Please help me slove ths case, just use the T1 and ON428 form to get the income tax return. These are all information the case gave.

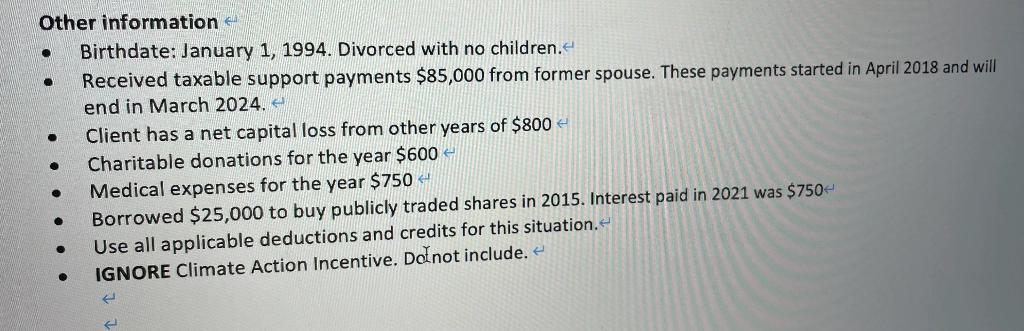

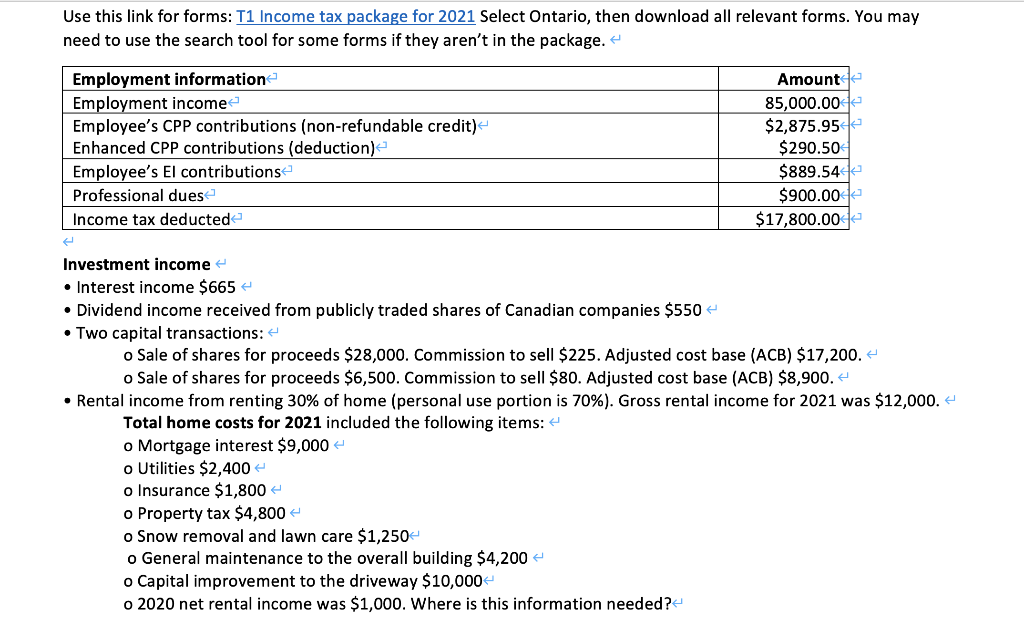

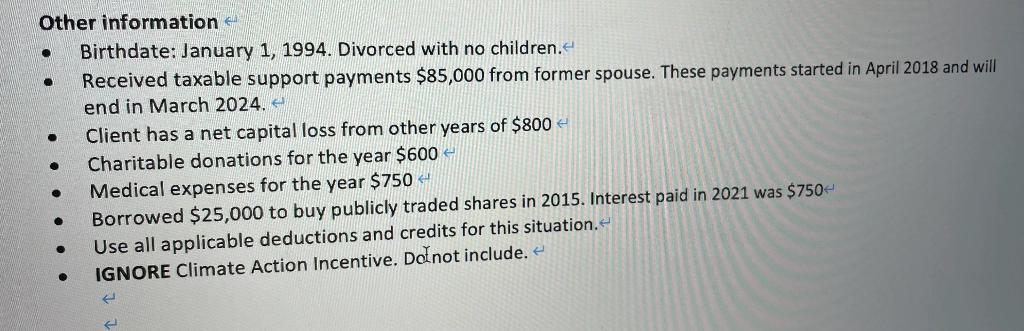

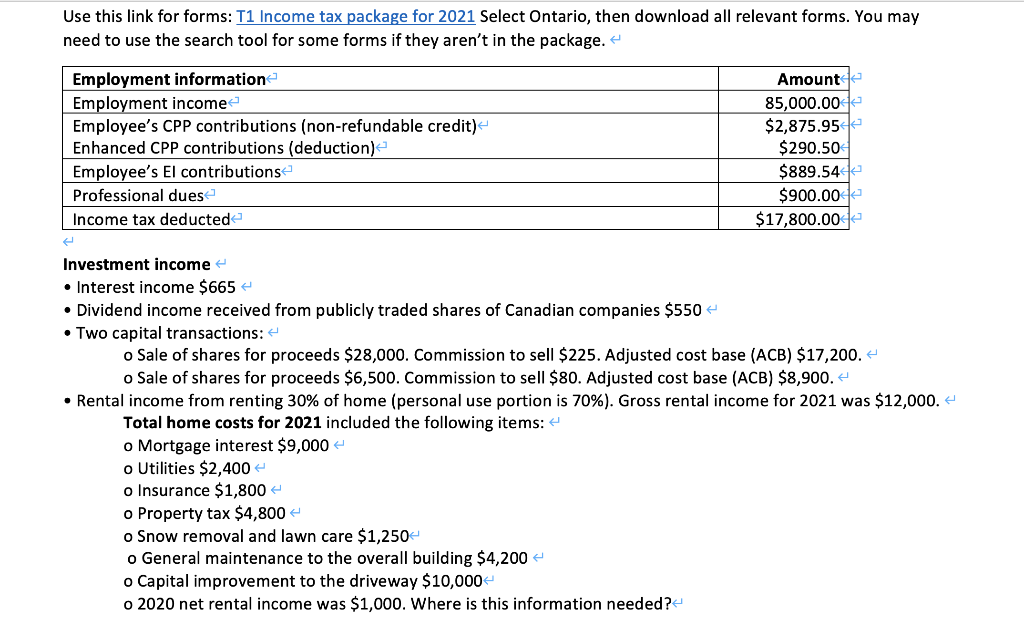

. Other information Birthdate: January 1, 1994. Divorced with no children. Received taxable support payments $85,000 from former spouse. These payments started in April 2018 and will end in March 2024. Client has a net capital loss from other years of $800 Charitable donations for the year $600 Medical expenses for the year $7504 Borrowed $25,000 to buy publicly traded shares in 2015. Interest paid in 2021 was $7504 Use all applicable deductions and credits for this situation. IGNORE Climate Action Incentive. Do not include. + . Use this link for forms: T1 Income tax package for 2021 Select Ontario, then download all relevant forms. You may need to use the search tool for some forms if they aren't in the package. Employment information Employment income Employee's CPP contributions (non-refundable credit) Enhanced CPP contributions (deduction) Employee's El contributions Professional dues Income tax deducted Amount 85,000.00 $2,875.95% $290.50 $889.542 $900.00 | $17,800.00 Investment income Interest income $665 Dividend income received from publicly traded shares of Canadian companies $550 Two capital transactions: o Sale of shares for proceeds $28,000. Commission to sell $225. Adjusted cost base (ACB) $17,200.4 o Sale of shares for proceeds $6,500. Commission to sell $80. Adjusted cost base (ACB) $8,900.4 Rental income from renting 30% of home (personal use portion is 70%). Gross rental income for 2021 was $12,000. Total home costs for 2021 included the following items: o Mortgage interest $9,000 o Utilities $2,400 o Insurance $1,800 o Property tax $4,800 o Snow removal and lawn care $1,250 o General maintenance to the overall building $4,200 o Capital improvement to the driveway $10,000 o 2020 net rental income was $1,000. Where is this information needed? . Other information Birthdate: January 1, 1994. Divorced with no children. Received taxable support payments $85,000 from former spouse. These payments started in April 2018 and will end in March 2024. Client has a net capital loss from other years of $800 Charitable donations for the year $600 Medical expenses for the year $7504 Borrowed $25,000 to buy publicly traded shares in 2015. Interest paid in 2021 was $7504 Use all applicable deductions and credits for this situation. IGNORE Climate Action Incentive. Do not include. + . Use this link for forms: T1 Income tax package for 2021 Select Ontario, then download all relevant forms. You may need to use the search tool for some forms if they aren't in the package. Employment information Employment income Employee's CPP contributions (non-refundable credit) Enhanced CPP contributions (deduction) Employee's El contributions Professional dues Income tax deducted Amount 85,000.00 $2,875.95% $290.50 $889.542 $900.00 | $17,800.00 Investment income Interest income $665 Dividend income received from publicly traded shares of Canadian companies $550 Two capital transactions: o Sale of shares for proceeds $28,000. Commission to sell $225. Adjusted cost base (ACB) $17,200.4 o Sale of shares for proceeds $6,500. Commission to sell $80. Adjusted cost base (ACB) $8,900.4 Rental income from renting 30% of home (personal use portion is 70%). Gross rental income for 2021 was $12,000. Total home costs for 2021 included the following items: o Mortgage interest $9,000 o Utilities $2,400 o Insurance $1,800 o Property tax $4,800 o Snow removal and lawn care $1,250 o General maintenance to the overall building $4,200 o Capital improvement to the driveway $10,000 o 2020 net rental income was $1,000. Where is this information needed