Answered step by step

Verified Expert Solution

Question

1 Approved Answer

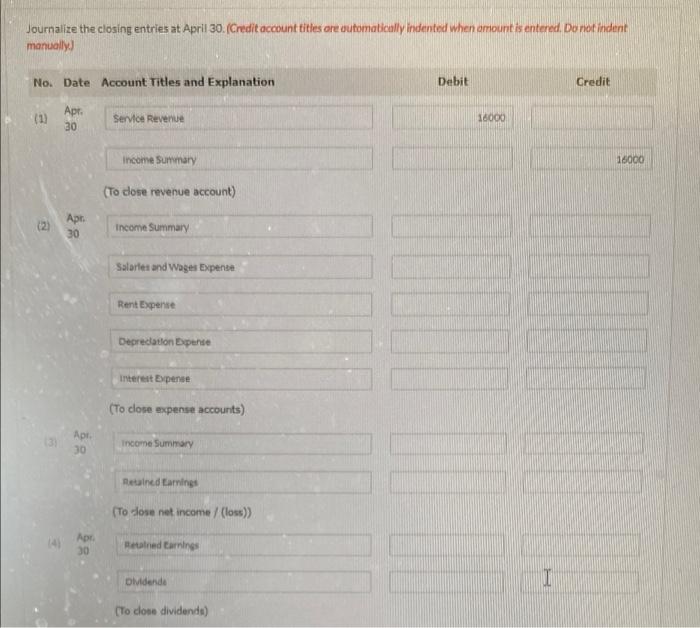

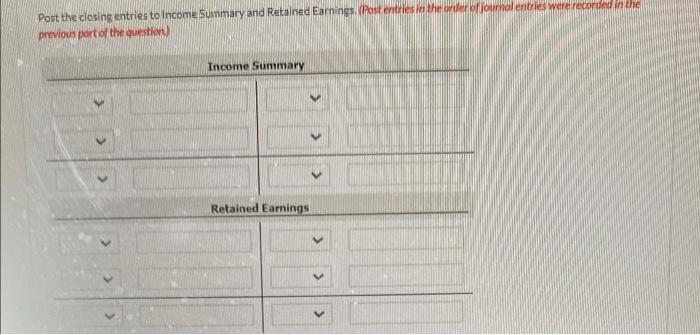

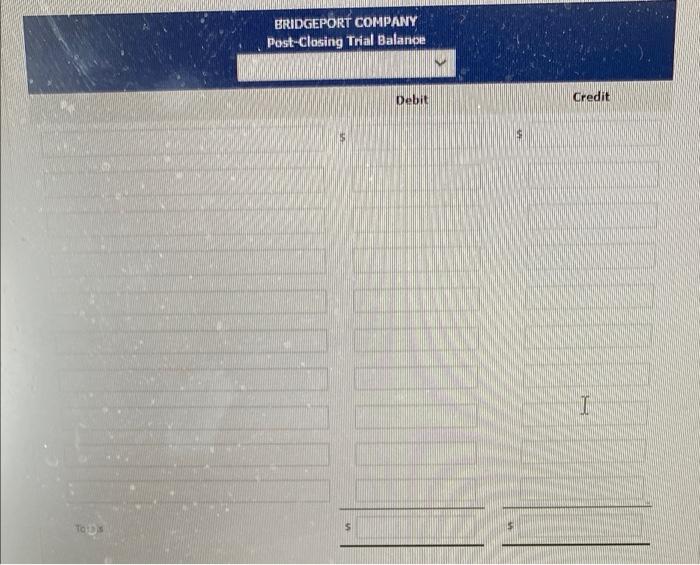

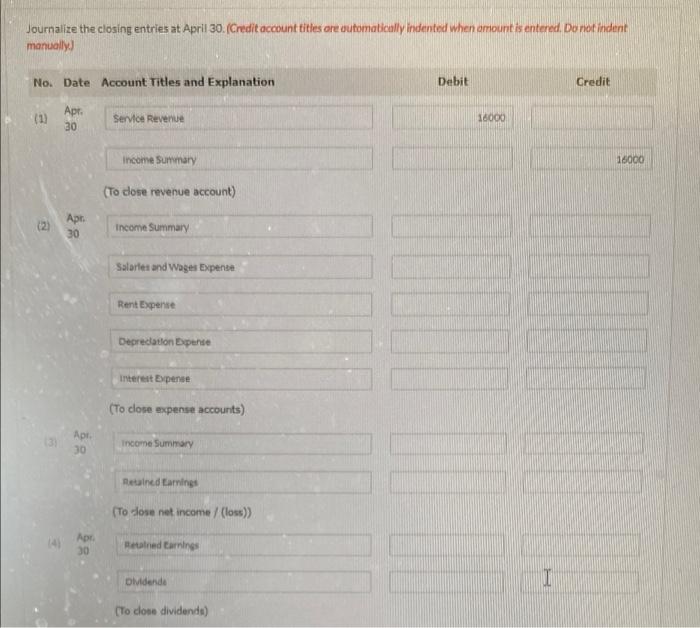

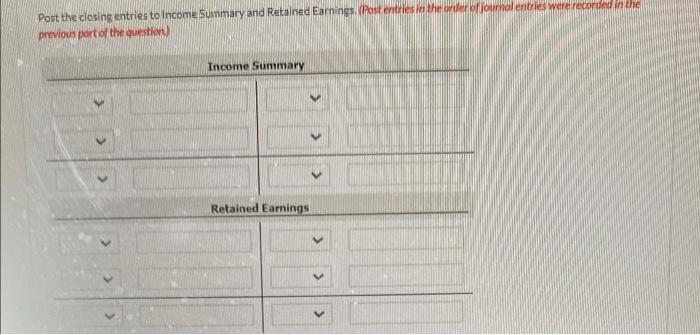

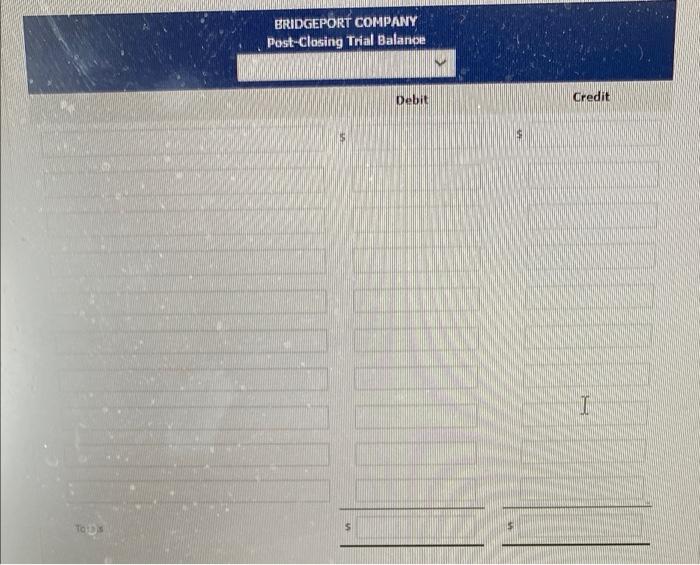

please help me prepare journalizing the closing entries, Posting the closing entries to Income summary and retained earnings, and preparing a post closing trial balance

please help me prepare journalizing the closing entries, Posting the closing entries to Income summary and retained earnings, and preparing a post closing trial balance

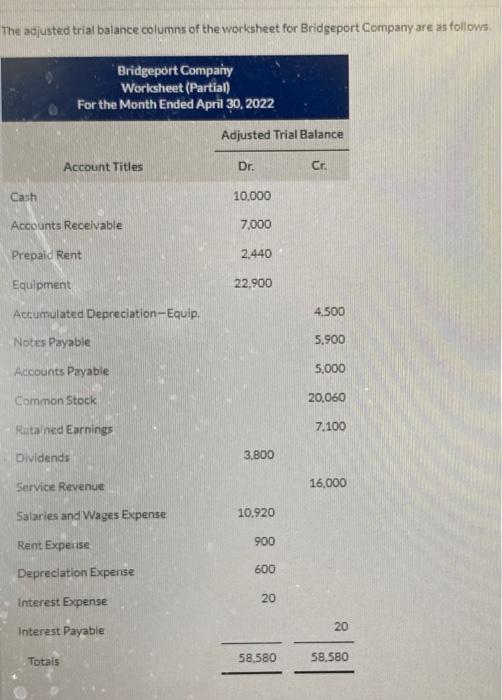

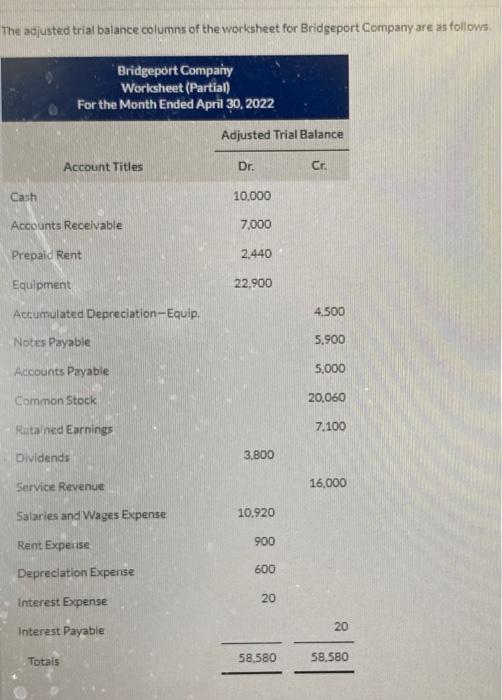

The adjusted trial balance columns of the worksheet for Bridgeport Company are as follows Bridgeport Company Worksheet (Partial) For the Month Ended April 30, 2022 Adjusted Trial Balance Account Titles Dr. Cr. Cash 10,000 Accounts Receivable 7,000 Prepaid Rent 2.440 Equipment 22.900 4,500 Accumulated Depreciation-Equip, Notes Payable 5.900 Accounts Payable 5,000 Common Stock 20.060 7.100 Ratained Earnings Dividends 3.800 Service Revenue 16,000 Salaries and Wages Expense 10.920 900 Rent Expense Depreciation Expense 600 Interest Expense 20 20 Interest Payable Totals 58.580 58.580 Journalize the closing entries at April 30. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit Apr 30 Service Revenue 16000 Income Surn mary 18000 (To dose revenue account) (2) Apr 30 Income Summary Salaries and Wages Expense Rent Expense Deprecatlon Espanse interest Expense (To close expense accounts) 3 Apr 30 Income Summary Retained Earnings [Todose net income / (los)) Apr 30 Retned taries Oldende I [To done dividende) Post the closing entries to Income Summary and Retained Earnings. (Post entries in the order of journal entries were recorded in the previous part of the question Income Summary > Retained Earnings V BRIDGEPORT COMPANY Post-Closing Trial Balance Debit Credit TO 5 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started