PLEASE HELP ME!!!

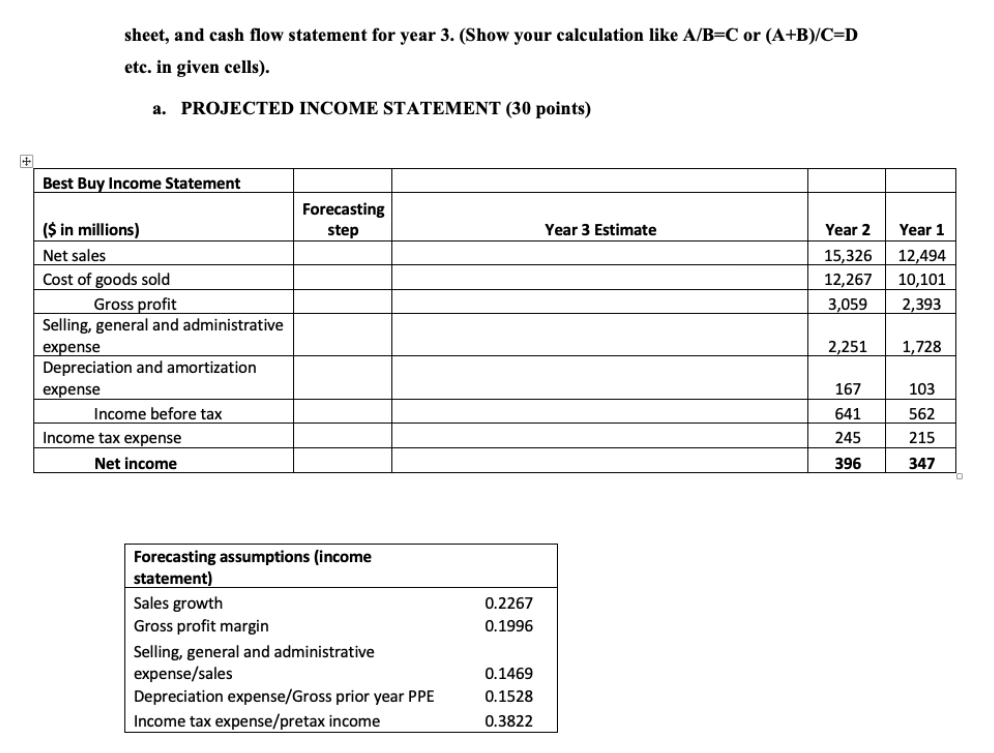

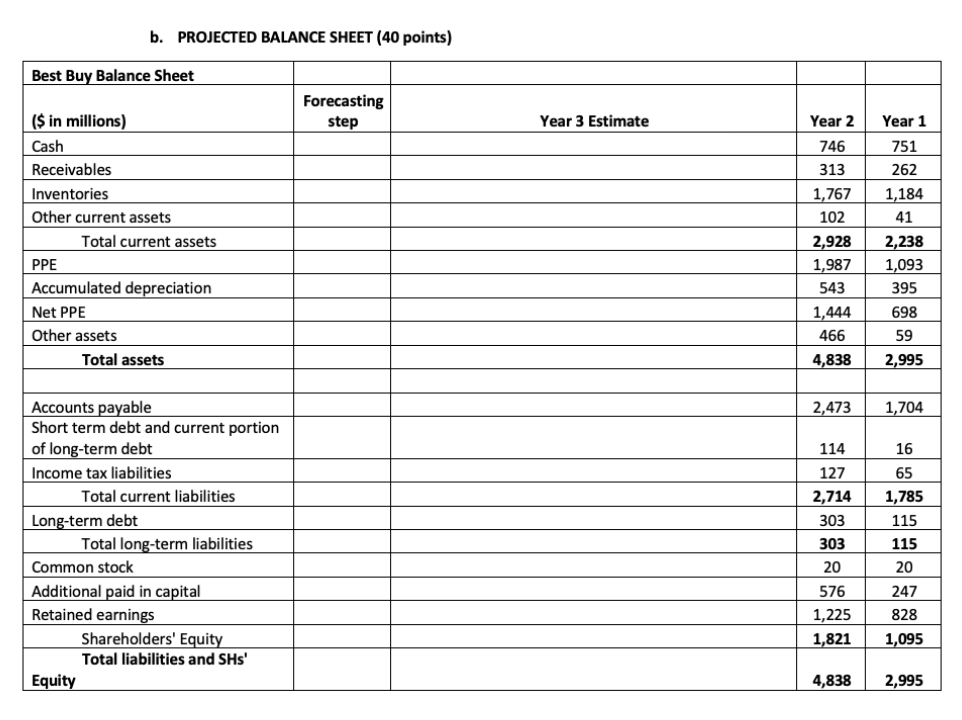

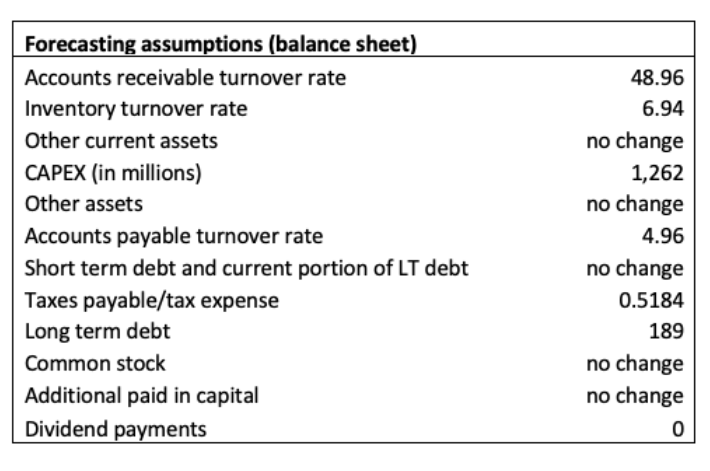

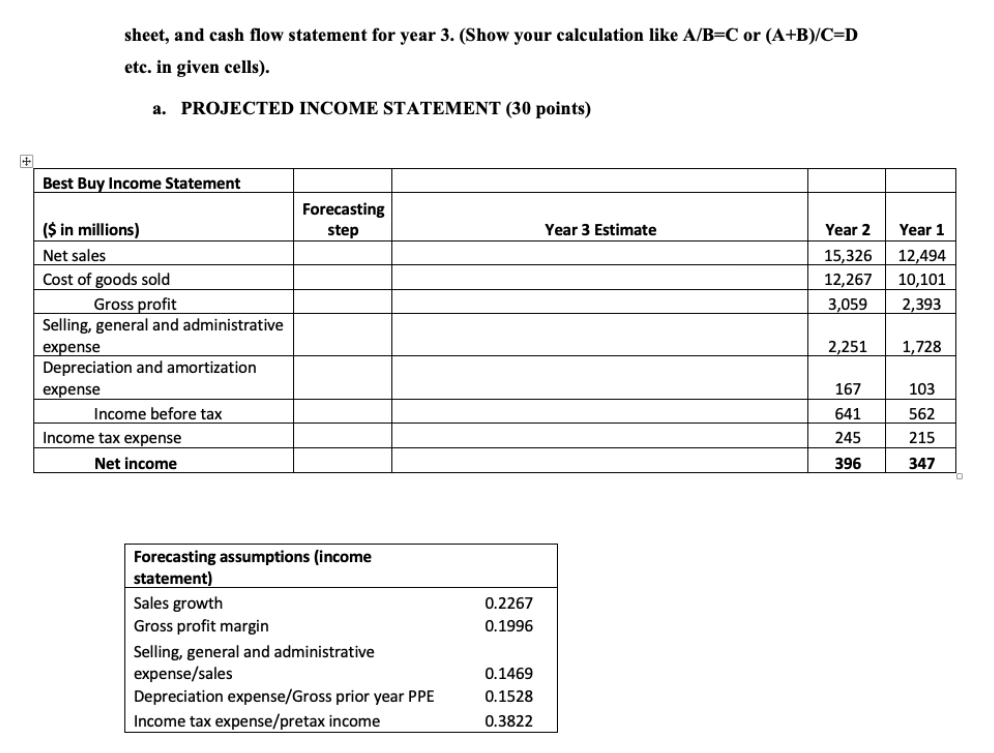

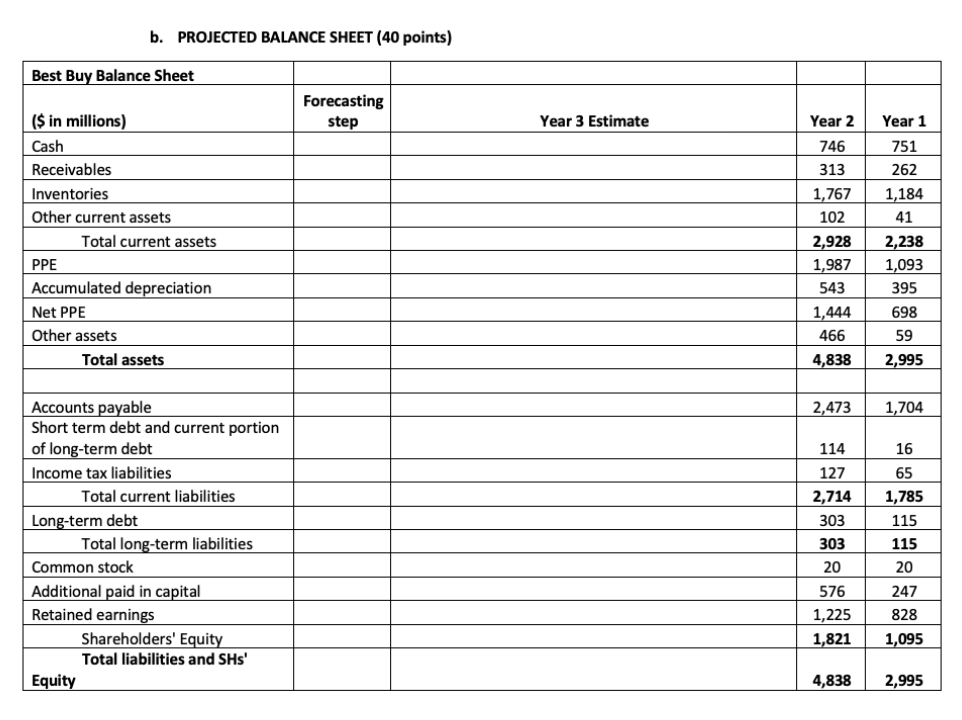

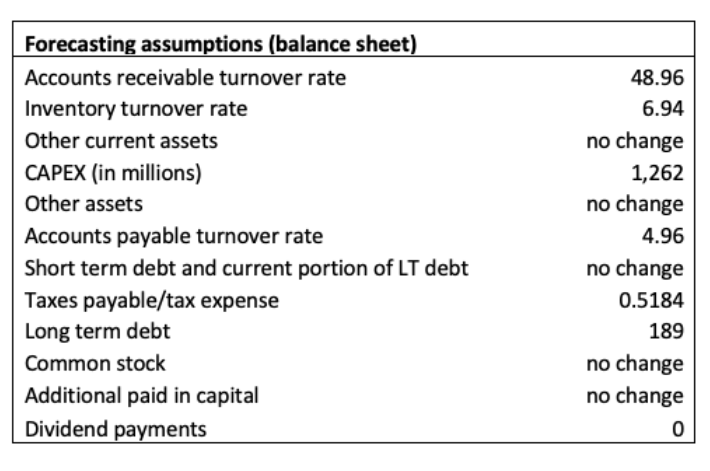

sheet, and cash flow statement for year 3. (Show your calculation like A/B=C or (A+B)/C=D etc. in given cells). a. PROJECTED INCOME STATEMENT (30 points) Best Buy Income Statement Forecasting step Year 3 Estimate Year 2 15,326 12,267 3,059 Year 1 12,494 10,101 2,393 ($ in millions) Net sales Cost of goods sold Gross profit Selling, general and administrative expense Depreciation and amortization expense Income before tax Income tax expense Net income 2,251 1,728 167 103 641 245 562 215 96 347 0.2267 0.1996 Forecasting assumptions (income statement) Sales growth Gross profit margin Selling, general and administrative expense/sales Depreciation expense/Gross prior year PPE Income tax expense/pretax income 0.1469 0.1528 0.3822 b. PROJECTED BALANCE SHEET (40 points) Best Buy Balance Sheet Forecasting step Year 3 Estimate Year 1 ($ in millions) Cash Receivables Inventories Other current assets Total current assets PPE Accumulated depreciation Net PPE Other assets Total assets Year 2 746 313 1,767 102 2,928 1,987 543 1,444 466 4,838 751 262 1,184 41 2,238 1,093 395 698 59 2,995 2,473 1,704 16 65 1,785 115 Accounts payable Short term debt and current portion of long-term debt Income tax liabilities Total current liabilities Long-term debt Total long-term liabilities Common stock Additional paid in capital Retained earnings Shareholders' Equity Total liabilities and SHs' Equity 114 127 2,714 303 303 20 576 1,225 1,821 115 20 247 828 1,095 4,838 2,995 Forecasting assumptions (balance sheet) Accounts receivable turnover rate Inventory turnover rate Other current assets CAPEX (in millions) Other assets Accounts payable turnover rate Short term debt and current portion of LT debt Taxes payable/tax expense Long term debt Common stock Additional paid in capital Dividend payments 48.96 6.94 no change 1,262 no change 4.96 no change 0.5184 189 no change no change 0 sheet, and cash flow statement for year 3. (Show your calculation like A/B=C or (A+B)/C=D etc. in given cells). a. PROJECTED INCOME STATEMENT (30 points) Best Buy Income Statement Forecasting step Year 3 Estimate Year 2 15,326 12,267 3,059 Year 1 12,494 10,101 2,393 ($ in millions) Net sales Cost of goods sold Gross profit Selling, general and administrative expense Depreciation and amortization expense Income before tax Income tax expense Net income 2,251 1,728 167 103 641 245 562 215 96 347 0.2267 0.1996 Forecasting assumptions (income statement) Sales growth Gross profit margin Selling, general and administrative expense/sales Depreciation expense/Gross prior year PPE Income tax expense/pretax income 0.1469 0.1528 0.3822 b. PROJECTED BALANCE SHEET (40 points) Best Buy Balance Sheet Forecasting step Year 3 Estimate Year 1 ($ in millions) Cash Receivables Inventories Other current assets Total current assets PPE Accumulated depreciation Net PPE Other assets Total assets Year 2 746 313 1,767 102 2,928 1,987 543 1,444 466 4,838 751 262 1,184 41 2,238 1,093 395 698 59 2,995 2,473 1,704 16 65 1,785 115 Accounts payable Short term debt and current portion of long-term debt Income tax liabilities Total current liabilities Long-term debt Total long-term liabilities Common stock Additional paid in capital Retained earnings Shareholders' Equity Total liabilities and SHs' Equity 114 127 2,714 303 303 20 576 1,225 1,821 115 20 247 828 1,095 4,838 2,995 Forecasting assumptions (balance sheet) Accounts receivable turnover rate Inventory turnover rate Other current assets CAPEX (in millions) Other assets Accounts payable turnover rate Short term debt and current portion of LT debt Taxes payable/tax expense Long term debt Common stock Additional paid in capital Dividend payments 48.96 6.94 no change 1,262 no change 4.96 no change 0.5184 189 no change no change 0