Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me please Problem# 1 (SSSS): You observe following three securities in the market. (1)Zero-coupon bond: Maturity = 5 years, Face value = $500,

please help me please

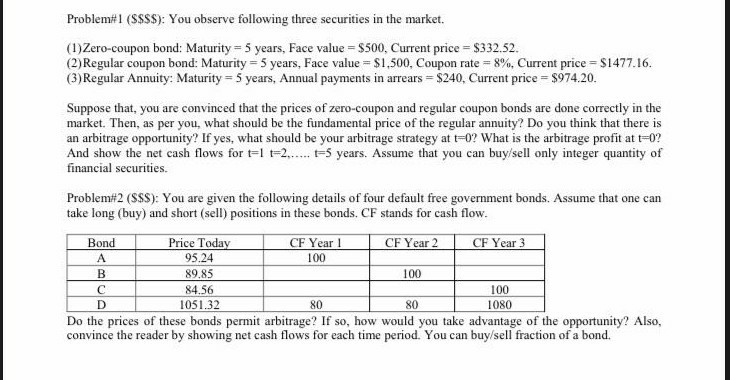

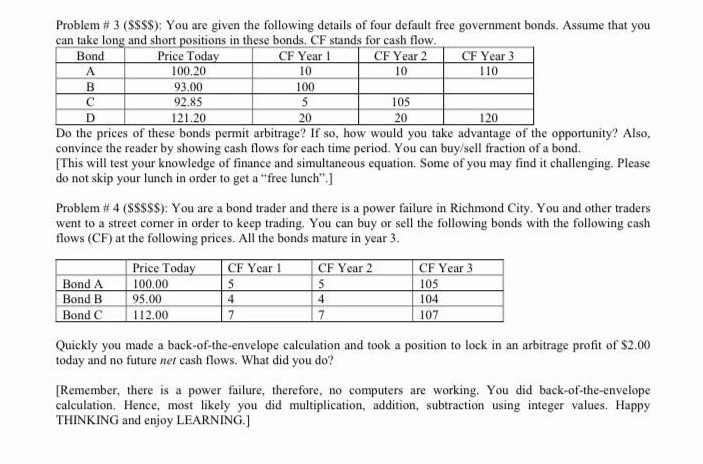

Problem# 1 (SSSS): You observe following three securities in the market. (1)Zero-coupon bond: Maturity = 5 years, Face value = $500, Current price = $332.52. (2) Regular coupon bond: Maturity = 5 years, Face value = $1,500, Coupon rate = 8%, Current price = $1477.16. (3) Regular Annuity: Maturity = 5 years, Annual payments in arrears = $240. Current price = $974.20. Suppose that, you are convinced that the prices of zero-coupon and regular coupon bonds are done correctly in the market. Then, as per you, what should be the fundamental price of the regular annuity? Do you think that there is an arbitrage opportunity? If yes, what should be your arbitrage strategy at t-0? What is the arbitrage profit at t-02 And show the net cash flows for t=l t=2...... t=5 years. Assume that you can buy sell only integer quantity of financial securities. Problem#2 (SSS): You are given the following details of four default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Bond Price Today CF Year 1 CF Year 2 CF Year 3 95.24 100 B 80 85 100 84.56 100 1051.32 80 1080 Do the prices of these bonds permit arbitrage? If so, how would you take advantage of the opportunity? Also, convince the reader by showing net cash flows for each time period. You can buy sell fraction of a bond. Problem # 3 (S$SS): You are given the following details of four default free government bonds. Assume that you can take long and short positions in these bonds. CF stands for cash flow. Bond P rice Today CF Year 1 CF Year 2 CF Year 3 100.20 10 10 110 B 93.00 100 92.85 105 DI 121.20 20120 Do the prices of these bonds permit arbitrage? If so, how would you take advantage of the opportunity? Also, convince the reader by showing cash flows for each time period. You can buy sell fraction of a bond. [This will test your knowledge of finance and simultaneous equation. Some of you may find it challenging, Please do not skip your lunch in order to get a "free lunch"] Problem #4 (SSSSS): You are a bond trader and there is a power failure in Richmond City. You and other traders went to a street corner in order to keep trading. You can buy or sell the following bonds with the following cash flows (CF) at the following prices. All the bonds mature in year 3. CF Year 1 CF Year 2 Bond A Bond B Bond C Price Today 100,00 95.00 112.00 CF Year 3 105 104 107 4 Quickly you made a back-of-the-envelope calculation and took a position to lock in an arbitrage profit of $2.00 today and no future net cash flows. What did you do? [Remember, there is a power failure, therefore, no computers are working. You did back-of-the-envelope calculation. Hence, most likely you did multiplication, addition, subtraction using integer values. Happy THINKING and enjoy LEARNING.] Problem# 1 (SSSS): You observe following three securities in the market. (1)Zero-coupon bond: Maturity = 5 years, Face value = $500, Current price = $332.52. (2) Regular coupon bond: Maturity = 5 years, Face value = $1,500, Coupon rate = 8%, Current price = $1477.16. (3) Regular Annuity: Maturity = 5 years, Annual payments in arrears = $240. Current price = $974.20. Suppose that, you are convinced that the prices of zero-coupon and regular coupon bonds are done correctly in the market. Then, as per you, what should be the fundamental price of the regular annuity? Do you think that there is an arbitrage opportunity? If yes, what should be your arbitrage strategy at t-0? What is the arbitrage profit at t-02 And show the net cash flows for t=l t=2...... t=5 years. Assume that you can buy sell only integer quantity of financial securities. Problem#2 (SSS): You are given the following details of four default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Bond Price Today CF Year 1 CF Year 2 CF Year 3 95.24 100 B 80 85 100 84.56 100 1051.32 80 1080 Do the prices of these bonds permit arbitrage? If so, how would you take advantage of the opportunity? Also, convince the reader by showing net cash flows for each time period. You can buy sell fraction of a bond. Problem # 3 (S$SS): You are given the following details of four default free government bonds. Assume that you can take long and short positions in these bonds. CF stands for cash flow. Bond P rice Today CF Year 1 CF Year 2 CF Year 3 100.20 10 10 110 B 93.00 100 92.85 105 DI 121.20 20120 Do the prices of these bonds permit arbitrage? If so, how would you take advantage of the opportunity? Also, convince the reader by showing cash flows for each time period. You can buy sell fraction of a bond. [This will test your knowledge of finance and simultaneous equation. Some of you may find it challenging, Please do not skip your lunch in order to get a "free lunch"] Problem #4 (SSSSS): You are a bond trader and there is a power failure in Richmond City. You and other traders went to a street corner in order to keep trading. You can buy or sell the following bonds with the following cash flows (CF) at the following prices. All the bonds mature in year 3. CF Year 1 CF Year 2 Bond A Bond B Bond C Price Today 100,00 95.00 112.00 CF Year 3 105 104 107 4 Quickly you made a back-of-the-envelope calculation and took a position to lock in an arbitrage profit of $2.00 today and no future net cash flows. What did you do? [Remember, there is a power failure, therefore, no computers are working. You did back-of-the-envelope calculation. Hence, most likely you did multiplication, addition, subtraction using integer values. Happy THINKING and enjoy LEARNING.]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started