Answered step by step

Verified Expert Solution

Question

1 Approved Answer

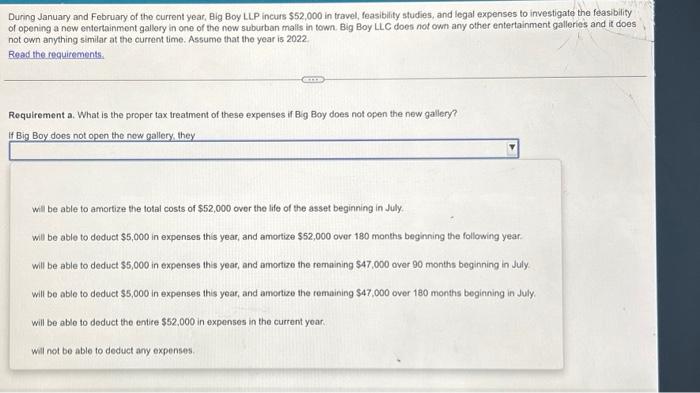

please help me select the best answer!! During January and February of the current year, Big Boy LLP incurs $52,000 in travel, feasibility studies, and

please help me select the best answer!!

During January and February of the current year, Big Boy LLP incurs $52,000 in travel, feasibility studies, and legal expenses to investigate the feasibilify of opening a new entertainment gallery in one of the now suburban malls in town. Big Boy LLC does not own any other entertainment galleries and it does not own anything similar at the current time. Assume that the year is 2022. Read the requirements. Requirement a. What is the proper tax treatment of these expenses if Big Boy does not open the new gallery? Will be able to amortize the total costs of $52,000 over the life of the asset beginning in July. Will be able to deduct $5,000 in expenses this year, and amortize $52,000 over 180 months beginning the following year. will be able to deduct $5,000 in expenses this year, and amortize the remaining $47,000 over 90 months beginning in July will be able to deduct $5,000 in expenses this year, and amortize the remaining $47,000 over 180 months beginning in July. will be able to deduct the entire $52,000 in expenses in the current yoar. Will not be able to deduct any expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started