Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me solve A-G October sales are estimated to be $340,000, of which 40 percent will be cash and 60 percent will be credit.

please help me solve A-G

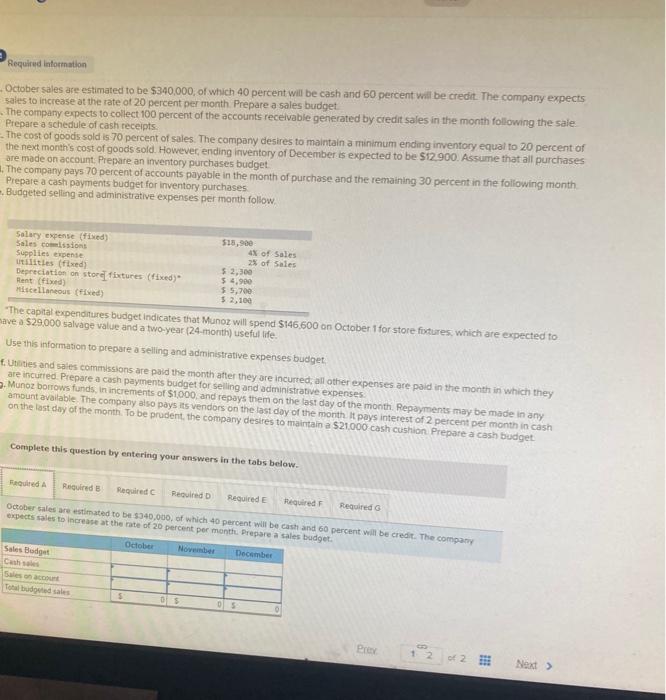

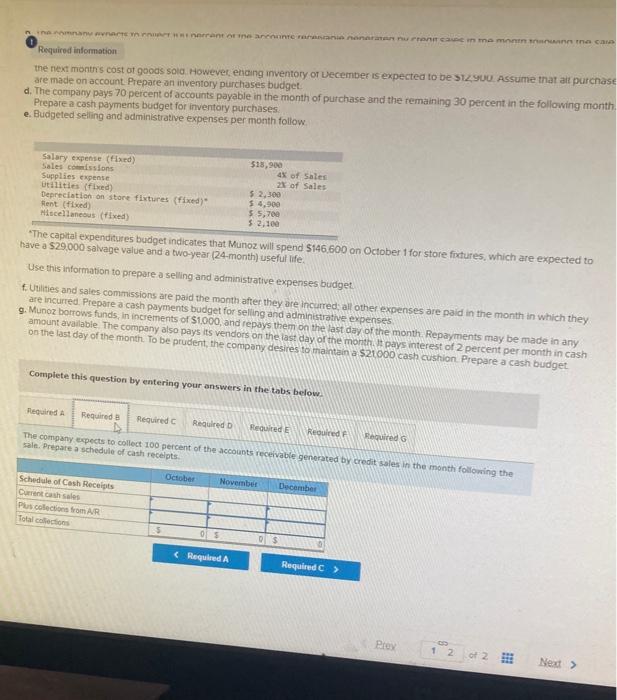

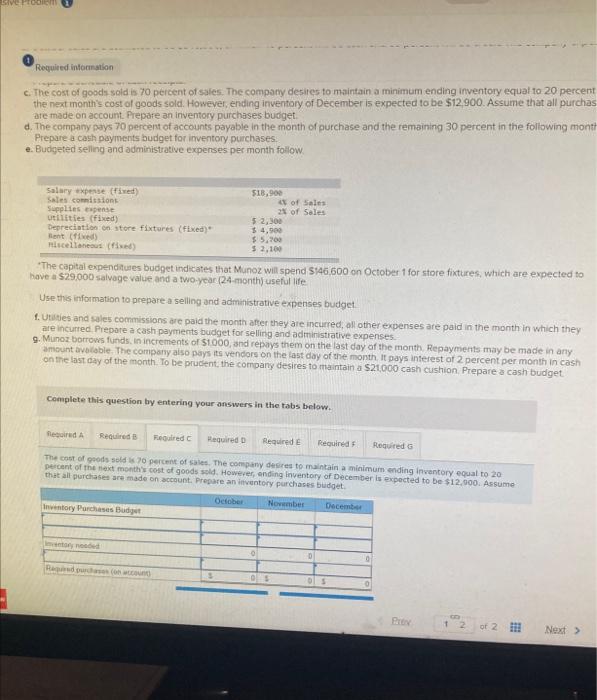

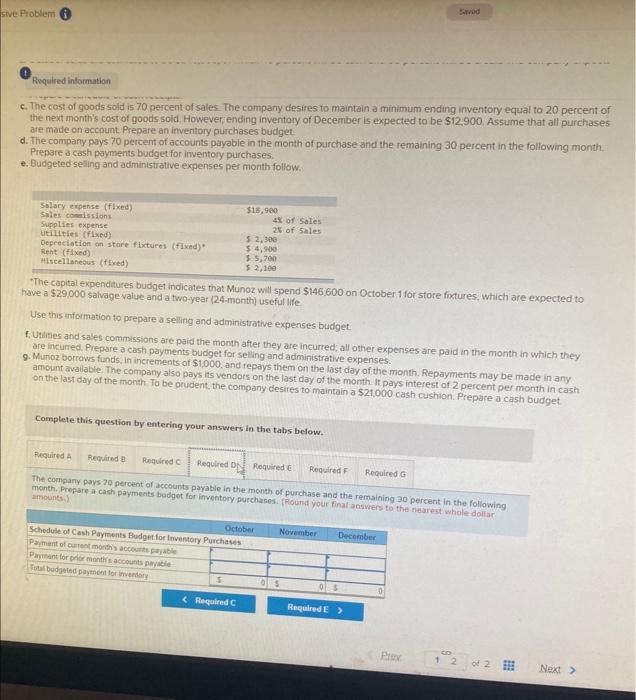

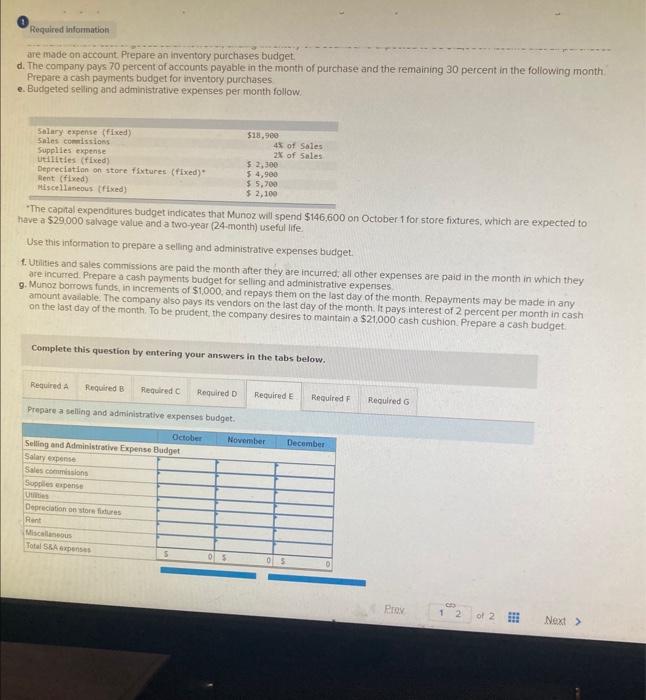

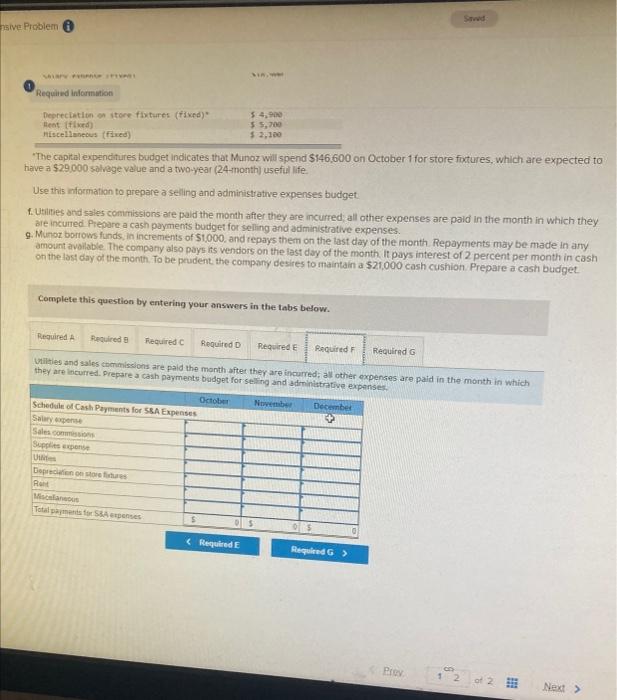

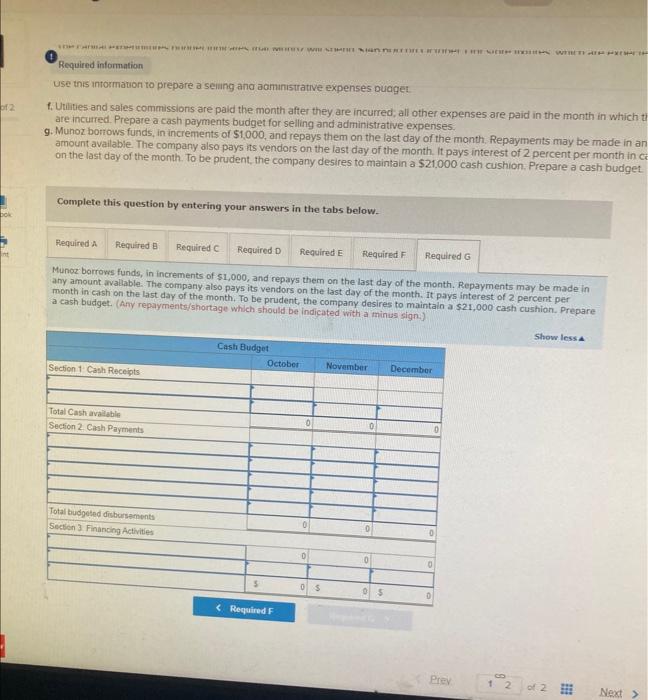

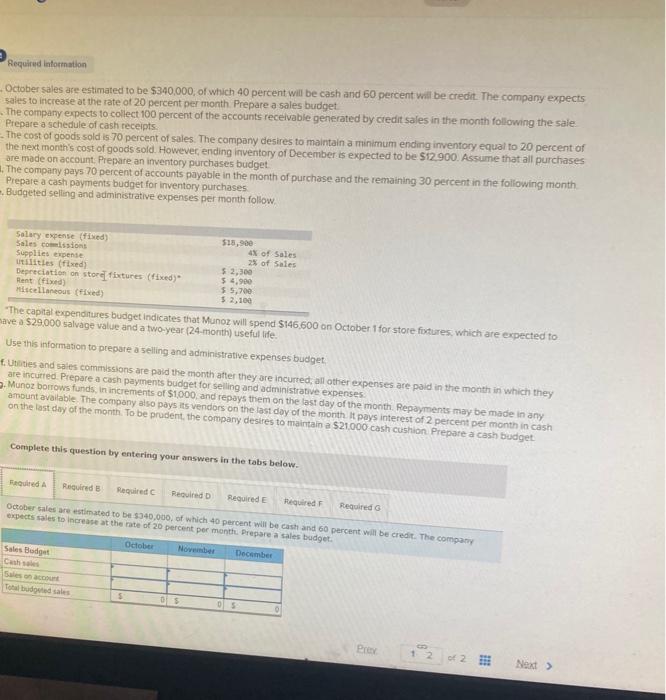

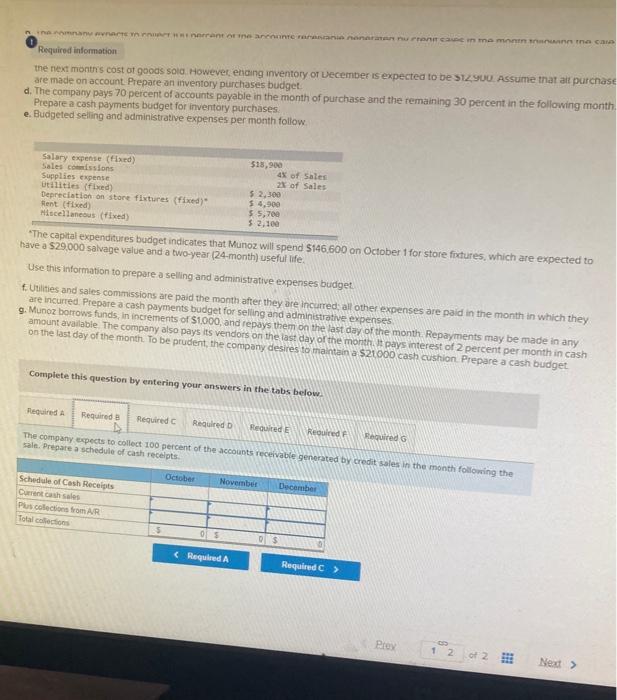

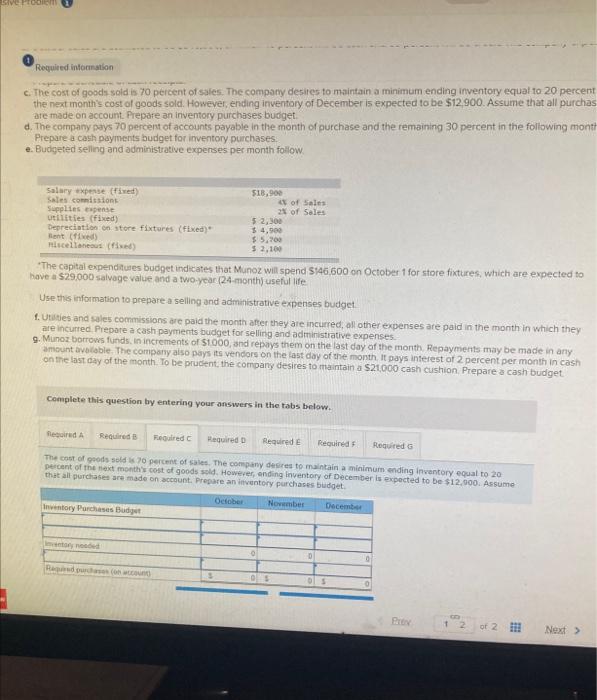

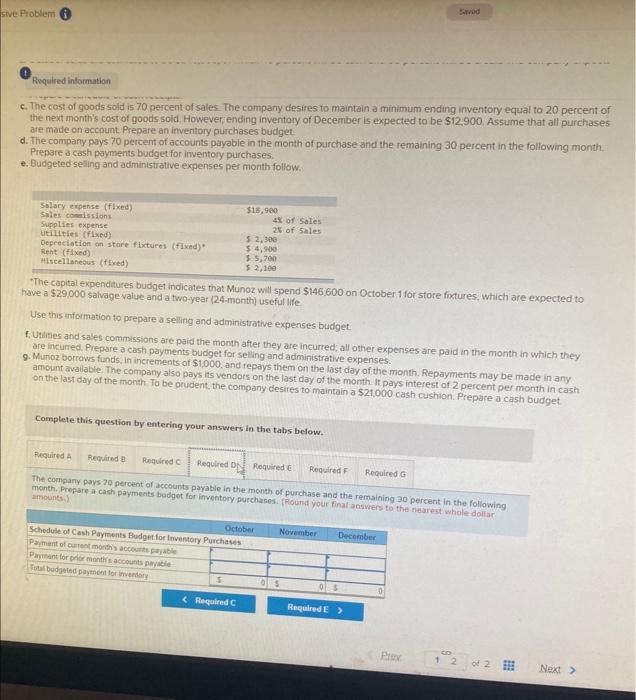

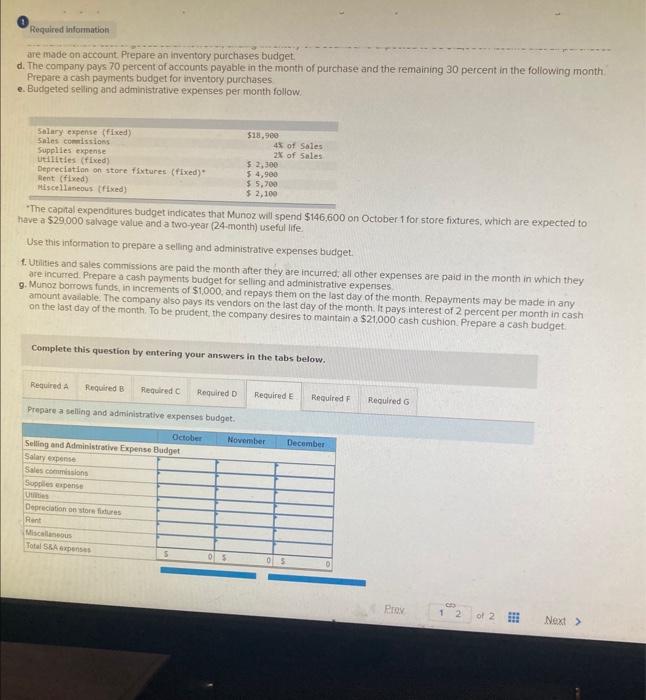

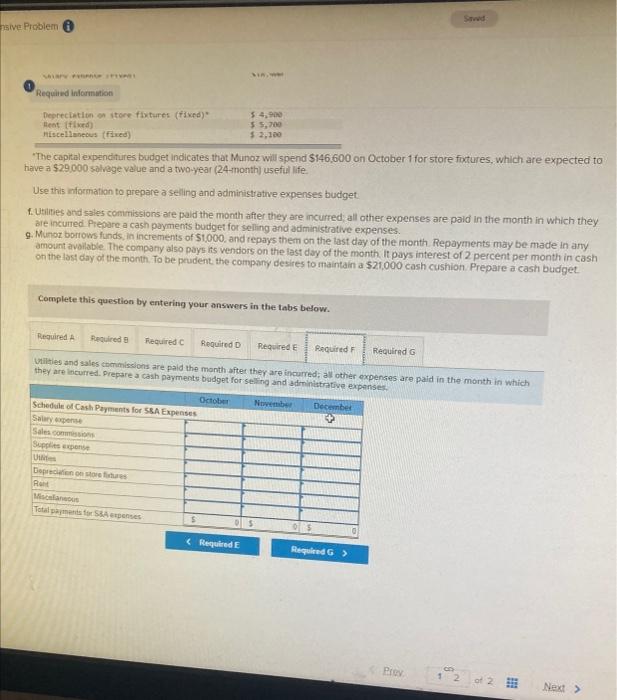

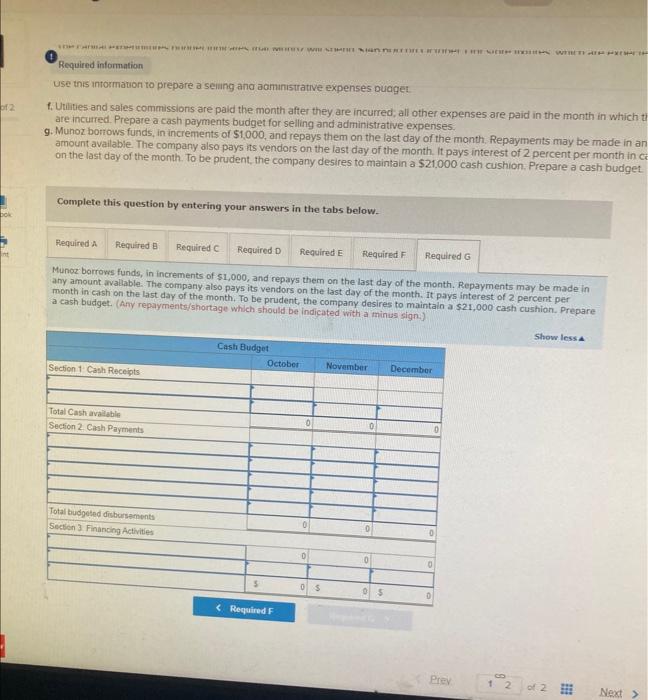

October sales are estimated to be $340,000, of which 40 percent will be cash and 60 percent will be credit. The company expects sales to increase at the rate of 20 percent per month. Prepare a sales budget The company expects to collect 100 percent of the accounts recelvable generated by credit sales in the month following the sale. Prepare a schedule of cash receipts. The cost of goods sold is 70 percent of sales. The company desires to maintain a minimum ending inventory equal to 20 percent of the next month's cost of goods sold. However, ending inventory of December is expected to be $12,900. Assume that all purchases are made on account. Prepare an inventory purchases budget The compaty pays 70 percent of accounts payable in the month of purchase and the remaining 30 percent in the foliowing month. Prepare a cash payments budget for inventory purchases Budgeted seling and adiministrative expenses per month follow. Use this information to prepare a selling and administrative expenses budget, f. Utities and sales commissions are paid the month atter they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 2. Munoz borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any on the last day of the month. To be prudent, the compan the last doy of the month. It pays interest of 2 percent per month in cash Complete this question by entering your answers in the tabs below. October cales are estimated to be 8340,040 , of which 40 percent will be cash and 60 percent will be credit. The company expects sales to increase at the note of 20 percent Dor mankint wil be cassi and 60 . Hles budget. Required information the next months cost of goods sola. However enang inventory or Uecember is expected to be s12yuU Assume that ait purchas: are made on account. Prepare an inventory purchases budget. d. The company pays 70 percent of accounts payable in the month of purchase and the remaining 30 percent in the following month Prepare a cash payments budget for inventory purchases. e. Budgeted selling and administrative expenses per month follow have a $29,000 salvage value and a twores that Munoz will spend $146,600 on October 1 for store fixtures, which are expected to Use this information to prepare a selling and administrative expenses budget f. Unities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses 9. Munoz bortows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any on the last day of the month. To be prudent, the company of last day of the morth th pays interest of 2 percent per month in cash Complete this question by entering your answers in the tabs below. The company expects to collect 100 percent of the accoubts reseivable senocated by credit soles in the month following the sale. Prepare a schiedule of cast recelpts. c. The cost of goods sold is 70 percent of sales. The compony desires to maintain a minimum ending inventory equal to 20 percent the next month's cost of goods sold. However, ending inventory of December 15 expected to be $12900. Assume that all purchas are made on account. Prepare an inventory purchases budget. d. The company pays 70 percent of accounts payable in the month of purchase and the remaining 30 percent in the following mont Prepare a cosh payments budget for inventory purchases. e. Budgeted selling and administrative expenses per month follow. "The capital expenditures bodpet indicates that Munoz will spend 5146,600 on October 1 for store fixtures, which are expected to have a $29,000 salvage value and a two-year (24-month) useful life Use this information to prepare a selling and administrative expenses budget. 1. Utities and sajes commissions dre paid the month after they are incurred, all other expenses are paid in the month in which they are incurted. Prepore a cash payments budget for selling and administrative expenses. 9. Munoz borrows funds, in increments of 51000 , and repays them on the last day af the month. Repayments may be made in any amount avbiabie. The company aiso pays its vendors on the last day of the month it pays interest at 2 percent per month in cash on thic last day of the month. To be prucent, the company desires to maintain a 521,000 cash cushion. Prepare a cash budget Complete this question by entering your answers in the tabs below. The cost of gaods sold is 70 percent of cales. The conpany desires to muintain a minimum ending inventory equal to 20 pecent of the noxt monthr cost of goods sild. Howerer, anding inventory of December is expected to be $12,000. Assume: (1) Required intormation c. The cost of goods sold is 70 percent of sales. The company desires to maintain a minimum ending inventory equal to 20 percent of the next month's cost of goods sold. However; ending inventory of December is expected to be $12,900. Assume that all purchases are made on account. Prepare an inventory purchases budget. d. The company pays 70 percent of accounts payable in the month of purchase and the remaining 30 percent in the following month. Prepare a cash payments budget for inventory purchases. e. Budgeted seling and administrative expenses per month follow. have a capital expenditures budget indicates that Munoz will spend $146,600 on October 1 for store fixtures, which are expected to have a $29,000 salvage value and a two-year (24-month) useful life Use this information to prepare a selling and administrative expenses budget. f. Ubilises and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses. 9. Munoz borrows funds, in increments of $1,000, and tepays them on the last day of the month. Repayments may be made in any on the last day of the month. To be prudent the company the last day of the month. It pays interest of 2 percent per month in cash . 4 be prudent, the company desires to maintain a $21,000 cash cushion. Prepare a cash budget. Complete this question by entering your answers in the tabs below. The company pays 70 percent of accounts payable in the month of purchase and the remaining 30 percent in the following month. Prepare a cash payments budgot for inventory purchases. ffound your final a reswers to the percent in the foliniting whole dollar. apounts.). Required information are made on account. Prepare an inventory purchases budget. d. The company pays 70 percent of accounts payable in the month of purchase and the remaining 30 percent in the following month. Prepare a cash payments budget for inventory purchases e. Budgeted seling and administrative expenses per month follow. Ine capitar expenditures budget indicates that Munoz will spend $146,600 on October 1 for store fixtures, which are expected to have a $29,000 salvage value and a two-year (24-month) useful life. Use this information to prepare a selling and administrative expenses budget. 1. Utiities and sales commissions are paid the month after they are incurred, all other expenses are paid in the month in which they are incurred. Prepare a cash payments budget for selling and administrative expenses 9. Munoz borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avalable. The company also pays its vendors on the last day of the month. It pays interest of 2 percent per month in cash on the ast day of the month. To bt prudent, the company desires to maintain a $21,000 cash cushion. Prepare a cash budget. Complete this question by entering your answers in the tabs below. Prepare a seliing and administrative expenses budget. "The capital expenditures budget indicates that Munoz will 5pend$146.600 on Octaber 1 for store fixtures, which are expected to have a $29,000 salvage value and a two-year (24-month) useful life. Use this information to prepare a selling and administrative expenses budget. f. Utilities and sales commissions are paid the month after they are incurred; all other expenses are paid in the month in which they are incumed. Prepure a cash payments budget for selling and administrative expenses. 9. Munoz borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avalable The company also pays its vendors on the last day of the month it pays interest of 2 percent per month in cash on the last day of the month. To be peudent the coimpany desires to maintain a $21,000 cash cushion. Prepare a cash budget. Complete this question by entering your answers in the tabs below. Vilites and sales commissions are paid the month after ther are incurred; al other expenses are paid in the month in which. they are incurred. Prepare a cash payments bodget for seling are incurred, as other expenges adminittiativa oumpes. 3 Required inlormation Use this antormation to prepare a seiung and aomunistrative expenses buaget. 1. Utilities and sales commissions are paid the month after they are incurred, all other expenses are paid in the mionth in which are incurred. Prepare a cash payments budget for selling and administrative expenses: 9. Munoz borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in a amount available. The company also pays its vendors on the last day of the month. it pays interest of 2 percent per month in on the last day of the month. To be prudent, the company desires to maintain a $21,000 cash cushion. Prepare a cash budget. Complete this question by entering your answers in the tabs below. Muncz borrows funds, in increments of $1,000, and repays them on the last day of the month. Repayments may be made in any amount avallable. The company also pays its vendors on the last day of the month. it pays interest of 2 percent per. month in cish on the last day of the month. To be prudent, the company desires to maintain a $21,000 cash cushion. Prepare

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started