Please help me resolve this.

Please help me resolve this.

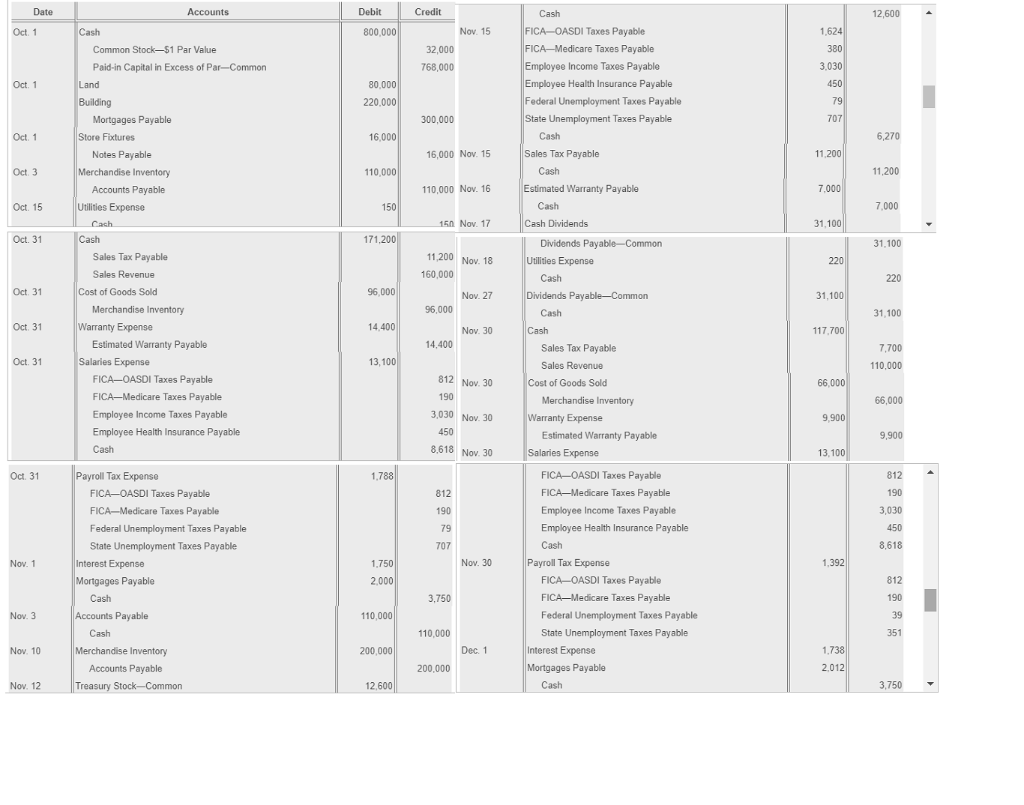

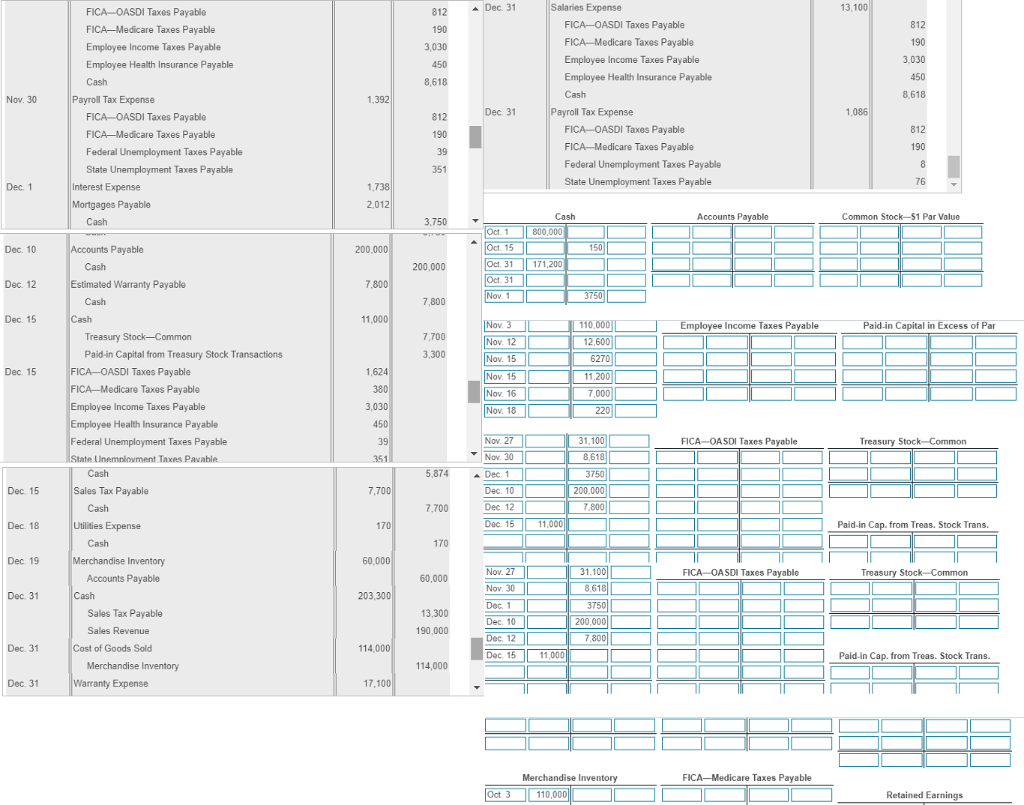

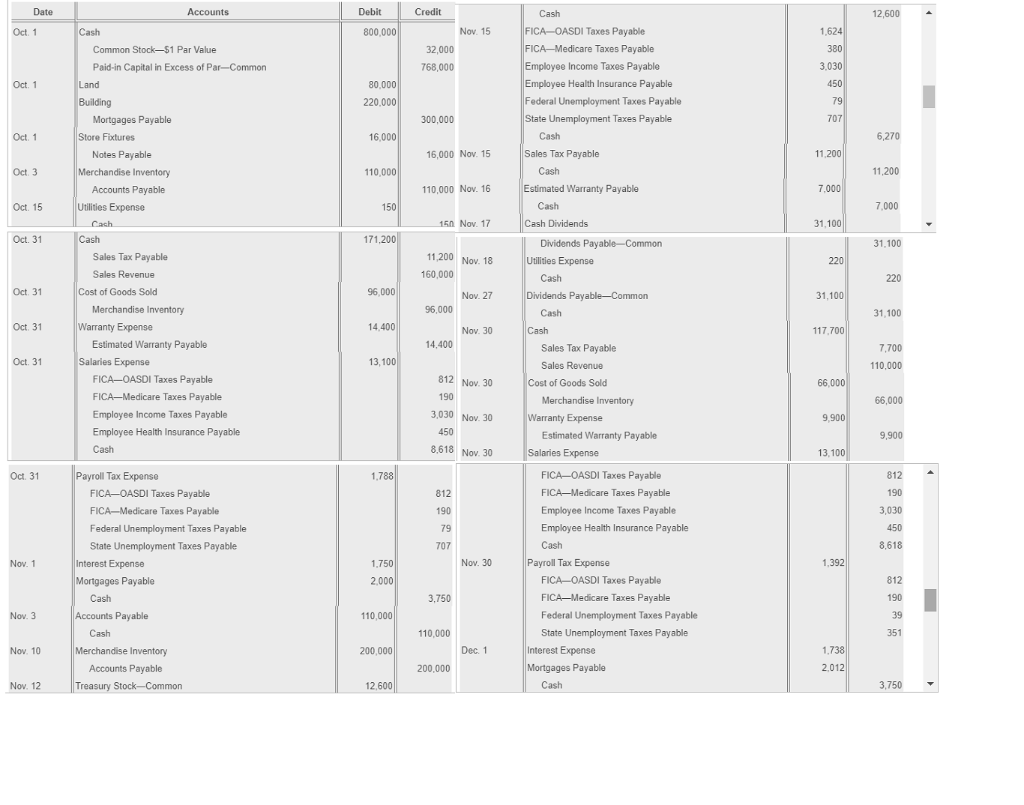

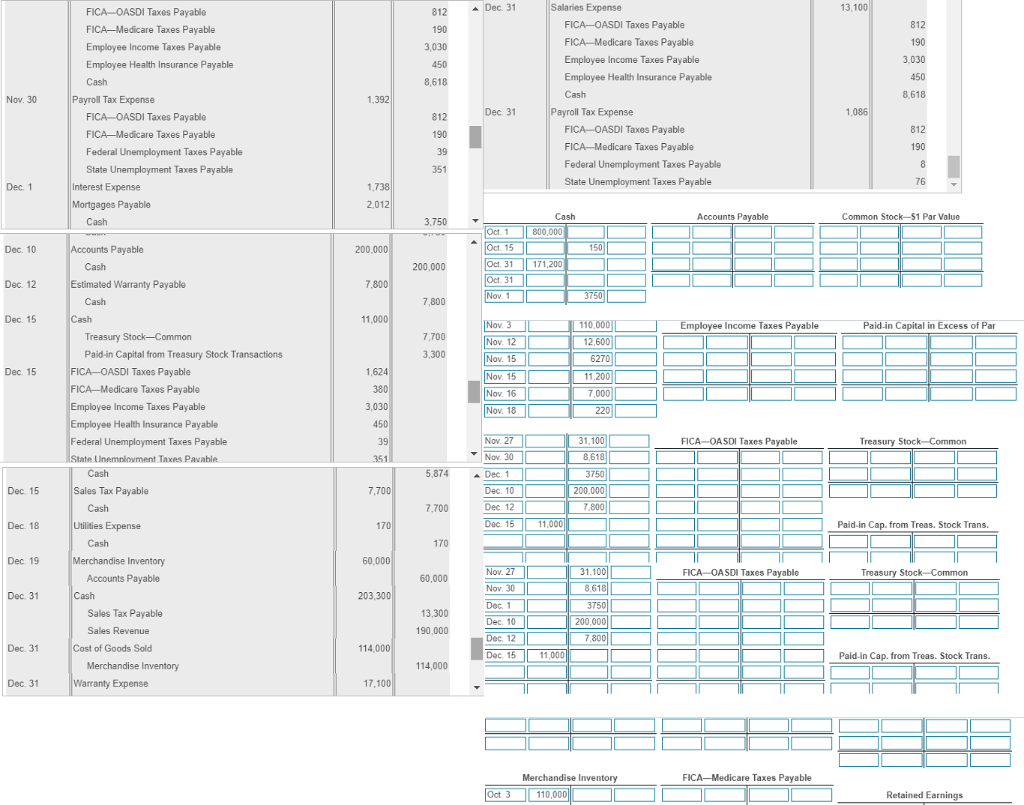

Date Debit 12,600 FICA-OASDI Taxes Payable FICA-Medicare Taxes Pay Employee Income Taxes Payable Employee Health Insurance Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable 1,624 380 3,030 450 800,000 Nov. 15 Common Stock-$1 Par Value able 2,000 768,000 Paid-in Capital in Excess of Par-Common 80,000 220,000 300,000 Mortgages Payable Store Fixtures 16,000 16,000 Nov. 15 Sales Tax Payable 11,200 Notes Payable Merchandise Inventory Accounts Payable 110,000 11,200 110,000 Nov. 16 Estimated Warranty Payable Oct. 15 Utilities Expense Cash 7,000 16No 17h Dedens Oct. 31 171,200 Dividends Payable-Common Utilities Expense 31,100 1,200 Nov. 18 160,000 Sales Tax Payable Sales Revenue Cash 220 Oct. 31 Cost of Goods Sold 96,000 Nov. 27 aya 31,100 Merchandise Inventory Warranty Expense 96,000 Cash 31,100 Oet 31 Waranty Expense 14.400 Nov. 30 Cash 117,700 Estimated Warranty Payable 14.400 Sales Tax Payable Sales Revenue Oct. 31 Salaries Expense 13,100 110,000 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable 812 Nov. 30 Cost of Goods Sold 3,030 Nov. 30 8,618 Nov. 30 66,000 Merchandise Inventory 66,000 Warranty Expense 9,900 Estimated Warranty Payable Salaries Expense 13,100 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable Cash Payroll Tax Expense 1,788 812 FICA OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable ,030 79 8,618 Nov. 30 Payroll Tax Expense Interest Expense Mortgages Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable 2,000 3,750 Accounts Payable 110,000 39 110,000 1 Interest Expense Mortgages Payable Nov. 10 Merchandise Inventory 200,000 Dec. Accounts Payable 200,000 2.012 Nov. 12 easury StockCommon 12,600 Salaries Expense 3,100 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable 812 Dec 31 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable ,030 Nov. 30 Payrol Tax Expense Payroll Tax Expense FICA OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Dec. 1 1,738 Mortgages Payable Common Stock--$1 Par Value 3,750 Oct 1800.000 Oct 15 10 ccounts Payable 200,000 00,000 Oct 31 171.200 31 Estimated Warranty Payable ,800 3750 7,800 110 Employee Income Taxes Payable id.in Capital in Excess of Par Treasury Stock-Common 7,700 Nov 12 Paid-in Capital from Treasury Stock Transactions FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable Federal Unemployment Taxes Payable 6270 15 31.100 FICA-OASDI Taxes Payable LInemrlowment Taxes Pavable Sales Tax Payable 7,700 Dec. 15 11,000 Paid-in Cap.from Treas. Stock Trans. Dec 19 rchande Inventary Dec 31 Cash 60,000 100FICA OASDI Taxes Payable Treasury Stock Common Accounts Payable 203,300 Sales Tax Payable Sales Revenue 13,300 200,000 90,000c12 Cost of Goods Sold 114,000 Dec. 15 11,000 Paid-in Cap. from Treas. Stock Trans. Merchandise Inventory Warranty Expense 114,000 Dec. 31 17,100 Merchandise Inve FICA-Medicare Taxes Payable Oct 3110,000 Date Debit 12,600 FICA-OASDI Taxes Payable FICA-Medicare Taxes Pay Employee Income Taxes Payable Employee Health Insurance Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable 1,624 380 3,030 450 800,000 Nov. 15 Common Stock-$1 Par Value able 2,000 768,000 Paid-in Capital in Excess of Par-Common 80,000 220,000 300,000 Mortgages Payable Store Fixtures 16,000 16,000 Nov. 15 Sales Tax Payable 11,200 Notes Payable Merchandise Inventory Accounts Payable 110,000 11,200 110,000 Nov. 16 Estimated Warranty Payable Oct. 15 Utilities Expense Cash 7,000 16No 17h Dedens Oct. 31 171,200 Dividends Payable-Common Utilities Expense 31,100 1,200 Nov. 18 160,000 Sales Tax Payable Sales Revenue Cash 220 Oct. 31 Cost of Goods Sold 96,000 Nov. 27 aya 31,100 Merchandise Inventory Warranty Expense 96,000 Cash 31,100 Oet 31 Waranty Expense 14.400 Nov. 30 Cash 117,700 Estimated Warranty Payable 14.400 Sales Tax Payable Sales Revenue Oct. 31 Salaries Expense 13,100 110,000 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable 812 Nov. 30 Cost of Goods Sold 3,030 Nov. 30 8,618 Nov. 30 66,000 Merchandise Inventory 66,000 Warranty Expense 9,900 Estimated Warranty Payable Salaries Expense 13,100 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable Cash Payroll Tax Expense 1,788 812 FICA OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable ,030 79 8,618 Nov. 30 Payroll Tax Expense Interest Expense Mortgages Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable 2,000 3,750 Accounts Payable 110,000 39 110,000 1 Interest Expense Mortgages Payable Nov. 10 Merchandise Inventory 200,000 Dec. Accounts Payable 200,000 2.012 Nov. 12 easury StockCommon 12,600 Salaries Expense 3,100 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable 812 Dec 31 FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable ,030 Nov. 30 Payrol Tax Expense Payroll Tax Expense FICA OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Dec. 1 1,738 Mortgages Payable Common Stock--$1 Par Value 3,750 Oct 1800.000 Oct 15 10 ccounts Payable 200,000 00,000 Oct 31 171.200 31 Estimated Warranty Payable ,800 3750 7,800 110 Employee Income Taxes Payable id.in Capital in Excess of Par Treasury Stock-Common 7,700 Nov 12 Paid-in Capital from Treasury Stock Transactions FICA-OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Income Taxes Payable Employee Health Insurance Payable Federal Unemployment Taxes Payable 6270 15 31.100 FICA-OASDI Taxes Payable LInemrlowment Taxes Pavable Sales Tax Payable 7,700 Dec. 15 11,000 Paid-in Cap.from Treas. Stock Trans. Dec 19 rchande Inventary Dec 31 Cash 60,000 100FICA OASDI Taxes Payable Treasury Stock Common Accounts Payable 203,300 Sales Tax Payable Sales Revenue 13,300 200,000 90,000c12 Cost of Goods Sold 114,000 Dec. 15 11,000 Paid-in Cap. from Treas. Stock Trans. Merchandise Inventory Warranty Expense 114,000 Dec. 31 17,100 Merchandise Inve FICA-Medicare Taxes Payable Oct 3110,000

Please help me resolve this.

Please help me resolve this.