PLEASE HELP ME!!!

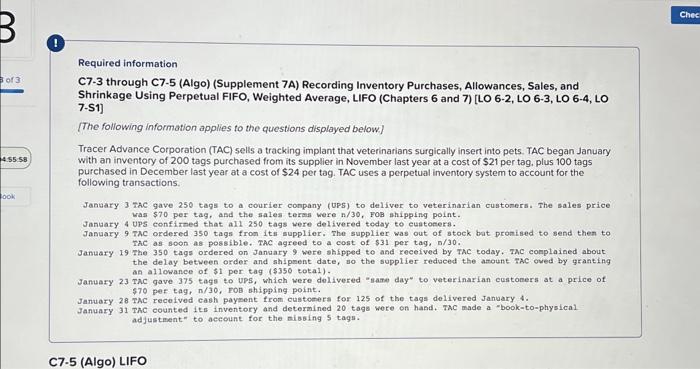

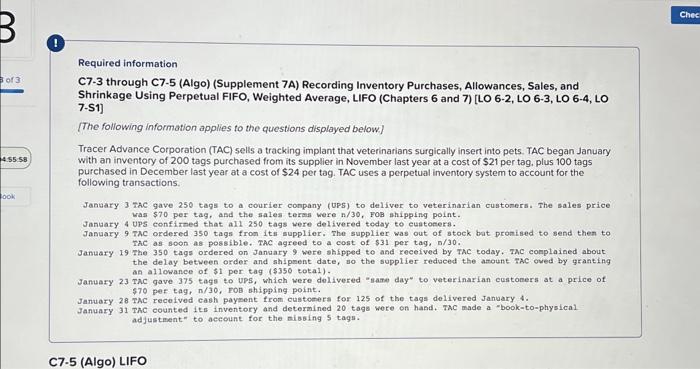

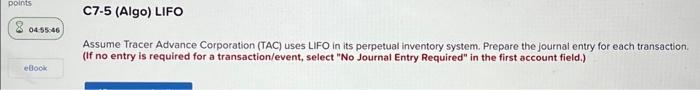

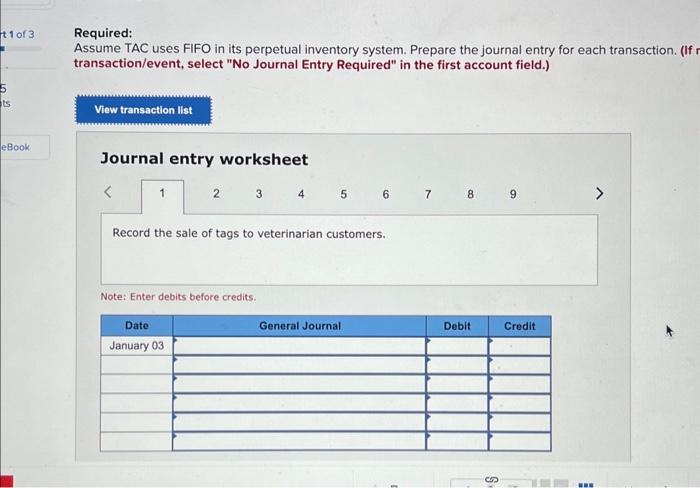

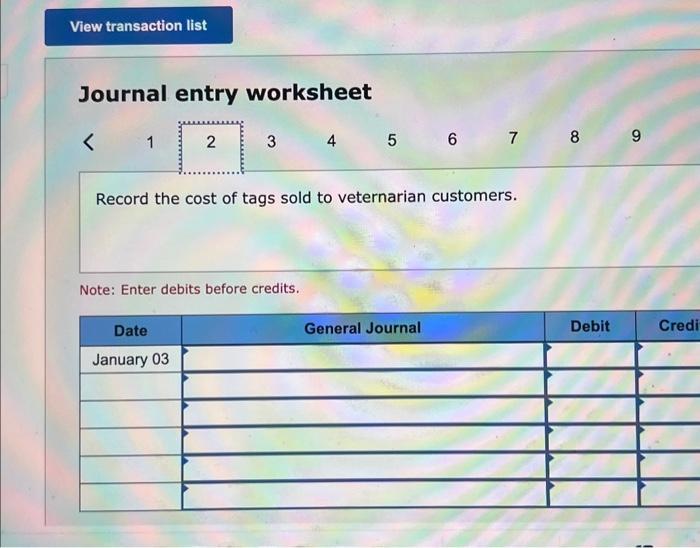

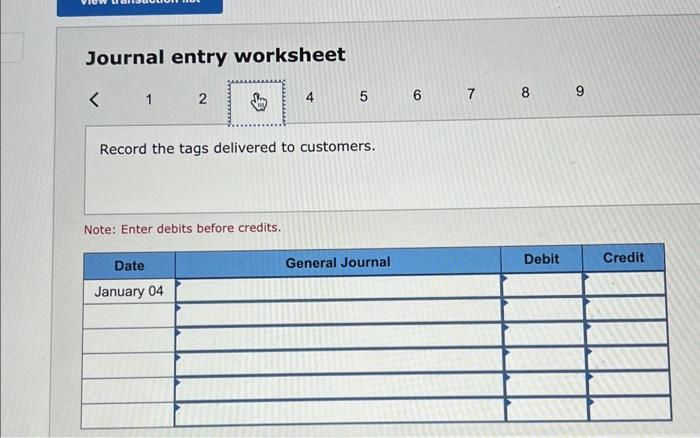

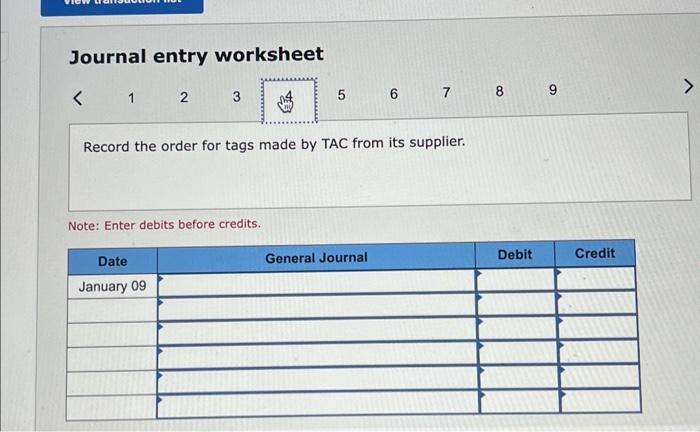

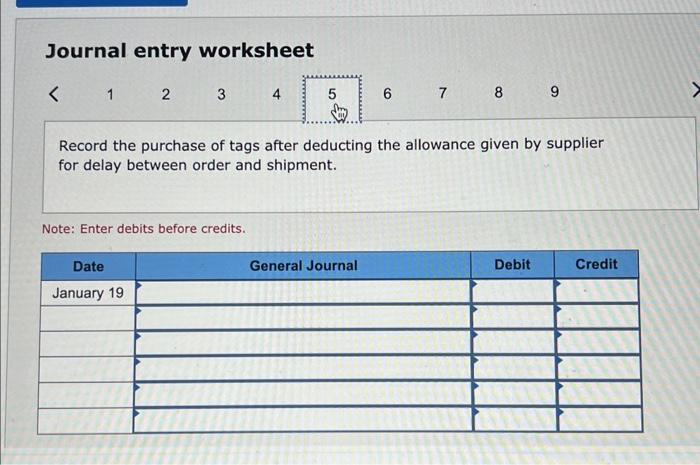

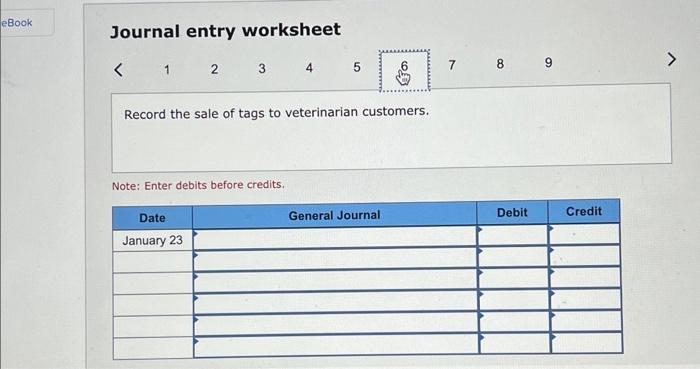

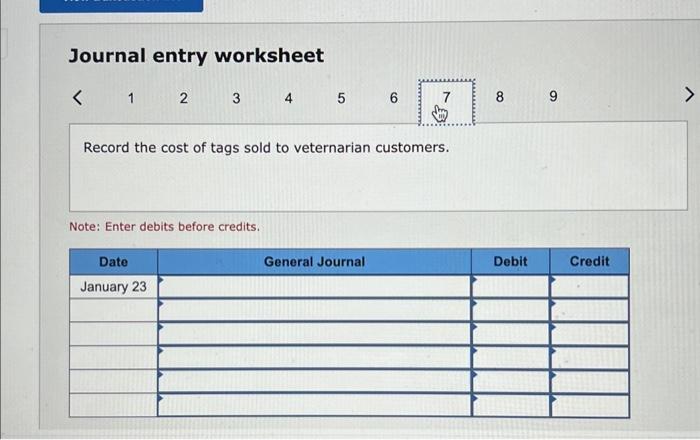

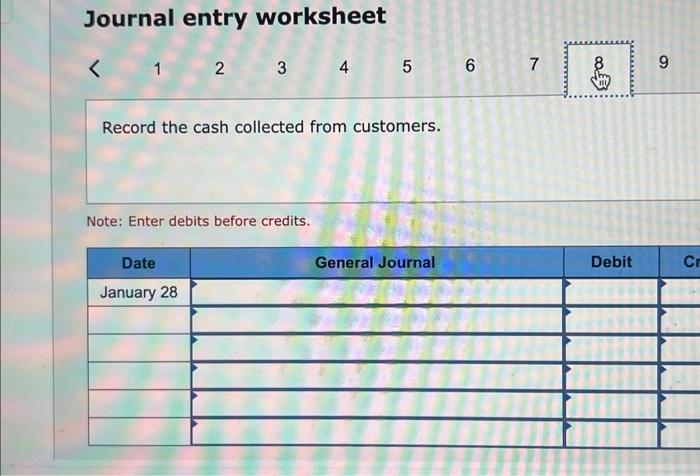

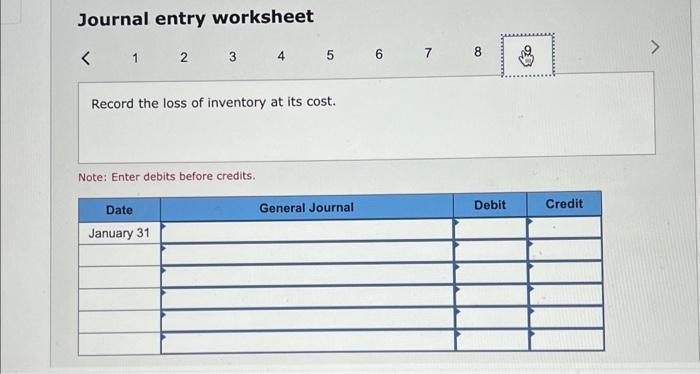

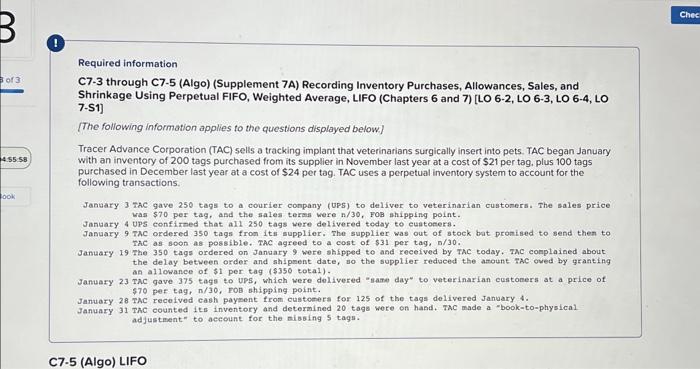

Required information C7-3 through C7-5 (Algo) (Supplement 7A) Recording Inventory Purchases, Allowances, Sales, and Shrinkage Using Perpetual FIFO, Weighted Average, LIFO (Chapters 6 and 7) [LO 6-2, LO 6-3, LO 6-4, LO 7-S1] [The following information applies to the questions displayed below] Tracer Advance Corporation (TAC) sells a tracking implant that veterinarians surgically insert into pets. TAC began January with an inventory of 200 tags purchased from its supplier in November last year at a cost of \$21 per tag. plus 100 tags purchased in December last year at a cost of $24 per tag. TAC uses a perpetual inventory system to account for the following transactions. Jantary 3 IAC gave 250 tags to a courier conpany (UPs) to deliver to veterinarian custoners. The sales price was $70 per tag, and the sales terms were n/30, FoB shipping point. January 4 UPs confirned that all 250 tags were delivered teday to cuntomers. January 9 TAC ordered 350 tags from its supplier. The supplier was out of stock bat pronised to send then to TAC as soon as possible. TAC agreed to a cost of $31 per tag, D/30. January 19 the 350 tags ordered on Janaary 9 were shipped to and received by ThC today. TaC complained about the delay between order and shipment date, so the supplier reduced the amount Fac oved by granting an allowance of $1 per tag (\$350 total). January 23TAC gave 375 tags to ups, which were delivered "sane day" to veterinarian custoners at a price of $70 per tag, n/30, rob shipping point. January 28FAC recelved cash payment from customers for 125 of the tags delivered January 4. January 31 TAC counted its inventory and determined 20 togs were on habd. TAC made a "book-to-physical adjustment" to account for the mising 5 tags. Assume Tracer Advance Corporation (TAC) uses LIFO in its perpetual inventory system. Prepare the journal entry for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required: Assume TAC uses FIFO in its perpetual inventory system. Prepare the journal entry for each transaction. ( transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 4 5 6 7 8 9 Record the sale of tags to veterinarian customers. Note: Enter debits before credits. Journal entry worksheet Record the cost of tags sold to veternarian customers. Note: Enter debits before credits. Journal entry worksheet Record the tags delivered to customers. Note: Enter debits before credits. Journal entry worksheet Record the order for tags made by TAC from its supplier. Note: Enter debits before credits. Journal entry worksheet Record the purchase of tags after deducting the allowance given by supplier for delay between order and shipment. Note: Enter debits before credits. Journal entry worksheet Record the sale of tags to veterinarian customers. Note: Enter debits before credits. Journal entry worksheet 1 Record the cost of tags sold to veternarian customers. Note: Enter debits before credits. Journal entry worksheet Record the cash collected from customers. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits