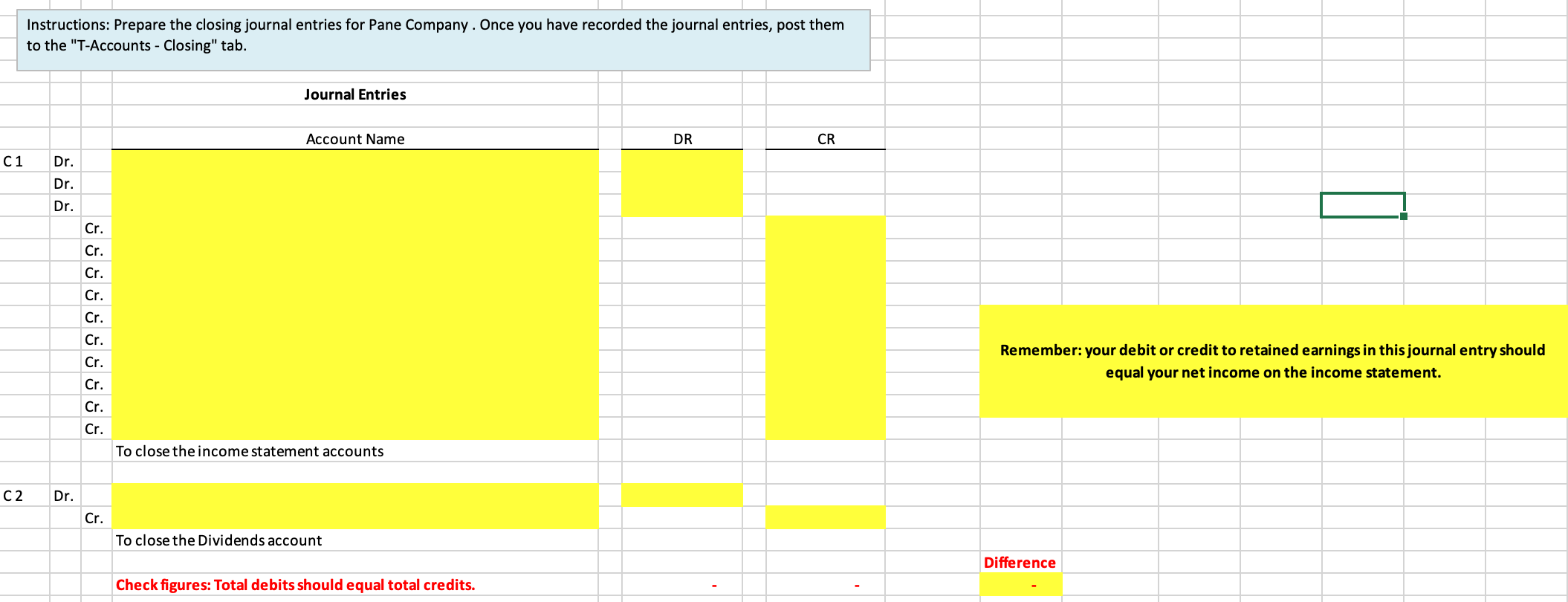

Please help me prepare the closing journal entries for Pane Company! Ive attached my t accounts below also. thank you in advance!

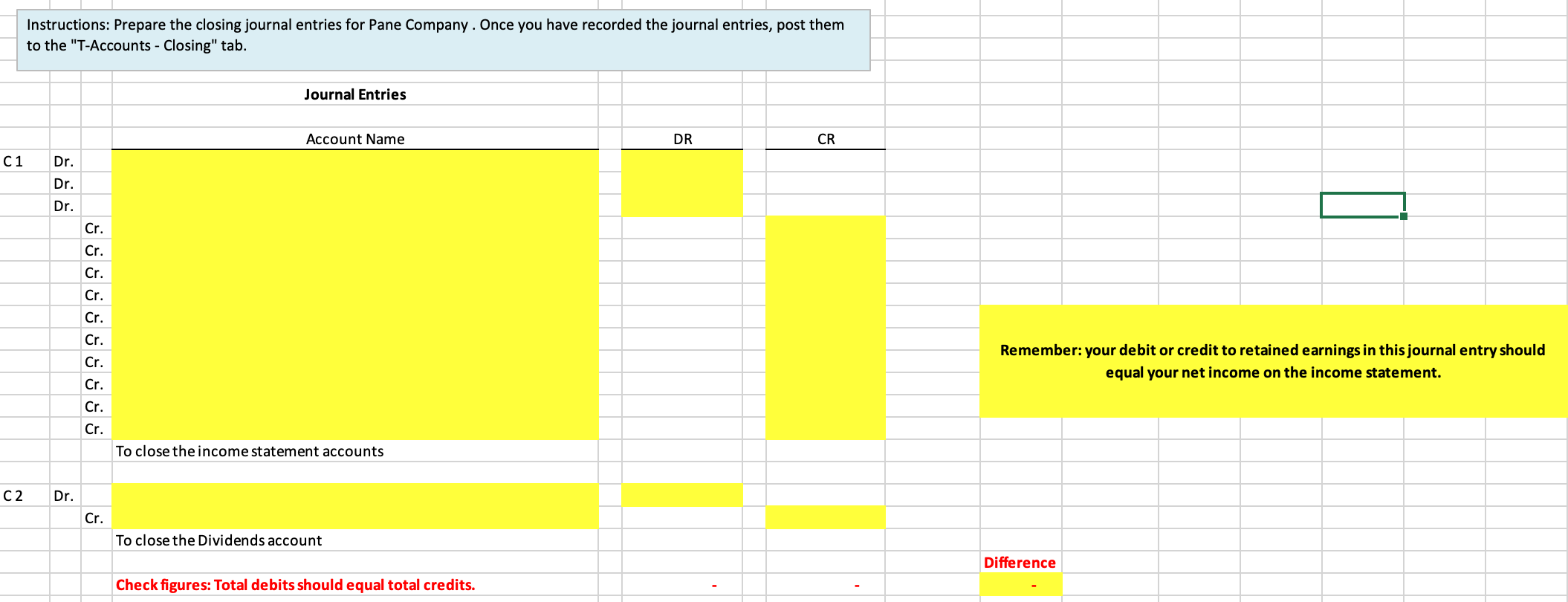

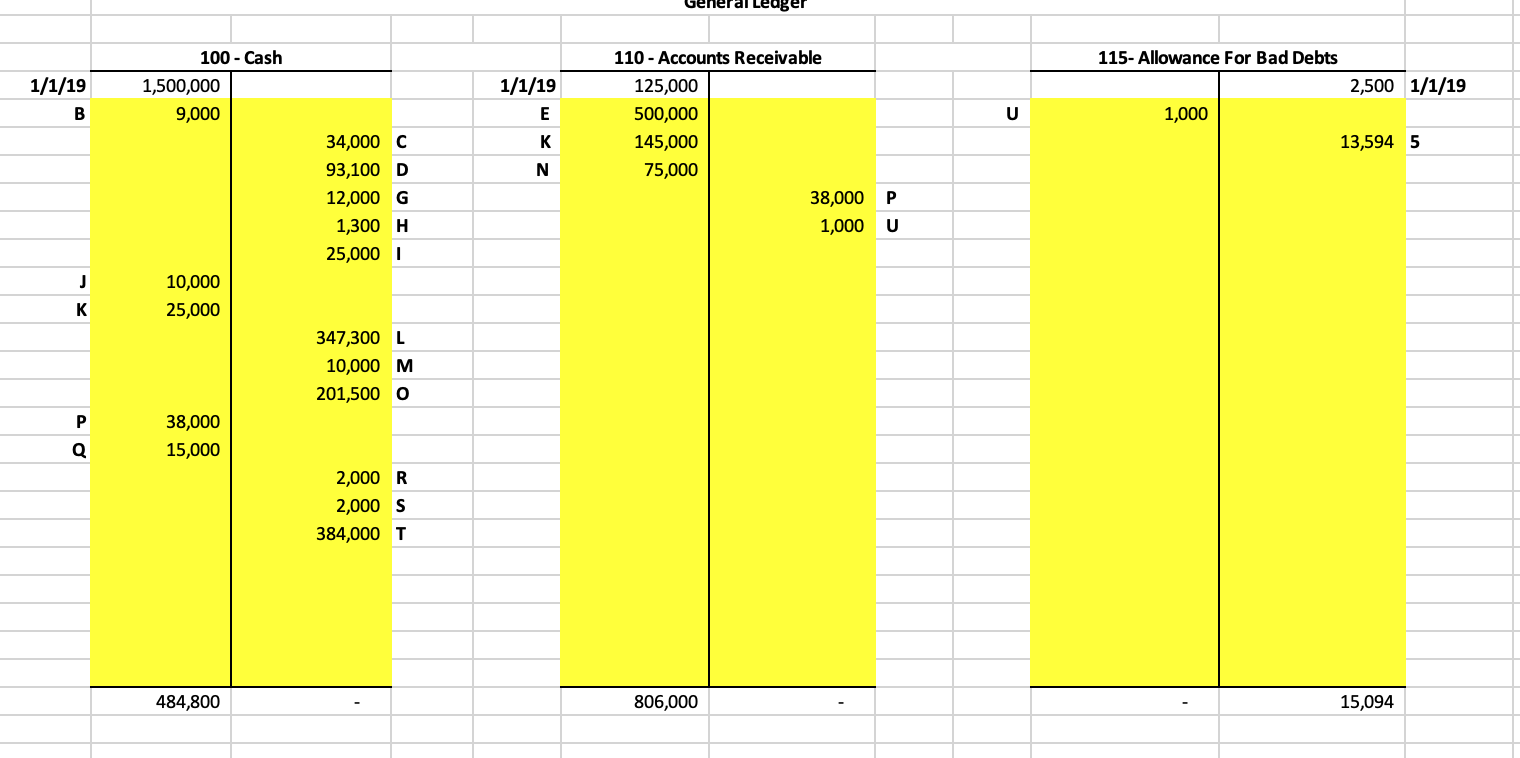

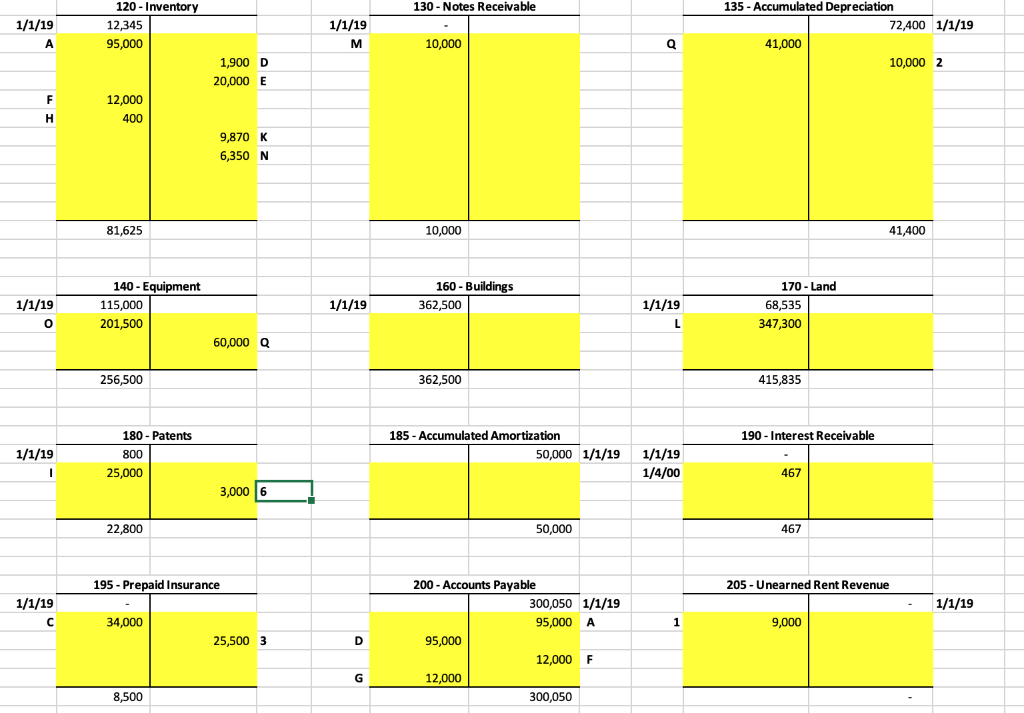

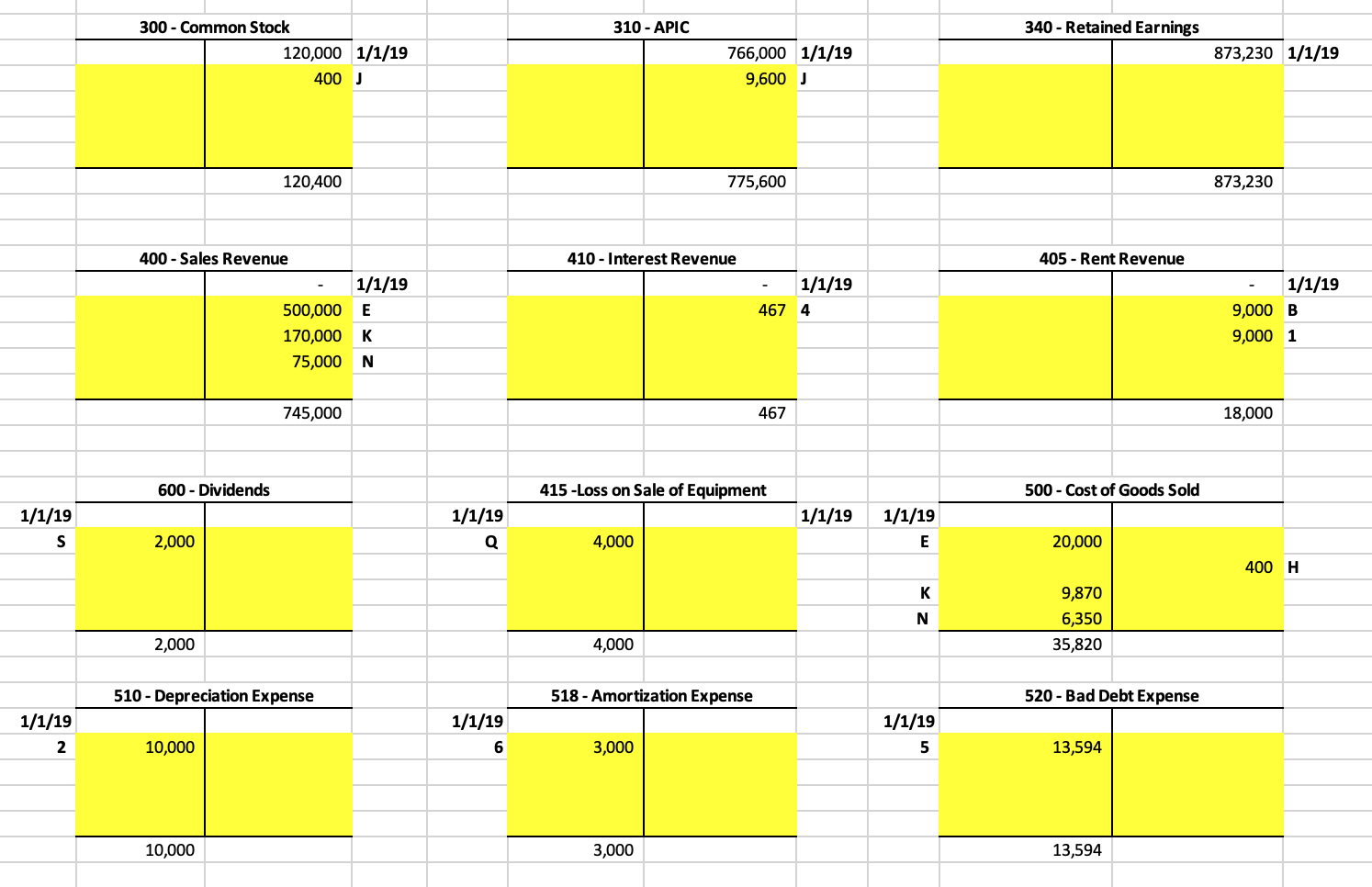

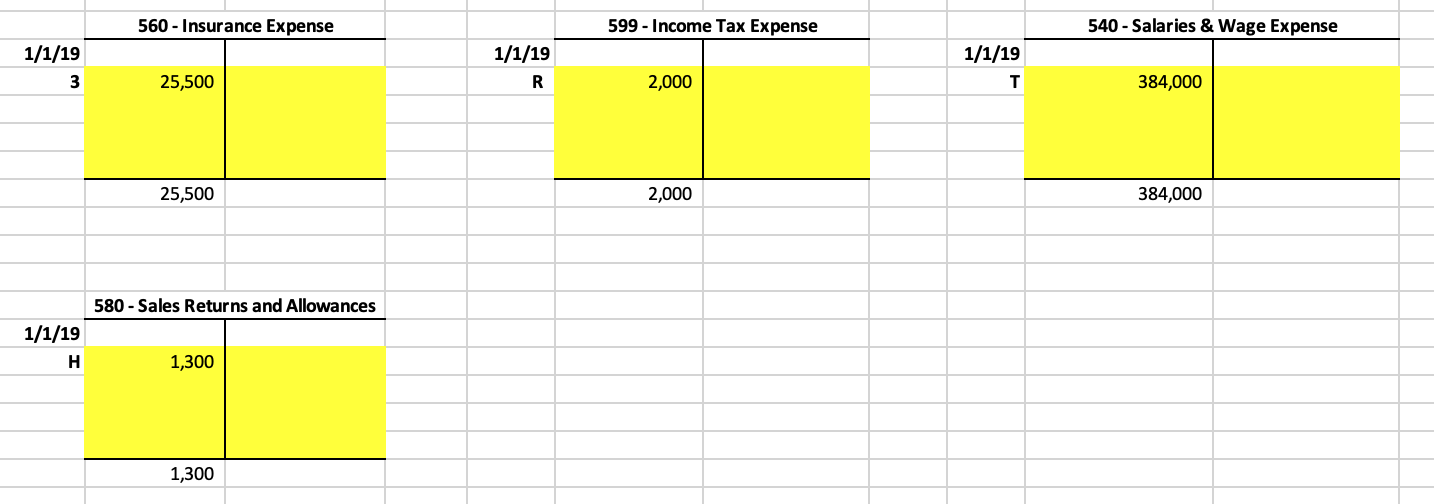

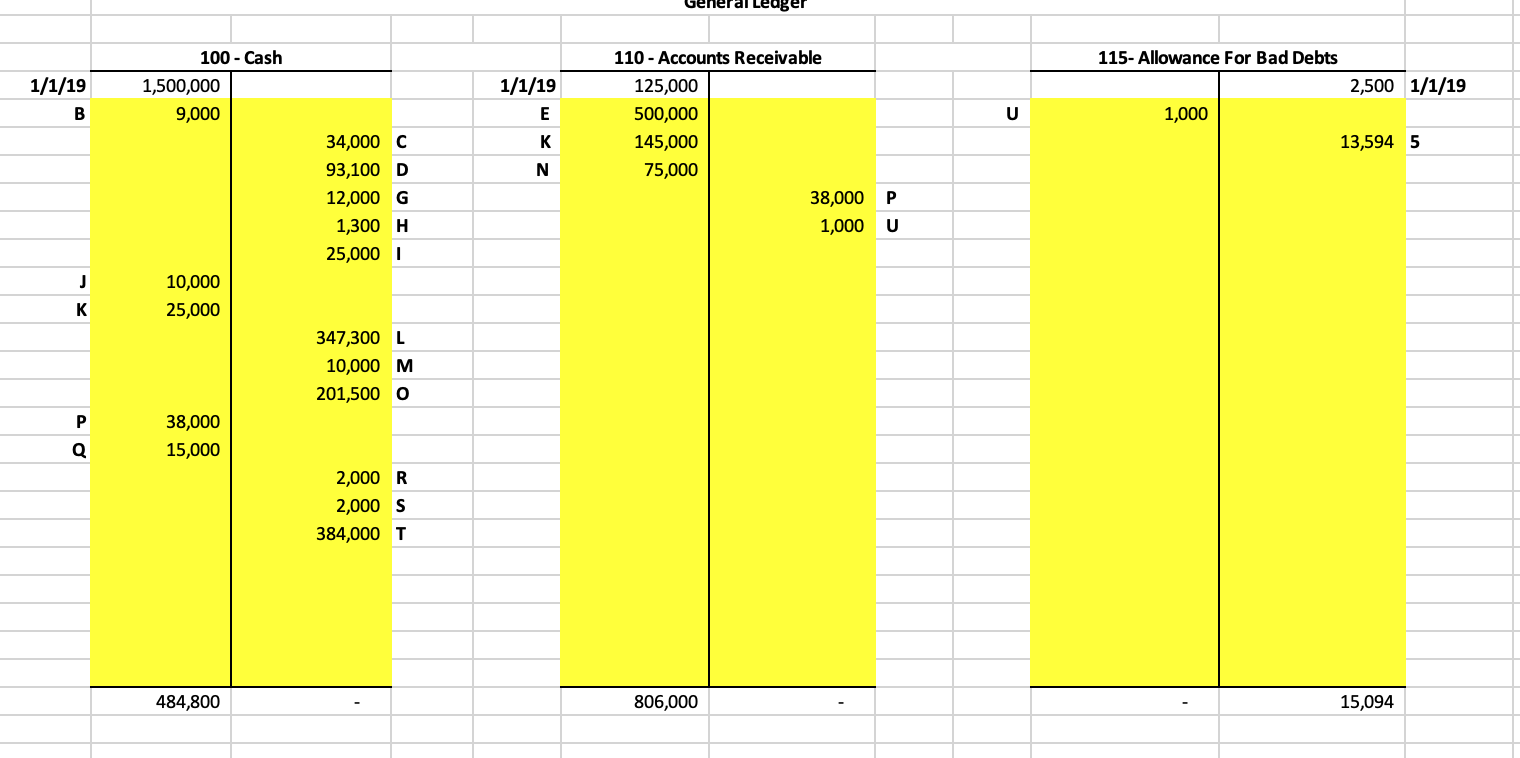

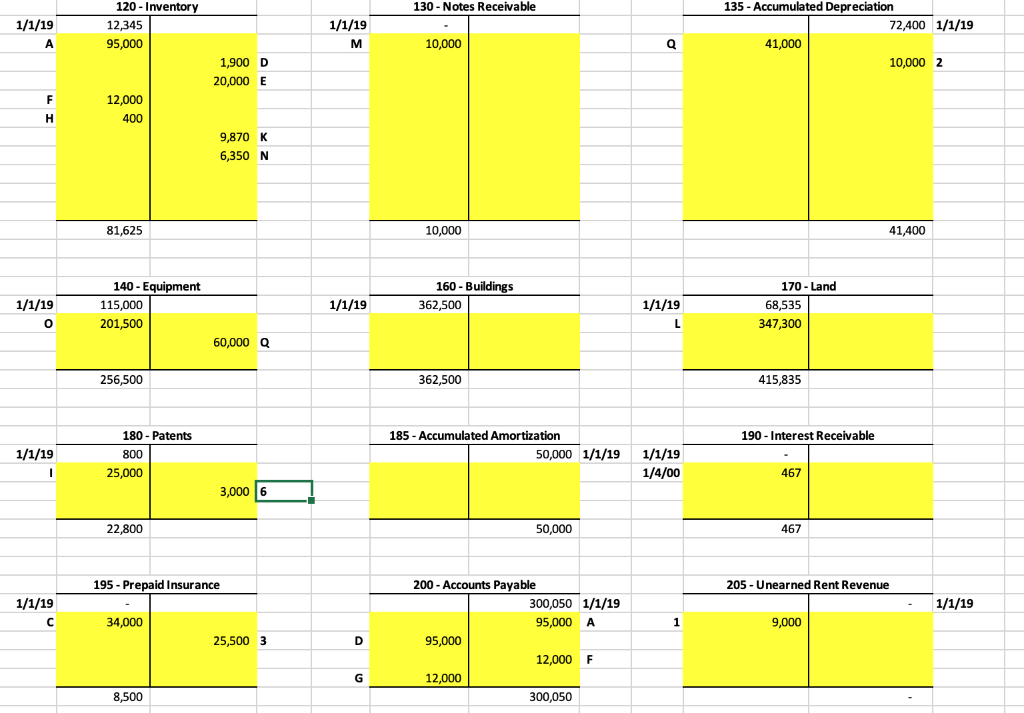

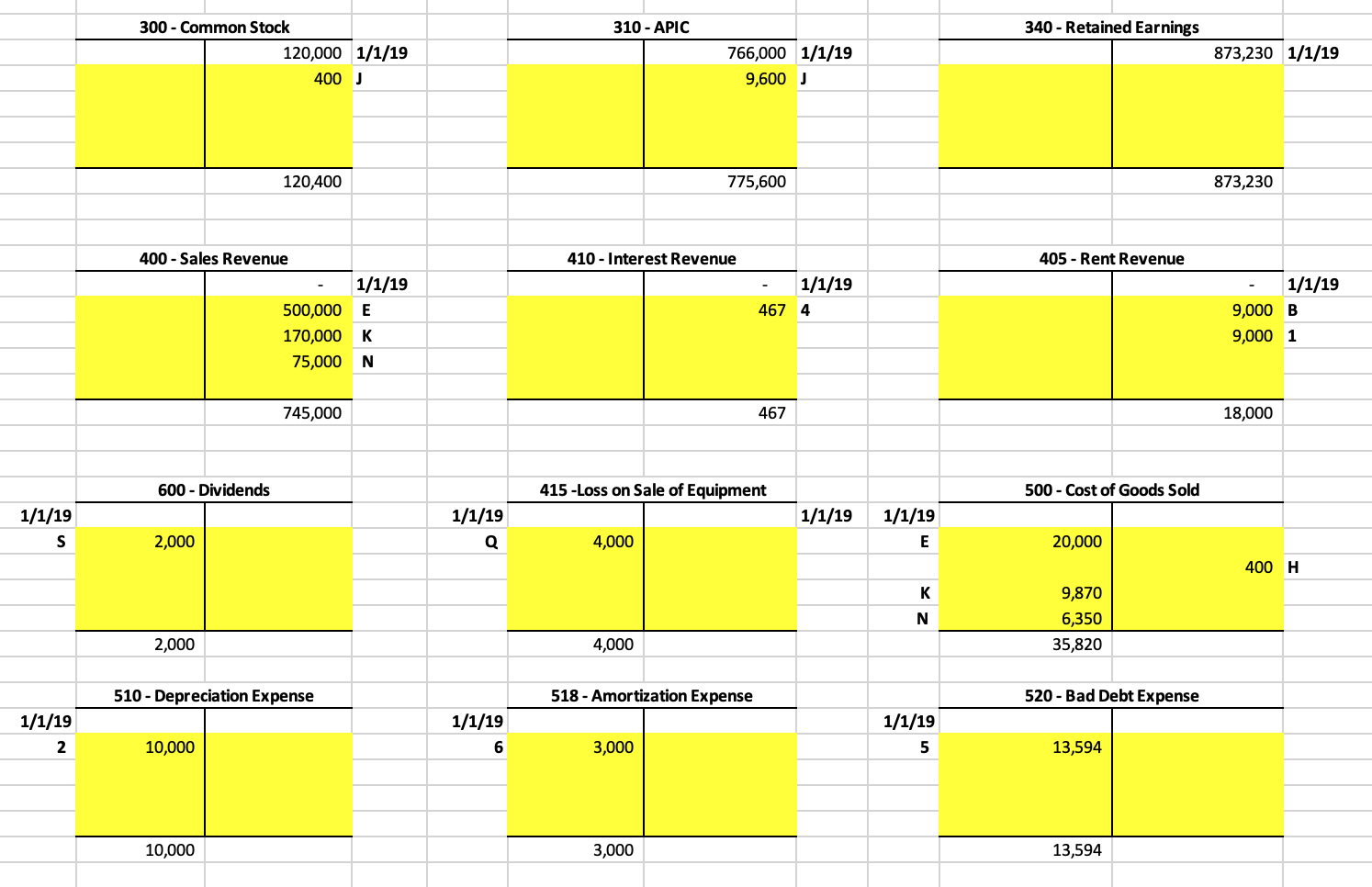

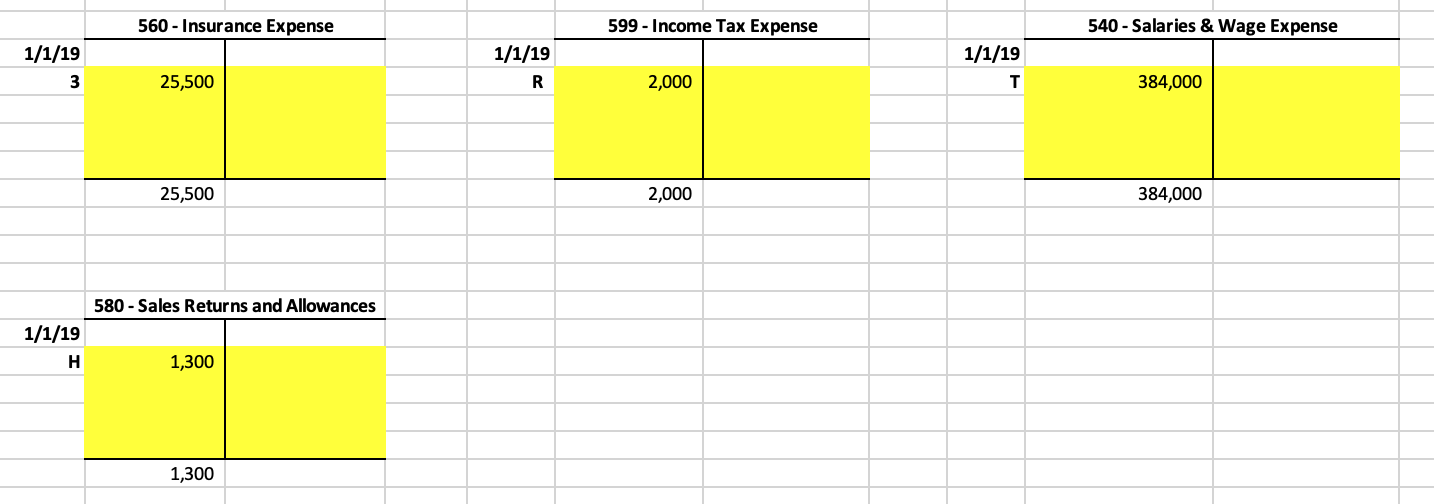

Instructions: Prepare the closing journal entries for Pane Company. Once you have recorded the journal entries, post them to the "T-Accounts - Closing" tab. Journal Entries Account Name DR CR C1 Dr. Dr. Dr. Cr. Cr. Cr. Cr. Cr. Cr. Cr. Cr. Remember: your debit or credit to retained earnings in this journal entry should equal your net income on the income statement. Cr. Cr. To close the income statement accounts C2 Dr. Cr. To close the Dividends account Difference Check figures: Total debits should equal total credits. 115- Allowance For Bad Debts 100 - Cash 1,500,000 9,000 1/1/19 B 2,500 1/1/19 1/1/19 E U 1,000 K N 13,594 5 110 - Accounts Receivable 125,000 500,000 145,000 75,000 38,000 P 1,000 34,000 C 93,100 D 12,000 G 1,300 H 25,000 J 10,000 25,000 K 347,300 L 10,000 M 201,500 P 38,000 15,000 Q 2,000 R 2,000 S 384,000 T 484,800 806,000 15,094 130 - Notes Receivable 1/1/19 A 120 - Inventory 12,345 95,000 1/1/19 M 135 - Accumulated Depreciation 72,400 1/1/19 41,000 10,000 2 10,000 Q 1,900 D 20,000 E F 12,000 400 H 9,870 K 6,350 N 81,625 10,000 41,400 140 - Equipment 115,000 201,500 160 - Buildings 362,500 1/1/19 o 1/1/19 1/1/19 L 170 - Land 68,535 347,300 60,000 256,500 362,500 415,835 190 - Interest Receivable 180 - Patents 800 25,000 185 - Accumulated Amortization 50,000 1/1/19 1/1/19 1/1/19 1/4/00 - 467 3,000 6 22,800 50,000 467 195 - Prepaid Insurance 205 - Unearned Rent Revenue 1/1/19 1/1/19 34,000 1 9,000 25,500 3 D 200 - Accounts Payable 300,050 1/1/19 95,000 A 95,000 12,000 F 12,000 300,050 8,500 310 - APIC 340 - Retained Earnings 300 - Common Stock 120,000 1/1/19 400 873,230 1/1/19 766,000 1/1/19 9,600 ) 120,400 775,600 873,230 400 - Sales Revenue 410 - Interest Revenue 405 - Rent Revenue 1/1/19 1/1/19 467 4 E 500,000 170,000 75,000 1/1/19 9,000 B 9,000 1 K N 745,000 467 18,000 600 - Dividends 415 -Loss on Sale of Equipment 500 - Cost of Goods Sold 1/1/19 1/1/19 S 1/1/19 Q 1/1/19 E 2,000 4,000 20,000 400 H K N 9,870 6,350 35,820 2,000 4,000 510 - Depreciation Expense 518 - Amortization Expense 520 - Bad Debt Expense 1/1/19 2 1/1/19 6 1/1/19 5 10,000 3,000 13,594 10,000 3,000 13,594 560 - Insurance Expense 599 - Income Tax Expense 540 - Salaries & Wage Expense 1/1/19 1/1/19 3 1/1/19 T 25,500 R 2,000 384,000 25,500 2,000 384,000 580 - Sales Returns and Allowances 1/1/19 H 1,300 1,300