Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me provide excel step by step so it will very helpful for me thank u Question 2: You borrow a five-year $13,000 loan

please help me

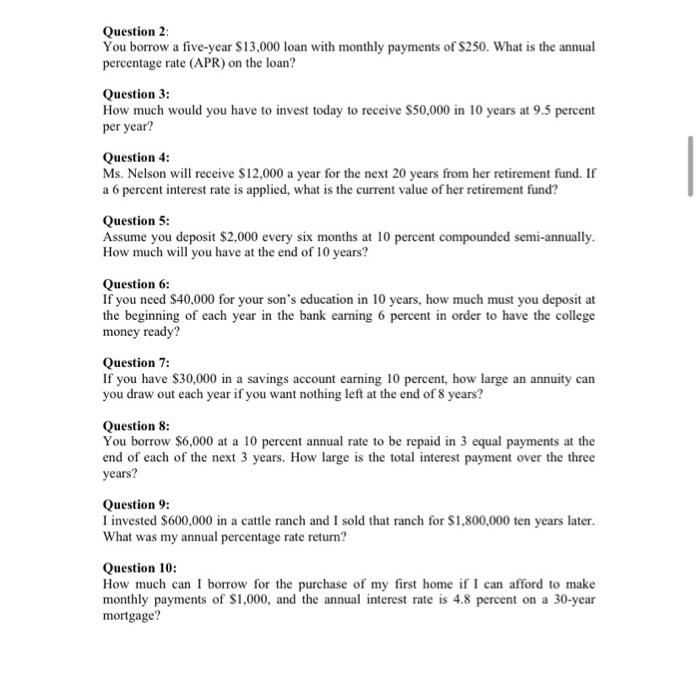

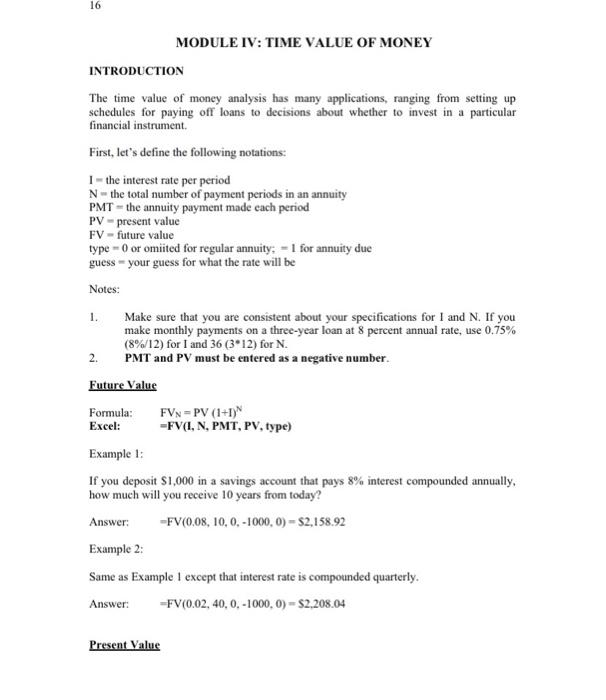

Question 2: You borrow a five-year $13,000 loan with monthly payments of \$250. What is the annual percentage rate (APR) on the loan? Question 3: How much would you have to invest today to receive $50,000 in 10 years at 9.5 percent per year? Question 4: Ms. Nelson will receive $12,000 a year for the next 20 years from her retirement fund. If a 6 percent interest rate is applied, what is the current value of her retirement fund? Question 5: Assume you deposit $2,000 every six months at 10 percent compounded semi-annually. How much will you have at the end of 10 years? Question 6: If you need $40,000 for your son's education in 10 years, how much must you deposit at the beginning of each year in the bank earning 6 percent in order to have the college money ready? Question 7: If you have $30,000 in a savings account earning 10 percent, how large an annuity can you draw out each year if you want nothing left at the end of 8 years? Question 8: You borrow $6,000 at a 10 percent annual rate to be repaid in 3 equal payments at the end of each of the next 3 years. How large is the total interest payment over the three years? Question 9: I invested $600,000 in a cattle ranch and I sold that ranch for $1,800,000 ten years later. What was my annual percentage rate return? Question 10: How much can I borrow for the purchase of my first home if I can afford to make monthly payments of $1,000, and the annual interest rate is 4.8 percent on a 30 -year mortgage? 16 MODULE IV: TIME VALUE OF MONEY INTRODUCTION The time value of money analysis has many applications, ranging from setting up schedules for paying off loans to decisions about whether to invest in a particular financial instrument. First, let's define the following notations: I = the interest rate per period N - the total number of payment periods in an annuity PMT = the annuity payment made each period PV = present value FV = future value type =0 or omiited for regular annuity; =1 for annuity due guess = your guess for what the rate will be Notes: 1. Make sure that you are consistent about your specifications for I and N. If you make monthly payments on a three-year loan at 8 percent annual rate, use 0.75% (8%/12) for I and 36(312) for N. 2. PMT and PV must be entered as a negative number. Future Value Formula:Excel:FVN=PV(1+1)N=FV(I,N,PMT,PV,type) Example 1: If you deposit $1,000 in a savings account that pays 8% interest compounded annually, how much will you receive 10 years from today? Answer: =FV(0.08,10,0,1000,0)=$2,158.92 Example 2: Same as Example 1 except that interest rate is compounded quarterly. Answer: =FV(0.02,40,0,1000,0)=$2,208.04 Present Value provide excel step by step so it will very helpful for me

thank u

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started