Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME RESPONDING ALL QUESTIONS PLEASE!! I WILL BE VERY THANFULL THANK YOU!! If you are unable to answer ALL questions, please do not

PLEASE HELP ME RESPONDING ALL QUESTIONS PLEASE!! I WILL BE VERY THANFULL THANK YOU!!

PLEASE HELP ME RESPONDING ALL QUESTIONS PLEASE!! I WILL BE VERY THANFULL THANK YOU!!

If you are unable to answer ALL questions, please do not respond.

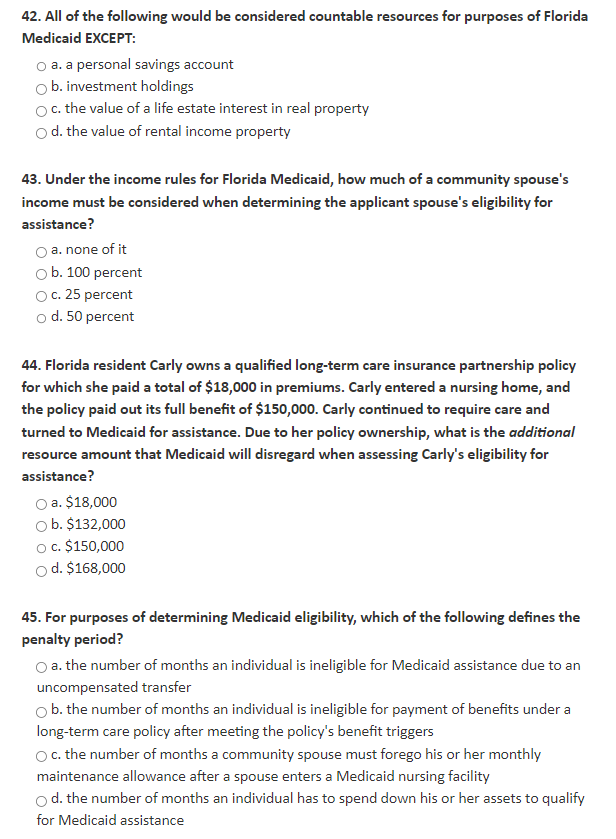

42. All of the following would be considered countable resources for purposes of Florida Medicaid EXCEPT: a. a personal savings account b. investment holdings c. the value of a life estate interest in real property d. the value of rental income property 43. Under the income rules for Florida Medicaid, how much of a community spouse's income must be considered when determining the applicant spouse's eligibility for assistance? a. none of it b. 100 percent c. 25 percent d. 50 percent 44. Florida resident Carly owns a qualified long-term care insurance partnership policy for which she paid a total of $18,000 in premiums. Carly entered a nursing home, and the policy paid out its full benefit of $150,000. Carly continued to require care and turned to Medicaid for assistance. Due to her policy ownership, what is the additional resource amount that Medicaid will disregard when assessing Carly's eligibility for assistance? a. $18,000 b. $132,000 c. $150,000 d. $168,000 45. For purposes of determining Medicaid eligibility, which of the following defines the penalty period? a. the number of months an individual is ineligible for Medicaid assistance due to an uncompensated transfer b. the number of months an individual is ineligible for payment of benefits under a long-term care policy after meeting the policy's benefit triggers c. the number of months a community spouse must forego his or her monthly maintenance allowance after a spouse enters a Medicaid nursing facility d. the number of months an individual has to spend down his or her assets to qualify for Medicaid assistanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started