Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me Principles of strategy risk and financial management techniques question QUESTION 3 (31 marks) Stay Ltd. (Stay) is a South African entity with

Please help me Principles of strategy risk and financial management techniques question

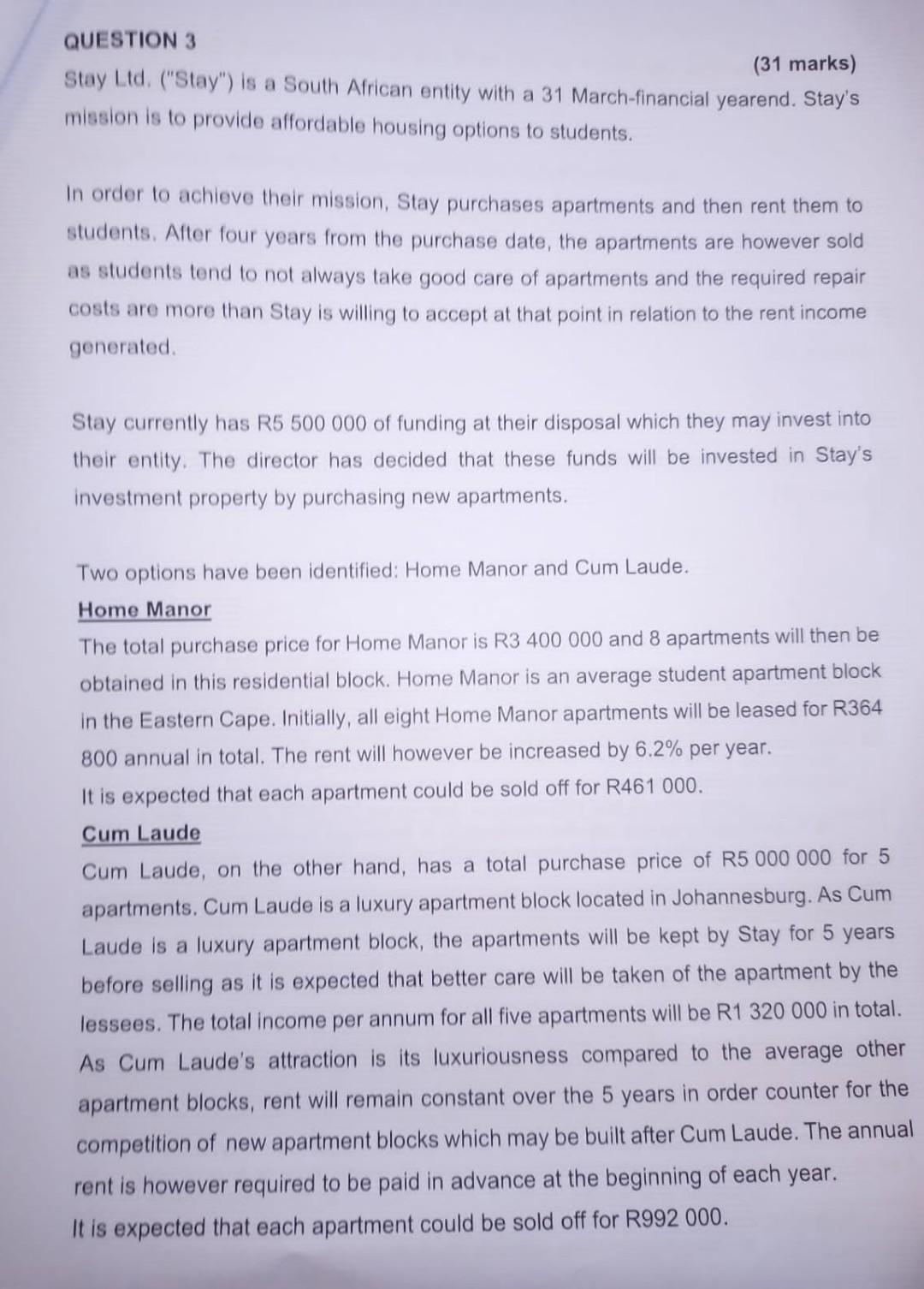

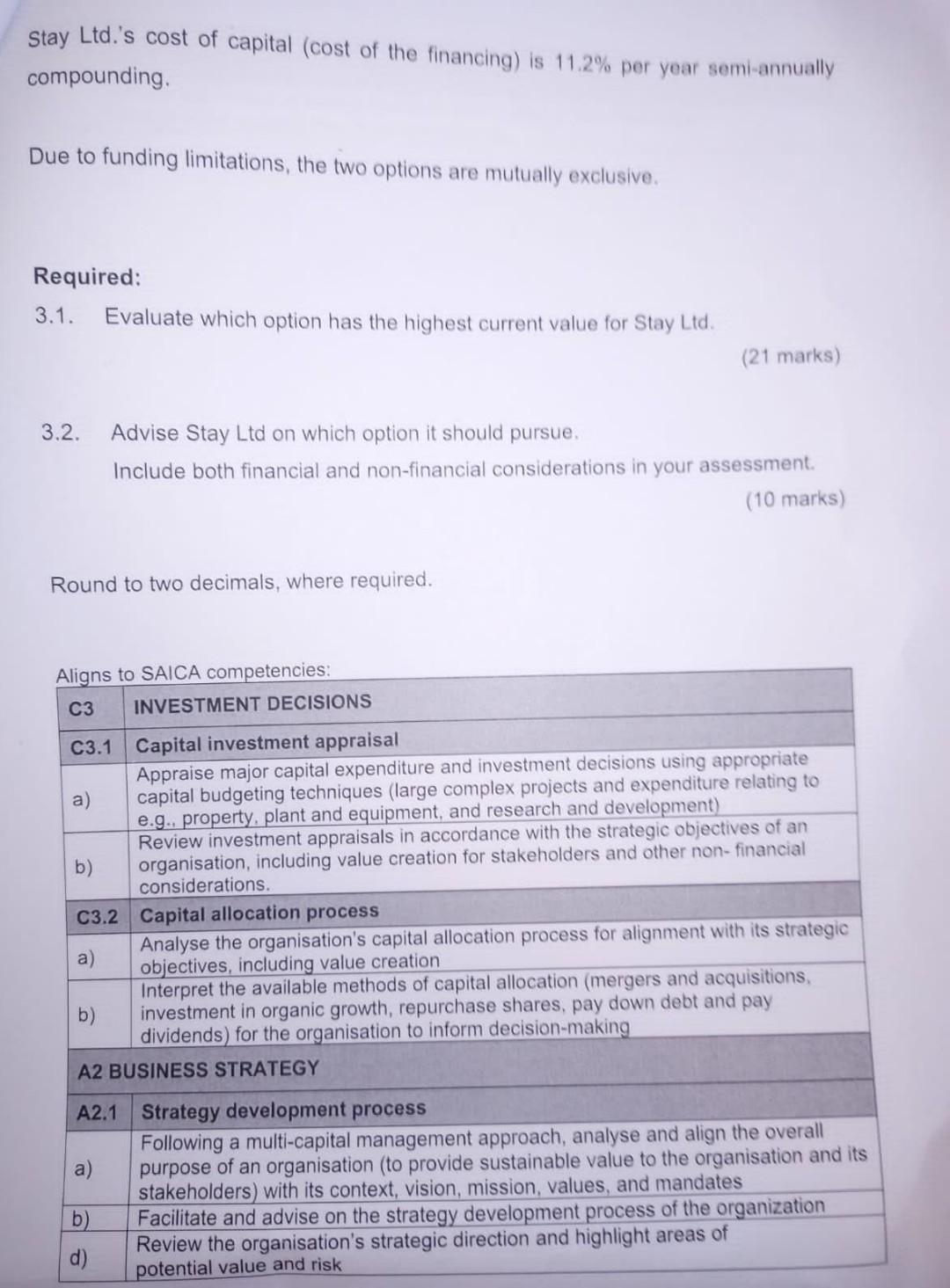

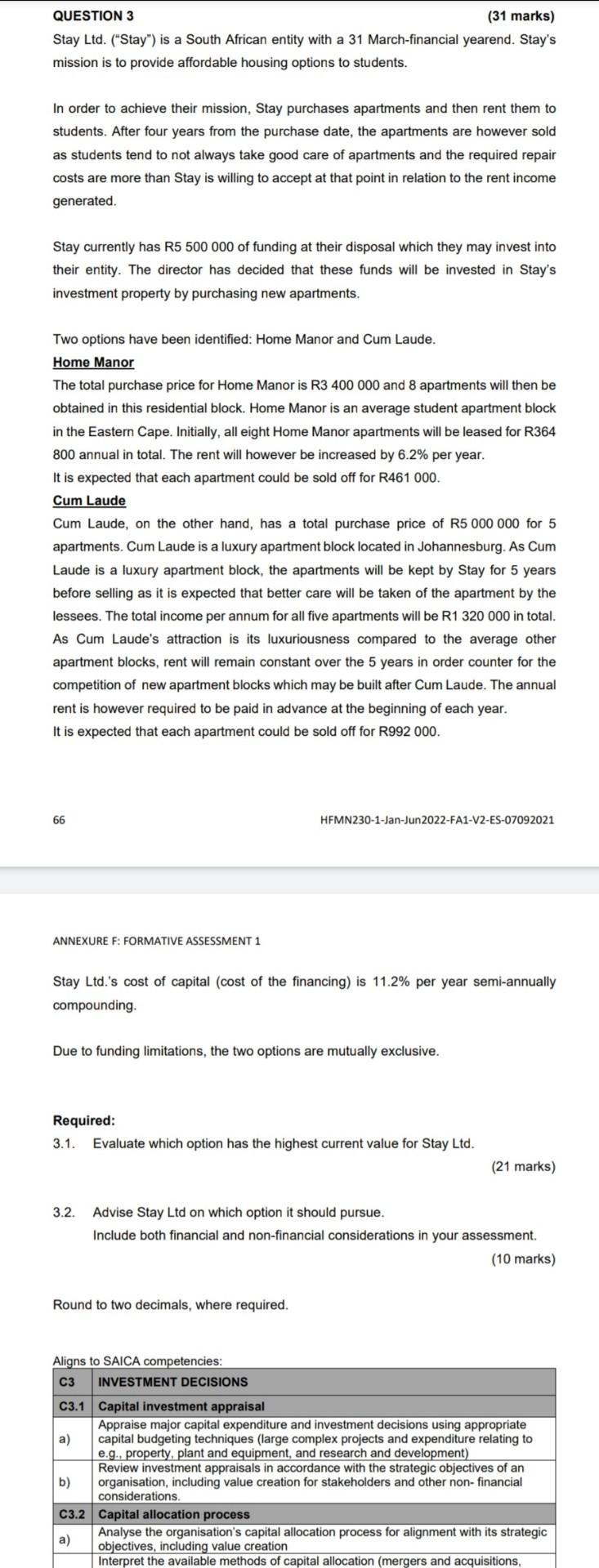

QUESTION 3 (31 marks) Stay Ltd. ("Stay") is a South African entity with a 31 March-financial yearend. Stay's mission is to provide affordable housing options to students. In order to achieve their mission, Stay purchases apartments and then rent them to students. After four years from the purchase date, the apartments are however sold as students tend to not always take good care of apartments and the required repair costs are more than Stay is willing to accept at that point in relation to the rent income generated Stay currently has R5 500 000 of funding at their disposal which they may invest into their entity. The director has decided that these funds will be invested in Stay's investment property by purchasing new apartments. Two options have been identified: Home Manor and Cum Laude. Home Manor The total purchase price for Home Manor is R3 400 000 and 8 apartments will then be obtained in this residential block. Home Manor is an average student apartment block in the Eastern Cape. Initially, all eight Home Manor apartments will be leased for R364 800 annual in total. The rent will however be increased by 6.2% per year. It is expected that each apartment could be sold off for R461 000. Cum Laude Cum Laude, on the other hand, has a total purchase price of R5 000 000 for 5 apartments. Cum Laude is a luxury apartment block located in Johannesburg. As Cum Laude is a luxury apartment block, the apartments will be kept by Stay for 5 years before selling as it is expected that better care will be taken of the apartment by the lessees. The total income per annum for all five apartments will be R1 320 000 in total. As Cum Laude's attraction is its luxuriousness compared to the average other apartment blocks, rent will remain constant over the 5 years in order counter for the competition of new apartment blocks which may be built after Cum Laude. The annual rent is however required to be paid in advance at the beginning of each year. It is expected that each apartment could be sold off for R992 000. Stay Ltd.'s cost of capital (cost of the financing) is 11.2% per year semi-annually compounding, Due to funding limitations, the two options are mutually exclusive. Required: 3.1. Evaluate which option has the highest current value for Stay Ltd. (21 marks) 3.2. Advise Stay Ltd on which option it should pursue. Include both financial and non-financial considerations in your assessment. (10 marks) Round to two decimals, where required. Aligns to SAICA competencies: C3 INVESTMENT DECISIONS C3.1 Capital investment appraisal Appraise major capital expenditure and investment decisions using appropriate a) capital budgeting techniques (large complex projects and expenditure relating to e.g. property, plant and equipment, and research and development) Review investment appraisals accordance with the strategic objectives of an b) organisation, including value creation for stakeholders and other non-financial considerations. C3.2 Capital allocation process Analyse the organisation's capital allocation process for alignment with its strategic a) objectives, including value creation Interpret the available methods of capital allocation (mergers and acquisitions, b) investment in organic growth, repurchase shares, pay down debt and pay dividends) for the organisation to inform decision-making A2 BUSINESS STRATEGY A2.1 Strategy development process Following a multi-capital management approach, analyse and align the overall a) purpose of an organisation (to provide sustainable value to the organisation and its stakeholders) with its context, vision, mission, values, and mandates b) Facilitate and advise on the strategy development process of the organization d) Review the organisation's strategic direction and highlight areas of potential value and risk QUESTION 3 (31 marks) Stay Ltd. ("Stay") is a South African entity with a 31 March-financial yearend. Stay's mission is to provide affordable housing options to students. In order to achieve their mission, Stay purchases apartments and then rent them to students. After four years from the purchase date, the apartments are however sold as students tend to not always take good care of apartments and the required repair costs are more than Stay is willing to accept at that point in relation to the rent income generated. Stay currently has R5 500 000 of funding at their disposal which they may invest into their entity. The director has decided that these funds will be invested in Stay's investment property by purchasing new apartments. Two options have been identified: Home Manor and Cum Laude. Home Manor The total purchase price for Home Manor is R3 400 000 and 8 apartments will then be obtained in this residential block. Home Manor is an average student apartment block in the Eastern Cape. Initially, all eight Home Manor apartments will be leased for R364 800 annual in total. The rent will however be increased by 6.2% per year. It is expected that each apartment could be sold off for R461 000. Cum Laude Cum Laude, on the other hand, has a total purchase price of R5 000 000 for 5 apartments. Cum Laude is a luxury apartment block located in Johannesburg. As Cum Laude is a luxury apartment block, the apartments will be kept by Stay for 5 years before selling as it is expected that better care will be taken of the apartment by the lessees. The total income per annum for all five apartments will be R1 320 000 in total. As Cum Laude's attraction is its luxuriousness compared to the average other apartment blocks, rent will remain constant over the 5 years in order counter for the competition of new apartment blocks which may be built after Cum Laude. The annual rent is however required to be paid in advance at the beginning of each year. It is expected that each apartment could be sold off for R992 000. 66 HEMN230-1-Jan-Jun 2022-FA1-V2-ES-07092021 ANNEXURE F: FORMATIVE ASSESSMENT 1 Stay Ltd.'s cost of capital (cost of the financing) is 11.2% per year semi-annually compounding Due to funding limitations, the two options are mutually exclusive Required: 3.1. Evaluate which option has the highest current value for Stay Ltd. (21 marks) 3.2. Advise Stay Ltd on which option it should pursue. Include both financial and non-financial considerations in your assessment. (10 marks) Round to two decimals, where required. Aligns to SAICA competencies: C3 INVESTMENT DECISIONS C3.1 Capital investment appraisal Appraise major capital expenditure and investment decisions using appropriate a) capital budgeting techniques (large complex projects and expenditure relating to e.g., property, plant and equipment, and research and development) Review investment appraisals in accordance with the strategic objectives of an b) organisation, including value creation for stakeholders and other non-financial considerations. C3.2 Capital allocation process a) Analyse the organisation's capital allocation process for alignment with its strategic objectives, including value creation Interpret the available methods of capital allocation (mergers and acquisitions, QUESTION 3 (31 marks) Stay Ltd. ("Stay") is a South African entity with a 31 March-financial yearend. Stay's mission is to provide affordable housing options to students. In order to achieve their mission, Stay purchases apartments and then rent them to students. After four years from the purchase date, the apartments are however sold as students tend to not always take good care of apartments and the required repair costs are more than Stay is willing to accept at that point in relation to the rent income generated Stay currently has R5 500 000 of funding at their disposal which they may invest into their entity. The director has decided that these funds will be invested in Stay's investment property by purchasing new apartments. Two options have been identified: Home Manor and Cum Laude. Home Manor The total purchase price for Home Manor is R3 400 000 and 8 apartments will then be obtained in this residential block. Home Manor is an average student apartment block in the Eastern Cape. Initially, all eight Home Manor apartments will be leased for R364 800 annual in total. The rent will however be increased by 6.2% per year. It is expected that each apartment could be sold off for R461 000. Cum Laude Cum Laude, on the other hand, has a total purchase price of R5 000 000 for 5 apartments. Cum Laude is a luxury apartment block located in Johannesburg. As Cum Laude is a luxury apartment block, the apartments will be kept by Stay for 5 years before selling as it is expected that better care will be taken of the apartment by the lessees. The total income per annum for all five apartments will be R1 320 000 in total. As Cum Laude's attraction is its luxuriousness compared to the average other apartment blocks, rent will remain constant over the 5 years in order counter for the competition of new apartment blocks which may be built after Cum Laude. The annual rent is however required to be paid in advance at the beginning of each year. It is expected that each apartment could be sold off for R992 000. Stay Ltd.'s cost of capital (cost of the financing) is 11.2% per year semi-annually compounding, Due to funding limitations, the two options are mutually exclusive. Required: 3.1. Evaluate which option has the highest current value for Stay Ltd. (21 marks) 3.2. Advise Stay Ltd on which option it should pursue. Include both financial and non-financial considerations in your assessment. (10 marks) Round to two decimals, where required. Aligns to SAICA competencies: C3 INVESTMENT DECISIONS C3.1 Capital investment appraisal Appraise major capital expenditure and investment decisions using appropriate a) capital budgeting techniques (large complex projects and expenditure relating to e.g. property, plant and equipment, and research and development) Review investment appraisals accordance with the strategic objectives of an b) organisation, including value creation for stakeholders and other non-financial considerations. C3.2 Capital allocation process Analyse the organisation's capital allocation process for alignment with its strategic a) objectives, including value creation Interpret the available methods of capital allocation (mergers and acquisitions, b) investment in organic growth, repurchase shares, pay down debt and pay dividends) for the organisation to inform decision-making A2 BUSINESS STRATEGY A2.1 Strategy development process Following a multi-capital management approach, analyse and align the overall a) purpose of an organisation (to provide sustainable value to the organisation and its stakeholders) with its context, vision, mission, values, and mandates b) Facilitate and advise on the strategy development process of the organization d) Review the organisation's strategic direction and highlight areas of potential value and risk QUESTION 3 (31 marks) Stay Ltd. ("Stay") is a South African entity with a 31 March-financial yearend. Stay's mission is to provide affordable housing options to students. In order to achieve their mission, Stay purchases apartments and then rent them to students. After four years from the purchase date, the apartments are however sold as students tend to not always take good care of apartments and the required repair costs are more than Stay is willing to accept at that point in relation to the rent income generated. Stay currently has R5 500 000 of funding at their disposal which they may invest into their entity. The director has decided that these funds will be invested in Stay's investment property by purchasing new apartments. Two options have been identified: Home Manor and Cum Laude. Home Manor The total purchase price for Home Manor is R3 400 000 and 8 apartments will then be obtained in this residential block. Home Manor is an average student apartment block in the Eastern Cape. Initially, all eight Home Manor apartments will be leased for R364 800 annual in total. The rent will however be increased by 6.2% per year. It is expected that each apartment could be sold off for R461 000. Cum Laude Cum Laude, on the other hand, has a total purchase price of R5 000 000 for 5 apartments. Cum Laude is a luxury apartment block located in Johannesburg. As Cum Laude is a luxury apartment block, the apartments will be kept by Stay for 5 years before selling as it is expected that better care will be taken of the apartment by the lessees. The total income per annum for all five apartments will be R1 320 000 in total. As Cum Laude's attraction is its luxuriousness compared to the average other apartment blocks, rent will remain constant over the 5 years in order counter for the competition of new apartment blocks which may be built after Cum Laude. The annual rent is however required to be paid in advance at the beginning of each year. It is expected that each apartment could be sold off for R992 000. 66 HEMN230-1-Jan-Jun 2022-FA1-V2-ES-07092021 ANNEXURE F: FORMATIVE ASSESSMENT 1 Stay Ltd.'s cost of capital (cost of the financing) is 11.2% per year semi-annually compounding Due to funding limitations, the two options are mutually exclusive Required: 3.1. Evaluate which option has the highest current value for Stay Ltd. (21 marks) 3.2. Advise Stay Ltd on which option it should pursue. Include both financial and non-financial considerations in your assessment. (10 marks) Round to two decimals, where required. Aligns to SAICA competencies: C3 INVESTMENT DECISIONS C3.1 Capital investment appraisal Appraise major capital expenditure and investment decisions using appropriate a) capital budgeting techniques (large complex projects and expenditure relating to e.g., property, plant and equipment, and research and development) Review investment appraisals in accordance with the strategic objectives of an b) organisation, including value creation for stakeholders and other non-financial considerations. C3.2 Capital allocation process a) Analyse the organisation's capital allocation process for alignment with its strategic objectives, including value creation Interpret the available methods of capital allocation (mergers and acquisitions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started