PLEASE HELP ME SHOW WORK, I HAVE THE ANSWERS BUT I DO NOT UNDERSTAND HOW TO GET THE ANSWERS. PLEASE EXPLAIN THANK YOU

PLEASE HELP ME SHOW WORK, I HAVE THE ANSWERS BUT I DO NOT UNDERSTAND HOW TO GET THE ANSWERS. PLEASE EXPLAIN THANK YOU

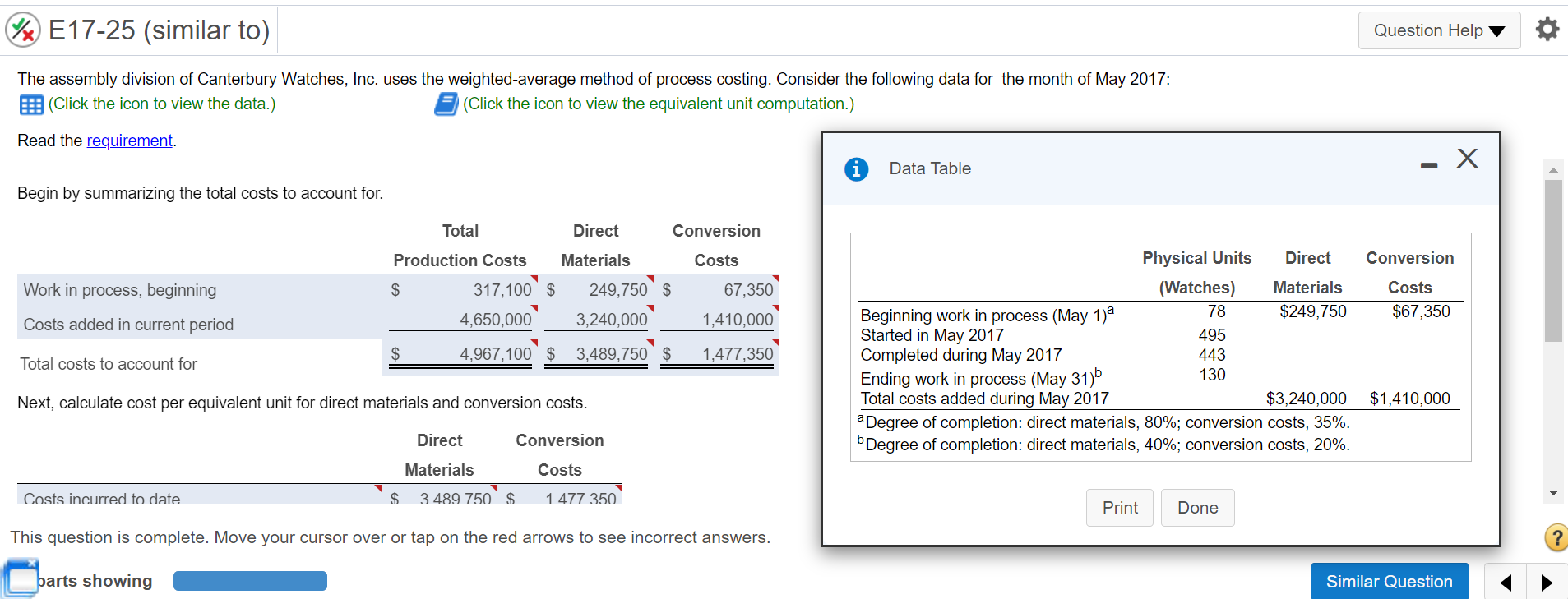

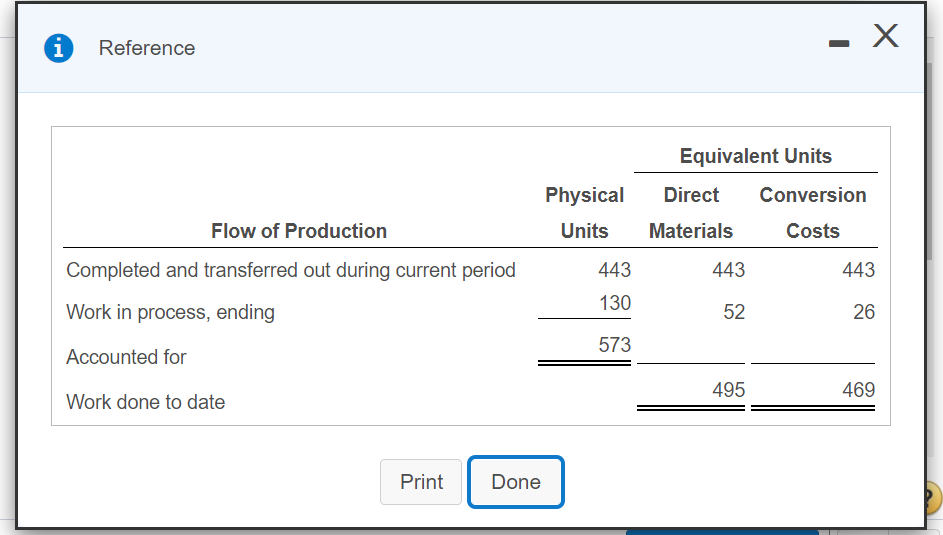

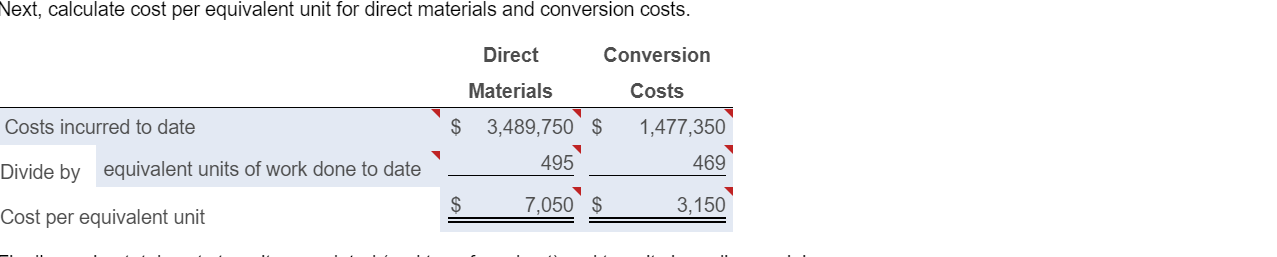

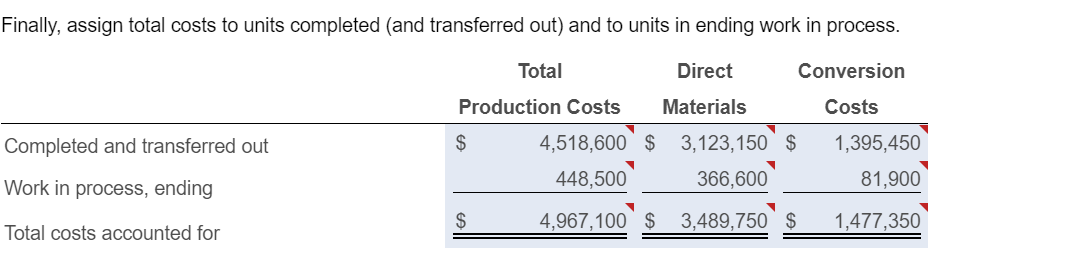

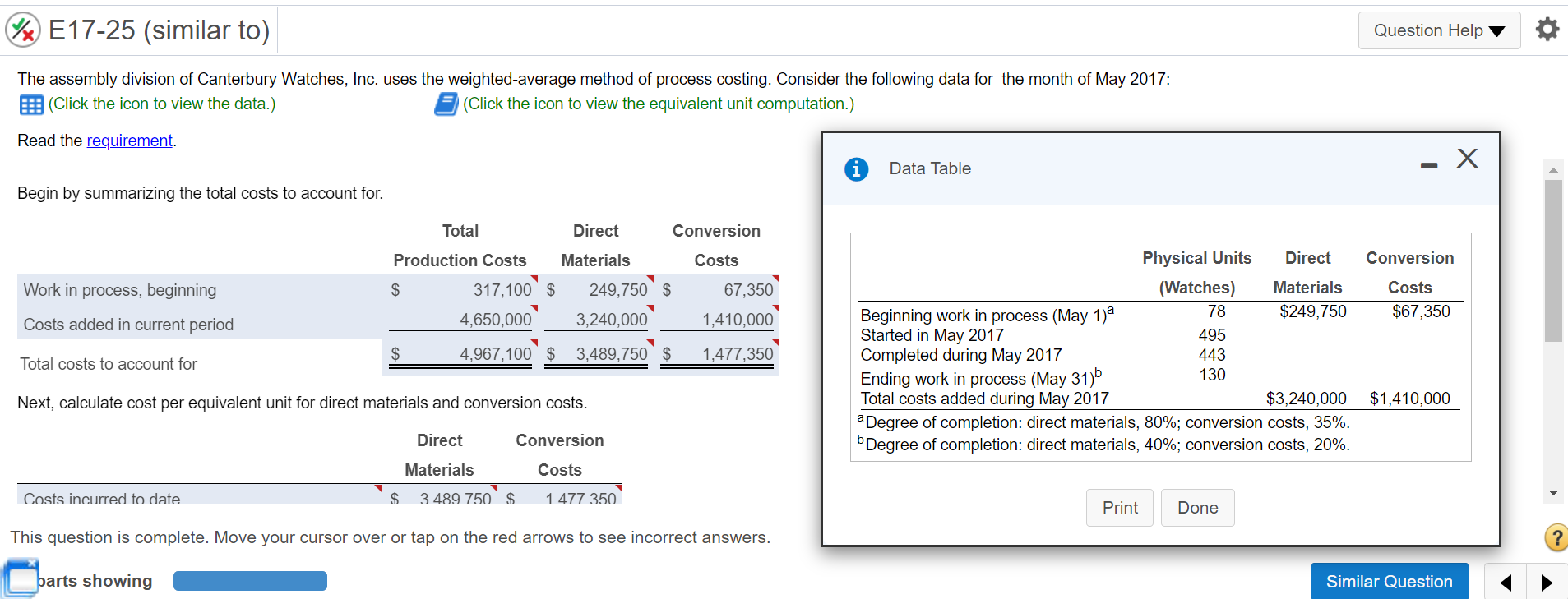

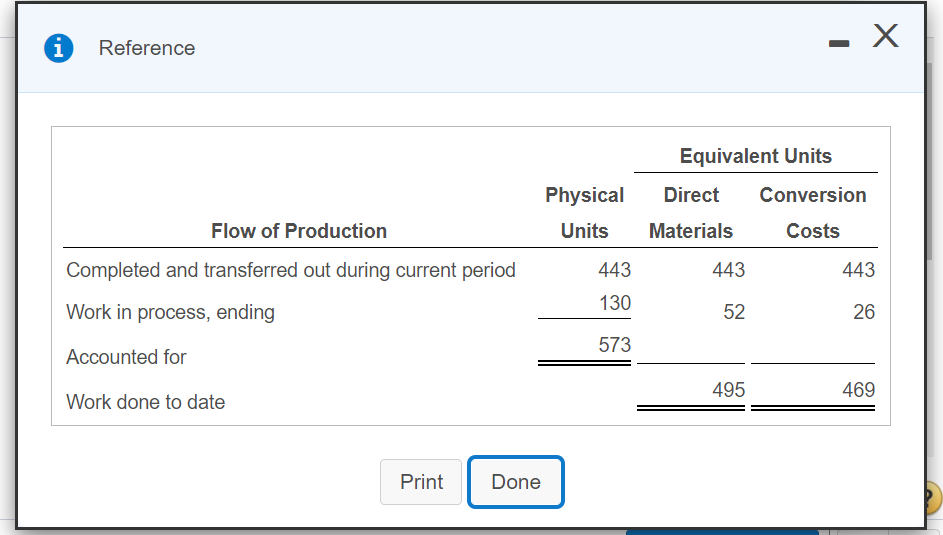

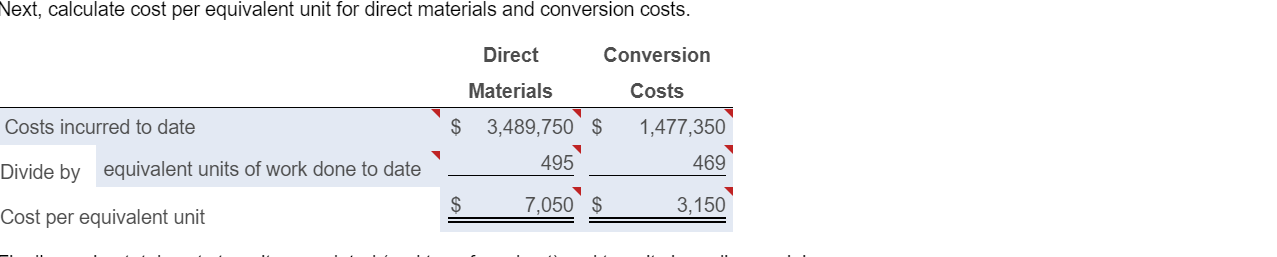

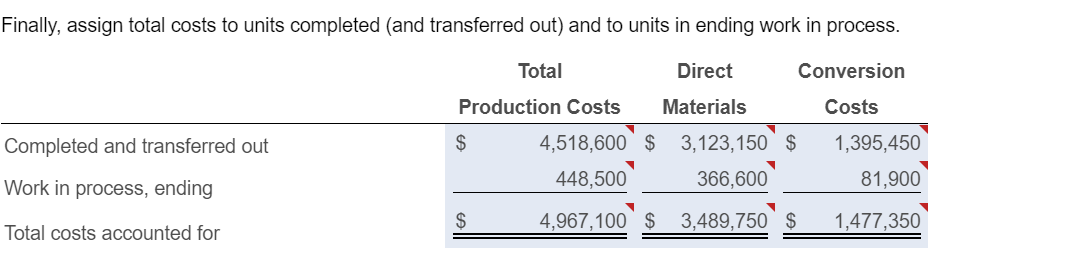

%) E17-25 (similar to) Question Help The assembly division of Canterbury Watches, Inc. uses the weighted average method of process costing. Consider the following data for the month of May 2017: B (Click the icon to view the data.) (Click the icon to view the equivalent unit computation.) Read the requirement. Data Table Begin by summarizing the total costs to account for. Total Direct Conversion Production Costs Materials Costs Conversion Work in process, beginning $ 317,100 $ 4,650,000 249,750 $ 3,240,000 67,350 1,410,000 Costs $67,350 Costs added in current period $ 4,967,100 $ 3,489,750 $ 1,477,350 Physical Units Direct (Watches) Materials Beginning work in process (May 1)a 78 $249,750 Started in May 2017 495 Completed during May 2017 443 Ending work in process (May 31) 130 Total costs added during May 2017 $3,240,000 a Degree of completion: direct materials, 80%; conversion costs, 35%. bDegree of completion: direct materials, 40%; conversion costs, 20%. Total costs to account for Next, calculate cost per equivalent unit for direct materials and conversion costs. $1,410,000 Direct Conversion Materials Costs Costs incurred to date $ 3 489 750 $ 1477 350 Print Done This question is complete. Move your cursor over or tap on the red arrows to see incorrect answers. parts showing Similar Question i - X Reference Equivalent Units Physical Direct Conversion Units Materials Costs Flow of Production Completed and transferred out during current period 443 443 443 130 Work in process, ending 52 26 573 Accounted for 495 469 Work done to date Print Done Next, calculate cost per equivalent unit for direct materials and conversion costs. Direct Conversion Materials Costs Costs incurred to date $ 3,489,750 $ 1,477,350 495 469 Divide by equivalent units of work done to date $ 7,050 $ 3,150 Cost per equivalent unit Finally, assign total costs to units completed (and transferred out) and to units in ending work in process. Total Direct Conversion Production Costs Materials Costs Completed and transferred out $ 3,123,150 $ 4,518,600 $ 448,500 1,395,450 81,900 Work in process, ending 366,600 $ Total costs accounted for 4,967,100 $ 3,489,750 $ 1,477,350

PLEASE HELP ME SHOW WORK, I HAVE THE ANSWERS BUT I DO NOT UNDERSTAND HOW TO GET THE ANSWERS. PLEASE EXPLAIN THANK YOU

PLEASE HELP ME SHOW WORK, I HAVE THE ANSWERS BUT I DO NOT UNDERSTAND HOW TO GET THE ANSWERS. PLEASE EXPLAIN THANK YOU