Please help me sole, solutions are from old question

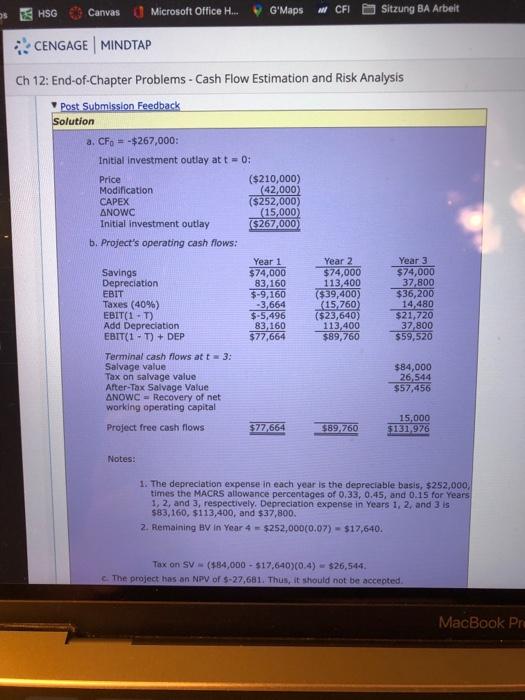

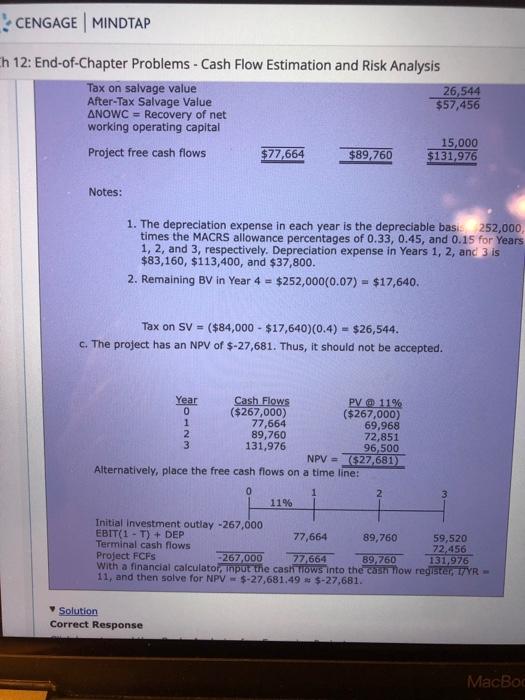

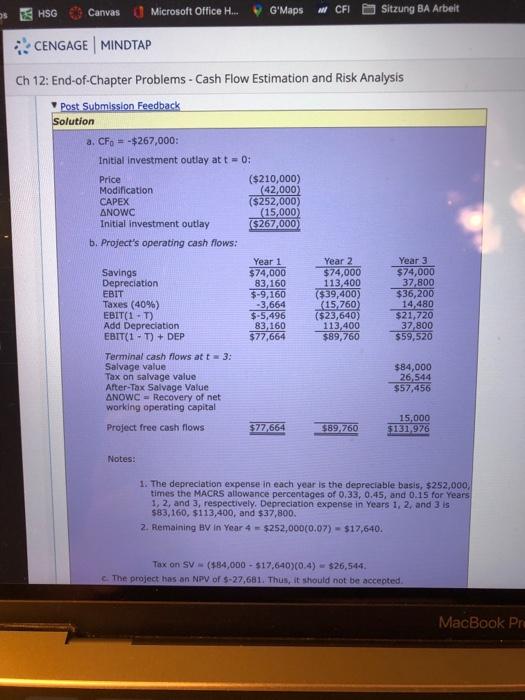

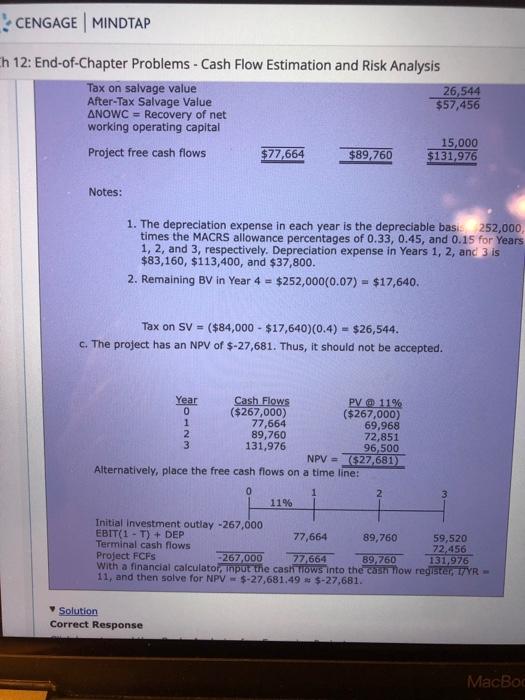

SO no.cengage.com/albumevoindex.html?deploymentid=580373236530384388978097535/BN 97803571234808bild:2563024&smated 2003ctdien Care Microsoft Office H. Ms. Com Sitzung BA Arbeit CENGAGE MINDTAP Ch 12: End-of-Chapter Problems. Cash Flow Estimation and Risk Analysis Q Search this count OX Back to Assignment Keep the Highest 2/5 Attempts 2 S. Problem 12.08 Click here to read the books Analysis of an Expension Project NEW PROJECT ANALYSIS You must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $180,000, and it would cost another 5.36,000 to modify the count for ce by them. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $54,000. The applicable depreciation rates are 33, 45%, 15% and 7. The equipment would more $10.000 net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm 561,000 per year in before tax labor. There tax rate is 10% What is the initial investment outlay for the spectrometer, that is what is the your project cash flow? Round your answer to the nearest cent. Negative amount should be red by $ b. What are the project's annual cash flows in Years 1, 2 and 37 Round your answers the rest cent In Year 15 En Year 2 In Years If the WACC s 1 should the spectrometer be purchased? Grade it Now Save & Continue Continue without saving MacBook Pro HSG G'Maps CFI Sitzung BA Arbeit Canvas Microsoft Office H.... CENGAGE MINDTAP Ch 12: End-of-Chapter Problems - Cash Flow Estimation and Risk Analysis Post Submission Feedback Solution a. CF-$267,000: Initial investment outlay at t = 0; Price ($210,000) Modification (42,000) CAPEX ($252,000) ANOWC (15,000) Initial investment outlay ($267,000) b. Project's operating cash flows: Year 1 Savings $74,000 Depreciation 83,160 EBIT 5-9,160 Taxes (40%) -3,664 EBIT(1-T) $-5,496 Add Depreciation 83,160 EBIT(1 - T) + DEP $77,664 Terminal cash flows at t 3: Salvage value Tax on salvage value After-Tax Salvage Value ANOWC - Recovery of net working operating capital Project free cash flows $77,664 Year 2 $74,000 113,400 ($39,400) 15.760) (523,640) 113,400 $89,760 Year 3 $74,000 37,800 $36,200 14,480 $21,720 37,800 $59,520 $84,000 26,544 $57,456 $89,760 15,000 $131,976 Notes: 1. The depreciation expense in each year is the depreciable basis, $252,000, times the MACRS allowance percentages of 0.33, 0.45, and 0.15 for Years 1, 2, and 3, respectively, Depreciation expense in Years 1, 2 and 3 is $83,160, $113,400, and $37,800. 2. Remaining BV in Year 4 - $252,000(0.07) - $17,640. Tax on SV (584,000 - $17,640)(0.4) - $26,544 The project has an NPV of $-27,681. Thus, it should not be accepted MacBook Pro CENGAGE MINDTAP Ch 12: End-of-Chapter Problems - Cash Flow Estimation and Risk Analysis Tax on salvage value 26,544 After-Tax Salvage Value $57,456 ANOWC = Recovery of net working operating capital 15,000 Project free cash flows $77,664 $89,760 $131,976 Notes: 1. The depreciation expense in each year is the depreciable basi 252,000, times the MACRS allowance percentages of 0.33, 0.45, and 0.15 for Years 1, 2, and 3, respectively. Depreciation expense in Years 1, 2, and 3 is $83,160, $113,400, and $37,800. 2. Remaining BV in Year 4 = $252,000(0.07) = $17,640. Tax on SV = ($84,000 - $17,640)(0.4) = $26,544. c. The project has an NPV of $-27,681. Thus, it should not be accepted. Year Cash Flows PV 11% 0 ($267,000) ($267,000) 1 77,664 69,968 2 89,760 72,851 3 131,976 96,500 NPV = 1527,681 Alternatively, place the free cash flows on a time line: 0 2 11% Initial Investment outlay -267,000 EBIT(1 - T) + DEP 77,664 89,760 59,520 Terminal cash flows 72.456 Project FCFs -267,000 77,664 89,760 131,976 With a financial calculator, input the cash Tows into the cast how register, TYR 11, and then solve for NPV - $-27,681.49 * $-27,681. Solution Correct Response MacBoc