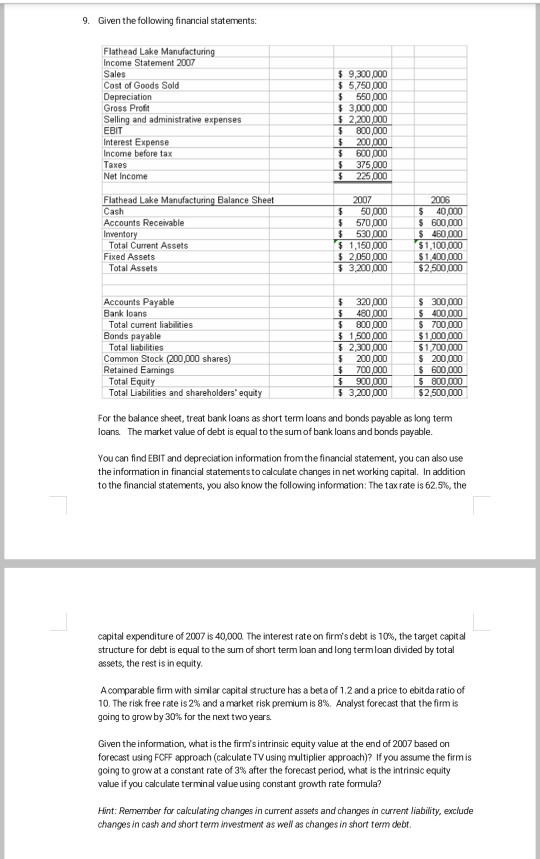

Please help me out with this ! thank you ! 9. Given the following financial statements: Flathead Lake Manufacturing Income Statement 2007 Sales Cost of

Please help me out with this ! thank you !

9. Given the following financial statements: Flathead Lake Manufacturing Income Statement 2007 Sales Cost of Goods Sold Depreciation Gross Proft Selling and administrative expenses EBIT interest Expense Income before tax 9,300,000 5,750000 550,000 3,000 000 800,000 600 ,000 Net Income Flathead Lake M Balance Sheet 2007 50 ash Accounts Receivable Irnventory Fixed Assets 570,000 600,000 $ 460,000 1,100,000 1,400 2 500 ,000 $530 1,150,000 Total Current Assets 3,200000 $ Total Assets Accounts Payable Bank loans 320,000 300,000 700,000 $1 700,000 400 Total current liabilities Bonds payable 5 800,000 1,500 5 2,300000 5 200,000 700 900 3,200000 Total liabilities Common Stock (200000 shares) Retained Eamings 200,000 $ 600 Total Equity 800 2,500,000 Total Liabilities and shareholders equity For the balance sheet, treat bank loans as short term loans and bonds payable as long term loans. The market value of debt is equal to the sum of bank loans and bonds payable. You can find EBIT and depreciat ion information fromthe financial statement, you can also use the information in financial statements to calculate changes in net working capital. In addition to the financial statements, you also know the following information: The tax rate is 62.5%, the capital expenditure of 2007 is 40,000 The interest rate on firm's debt is 10%, the target capital structure for debt is equal to the sum of short term loan and long termloan divided by total assets, the rest is in equity. Acomparable firm with similar capit al structure has a beta of 1.2 and a price to ebitda ratio of 10. The risk free rate is 2% and a market risk premium is 8%. Analyst forecast that the firm is going to grow by 30% for the next two y ears Given the information, what is the firm's intrinsic equity value at the end of 2007 based on forecast using FCFF approach (cakculate TV using multiplier approach)? If you assume the firm is going to grow at a constant rate of 3% after the forecast period, what is the intrinsic equity value if you calculate terminal value using constant growth rate formula? Hint: Remember for calculating changes in current assets and changes in current liability, exclude changes in cash and short term investment as well as changes in short term debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started