Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me preparing the Form 1040 and schedules 1,2,3, C and SE and Form 8995. Thank you! , as a 37. Maria A. Solo

Please help me preparing the Form 1040 and schedules 1,2,3, C and SE and Form 8995. Thank you!

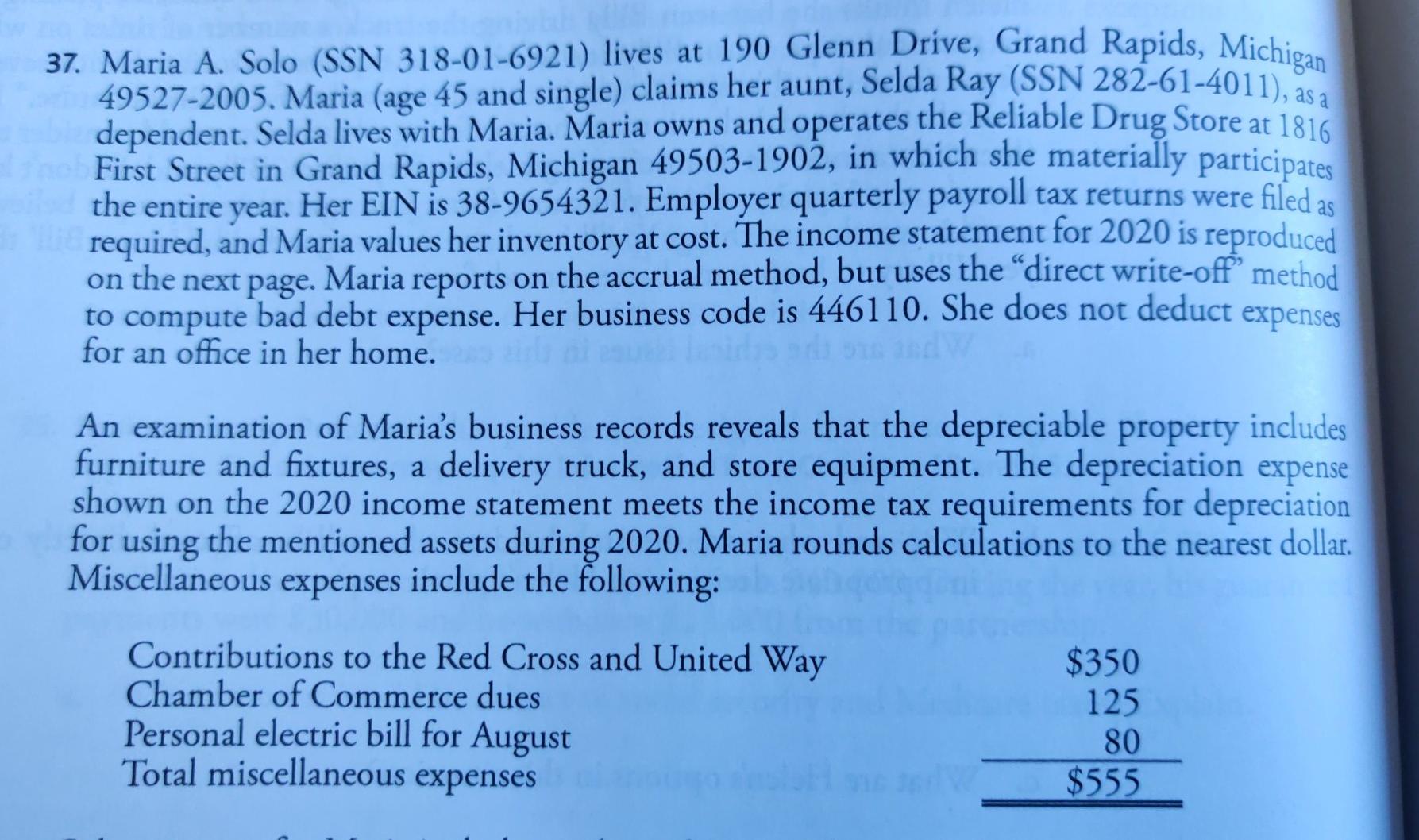

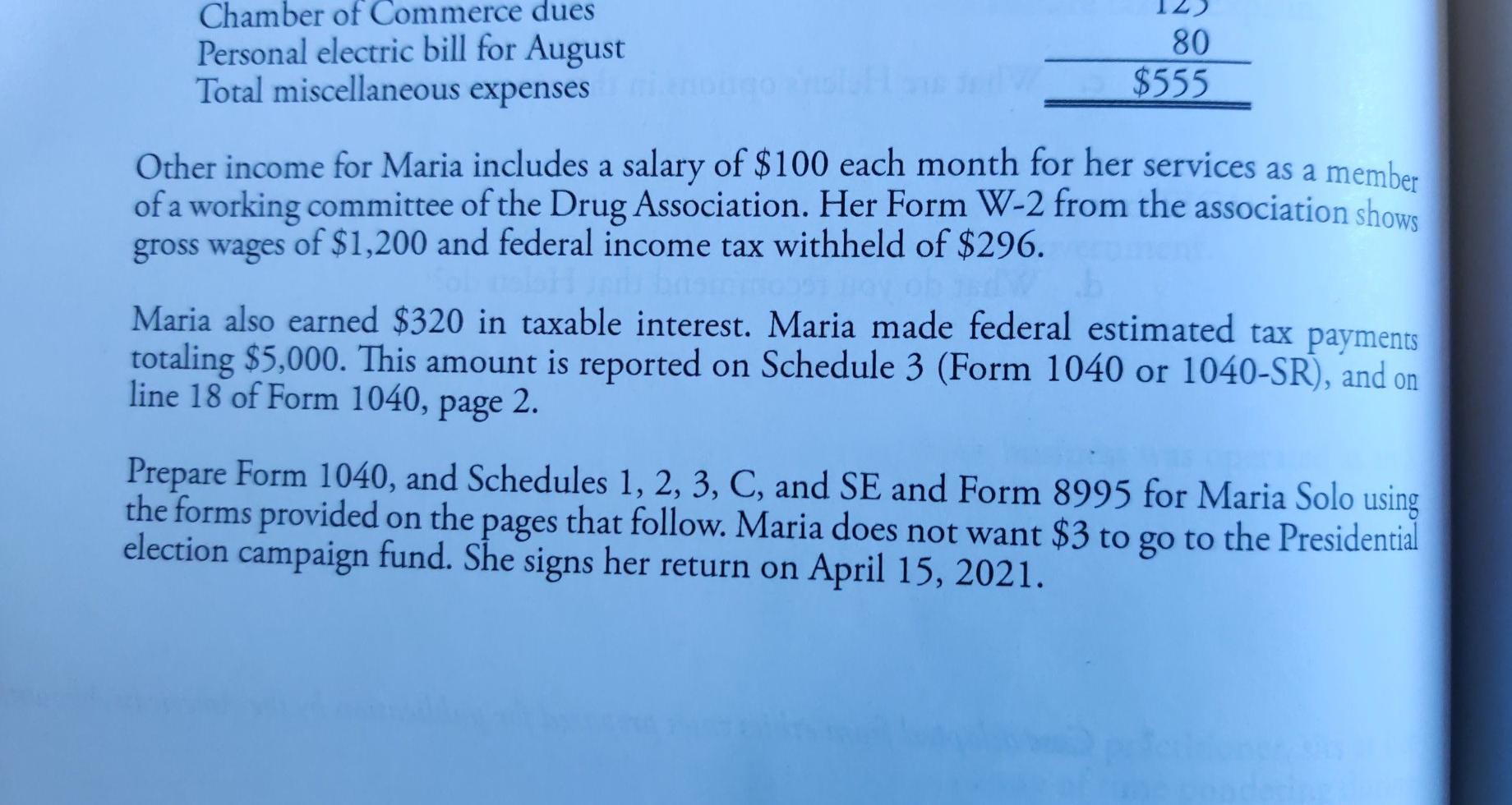

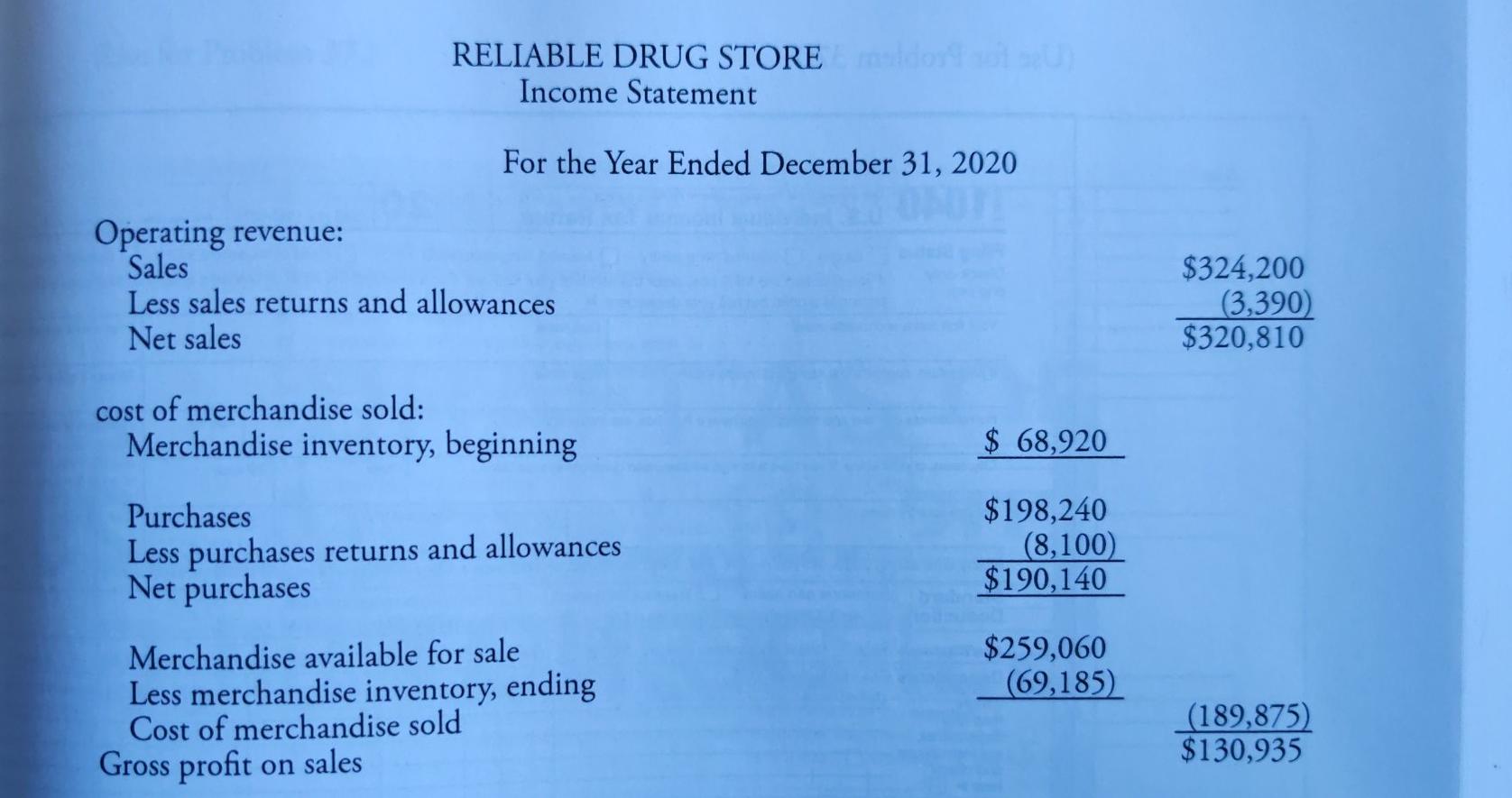

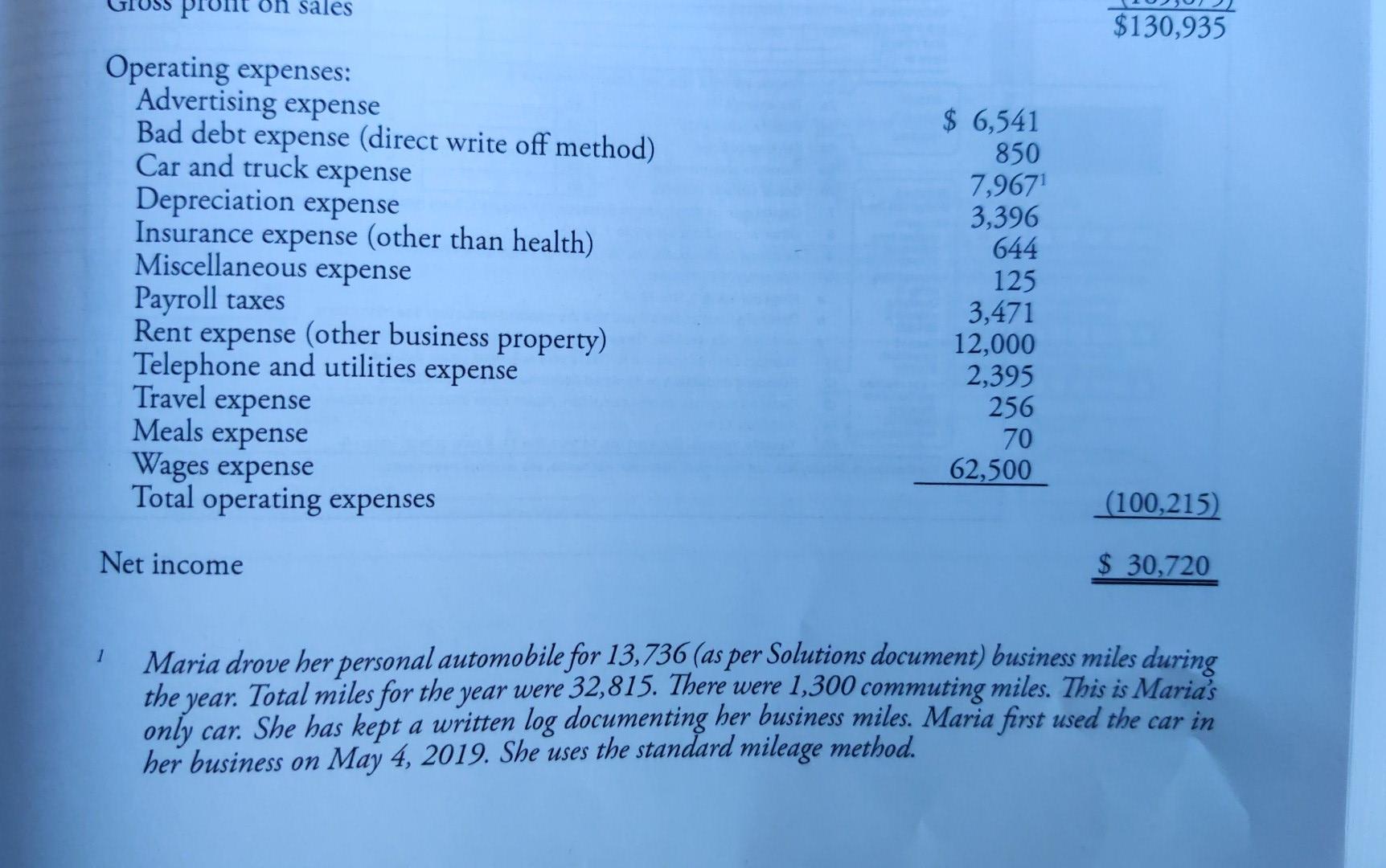

, as a 37. Maria A. Solo (SSN 318-01-6921) lives at 190 Glenn Drive, Grand Rapids, Michigan 49527-2005. Maria (age 45 and single) claims her aunt, Selda Ray (SSN 282-61-4011), dependent. Selda lives with Maria. Maria owns and operates the Reliable Drug Store at 1816 First Street in Grand Rapids, Michigan 49503-1902, in which she materially participates the entire year. Her EIN is 38-9654321. Employer quarterly payroll tax returns were filed as required, and Maria values her inventory at cost . The income statement for 2020 is reproduced on the next page. Maria reports on the accrual method, but uses the direct write-off" method to compute bad debt expense. Her business code is 446110. She does not deduct expenses for an office in her home. An examination of Maria's business records reveals that the depreciable property includes furniture and fixtures, a delivery truck, and store equipment. The depreciation expense shown on the 2020 income statement meets the income tax requirements for depreciation for using the mentioned assets during 2020. Maria rounds calculations to the nearest dollar. Miscellaneous expenses include the following: Contributions to the Red Cross and United Way Chamber of Commerce dues Personal electric bill for August Total miscellaneous expenses $350 125 80 $555 Chamber of Commerce dues Personal electric bill for August Total miscellaneous expenses 80 $555 Other income for Maria includes a salary of $100 each month for her services as a member of a working committee of the Drug Association. Her Form W-2 from the association shows gross wages of $1,200 and federal income tax withheld of $296. Maria also earned $320 in taxable interest. Maria made federal estimated tax payments totaling $5,000. This amount is reported on Schedule 3 (Form 1040 or 1040-SR), and on line 18 of Form 1040, page 2. Prepare Form 1040, and Schedules 1, 2, 3, C, and SE and Form 8995 for Maria Solo using the forms provided on the pages that follow. Maria does not want $3 to go to the Presidential election campaign fund. She signs her return on April 15, 2021. RELIABLE DRUG STORE Income Statement For the Year Ended December 31, 2020 Operating revenue: Sales Less sales returns and allowances Net sales $324,200 (3,390) $320,810 cost of merchandise sold: Merchandise inventory, beginning $ 68,920 Purchases Less purchases returns and allowances Net purchases $198,240 (8,100) $190,140 $259,060 (69,185) Merchandise available for sale Less merchandise inventory, ending Cost of merchandise sold Gross profit on sales (189,875) $130,935 Pront on sales $130,935 Operating expenses: Advertising expense Bad debt expense (direct write off method) Car and truck expense Depreciation expense Insurance expense (other than health) Miscellaneous expense Payroll taxes Rent expense (other business property) Telephone and utilities expense Travel expense Meals expense Wages expense Total operating expenses $ 6,541 850 7,967 3,396 644 125 3,471 12,000 2,395 256 70 62,500 (100,215) Net income $ 30,720 1 Maria drove her personal automobile for 13,736 (as per Solutions document) business miles during the year. Total miles for the year were 32,815. There were 1,300 commuting miles. This is Maria's only car. She has kept a written log documenting her business miles. Maria first used the car in her business on May 4, 2019. She uses the standard mileage methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started